Debentures are ranked as creditors of the company. These are the popular method the companies use to procure long-term finance for their financial needs. A debenture is long-term debt and issued under the common seal of the company. The funds raised through debentures represent the debts, and the holders of the debenture are the creditors of the company. Due to this, the characteristics of debentures are very important.

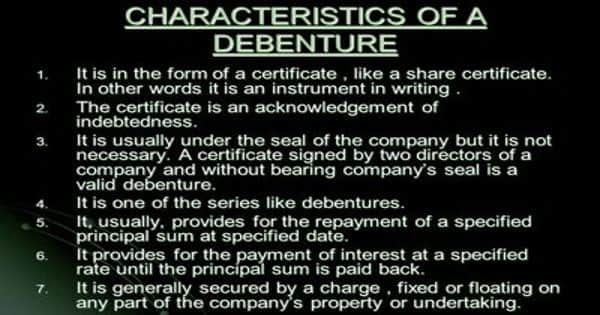

In brief, a debenture possesses the following characteristics.

- Loan Instrument

Debenture is an instrument of loan. It is issued by a company and is usually in the form of a certificate which is an acknowledgment of indebtedness.

- Fixed Rate of Interest

Interest is paid at a fixed rate every year and debentures are known as”fixed cost bearing capital”. The rate of interest on debentures is fixed and is paid every financial year. Therefore, investors also call debentures fixed cost bearing capital.

- Common Seal

Debenture has a common seal of the company. The debenture is a certificate that the company issues under its seal (debenture deed). It shows the amount and date of repayment of the debt along with the rate of interest.

- Redeemable

A debenture is redeemable at a fixed and specified time. It usually specifies a particular period or date as the date of repayment. it also provides for the payment of a special principal and interest at the specified date. But a company is not debarred from issuing perpetual or irredeemable debentures

- Creditors not Owners

Debenture-holders are the creditors of company not owners. Therefore, they do not have the power to control the operations of the company. The debenture holders do not have the right to vote to elect the directors and to determine any managerial policy.

- Long Term Capital

Debenture is a form of long-term borrowed capital. It is generally secured by a charge, fixed or floating on any part of the company’s property or undertaking.

- Maturity Period

The debentures are the long term source of finance. They consist of long term pre-set maturity period. Normally, the debentures have the maturity period of 10-20 years and are repayable at the end of the maturity period. At the maturity, the company repays the principal investment amount to the holder.

- No Voting Right

Debenture-holders have no right to cast vote in company’s general meting. Debenture holders normally do not have representation in the Board of the company.

- Priority For Repayment

At the time of liquidation, first priority is given to debenture-holders at the time of repayment. It generally creates a charge on the undertaking of the company or some parts of its property, but there may be debenture without any such charge

- Expensive

Debentures can be issued to fulfill the requirement of huge capital. Debentures may be issued with or without the security of assets of the company. Small firms most often find it more expensive source of financing.

Information Source: