An Inventory write-down is an accounting procedure that is used to exhibit the discount of an inventory’s value, required when the inventory’s market price drops beneath its book value on the balance sheet. As an example, suppose a business has a product in stock that costs 1,000 and has determined that due to a decline in the market for the product, its price is estimated to be really worth 700.

We reduce the value of finishing inventory for the time that we pay down or write off inventory. If the firm uses the “Just in Time” inventory technique, a company cannot stop getting stocked inventory. The lifetime of an inventory depends primarily on what it is. It would be higher than the actual value of inventory that exists in our company financial statement. This implies that our financial statements would provide false details on the financial position of our company.

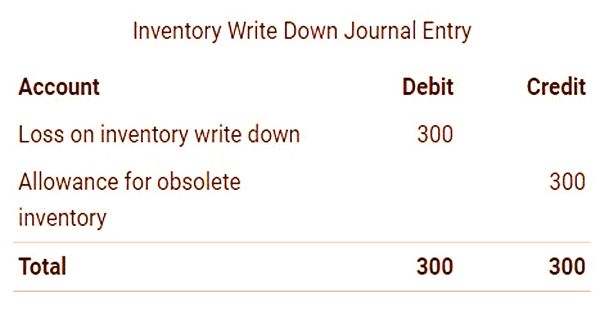

(Example of Inventory Write Down)

Excess stored inventory at some stage will be near the end of its lifetime which will result in defective or unsellable goods in turn. In this case, a write-down occurs by either reducing the inventory value or completely eliminating it. The inventory equation states that the cost of goods sold, or COGS, equals the opening stock plus purchases minus ending inventory. Write-downs consequently elevate COGS, which has the effect of lowering gross profits and taxable income.

The inventory value drops from 1,000 to 700, and the value decrease that needs to be reflected in the accounting reports is 1,000 – 700 = 300.

The inventory write-down journal entry is as follows:

Debit COGS for the loss and credit inventory by the same sum to report the write-down without using an inventory reserve. Goods which are damaged in manufacturing or when shipped often lead to write-downs of inventory. Stolen merchandise and inventory used as in-store displays are other common causes of inventory write-downs (goods placed on display are not ready for consumption).

Whenever we know that a write-down is needed for our inventory goods, we should charge the sum of the cost immediately. If we have some idea of how much inventory we can write down for the time to promote the corresponding principles, we will consider the cost in advance. This write-down sum must not be extended over future accounting periods, as this would suggest that due to the write-down amount that is not real, our organization is getting benefits. If we become conscious of real losses, the write-down debit inventory reserve, and credit inventory.

An inventory write-down is handled as an expense, which reduces internet income. The write-down also reduces the owner’s equity; this also impacts stock turnover for subsequent periods. The Accounting Equation, Assets = Liabilities + Owners Equity indicates that the company’s total assets are always equal to the company’s total liabilities plus the equity. The inventory write-down represents an expected decrease in the value of the inventory at this point, and the reduction is reflected in the outdated inventory allowance counter asset account rather than the inventory account itself.

Information Sources: