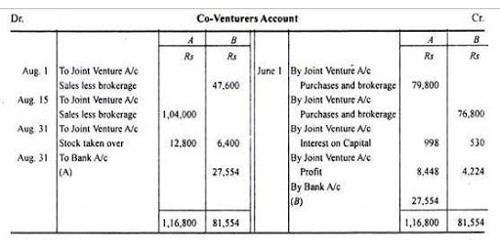

Co-ventures Account

Like the capital accounts in partnership, the co-venture account is opened in a joint venture. Co-venture is a business project or enterprise undertaken jointly by two or more companies, each sharing in the capitalization and in any profits or losses. It is credited with the investment of each co-venture and debited with the drawings made by them. The persons who run the business on partnership are called partners and the persons who agreed to take the project as a joint venture are called co-venturers. They are similar to Partners in the Partnership firm. Co-ventures have unlimited liability if there is a huge loss in the venture.

The profits of the venture are credited and loss of venture is debited. This account comes to end by cash payment from a joint bank account. There is no limit specified for the numbers of co-venturers, but the number of partners is limited to 10 under banking business and 20 for any other trade or business. Concerned parties to the joint ventures are known as co-venturers. liabilities of co-venturers are limited to the particular assignment or project agreed upon. The liabilities of co-venturers are limited to their profit sharing ratio or as per agreed terms −

Suppose ‘A’ and ‘B’ undertake the job to develop a park for consideration of 50,00 $. Since they come together for work on a specific project, it will term as a joint venture and each of them (A and B) will be called a co-venturer. Further, this venture will automatically terminate once the project is completed.

The co-venturers of a Joint venture are the owners of a Joint venture, whereas the relationship of a consignor and consignee is of Owner and Agent. the co-venturers of joint venture share profits as per the agreed profit sharing ratio. The profit or loss so made on the venture is transferred to this account in profit sharing ratio and this account is closed by cash payment from joint bank and vice versa in the opposite case.