The achievement of a real and permanent reduction in the unit cost of manufactured products is referred to as cost reduction. As a result, it is constantly striving to achieve genuine cost savings in production, distribution, selling, and administration. This is a method of lowering the cost per unit of production without sacrificing quality. Higher costs reduce profits; therefore, cost evaluations should be performed on a regular basis to minimize the negative impact. It does not accept a standard or budget as impenetrable or fixed; rather, it constantly challenges the standards or budgets to improve them.

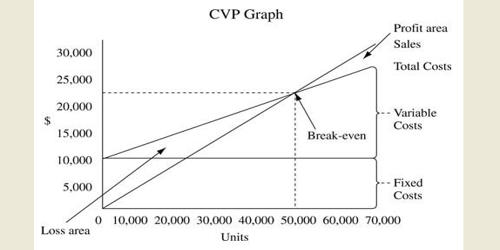

There are only two ways to maximize profit in any organization: increase unit sale price or reduce unit cost. Both of the preceding scenarios may result in a good profit. It is a corrective function based on a continuous process of cost, function, and other analysis for the further economy in the application of factors of production.

For example, ABC is a car manufacturer that buys many components from a variety of suppliers, including a single tyre supplier. ABC planned to buy 2,500 tyres for the year at a cost of $750 per tyre at the start of the year. However, the supplier raised the price of a tyre to $1,250 halfway through the year. Following the price increase, ABC purchased 1,800 tyres. As a result, the resulting difference will be,

Expected total cost for 2,500 tyres = $ 1,875,000

Actual cost for 25,500 tyres (700* $750) + (1,800* $1,250) =$ 2,775,000

Variance = ($ 900,000)

Management can take the following actions to ensure that the variance is minimized for the next year by,

- Negotiations with the supplier to reduce the price

- Terminate business with the supplier and acquire a new supplier who sells tyres at a lower price

In this type of situation, management must exercise extreme caution and refrain from making decisions solely based on financial indicators, but must also consider qualitative factors. In the preceding example, ABC Company may be a well-known world-class automobile manufacturer that has been purchasing tyres exclusively from the aforementioned supplier for a number of years due to the proven quality. Toyota, for example, purchases tyres for their automobiles from Goodyear. If the supplier produces a quality product in comparison to other suppliers and has the capacity to meet all of the company’s needs, terminating a business relationship due to a price increase is not a wise decision. Thus, is it essential to carry out both cost control and cost reduction after a detailed consideration of their effects on costs.

Every cost-cutting strategy is based on the assumption that there is always room for cost-cutting. Continuous research is conducted in various areas to determine the best possible methods of performance while ensuring the lowest possible costs.

The cost reduction should be genuine and long-term. Reductions due to windfalls, changes in government policy such as a reduction in taxes (or duties or due to temporary) and measures taken to alleviate financial difficulties do not fall squarely within the purview of cost reduction.