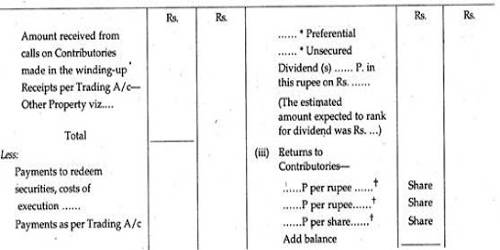

Liquidator’s statement of account of the winding-up is prepared for the period starting from the commencement of winding up to the close of winding up. his account takes the form of Cash Account. The main job of the liquidator is to collect the assets of the company and realize them and distribute the money realized among the right claimants. It is the duty of the liquidator to realize the assets and disburse the same among those who have a proper claim. For this purpose, he is to prepare a statement of account which is known as Liquidator’s Final Statement of Account. In the preparation of the Liquidators Statement of Account, the principle of double-entry is not involved.

Payment Side of Liquidator’s Final Statement

(i) Secured Creditors: While raising a long term debt, a company may mortgage its property as a security to the debt provider. Such a debt comes under secured creditors. In other words, the secured creditor is such a loan that has been taken from the loan provider on collateral securities.

(ii) Liquidation Costs: It is an expense incurred by the liquidator while liquidating the company. It includes liquidator’s remuneration and commission and any legal expenses on the process of liquidation.

(iii) Preferential Creditors: It is placed in the third position in order of payment. It includes the amount payable to government and employees. Taxes, Fees, Electricity charges, Water supply charge, etc. are the examples of payable due to government. Similarly, salaries and wages, provident fund, gratuity and other amounts payable to the employee are some of the examples of due to employees.

(iv) Debenture Holders: It includes the amount of payable to debenture holders with outstanding interest therein. The debenture interest should be paid up to the date of liquidation if it is insolvent and if the company is solvent, the interest on debentures will be paid up to the date of payment.

(v) Unsecured Creditors: If the loan is raised by a company without any collateral securities, it is known as unsecured creditors. Bank overdrafts, creditors, outstanding expenses, etc. are examples of unsecured creditors.

(vi) Payment Made To Shareholders: After paying all the above dues, the turn goes towards the shareholders. Among the shareholders, the first priority must be given to preference shareholders. The preference shareholders will get the principal plus arrear of dividends. The last party to receive anything left, after the payment of preference shareholders, is equity shareholders.