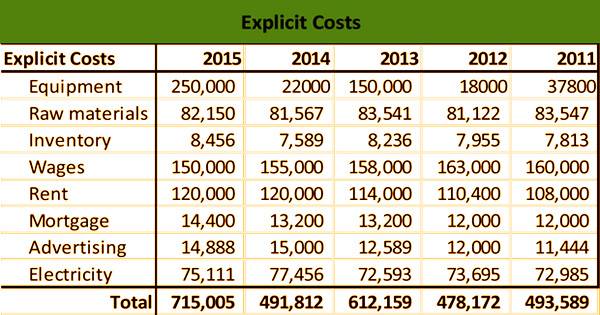

Company operating costs, or expenditures, are explicit costs that are easily quantifiable and recognizable. As compared to implied costs, it is a direct payment made to someone in the process of running a company, such as salaries, rent, and supplies, where no explicit payment is made. Those expenses have dollar amounts clearly specified, which flow through to the statement of income. Wages, mortgage fees, electricity, raw materials, and other direct costs are examples of clear costs.

Explicit costs really require money surges towards the remuneration of wages, lease, contract, crude materials, publicizing, utilities, stock, and hardware. Additionally alluded to as bookkeeping costs, the express expenses of an organization are recorded in its books (bookkeeping records) and become recorded costs on the organization’s fiscal summaries, for example, its asset report and salary proclamation. A company’s net revenue (NI) represents the remaining revenue that remains after all the clear expenses have been paid. The only accounting costs that are required to measure a profit are explicit costs since they have a direct effect on the bottom line of business. The explicit-cost metric is particularly beneficial for the long-term strategic planning of businesses.

Example of Explicit Costs

Explicit costs are referred to as such mostly to recognize them from verifiable expenses. It accompanies recognizable dollar esteem and consistently includes an installment of cash; for instance, compensation paid to workers. In the explicit costs, some accountants include depreciation and amortization, but this is wrong since depreciation and amortization do not concern observable expenses. Tangible assets and monetary transactions require explicit costs and result in tangible business opportunities. Because of the paper trail, these expenditures are easy to recognize, register, and audit.

Implicit costs do not require a cash charge but reflect a resource investment. Employee benefits, charges for the procurement of raw materials, rent, and energy costs, on the other hand, are clear because they require a cash outlay which the company reports on its financial statements. Examples of overt costs include expenditures related to ads, materials, services, inventory, and purchase equipment. In spite of the fact that the devaluation of an advantage isn’t an action that can be substantially followed, deterioration cost is an express expense since it identifies with the expense of the fundamental resource possessed by the organization.

When considering economic benefit, explicit costs are taken into account along with implied ones; accounting profit only takes into account explicit costs. Implicit or inferred costs, by comparison, are not explicitly specified, described, or recorded as costs. The time taken and spent on training a new employee on how to operate a computer or compile and send a report is an example of an implied expense. Organizations utilize both unequivocal and understood costs while figuring an organization’s financial benefit characterized as the all-out return an organization gets dependent on all expenses brought about to achieve that income.

Explicit costs have a direct effect on the performance of the company. With an explicit cost rise of 45 percent, it is clear that the cost-cutting strategy introduced by the manager is unsuccessful. When evaluating the activities of an organization, including income, management will use explicit costs but will measure implied costs only for decision-making or choosing between several alternatives. The explicit costs of an organization incorporate all money related installments that the organization makes all cordial income in the conventional course of working its business. Common explicit business costs include the following:

- Wages, salaries, bonuses, commissions, and any other form of compensation given to employees of the company

- The cost of benefits provided to employees, such as insurance

- Production costs apply to the products that a business has to buy in order to manufacture the goods and/or services it offers

- Marketing and advertising costs

- Rent or mortgage payments on company facilities

- Utilities, such as electricity and internet service

- The cost of the purchase or lease and maintenance of equipment needed for service by a corporation, such as the manufacture of machines or vehicles

- Taxes, insurance, legal fees, etc.

- Depreciation is an exception to the concept of clear costs as monetary payments made; although depreciation may not require a cash payment, it has an observable, quantifiable value and constitutes a company’s usual operating expense.

Explicit costs should be overseen so the firm can expand its gainfulness by bringing down its promoting, home loan, and stock costs. The publicizing consumption would be an unequivocal expense. In the long haul, the supervisor needs to ensure that the organization’s incomes stay solid so inventories are sold. On the other hand, in order to minimize its clear expenditures, the organization has to reduce inventories and even employee hours. In particular, the economic benefit is used extensively to assess if a corporation can enter a market or sector or leave it.

Information Sources: