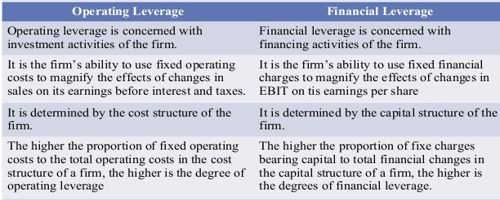

Leverage is a firm’s ability to employ new assets or funds to create better returns or to reduce costs. That’s why leverage for any company is very significant. Operating leverage is an indication of how a company’s costs are structured and is used to determine the break-even point for a company. Financial leverage refers to the amount of debt used to finance the operations of a company.

Operating leverage results from the existence of fixed operating cost in the cost structure of a firm. Financial leverage arises when a firm uses debt funds with a fixed financial charge.

Operating leverage is the ability of the firm to use fixed operating costs to magnify the effects of changes in sales on its EBIT. Financial leverage is the ability of the firm to use fixed financial charges to magnify the effects of changes in EBIT on the firm’s earnings per share.

Difference between Operating Leverage and Financial Leverage

Following are the main differences between operating leverage and financial leverage:

- Meaning

The use of such assets in the company’s operations for which it has to pay fixed costs is known as Operating Leverage. The use of debt in a company’s capital structure for which it has to pay interest expenses is known as Financial Leverage.

- Relation

Operating leverage shows the relationship between sales and operating profit. Financial leverage shows the relationship between operating profit and earning per share.

- Cause

Operating leverage arises due to the use of fixed operating costs. Financial leverage arises due to the use of debt or the cost of financing. Operating Leverage arises due to the company’s cost structure. Conversely, the capital structure of the company is responsible for Financial Leverage.

- Measurement of Risk

Operating leverage measures the business risk. Financial leverage measures the financial risk. The Operating Leverage measures the effect of fixed operating costs, whereas Financial Leverage measures the effect of interest expenses. Operating Leverage creates a business risk while Financial Leverage is the reason for financial risk.

- Calculation

Operating leverage can be calculated when we divide contribution by EBIT of the firm. Financial leverage can be calculated when we divide EBIT by EBT of the firm.

- Application

The Degree of Operating Leverage (DOL) is used to measure the effect on earnings before interest and tax (EBIT) due to the change in Sales. The Degree of Financial Leverage (DFL) is used to measure the effect on Earnings per Share (EPS) due to the change in firms operating profit i.e. EBIT.

While the performance of financial analysis, Leverage, is used to measure the risk-return relation for alternative capital structure plans. It magnifies the changes in financial variables like sales, costs, EBIT, EBT, EPS, etc. Operating leverage and financial leverage are both critical on their own terms. And they both help businesses in generating better returns and reduce costs.

Information Source: