The information gathered for an audit of a company’s financial transactions, internal control procedures, and other things required for an auditor or certified public accountant (CPA) to certify financial statements is known as auditing evidence. An inadequate assessment implies that the reviewer has discovered sensible affirmation that a substance’s accounting articulations are not substantially misquoted. The sum and kind of auditing evidence considered differing extensively dependent on the sort of firm being evaluated just as the necessary extent of the audit. Until auditors may reach a verdict on the financial statements as a whole or in part, they must ensure that the information they have obtained is adequate and of sufficient quality.

Auditors need audit evidence to determine if a company’s financial transactions are accurate, so that a CPA (Certified Public Accountant) can validate their financial statements. Instances of auditing evidence incorporate financial balances, the executives accounts, payrolls, bank articulations, solicitations, and receipts. Great reviewing proof ought to be adequate, dependable, gave from a fitting source, and pertinent to the current audit. For the auditor to form audit opinions, sufficient and accurate audit evidence is required. Audit risks are also contingent on auditing adequate and relevant evidence.

Auditing is the way toward checking and confirming a substance’s budget reports for exactness and reasonableness. Exchanges that are recorded inside the monetary records of a substance should be a reasonable portrayal of the element’s monetary situating and real activities. Audit evidence is the facts that the auditor must consider during the audit preparation stage in order to design the most appropriate and productive audit strategy. Internal management procedures’ dependability, for example, as well as analytical analysis systems. The objective of any audit is to decide if an organization’s fiscal summaries agree with generally accepted accounting principles (GAAP), international financial reporting standards (IFRS), or another arrangement of bookkeeping standards appropriate to a substance’s purview.

The auditor obtains audit proof at all levels of the audit, including preparation, execution, and conclusion. The auditors collect this information using a variety of technologies and techniques that are appropriate for them. A company’s financial statements are generated internally. The cycle presents a degree of hazard for control or fake conduct from insiders who can adjust data while setting up the financials. Evaluating is a fundamental interaction that guarantees that control or deceitful conduct isn’t being directed.

Since publicly traded entities are expected to provide thoroughly audited financial statements to shareholders on a regular basis, auditors and accountants must compile and organize auditing evidence as part of their job. Audit proof comes in a variety of shapes and sizes, as well as from a variety of sources. Data or facts, physical or nonphysical, may be used as audit evidence.

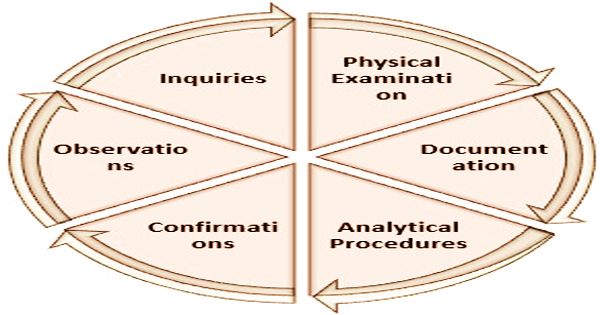

Types of Audit Evidence –

- Physical Examination: The auditing process begins with a physical inspection of the asset and, if appropriate, a count. Depending on the purpose of the audit, this information is gathered whenever possible.

- Documentation: The auditor collects written records such as acquisition invoices, sales invoices, business policy documents, and so on, which may be internal or external. This evidence is more trustworthy because it includes written proof on which the auditor bases his decision.

- Analytical Procedures: The analytical procedure is used by the auditor to obtain the necessary data or to determine the accuracy of various pieces of information. The auditor’s comparisons, estimates, and relationships between the different data are all part of this process.

- Confirmations: Auditors also request third-party balance confirmations to ensure that clients do not alter the balances presented in the financial statements. This is the receipt of a written response from a third party to check the accuracy and validity of various details that the auditor requires.

- Observations: Before coming to any conclusions, the company’s auditor observes the different operations of the clients and their staff.

- Inquiries: Inquiries are the various questions posed by the company’s auditor to the company’s management or concerned employees in places where the auditor has doubts. The answers to these questions are obtained by the auditor.

Evidence is a vital part of auditing. Budget reports can without much of a stretch be misquoted. It is needed by reviewers to check reality inside monetary records. To put it plainly, evaluating proof is intended to furnish evaluators with the data for them to make the judgment on whether budget reports are precise and valid. Internal representatives of an agency, such as management and internal finance departments, provide evidence that supports and verifies financial details. Proof, on the other hand, can contradict information given by internal participants, which can indicate mistakes or fraud.

Characteristics of Evidence in an Audit –

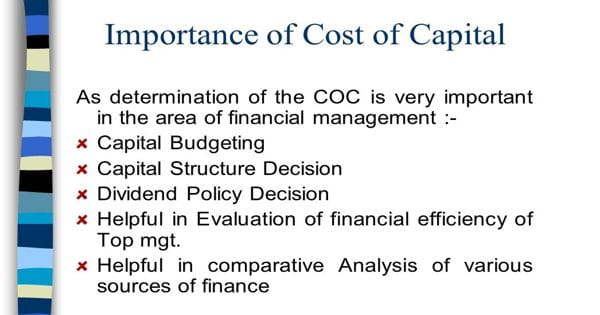

Good auditing evidence can be measured by the extent of the following characteristics:

- Nature: It is a term that describes the type of data that is obtained. The details may be given in a variety of ways, including legal records, presentations, or oral confirmation from employees.

- Relevance: It refers to the pertinence of the information to provide an opinion.

- Reliability: It refers to deciding whether or not the information can be trusted or used to form an opinion. It is important to understand the information’s source.

- Source: Accounting evidence may be collected either directly from the corporation or from a third party. Externally sourced data is usually thought to be more reliable and is therefore favored.

- Sufficiency: It considers whether the information given is of sufficient quantity to enable auditors to make an accurate determination. If an auditor was issued only one bank statement from a corporation, he or she would not be able to draw any conclusions about the company’s financial situation.

In an audit, evidence is gathered to complete the auditing process. Here are some examples:

- Bank statements

- Bank accounts

- Transaction records

- Management accounts

- Payrolls

- Billing invoices

- Receipts

- Inventory counts

The assemblage of the things of evidence is utilized to close whether budget reports have been precisely introduced. The review proof is data that the evaluator is to consider whether the budget summaries overall present with fulfillment, legitimacy, exactness, and consistency with the examiner’s comprehension of the element. Auditors prefer information that is written rather than spoken; information that comes from a third-party source rather than from inside the company; and original documents rather than copies of certain documents; the auditor must have a thorough understanding of the company in order to request sufficient auditing evidence; the auditor must make firsthand findings rather than rely on reports from another source.

Information Sources: