Accounts receivable turnover is defined as the ratio of a period’s average accounts receivable divided by the period’s net credit sales. This ratio provides the business with a clear picture of how efficiently it collects on debts owed on credit extended, with a lower number indicating greater efficiency.

The accounts receivable turnover ratio, also known as the debtor’s turnover ratio, is an efficiency ratio that measures how well a company collects revenue and, as a result, how well it uses its assets. The accounts receivable turnover ratio counts the number of times a company collects its average accounts receivable during a given period.

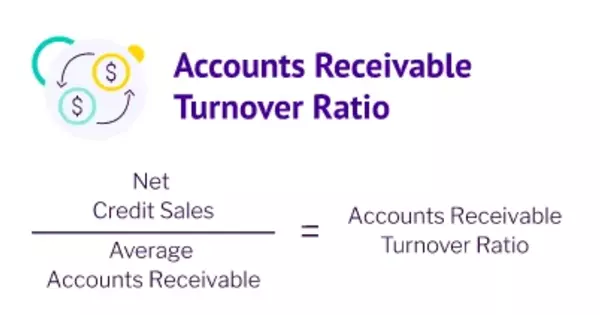

Accounts Receivable Turnover Ratio Formula –

The accounts receivable turnover ratio formula is as follows:

Accounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable

Where:

Net credit sales are sales where the cash is collected at a later date. The formula for net credit sales is = Sales on credit – Sales returns – Sales allowances.

Average accounts receivable is the sum of starting and ending accounts receivable over a time period (such as monthly or quarterly), divided by 2.

For example, Joe’s Bait Company supplies fish bait to stores at docks and marinas throughout the Southeast. The company invoices each of the stores once a month. Payment terms are the same for each customer: net30, meaning payment is due thirty days after the invoice date. Some of the company’s customers pay on time as agreed, but some pay late. A few may go out of business and not pay Joe’s Bait Company anything at all, which would result in bad debt.

By comparison, LookeeLou Cable TV company delivers cable TV, internet and VoIP phone service to consumers. All customers are billed a month in advance of service delivery, thereby preventing any customer from receiving services without paying the bill. In other words, its accounts receivables are better protected as service can be disconnected before further credit is extended to the customer.

In both cases, the accounts receivable turnover ratio shows how long it takes customers to pay, on average, and that information, in turn, reveals a lot about how financially stable the company is and how well its cash flow is managed.

Accounts receivable are effectively short-term interest-free loans extended by businesses to their customers. If a business makes a sale to a customer, it may extend terms of 30 or 60 days, which means the customer has 30 to 60 days to pay for the product.

The receivables turnover ratio measures how efficiently a company can collect on its receivables or credit extended to customers. The ratio also counts the number of times a company’s receivables are converted to cash over a given time period. On an annual, quarterly, or monthly basis, the receivables turnover ratio is calculated.