EXECUTIVE SUMMARY

The internship report is prepared with respect to the three months internship program in MARHK & Co. (Chartered Accountants).

Reports are essential to audit and assurance engagements because they communicate the auditor’s findings. Users of financial statements rely on the auditor’s report to provide assurance on the company’s financial statements. Auditor is likely to be responsible if an incorrect audit report is issued. The audit report is the final step in the entire audit process. The auditor’s report should contain a clear written expression of opinion on the financial statement taken as a whole. A measure of uniformity in the structure and nature of the auditor’s report is desirable because it helps to promote the user’s understanding and to identify unusual circumstances when they occur.

This internship report is aimed at providing a comprehensive picture about the auditor’s report structure and nature (type) which are practiced by the chartered accountants in Bangladesh in comparison with the standard guidelines stated in Bangladesh Standard on Auditing (BSA)-700 and other relevant literatures. Efforts have been employed to make the content relevant, reliable and understandable.

The report has been segmented into six parts. These are basically introduction, auditing standard: Bangladesh perspective, the audit report, findings and analysis, recommendation and conclusion. The introduction part focuses on introduction, background, origin of the report, scope of the report, objectives, methodology, and limitations. The second part outlines the auditing standards emphasizing on Bangladesh perspective. It also states the scope and assurance nature of the audit& control, corporate governance and audit, economic significance of the audit, advantages of an audit, and audit in Bangladesh. The third part of the report gives a theoretical understanding about audit report addressing the standard guidelines stated in BSA-700 and other relevant literatures focusing on the structure and nature of the audit report issued by the independent auditor. This fourth part which is the most important one, gives the actual practices by chartered accountants in Bangladesh, as observed in the sample. This part also gives an analytical knowledge about standard and actual practices. The fifth part shows recommendation of the report. Last part of the report concluded with some constructive recommendation regarding good practice.

I have taken all the reasonable care to ensure the quality of the report and I hope that it has included all the necessary information which is in the scope of my ability.

I would like to express that my effort for this report will provide you a better picture regarding the practices of chartered accountants in Bangladesh.

Chapter 1

Introduction

Introduction:

Assurance services are independent professional services that improve the quality of information for decision makers. Individuals who are responsible for making business decisions seek assurance services to help improve the reliability and relevance of the information used as the basis of their decisions. Assurance services are valued because the assurance provider is independent and perceived as being unbiased with respect to the information examined. Assurance services can be performed by CAs (Chartered accountants in Bangladesh) or by a variety of other professionals. One category of assurance services provided by CAs is attestation service.

An Audit of historical financial statements is a form of attestation service in which the auditor issues a written report expressing an opinion about whether the financial statements are in material conformity with generally accepted accounting principles (GAAP) or international financial reporting standards (IFRSs). Audit represents the predominant form of assurance performed by CA firms. When presenting information in the form of financial statements, the client makes various assertions about its financial condition and results of operations. External users who rely on those financial statements to make business decisions look to the auditor’s report as an indication of the statements’ reliability. They value the auditor’s assurance because of the auditor’s independence from the client and knowledge of financial statement reporting matters (Arens, 2000).

The objectives of an audit of financial statements is to enable the auditor to express an opinion whether the financial statements are prepared, in all material respects, in accordance with an identified financial reporting framework. The term “financial statements as defined by the council of the ICAB “framework of presentation of financial statements” covers balance sheets, income statements or profit and loss accounts. Cash flow statements, notes and other statements and explanatory material which are identified as being part of the financial statements. Although the auditors’ opinion enhances the credibility of the financial statements, the user cannot assume that the opinion is an assurance as to the future viability of the entity nor

the efficiency or effectiveness with which management has conducted the affairs of the entity (ICAB, 2004).

An audit is defined by the International Auditing Practices Committee (IAPC) of International Federation of Accountants (IFAC) as:

The independent examination of the financial information of any entity, whether profit oriented or not, and irrespective of its size, or legal form, when such an examination is conducted with a view to expressing an opinion thereon. The term financial information encompasses financial statements.

There are three primary types of audits: financial statements audits, operational audits, and compliance audits. The latter two services are often called audit activities, even though they are most similar to assurance and attestation services (ICAB, 1999).

Background:

The internship Program of BBA student of the Faculty of Business Studies, Bangladesh University of Business & Technology (BUBT), is an integral part of BBA program. After completion of the program period a student must submit the report .Four (4) credit hours for this internship program out of 124 credit hours of the program. The program is of three months duration. I was assigned to MARHK & Co. (Chartered Accountants). To compete with the supervisor of the program I have selected a topic “Nature of the Audit Reports of the Listed Companies in Bangladesh”.

Origin of the report:

The report entitled “Nature of the Audit Reports of the Listed Companies in Bangladesh” has been prepared as a partial fulfillment of BBA program authorized by the Faculty of Business Studies, Bangladesh University of Business & Technology (BUBT).

Scope of the report:

During these three months internship program in MARHK & Co. (Chartered Accountants) that time I am gather practical experience about my topic. So it is great opportunity to me.

Objectives of the study:

The main objective of the study is to analyze structure of the audit report of the companies issued by the independent auditor(s) to the shareholders of the companies concerned.

Broad Objectives:

The board objective of the study is to prepare a report on “Nature of the Audit Reports of the Listed Companies in Bangladesh.”

Specific Objectives:

It will serve the purpose of identifying and familiarizing with the deviation in those reports from standard structure as described in various literatures especially in Bangladesh Standards on Auditing (BSA)-700. Other objectives are the byproduct of the study as follows:

- To have an overall knowledge about standard structure of the auditor’s report.

- To have an idea about real world practice of chartered accountants as well as CA firms.

- To evaluate the auditor’s compliance with requirements in an audit report.

- To identify the necessity of harmonized audit reporting.

- To acquire practical knowledge about various types of audit report that is mandatory for my professional education.

Methodology of the study:

Study type:

The study is basically of content analysis. Content analysis is a research technique that obtains data by observing and analyzing the content or message of advertisement, union contracts, reports, letters, and the like. It involves systematic analysis, as well as observation, to identify the specific information content and characteristics of the messages. Content analysis studies the message itself. Its objective is to obtain a quantitative description of the manifest content of communication. This technique measures the extent of emphasis, or omission of emphasis, on any analytical category. (Zikmund, 2003)

Population and Sample:

As the study on the audit reports of the companies doing operations in Bangladesh, my population should be all the companies doing operations in Bangladesh with the special emphasis on the listed companies in the Dhaka Stock Exchange in Bangladesh.

Sample size of the study is 60 audit reports selected on random basis.

From the table below it is seen that out of 271 companies are listed on the DSE, as on August, 2010. Of the 271 companies, I have selected 60 companies (Table-1.6) for study on their audit report audited by various audit firms in Bangladesh and a framework of requirement categories in an audit report for my study. The annual reports of the 60 companies are 2008 and 2009 studied. The study has been based mainly on secondary data of the samples. The main sources of data are the Annual Reports of the selected samples.

Table-1.6: Sector wise distribution of listed companies in DSE

| SL No. | Sector | Population | Sample Companies |

| 1 | Bank and Financial Institute | 51 | 15 |

| 2 | Investment | 28 | |

| 3 | Engineering | 22 | 5 |

| 4 | Food and Allied Products | 23 | 10 |

| 5 | Fuel and Power | 11 | 2 |

| 6 | Jute | 3 | 1 |

| 7 | Textile | 27 | 5 |

| 8 | Pharmaceuticals and Chemicals | 21 | 2 |

| 9 | Paper and Printings | 2 | 1 |

| 10 | Service and Real estate | 4 | 1 |

| 11 | Cement | 7 | 2 |

| 12 | IT Sectors | 5 | 2 |

| 13 | Tannery | 5 | 1 |

| 14 | Ceramic | 5 | 1 |

| 15 | Insurance | 44 | 10 |

| 16 | Telecommunication | 1 | 1 |

| 17 | Travel | 1 | 0 |

| 18 | Miscellaneous | 11 | 1 |

| Total | 271 | 60 |

Source: monthly Review of DSE, August, 2010

Limitation of the study:

The study is conducted with an objective to make a through study of audit report issued by independent auditor of the listed companies. I faced some challenges during my study. Though I have overcome the faced challenges I had some limitations also. These limitations are number of sample, time and cost.

Number of sample:

For the difficulty of collecting all the audit reports of listed companies in DSE, I have taken 60 listed companies and out of 271 listed companies and all the national & multinational companies operating in Bangladesh.

Time:

Time was limited as I have completed my internship by August 31, 2010 and engaged in studying chartered accountancy in full swing resulting in time constraint for study. So, time span was not sufficient to cover all information.

