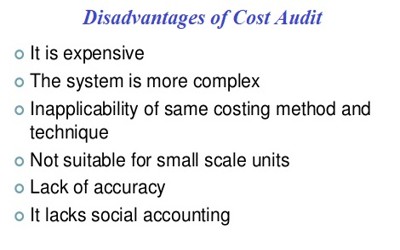

Cost Audit stands for the verification of cost accounts and checks on the adherence to cost accounting plan. It is an audit of the efficiency of minute details of expenditure while the work is in progress and not a post-mortem examination. It offers many advantages to management, cost accountant, shareholders, statutory auditor, consumers, and the government. Though some Disadvantages of Cost Auditare describe below –

Disadvantages of Cost Audit –

- Holding a Cost Audit can be costly. This is because a company will often bring in an independent auditor who is normally charging a higher price. Delay in receiving costing information does not result in taking quality decision by the management.

- A Cost Audit can be a long process which will likely involve more time. This extra time and effort can impact an employee’s day to day routine work. Only past performances are available in the costing records but the management is making a decision for the future.

- If a Cost Audit is carried out in order to find fraudulent activity it can take a long time by which time people pinching could have covered their tracks. The cost of the previous year is not the same in the succeeding year. Hence, cost data are not highly useful.

- Cost Audits involve a large amount of estimation and so there is the possibility that figures will be incorrect and if record keeping from the company is not good to start with then inaccuracies will be arises.

- Financial character expenses are not included for cost calculation. Hence, the calculated cost is not correct always.

- Cost Accounting fails to solve the problems relating to work-study, time and motion study and operation research. This process requires additional time and effort on an employee’s part.

- It is not an independent system of accounting. It depends on other accounting systems.