GoTo, the merged entity formed by the merging of Gojek (an Indonesian ride-hailing firm) and Tokopedia (an Indonesian e-commerce company), raised $1.1 billion (IDR15.8 trillion) in its public-market debut earlier this month on the Indonesia Stock Exchange (IDX). GoTo most recently secured $1.3 billion in what was previously referred to as pre-IPO fundraising in late 2021. According to Yahoo Finance statistics, GoTo’s IPO was a success, with shares priced at 338 Rupiah each and trading as high as 442 Rupiah. GoTo has given back some of its gains since its initial public offering, but it is still worth more per share than it was valued at.

The firm just closed at 358 Rupiah, down slightly more than 5% in the most recent trading session. The IPO market is currently dormant across the world, particularly in the United States, where numerous technological companies have already been listed. GoTo expressed interest in dual-listing at first, but finally opted to list only on the Indonesian market.

The Exchange was intrigued by GoTo’s ability to float without sinking, given the normally icy global IPO atmosphere. Let’s look at the company’s financial performance and the consequent multiples this morning. We’ll then look at its preferred market as we try to figure out why it appears that no high-growth IT Company can go public in the United States, but a massive listing in the less-crowded Indonesian market is possible.

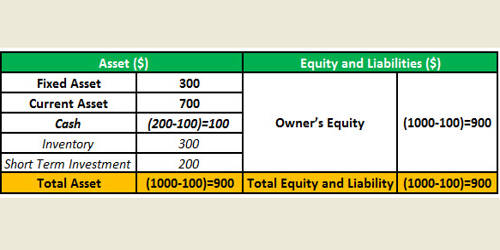

Financials, The firm reported a combined gross transaction volume (GTV) of $22 billion in 2020 when Gojek and Tokopedia merged. In other words, it was already a major worry. The business recently announced that it added $28.8 billion in total GTV in the 12 months ending September 30, 2021. From the standpoint of platform spend, that’s growth, but not quick growth. According to Deal Street Asia’s analysis of GoTo’s planned results based on a document “made for investors,” the firm expects to grow its net sales from 3.328 trillion Rupiah ($231.7 million) in 2020 to 6.258 trillion Rupiah ($435.8 million) in 2021. According to projections, the company’s net sales will reach 10.696 trillion Rupiah ($744.8 million) in 2022. According to Yahoo Finance, GoTo is now worth 424 trillion Rupiah. This equates to a market capitalization of $29.53 billion. In terms of extremely loose multiples, the business is valued at little under 40 times projected net revenue in 2022, which is far from inexpensive. Is it crazy for investors to pay so much for GoTo stock?