Cost:

Huge cost was involved for completion of the study as I had to purchase the published annual report from the premise of DSE or from download from internet for getting the sample audit report which also restricted me to limit the number of sample.

Chapter 2

Auditing: Bangladesh Perspective

Audit in Bangladesh:

The Companies Act 1994 makes it compulsory for every company to have its accounts audited by qualified auditors. The desirability of this provision can be based on the fact that shareholders who contribute the capital of the company leave its management and control in the hands of directors. Auditors are there to safeguard the interest of shareholders.

The qualified chartered accountants from the Institute of Chartered Accountants of Bangladesh (ICAB) are eligible for auditing practices after getting sufficient experience in this field through a firm established through the approval of ICAB.

Chronological incidents of Company Audit (ICAB, 1999) reveal the following sequential incidents towards auditing standards and practice in Bangladesh over the years:

1850: Indian Joint Stock Companies Act (enacted in UK as the 1844 Act)

All incorporated companies required to have their annual financial statements audited. The Act did not require that the auditor be independent or be a professional accountant. The audit report was to state whether the balance sheet gave a full and fair view of its state of affairs.

1859: Nichol’s Case: The judgment stated that it was part of the auditors’ duty to discover fraudulent misrepresentation. This was the start of fraud and error detection as the main audit objective for the next 80 years or so.

1896: Re. Kingston Cotton Mill: The judge remarked that the auditor was a watchdog not a bloodhound, and that what was required of him was the exercise of what was regarded at the time as reasonable skill and care in the circumstances.

1913: Companies Act (India): Every company required to have its accounting books and records audited. A report had to be made on the balance sheet and profit and loss account. Auditors had to be professionally qualified.

1932: Auditors’ Certificate Rule: A comprehensive set of rules governing the regulation and training for the auditors.

1936: Amendments to 1913 Act: Increasing awareness took place about the importance of financial information to investors.

1947: Partition adopted by Pakistan.

1950: Auditors’ Certificate Rules 1950: These replaced the 1932 rules. Under these rules persons who fulfilled specified conditions in relation to practical and theoretical training could have their names entered in the register and use the designation “Registered Accountant”. Only a registered accountant could be appointed auditor of a public limited company.

1961: Institute of Chartered Accountants of Pakistan (ICAP): ICAP was formed from registered accountants. Government created department of accountancy.

1973: Formation of ICAB: Bangladesh liberated in 1971 creating a major problem because of the lack of an institute. In 1972 Institute of Chartered Accountants of Bangladesh formed under Bangladesh Chartered Accountants Order 1973 (P.O. No. 2 of 1973).

1973: Onwards: Bangladesh had been participating in the creation of International Accounting and Auditing Standards. Increasing awareness of the role of accounting and auditing was been going on.

Control, Corporate Governance and Audit:

The term control is used at a wide range of levels. At one extreme it means effects to achieve organizational goals and objectives; at another extreme the concern of control is to see if there are two approved signatures on a disbursement check; and in between there are all sorts of resources and operational activities, which must be dealt with (Chowdhury, 2004). Otley and Bery (1980) view that the study of organization and the study of control are interrelated. According to McMahon and Ivancevich (1976), an organization implies control. The above view has support from Tannenbaum (1968) when he claims that an organization without some form of control is impossible. He states that an organization can be seen as the relationship of human beings, the exercise of power, use of resources, and the distribution of resources. All these organizational issues need to be planned, carefully designed, directed, motivated, and controlled. There are control mechanisms internal and external to the organization. The external control mechanisms include market competition, government regulations, the market for takeovers, and corporate governance and monitoring by shareholders, auditors, and independent outside experts (Chowdhury, 2004). Committee on Corporate Governance (September 1999) suggests that external auditors shall perform fair audits independently from the corporation concerned, its management and controlling shareholders, so that shareholders and other users may maintain confidence in the corporation’s accounting information. Sir Adrin Cadbury perfectly said, “Corporate governance is considered withholding balance between economic and social goals and between individual and community goals. The aim is to align as nearly as possible the interests of individuals, corporations and society” (Cadbury, 2003). Corporate governance has become a top priority for the regulatory bodies with the objective of providing better and effective protection to all stakeholders and also to make the market confident as research reveals a positive correlation between corporate governance and share prices (Ahmad, 2004). Various elements of corporate governance discussion includes the legal framework, ownership structure, shareholding and protection of minority shareholders, board of directors, and the role of capital markets and Securities and Exchange Commission (SEC) in corporate governance, accounting and auditing standards, independent auditor’s report(Ahmed, 2005). Corporate Governance Committee (1997) stated remarkably, “An audit committee is to be created within the board of directors. All the members of the committee are to be non-executive directors. Its function will be to audit the quality of compliance achievements, as well as the appropriateness of risk management of management. Auditors should audit beyond the normal inspection of compliance by management, and at the very least should make due judgments on the strategic decisions made by the board of directors. The quality of corporate auditing has to be upgraded by designating more than one independent auditors and by a more systematized auditing” (Corporate Governance Committee, 1997).

Economic significance of the audit:

Economic significance of the audit of the financial statements of the company emphasizes the great importance of the audit. ICAB well stated: In Bangladesh as in most other developed and developing societies, the owners of resources place them in the custody or stewardship of others. Examples of this process are the shareholders (owners) of a company committing the resources of the company to the stewardship of the directors; the public at large committing publicly owned resources to the stewardship of elected representatives. The owners hold the stewards accountable. Under the stewardship system of financial reporting, the shareholders, who defector represent the ownership of corporate entity, are distinct separate from the board of directors, who defector represent the management of the company. The share holders appoint the directors in the company annual general meeting to manage the entity in the best interest of the ownership. The shareholders need an honest, unbiased, objective, independent expert, professional opinion, and evaluation of the performance of responsibilities entrusted upon the directors. The management is unlikely to render that opinion and appraisal with any degree of objectivity. Hence the auditor acts as a “bridge” helping to make management accountable to shareholder, through his audit report on the company’s financial information. The concept of audit independence also enumerates from the application of this system of stewardship reporting of financial reporting. The accountability is frequently in the form of annual reports incorporating financial statements. The typical example is the annual report and accounts of limited companies produced by the directors in accounting for their stewardship to the shareholders. Before these financial statements can be accepted by the owners, they need to be examined by audit (ICAB, 1999).

Thus the role of the audit is essentially linked with the role of accounting information, and may be summarized (ICAB, 1 999):

(a) The owners of resources (investors) must make decisions on the employment of these resources;

(b) Such decisions are linked with the expected returns from investments;

(c) In the absence of forecast information the investors look at historical data as a guide to the future;

(d) Such data is provided by the stewards of the resources (e.g. the company management);

Since their interest may conflict with the investors, the audit serves the function of lending credibility to the financial statements.

We have seen that the need for an external audit arises primarily when the ownership and management of an enterprise are separated. There are, however, certain inherent advantages in having financial statements audited even where no statutory requirement exists for such an audit:

Disputes between management may be more easily settled. For instance, a partnership which has complicated profit-sharing arrangements may require an independent examination of the accounts to ensure as far as possible an accurate assessment and division of those profits;

Major changes in ownership may be facilitated if past accounts contain an unqualified audit report. For instance, where two sole traders merge their business to form a new partnership;

Applications to third parties for finance may be enhanced by audited accounts. However, do remember that a bank, for instance, is likely to be far more concerned about the future of the business and available security than the past historical cost accounts, audited or otherwise;

An auditor may well discover major errors and fraud during his audit, even though such a discovery is not the primary objective of the audit;

The audit is likely to involve an in-depth examination of the business and so may enable the auditor to give more constructive advice to management on improving the efficiency of the business (ICAB, 1999).

Auditing standards:

These prescribed basic principles and practices which members are expected to follow in the conduct of an audit. Apparent failures by members to observe these standards may be enquired into by appropriate committees of the accountancy bodies and may lead to disciplinary action. Major accountancy bodies of the world have issued auditing standards to be followed by their respective members. The major accounting bodies of the United Kingdom and Eire formed themselves into a body known as the Consultative Committee of Accountancy Bodies. This body through its sub-committee known as Auditing Practices Committee (APC) is issuing auditing standards and guidelines (ASC). The initial major standards issued by the APC encompassed:

(i) The auditor’s operational standard

(ii) The audit report

(iii) Qualification in audit reports.

There is more detailed guidance on how the auditing standards may be applied in practice. Since it would be impossible to establish a code of rules sufficiently elaborate to cater for all situations these guidelines are not mandatory. However, they do represent a code of current best practice and an auditor would be unwise to ignore them unless he had good grounds for doing so. In a court of law for instance, the court would be likely to use auditing standards and guidelines as indicative of best practice and would be likely to judge the auditor’s work against the advice laid down in the guidelines or standards.

Auditing statements:

In addition to the auditing standards and guidelines, some accounting bodies also issue auditing statements on the general principles of auditing.

International Federation of Accountants:

The International Federation of Accountants (IFAC) came into existence on 7 October 1977 with the board objective of the development and enhancement of a co-coordinated worldwide accountancy profession with harmonized standards. In working toward this objective, the Council of IFAC has established International Auditing Practices Committee (IAPC) to develop and issue, on behalf of the Council guidelines on generally accepted auditing practices and on the form and content of audit reports (ICAB, 1999).

The Institute of Chartered Accountants of Bangladesh (ICAB):

The Institute of Chartered Accountants of Bangladesh (ICAB), being the only institute in Bangladesh for providing CA education, combines a high value qualification with a reputation as the country’s best institution for training and supports the chartered accountants. ICAB pursues the following objectives:

– Regulate the accountancy profession and matters connected therewith in the country.

– Ensure sound professional ethics and code of conduct by its members

– Provide specialized training and professional expertise in accounting, auditing, taxation, corporate laws, management consultancy, information technology and related subjects.

– Impart mandatory continuing professional education (CPE) to its members.

– Foster acceptance and observe of International Financial Reporting Standards (IFRSs) and International Standards on Auditing (ISA) and adopt IFRSs and ISA in Bangladesh as Bangladesh Financial Reporting Standards (BFRSs) and Bangladesh Standards of Auditing (BSA) respectively.

– Keep abreast of latest development in accounting techniques, audit methodology, information technology, management consultancy and related fields.

– Liaise with international and regional organizations to influence the development of efficient capital market and international trade in services.

ICAB adopts the standards as Bangladesh Standards on Auditing (BSA) as listed in appendix1:

General principles of an Audit:

The Auditor should comply with the Code of Ethics for Professional Accountants issued by the Council of the Institute of Chartered Accountants of Bangladesh. Ethical principles governing the auditors’ professional responsibilities (ICAB, 2004) are:

(a) Independence;

(b) Integrity;

(c) Objectivity;

(d) Professional competence and due care;

(e) Confidentiality;

(f) Professional behavior; and

(g) Technical Standards

The auditor should conduct an audit in accordance with BSAs or ISAs as adopted in Bangladesh. These contain basic principles and essential procedures together with related guidance in the form of explanatory and other material.

The auditor should plan and perform an audit with an attitude of professional skepticism recognizing that circumstance may exist that cause the financial statements to be materially misstated. An attitude of professional skepticism means the auditor makes a critical assessment, with a questioning mind, of the validity of audit evidence obtained and is alert to audit evidence that contradicts or brings into question the reliability of documents or management representations. For example, an attitude of professional skepticism is necessary throughout the audit process for the auditor to reduce the risk of overlooking suspicious circumstances, of over generalizing when drawing conclusions from audit observations, and of using faulty assumptions in determining the nature, timing and extent of the audit procedures and evaluating the results thereof. In planning and performing an audit, the auditor neither assumes that management is dishonest nor assumes unquestioned honesty. Accordingly, representations from management are not a substitute for obtaining sufficient appropriate audit evidence to be able to draw reasonable conclusions on which to base the audit opinion.

Scope of an audit:

The term “scope of an audit” refers to the audit procedures deemed necessary in the circumstances to achieve the objective of the audit. The procedures required to conduct an audit in accordance with BSAs should be determined by the auditor having regard to the requirements of BSAs, relevant professional bodies, legislation, regulations and, where appropriate, the terms of the audit engagement and reporting requirements.

Reasonable assurance:

An audit in accordance with BSAs is designed to provide reasonable assurance that the financial statements taken as a whole are free from material misstatement. Reasonable assurance is a concept relating to the accumulation of the audit evidence necessary for the auditor to conclude that there are no material misstatements in the financial statements taken as a whole. Reasonable assurance relates to the whole audit process.

An auditor cannot obtain absolute assurance because there are inherent limitations in an audit that affect the auditor’s ability to detect material misstatements. These limitations result from factors such as:

– The use of testing.

– The inherent limitations of any accounting and internal control system (for example, the possibility of management override or collusion).

– The fact that most audit evidence is persuasive rather than conclusive.

Also, the work undertaken by the auditor to form an opinion is permeated by judgment, in particular regarding:

(a) The gathering of audit evidence, for example, in deciding the nature, timing and extent of audit procedures; and

(b) The drawing of conclusions based on the audit evidence gathered, for example, assessing the reasonableness of the estimates made by management in preparing the financial statements.

Further, other limitations may affect the persuasiveness of audit evidence available to draw conclusions on particular financial statement assertions (for example, transactions between related parties). In these cases certain BSAs identify specified audit procedures which will, because of the nature of the particular assertions, provide sufficient appropriate audit evidence in the absence of:

(a) Unusual circumstances which increase the risk of material misstatement beyond that which would ordinarily be expected; or

(b) Any indication that a material misstatement has occurred.

Accordingly, because of the factors described above, an audit is not a guarantee that the financial statements are free of material misstatement (ICAB, 2004).

Chapter 3

The Audit Report

Introduction:

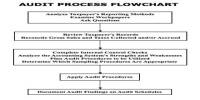

The final phase of an audit engagement is reporting the findings. To meet his or her reporting responsibilities, the auditor must (1) have a thorough understanding of the four reporting standards, (2) know the exact wording of the auditor’s standard report and the conditions that must be met for it to be issued, (3) understand the types of departures from the standard report and the circumstances when each is appropriate, and (4) be knowledgeable of certain other special reporting considerations (Boynton, 2001). The four reporting standards, according to Boynton (2001) are as:

(a) the report shall state whether the financial statements are presented in accordance with generally accepted accounting principles;

(b) the report shall identify those circumstances in which such principles have not been consistently observed in the current period in relation to the preceding period;

(c) informative disclosures in the financial statements are to be regarded as reasonably adequate unless otherwise stated in the report;

(d) the report shall either contain an expression of opinion regarding the financial statements, taken as a whole, or an assertion to the effect that an opinion cannot be expressed; the reasons thereof should be stated. In all cases where an auditor’s name is associated with financial statements, the report should contain a clear-cut indication of the character of the auditor’s work, if any, and the degree of responsibility the auditor is taking.

Bangladesh Standards on Auditing 700: The Auditor’s Report on Financial Statements:

Bangladesh Standards on Auditing 700: The Auditor’s Report on Financial Statements described the following guidelines to comply by the auditor:

The purpose of this Bangladesh Standard on Auditing (BSA) is to establish standards and provide guidance on the form and content of the auditor’s report issued as a result of an audit performed by an independent auditor’s of the financial statements of an entity. Much of the guidance provided can be adapted to auditor’s reports on financial information other than financial statements.

The auditor should review and assess the conclusions drawn from the audit evidence obtained as the basis for the expression of an opinion on the financial statements.

This review and assessment involves considering whether the financial statements have been prepared in accordance with an acceptable financial reporting framework I being either Bangladesh Accounting Standards (BASs) or relevant national standards or practices. It may also be necessary to consider whether the financial statements comply with statutory requirements.

The auditor’s report should contain a clear written expression of opinion on the financial statements taken as a whole.

Basic Elements of the Auditor’s Report According to BSA 700:

The auditor’s report includes the following basic elements, ordinarily in the following layout:

(a) Title: The auditor’s report should have an appropriate title. It may be appropriate to use the term “Independent Auditor” in the title to distinguish the auditor’s report from reports that might be issued by others, such as by officers of the entity, the board of directors, or from the reports of other auditors who may not have to abide by the same ethical requirements as the independent auditor.

(b)Addressee: The auditor’s report should be appropriately addressed as required by the circumstances of the engagement and local regulations. The report is ordinarily addressed either to the shareholders or the board of directors of the entity whose financial statements are being audited.

(c) Opening or introductory paragraph:

- i. Identification of the financial statements audited;

- ii. A statement of the responsibility of the entity’s management and the responsibility of the auditor;

The following matters are important in this case:

(i) The auditor’s report should identify the financial statements of the entity that have been audited, including the date of and period covered by the financial statements.

(ii) The report should include a statement that the financial statements are the responsibility of the entity’s management and a statement that the responsibility of the auditor is to express an opinion on the financial statements based on the audit.

(iii) Financial statements are the representations of management. The preparation of such statements requires management to make significant accounting estimates and judgments, as well as to determine the appropriate accounting principles and methods used in preparation of the financial statements. This determination will be made in the context of the financial reporting framework that management chooses, or is required to use. In contrast, the auditor’s responsibility is to audit these financial statements in order to express an opinion thereon.

An illustration of these matters in an opening (introductory) paragraph is; “We have audited the accompanying balance sheet of the ABC Company as of December 31, 20XX, and the related statements of income and cash flows for the year then ended. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audit”

(d) Scope paragraph (describing the nature of an audit):

(i) A reference to the BSAs or relevant national standards or practices;

(ii) A description of the work the auditor performed;

The following issues are important in this case:

(i) The auditor’s report should describe the scope of the audit by stating that the audit was conducted in accordance with BSAs.

“Scope” refers to the auditor’s ability to perform audit procedures deemed necessary in the circumstances. The reader needs this as an assurance that the audit has been carried out in accordance with established standards or practices. Unless otherwise stated, the auditing standards or practices followed are presumed to be those of the country indicated by the auditor’s address.

(ii) The report should include a statement that the audit was planned and performed to obtain reasonable assurance about whether the financial statements are free of material misstatement.

(iii) The auditor’s report should describe the audit as including:

- Examining, on a test basis, evidence to support the financial statement amounts and disclosures;

- Assessing the accounting principles used in the preparation of the financial statements;

- Assessing the significant estimates made by management in the preparation of the financial statements; and

- Evaluating the overall financial statement presentation.

(iv) The report should include a statement by the auditor that the audit provides a reasonable basis for the opinion.

(v) An illustration of these matters in a scope paragraph is:

“We conducted our audit in accordance with Bangladesh Standards on Auditing (BSA). Those Standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion”

(e) Opinion paragraph: there should be an opinion paragraph containing

- i. Reference to the financial reporting framework used to prepare the financial statements (including identifying the country of origin of the financial reporting framework when the framework used is not Bangladesh Accounting Standards); and

- ii. An expression of opinion on the financial statements;

The following issues are important in this case:

(i) The opinion paragraph of the auditor’s report should clearly indicate the financial reporting framework used to prepare the financial statements(including identifying the country of origin of the financial reporting framework when the framework used is not Bangladesh Accounting Standards) and state the auditor’s opinion as to whether the financial statements give a true and fair view (or are presented fairly, in all material respects) in accordance with that financial reporting framework and, where appropriate, whether the financial statements comply with statutory requirements.

(ii) The terms used to express the auditor’s opinion are “give a true and fair view” or “present fairly, in all material respects” and are equivalent. Both terms indicate, amongst other things, that the auditor considers only those matters that are material to the financial statements.

(iii) The financial reporting framework is determined by BASs, with an appropriate consideration of fairness and with due regard to Bangladesh legislation (Companies Act, Securities & Exchange Rule, Bank companies Act etc.) To advise the reader of the context in which the auditor’s opinion is expressed, the auditor’s opinion indicates the framework upon which the financial statements are based. The auditor refers to the financial reporting framework in such terms as: “… in accordance with Bangladesh Accounting Standards…” This designation will help the user to better understand which financial reporting framework was used in preparing the financial statements. When reporting on financial statements that are prepared specifically for use in another country, the auditor considers whether appropriate disclosure has been made in the financial statements about the financial reporting framework that has been used.

(iv) In addition to an opinion on the true and fair view (or fair presentation, in all material respects), the auditor’s report may need to include an opinion as to whether the financial statements comply with other requirements specified by relevant statutes or law.

An illustration of these matters in an opinion paragraph is: ”In our opinion, the financial statements give a true and fair view of (or present fairly, in all material respects) the financial position of the Company as of December 31, 20XX, and of the results of its operations and its each flows for the year then ended in accordance with Bangladesh Accounting Standards (BAS.)

(f) Date of the report: The auditor should date the report as of the completion date of the audit. This informs the reader that the auditor has considered the effect on the financial statements and on the report of events and transactions of which the auditor became aware and that occurred up to that date. Since the auditor’s responsibility is to report on the financial statements as prepared and presented by management, the auditor should not date the report earlier than the date on which the financial statements are signed or approved by management.

(g) Auditor’s address: The report should name a specific location, which is ordinarily the city where the auditor maintains the office that has responsibility for the audit.

