General Banking:

Financial institution/ intermediary that mediates or stands between ultimate borrowers and ultimate lenders is knows as banking financial institution. Banks perform this function in two ways- taking deposits from various areas in different forms and lending that accumulated amount of money to the potential investors in other different forms.

General Banking is the starting point of all the banking operating. General Banking department aids in taking deposits and simultaneously provides some ancillaries services. It provides those customers who come frequently and those customers who come one time in banking for enjoying ancillary services. In some general banking activities, there is no relation between banker and customers who will take only one service form Bank. On the other hand, there are some customers with who bank are doing its business frequently. It is the department, which provides day-to-day services to the customers. Every day it receives deposits from the customers and meets their demand for cash by honoring cheques. It opens new accounts, demit funds, issue bank drafts and pay orders etc. since bank in confined to provide the service everyday general banking is also known as retail banking.

General Banking Section of a branch is designed-

- To serve the general people for saving money

- To ensure smooth transaction for commercial people and

- To ensure security of preaches wealth of the clients and also for all other important activities.

The general banking involves the following activities–

5.1 Account opening

One cannot be a customer of the bank without opening an account. Account opening is an agreement between the customer and the bank. The form of account opening acts as a contract evidence. So account opening is one of the most important activities of a bank. The rules and regulations for opening of an account can vary according to types of accounts.

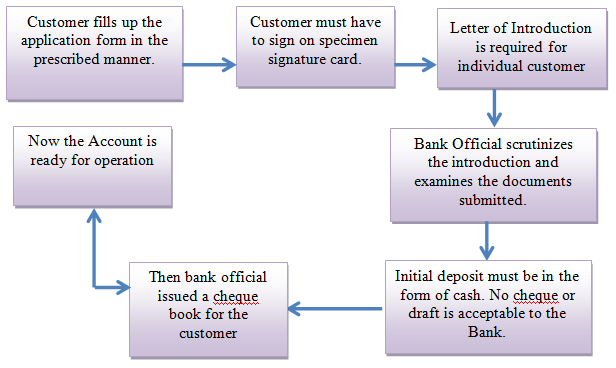

5.2Account Opening Procedure in a flow chart

Figure 1: Account opening procedure. (Source : General Banking Manual)

5.3Cheque Book:

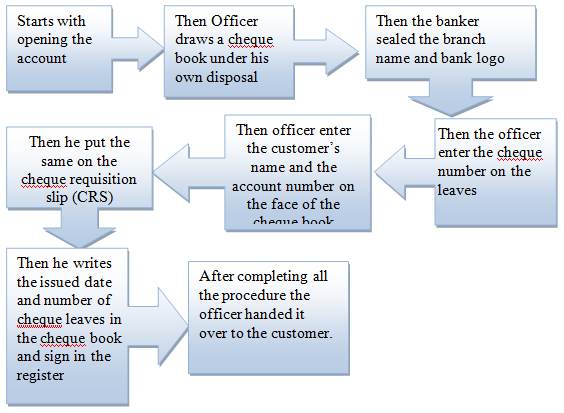

Cheque book is issued to the new customer after opening account. Two separate cheque books are given for current and saving accounts. AWCA accounts Cheque book consists 25 and 50 leafs, while MCA account Cheque book has 10 leafs. There is a cheque book issue register in this regard; where Cheque book number, leaf number, date of issue etc. information are kept. All the necessary numbers are the sent to the computer department to give entry in the program.

Figure 2: The process of cheque book issuance for new account.

5.4 Transfer of an account:

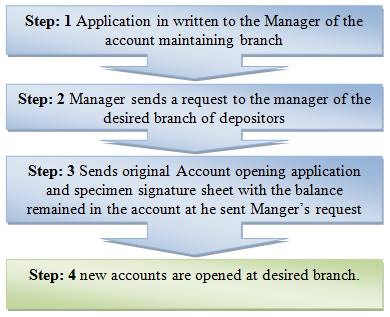

Figure 3: Transfer of an account.

5.5 Types of Accounts

One cannot imagine the banking business without deposits. So the most important activity of the commercial bank is to receive the deposits from the customers Shahjalal Islami Bnak’s deposits can be divided as follows—

iv. AL-Wadiah Current Deposit

For private, individuals, merchants, traders, importers and exporters mill and factory overset this type of account is advantageous. The minimum deposit of Tk.5000 for opening of a current account is required with reference.

The benefits of current account are as follows-

- Statement of account on monthly basis/any time.

- Free checkbook

- Statement by fax on demand

- Any number of transactions a data

v) Monthly income scheme:

It is a monthly income scheme that really makes good sense. A sure investment for a steady return.

Highlights of the Scheme:

- Minimum deposit TK, 50,000.00 and profit will be TK, 450.00.

- Higher monthly income for higher deposit.

- The scheme is for a 5-year period.

Objectives of the scheme

- The depositors have to fill up forms for opening this account.

