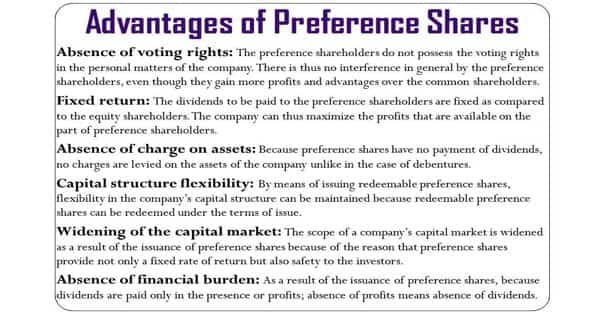

Preference shares are a mode for companies to raise capital on a regular basis. These are used by big corporate as a long-term source of funding their projects. The major benefits are in the form of an absence of a legal obligation to pay the dividend, improve borrowing capacity, saves dilution in control of existing shareholders and no charge on assets. They are known as hybrid financing instruments because they share attributes of both equity and debt.

Advantages of Preference Shares

The primary advantage for shareholders is that the preference shares have a fixed dividend. Owners of preference shares receive fixed dividends, well before common shareholders see any money. This payout is typically done prior to any dividends being paid to common shareholders.

In either case, dividends are only paid if the company turns a profit. But there is a wrinkle to this situation because a type of preference shares known as cumulative shares allow for the accumulation of unpaid dividends that must be paid out at a later date.

Preference shareholders have a prior claim on business assets. If the business decides to file for bankruptcy or liquidates, preference shareholders can stake a higher claim on the assets of the business. This makes the risk of investment tolerable as opposed to the common shareholder. So, once a struggling business finally rebounds and is back in the black, those unpaid dividends are remitted to preferred shareholders before any dividends can be paid to common shareholders.

With preference shares, shareholders are allowed to trade in their convertible shares for a pre-decided number of common shares. If the company is able to meet a specified profit mark that was determined earlier, then the shareholder has the opportunity to experience add-on dividends.

Preferred shares offer advantages to both issuers and holders of the securities. The issuers may benefit in the following way:

- No dilution of control: This type of financing allows issuers to avoid or defer the dilution of control, as the shares do not provide voting rights or limit these rights.

- No obligation for dividends: The shares do not force issuers to pay dividends to shareholders. For example, if the company does not have enough funds to pay dividends, it may just defer the payment.

- Flexibility of terms: The company’s management enjoys the flexibility to set up almost any terms for the shares.

Preferred shares can also be an attractive alternative for investors. The investors may benefit in the following way:

- Secured position in case of the company’s liquidation: Investors with preferred stock are in a more secure position relative to common shareholders in the event of liquidation, because they have a priority in claiming the company’s assets.

- Fixed income: These shares provide their shareholders with a fixed income in the form of dividend payments.

Information Source: