Responsibility Accounting assists management in controlling costs and budgets. It concentrates on the cost drivers but not on who utilizes them or who is accountable for them. Responsibility accounting, on the other hand, is a control system in which individuals are given responsibility for achieving certain accounting objectives.

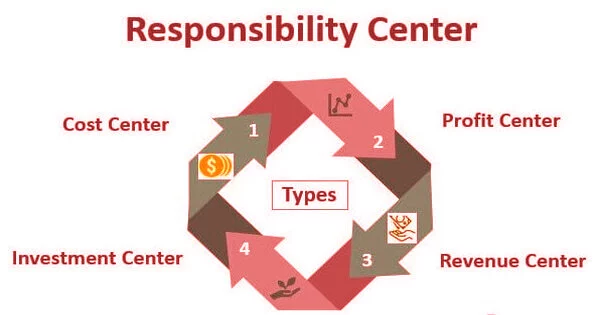

A responsibility accounting structure assists management in evaluating the financial performance of the organization’s segments. A responsibility accounting structure includes responsibility centers. Cost centers, discretionary cost centers, revenue centers, profit centers, and investment centers are the four types of responsibility centers.

- Cost centers are responsibility centers that focus only on expenses.

- Revenue centers are responsibility centers that focus on revenues.

- Profit centers are responsibility centers that focus on revenues and expenses.

- Investment centers are responsibility centers that consider the investments made by the responsibility center.

The following are the types of responsibility centers:

- Cost Center

It is a unit within a firm that only has cost control, such as the production department. The center only contributes to the costs that have already been incurred. Other functions, including as revenues and investments, are not within the jurisdiction of the cost center. It is important to highlight that a manager in charge of any cost center is only accountable for controllable expenses, not uncontrollable costs. The housekeeping department, for example, will simply incur charges.

- Revenue Center

This unit is only responsible for revenue generation and is not responsible for any other company functions. The revenue center only serves to generate sales. A revenue center would be the sales and marketing divisions. As an example, consider an organization’s sales department.

- Profit Center

The profit center is in charge of both costs and revenues. It adds to both revenue and expenses, resulting in a profit or loss. The factory is one example of this; its cost is the raw material, and its revenue is the products it passes to other departments. For example, the product line is a profit center, and the product manager is in charge. Furthermore, a company’s branches in different regions are accountable for both expenditures and revenues.

- Investment Center

Profits and returns on investment are the responsibility of the center. The investment center is in charge of costs, income, and investments. Alternatively, the individual is in charge of investing a company’s assets as efficiently as possible. The latter contains the fund that is invested in the activities of the organization. A cost center, like a corporate headquarters, operates as a separate company. A corporation assesses an investment center’s performance using statistics such as ROI (return on investment), economic value-added, and others. A subsidiary entity of a firm, for example, is an investment center. In that case, the president of the subsidiary would be in charge.