Fixed Capital Account of Partners

Under the fixed nature of capital, the capital of each partner remains constant from the start of partnership till at the end of it. This is one of the ways of keeping partners’ contribution i.e. capital in the books of the firm. The main aim of maintaining fixed capital accounts of partners is to show the amount of original contribution of partners throughout the whole year on a constant figure. No adjustments like interest on capital, partner’s salary/commission, Drawings, and profit or loss earned during the operation is made. A partnership can maintain a single partnership capital account for all partners, with a supporting schedule that breaks down the capital account for each partner.

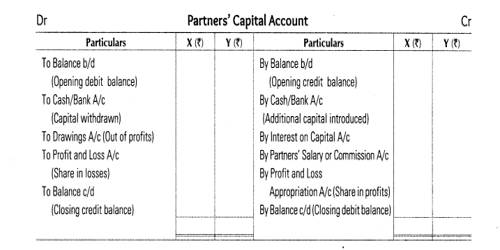

Two accounts are maintained for each partner namely (a) Capital account and (b) Current account.

- Partners’ capital account – Capital account is credited with the original amount of capital introduced by a partner into the business and any additional capital introduced by him/her in the subsequent years.

- Partners’ current account – Partners’ current account is prepared for recording all transactions between the partner and the firm other than initial capital introduced, additional capital introduced and capital permanently withdrawn.

A firm prepares Fixed Account with very basic capital-related transactions. Under this method, Capital Accounts are maintained. At the time of the dissolution of the partnership, each partner’s current account balance is transferred to capital A/c. All losses are debited to the Current A/c and the Capital account only has entries if capital permanently is withdrawn or added in the year. One of which shows the original capital of the partners without any change throughout the year and another account is opened to record the transactions between the partners and the firm, that is, salary to partners, commission to partners, bonus to partners, interest on capital and drawings made by the partners and so as like in the partners current account. The credit balance of the current account will be credited to the capital account and a debit balance of the current account will be debited to the respective partners’ capital account.

Fixed Capital means capital invested by each partner in the firm remains fixed or unaltered unless a partner introduces additional capital or withdraws out of his or her capital. The capital account of partners showing the original capital could be changed when there is a change in the constitution or when a partner draws money from the business against her/his capital. Unlike the Capital account, under these repetitive capital-related transactions does not affect the Capital balance.