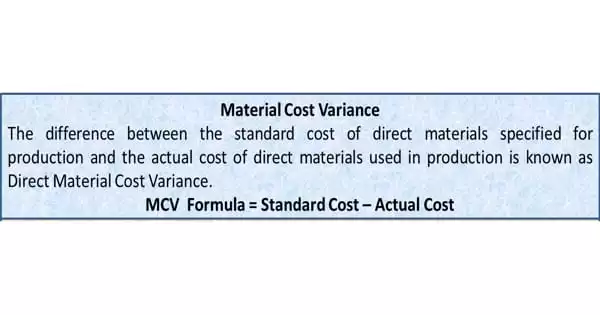

Material cost variation is the difference between the actual production volume and the real direct material cost as compared to the standard direct material cost. It is the difference between the standard cost of direct materials provided for the output attained and the actual cost of direct materials used. It indicates how much more or less money has been incurred as compared to the normal cost. As a result, Variance Analysis is a crucial tool for tracking departures from a company’s standard.

Material cost variation is also an issue, as it is the total of direct material utilization and price fluctuations. Variations might be beneficial or detrimental. This discrepancy in material costs could be attributable to differences in raw material utilization as well as price differences. If the real cost is less than the standard cost, the difference is regarded favorable; if the actual cost exceeds the standard cost, the difference is considered unfavorable. There is no general rule for calculating direct material cost variations.

Start A Writing Career And Live The Adventure

The following formula is used to calculate direct material cost variance:

MCV = (SQ x SP) – (AQ x AP)

Standard quantity (SQ) should be revised if standard outputs and actual outputs differ.

Revised standard quantity (RSQ) = (SQ/SO x AO)

Where,

- SQ = Standard Quantity

- SP = Standard Price

- AQ = Actual Quantity

- AP = Actual Price

- SO = Standard Output

- AO = Actual Output

Material cost variance represents the total of material price variance and material usage variances.

As such, MCV = Material price variance (MPV) + Material usage variance (MUV)

If the resulting figure is positive, the difference is denoted by favorable variance i.e.(F) and if the resulting figure is negative, the difference is denoted by unfavorable variance i.e.(U).

Material Cost Variance can be due to less purchase price being paid than the standard or because of a change in the quantity of material used. Thus, Material Cost Variance consists of two components: Material Price Variance and Material Usage Variance.

Calculation of Material Cost Variance:

Illustration

- Standard quantity of material Q for 500 units of output is fixed as 800 kg.

- Standard price per kg. of material Q is estimated to be $ 5

- Actual quantity of material Q was 800 kg.

- Actual price of material was $ 4.5 per kg.

- Actual output was 400 units.

Solution,

Since the standard outputs and actual outputs differ, the standard quantity should be revised.

Revised standard quantity (RSQ) = (SQ/SO) x AO =800/500 x 400 = 640 units.

Now,

Material Cost Variance(MCV) = (SQ x SP)-(AQ x AP) = (640×5)-(800×4.5) = $ 400 (U)

Since, the resulting figure is negative the variance is denoted as unfavorable i.e. (U).