Net operating profit after tax (NOPAT) is a financial metric that indicates how well a business worked, net of taxes, through its core activities. By eliminating the effect of the capital structure, NOPAT is used to make businesses more comparable. Net operating profit after tax (NOPAT) is a financial metric which, through its core operations, indicates how well a business performed, net of taxes. NOPAT is used to make companies more comparable by eliminating the effect of the capital structure. When the company had no liabilities on the books, by the end of the year it would be able to transfer the whole sum of money to its shareholders.

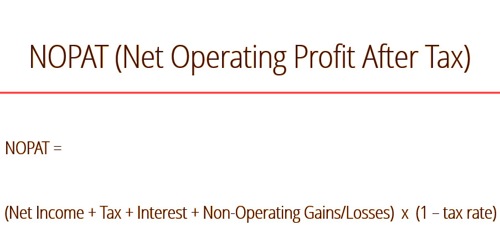

The NOPAT formula is as follows:

Simple form: Income from Operations x (1 – tax rate)

Or

Long-form:

(Net Income + Tax + Interest Expense + any Non-Operating Gains/Losses) x (1 – tax rate)

NOPAT is usually utilized in value-added (EVA) calculations and could be a more accurate examine operating efficiency for leveraged companies. NOPAT doesn’t include the tax savings many companies get thanks to existing debt. Both investors and creditors use this financial ratio to measure how profitable a company’s operations are and the way able they’re to pay shareholders and debt obligations. Typically, they only use this as a gauge because it’s not a precise measurement.

Analysts for mergers and acquisitions use NOPAT to measure Free Profit to Business (FCFF) and Net Income to Business. The accrual method of accounting typically creates timing difference between when earnings are recognized for book purposes and after they are recognized for tax purposes. Thus, there’s usually a difference between the particular money that may be distributed to shareholders and therefore the amount calculated.

The most popular approach to valuation is to measure the intrinsic value of a company (as opposed to its equity value) such that the intrinsic capital structure is overlooked and only the assets of the enterprise are used to assess its value. For measure NOPAT it is important to assess the operating profits, also known as the operating benefit. It includes gross income less operating expenses, which includes sales, general, and administrative expenses (e.g., office supplies).

It is necessary to calculate the operating income for measure NOPAT, also known as the operating gain. This includes gross income less operating expenditures, including sales, general, and administrative (e.g., office supplies) expenditures. It also includes depreciation and amortization (a non-cash expense) and does not include capital (an actual cash expense) expenditure. Analysts have a look at many various measures of performance when assessing a corporation as an investment. Net operating profit after tax could be a hybrid calculation that permits analysts to check company performance without the influence of leverage. During this way, it’s a more accurate measure of pure operating efficiency.

Operating profit and net profit are two extremely important metrics for a business. Operational profit informs us about the company’s operating performance while net income is an indicator of an enterprise’s overall profitability. Yet all of these definitions have certain drawbacks. Operating income does not take into account the productivity tax consequences, while net profit includes the effect of interest payments (and the resulting tax gain note tax is measured after interest payments have been reduced). Net income plus net after-tax interest expense (or net income plus net interest expense) multiplied by 1, minus the tax rate, is another way to calculate net operating profit after tax.

Information Sources: