Techniques of identifying Errors while Auditing

Generally, the auditor prepares the trial balance himself. The main objective of an audit is to prepare and present a report on the basis of accuracy, performance, and reliability. Auditors should be very careful about the recognition of errors because exploitation in accounting may also appear as error or it may be a result of negligence on part of a bookkeeper.

The auditor should perform the following functions to detect errors:

Check the total of trial balance. These errors are not noticeable from trail balance; these errors might be devoted accidentally or for the reason of exploitation of accounts to inflate or reduce profit.

Comparing data of books and accounts with the amount of trial balance.

The detection of errors of duplication is very difficult. Auditor should check the balance of books of accounts. It might be detected with an appropriate and minute observation of accounts.

The auditor should compare the balance of last year with the opening balance of the current year.

The error of commission occurs the entry made in the books of the original entry or the ledger account is wrong. The auditor should check the primary books of the account.

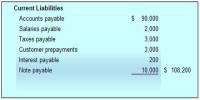

The auditor should prepare a list of debtors and creditors and such amount should be compared with the amount of trial balance.

Auditor should check carefully in those areas where there are chances of fraud. Fraud awareness creates whistleblowers in organizations which help companies to minimize the risk of fraud and errors.

Auditor should check carefully in those places where there are chances of a specific type of errors.