- The receipt, which is provided by the bank to the customers, is not transferable.

- The Bank will not provide profit to means if this deposit is withdrawer within one year of opening the account.

vi) Mudaraba multiple Deposit scheme

Investment leads a country to industrialization. But saving is the main source of investment. Without saving a country cannot build up capital. For this reason saving is called the skeleton of development. This is a nine years deposit, which increases the deposit more than triple. Shahjalal Islami Bank offers mudaraba multiple savings by creating more conscious and encouraging people to save.

vii) Hajj Deposit Scheme:

Hajj deposit at monthly installment from 1(one) year to 25 (twenty five) years are accepted under the above scheme to enable the account holder to perform hajj out of the accumulated saving with profit.

vii) Money Grower

Money gradually grows in this account. It is a monthly savings scheme. It secures the future with ease. A small saving today will provide comfort tomorrow. There are several types of Money Grower Scheme which are given bellow:

- Education Deposit Scheme (EDS)

Savings Period and Monthly Installment Rate the savings period is for 10, 15, or 20 years. Monthly installment rate is:

- Monthly Deposit Scheme (MDS)

Savings Period and Monthly Installment Rate the savings period is for 5, 8, or 10 years. Monthly installment rate is:

- Millionaire Scheme – 12 Yrs (MS12)

Savings Period and Monthly Installment Rate the savings period is for 12, 15, 20, or 25 years. Monthly installment rate is:

- Mohor Deposit Scheme (MSD)

Savings Period and Monthly Installment Rate the savings period is for 3, 5, or 8 years. Monthly installment rate is:

- Marriage Deposit Scheme (MSD)

Savings Period and Monthly Installment Rate the savings period is for 10, 12, 15 or 20 years. Monthly installment rate is:

5.6 Account Closing:

First a customer has to submit an application with his/her signature mentioning that he/she wants to close his/her A/C. Then the signature will be verified by the officer. Customer has to certify by different department (Advance, Foreign Exchange department) of Bank that he/she has no liabilities to the Bank. After that the Customer’s A/C is debited and then Bank issues a Pay Order in the name of A/C holder.

5.7 Account Transfer:

Customer has to submit an application mentioning that he/she wants to transfer his/her A/C to his desired Branch and the officer will verify the signature, Customer has to be certified by different department of Bank that he/she has no liabilities to the bank. Then total particulars of A/C holder will prepare and sent to the Customer’s desired branch. Liability of Recognizer is secondary and account holder is primary.

5.8General Practice at Regarding Accounts, in Account Opening Register:

After fulfilling all the requirements for opening account necessary entries are given in the account opening register. There are several registers for several accounts as MSD, ACD, SND, MDS and MTDR etc. Date of opening name of the account holder, nature of business, address, initial deposit, and introduction, and various information’s are recorded in that register. New accounts number is given from the list of new numbers provided by the computer department..

5.9 Pay Order (PO):

Pay Order an instrument, which is used to remit money with in a city thorough banking channel the instruments are generally safe as most of them are crossed.

5.10 Clearing:

As far safety is concerned customers get crossed check for the transaction. As we know crossed check cannot be encased from the counter rather it has though been collected through banking channel i.e. clearing. A client of SJIBI received a check of another bank, which is located within the clearing range deposit, the checks in account at SJIBL New SJIBL will not the money until the check is honored.

5.11 Outward Bills for Collection (OBC):

Customers deposit cheque, draft etc for collection attaching with their deposit receipt. Instrument within the range of clearing are collected through local clearing house but the other which are outside the clearing range are collected through OBC mechanism. A customer of SJIBL principal branch local office Dhaka is depositing a check of Sonali Bank Cox’s‑Bazar.

New as a collecting bank SJIBL principal branch will perform the following tasks:

- Received seal on deposit slip.

- SJIBL local office principal branch crossing indicating them as collecting bank.

- Endorsement give payees A/C will be credited on realization.

- Entry on register from where a controlling number is given.

Collecting bank can collect it either by its branches of by the drawer’s bank they will forward the bill then to that articulate branch. OBC number will be given on the forwarding letter.

5.12 Inward Bills for Collection (IBC):

In this case bank will work as an agent of the collection bank branch receives a forwarding letter and the bill. Next steps are:

- Entry in the IBC register, IBC number given.

- Endorsement given‑ “our branch endorsement confirmed”.

- The instrument is sent to clearing for collection.

- Miscellaneous creditor A/C.

More parts of this post-

General Banking Operation Of Shahjalal Islami Bank Limited.(Chapter-1)

General Banking Operation Of Shahjalal Islami Bank Limited.(Chapter-2)

General Banking Operation Of Shahjalal Islami Bank Limited.(Chapter-3)

General Banking Operation Of Shahjalal Islami Bank Limited.(Chapter-4)

General Banking Operation Of Shahjalal Islami Bank Limited.(Chapter-5)

General Banking Operation Of Shahjalal Islami Bank Limited.(Chapter-6)