Variable costing, also known as direct costing, is a costing method that includes only variable manufacturing costs in the cost of a unit of product — direct materials, direct labor, and variable manufacturing overhead. Direct costing is another name for variable costing. Only production costs that vary directly with output are treated as product costs in variable costing. Under this method, fixed manufacturing overhead is not considered a product cost.

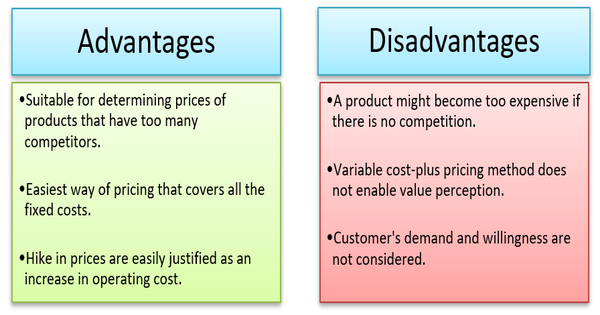

Advantages of Variable Costing

Some of the advantages are given below:

Variable costing can easily supply data on variable costs and contribution margin, which management requires every day to make decisions about special orders, capacity expansion, production shutdown, and so on.

- It aids in focusing on only those costs that are variable and directly affected by changes in production volume.

- It aids in cost volume profit (CVP) analysis by allowing for the determination of contribution margins, which can be used to identify profitable products and better resource allocation by the business.

- It removes the problem of fixed cost allocation which is quite tedious and at times subjective.

- It helps in better planning of operations by the business and acceptance of orders which exceed the Contribution margin. It helps undertake Break-even analysis which is frequently used by business managers.

Disadvantages of Variable Costing

Some of the disadvantages are given below:

- A directly identifiable fixed cost is one that is directly related to production. However, all fixed costs are treated as period costs. As a result, the production cost may be inaccurate.

- Variable costing misleads management into believing that a business can be profitable with a low contribution margin because it ignores fixed costs, which also affect profitability. It is only used for internal reporting, and businesses must conduct separate financial reporting.

- Another challenge with variable costing is the bifurcation of costs into fixed and variable, which in some cases is not possible because certain costs are difficult to divide into these categories and are semi-variable.

- Another disadvantage of variable costing is the lack of economies of scale. Variable cost per unit determined by Variable costing components does not remain constant as production volume increases; however, Variable costing does not capture the same.

Variable costing is an important component of product costing and is included in the business’s internal reporting framework. Variable costing is a useful method of identifying product costs when allocating fixed costs is not feasible or possible, or when management is more interested in knowing the additional costs to be incurred in production without considering fixed costs at all.