(h) Auditor’s signature: The report should be signed in the name of the audit firm. The auditor’s report is ordinarily signed in the name of the firm because the firm assumes responsibility for the audit.

Types of Audit Opinions:

The opinions expressed in the auditor’s report may be:

- Unqualified

- Other than Unqualified

a) qualified

b) adverse, or

c) disclaimer of opinion.

Arens (1991) described the form and content of an audit report as the followings:

Standard Unqualified Audit Report:

The most common type of audit report is the standard unqualified audit report. It is used for more than 90 percent of all audit reports. An unqualified audit report is expressed when the auditor is satisfied that the conditions set out below have been met in all material respects:

- the financial information has been prepared using acceptable accounting policies, and adhering to principles specified in Statements of Accounting Standard, which have been applied on a consistent basis;

- the financial information complies with the relevant legislation and regulations so far as they affect financial information and promulgations of the ICPAS;

- the view presented by the financial information as a whole is consistent with the auditor’s knowledge of the business of the entity;

- there is adequate disclosure of all material matters for a true and fair presentation of the financial information.

When the above conditions are met, the standard unqualified audit report is issued.

Departure form Statements of Accounting Standard:

It is one of the preconditions for the issuance of an unqualified opinion that financial statements comply with statements of accounting standard. However, in rare circumstances a departure from accounting standard may be necessary in order to present financial statements that give a true and fair view. The preface to Statements of Accounting standard requires that in the case of any departure, the financial statements should fully disclose and explain the departure.

Where a departure is not fully disclosed and explained in the financial statements and the effect of the departure, in the opinion of the auditor, does not alter his opinion as to the truth and fairness of the financial statements, the auditor should disclose and explain the departure in his report. Such disclosure and explanation include in the report will not be construed as a qualification of his opinion.

Emphasis of a matter:

Under certain circumstances the auditor may wish to draw the reader’s attention to important matters, which are already disclosed in the financial statements, to ensure that those are not overlooked. It is not the intention of the auditor to qualify his report by such reference but is aimed at emphasizing the specific matter. Accordingly, it is suggested that such reference should be made, not in the opinion paragraph of the audit report, but in a separate paragraph.

The following are examples of explanatory information the auditor may feel should be expressed:

- the existence of significant related party transactions;

- important events occurring subsequent to the balance sheet date;

- the description of accounting matters affecting the comparability of the financial statements with those of the preceding year.

Audit Reports Other than Unqualified:

Whenever the auditor is in a state of uncertainty or is in disagreement with management on matters that affect the financial statements materially, he must issue a report other than an unqualified report. In these circumstances there are three types of audit reports the auditor could choose from: qualified opinion, disclaimer of opinion and adverse opinion. Initially, in deciding whether to qualify his opinion, the auditor should have regard to materiality of the matter in the context of the financial statements on which he is reporting. A qualification of opinion is not warranted if the matter is not material.

Where the auditor is of the view that the matter is of material significance to the truth and fairness of the financial statements, he has to make a further decision as to whether or not the matter is of fundamental importance to the statements as a whole, before selecting the appropriate opinion to be expressed. An uncertainty becomes fundamental when its potential impact on the financial statements could be so great as to invalidate the truth and fairness of the financial statements as a whole. A disagreement becomes fundamental when the impact of the misstatements is so great that the financial statements are, in the opinion of the auditor, misleading.

Use of an Explanatory Paragraph:

When a report that is other than unqualified is issued, an explanatory paragraph should be inserted between the scope paragraph and the opinion paragraph to explain the qualification that affects the opinion. In the explanatory paragraph, the auditor should give a clear description of all substantive reasons for his conclusions and, unless impractical, should include a quantification of the possible effect on the financial statements.

The three types of audit qualifications and the circumstances under which they are issued are discussed below.

Qualified Opinion:

There are two forms of qualified opinion” “subject to” qualified opinion and “except for” qualified opinion.

Subject to” Qualified Opinion:

This opinion is relevant when the auditor is uncertain whether a particular matter which he considers material has been fairly stated in the financial statements. The uncertainty could arise due to scope restriction consequent to which the auditor is unable to carry out audit procedures which he considers are essential, or due to inherent uncertainties associated with the nature of the matter.

In a “subject to” qualified opinion the auditor disclaims an opinion on a particular matter in the financial statement which he considers is of material significance. The auditor does not consider the matter as being of fundamental importance, and he believes that the overall financial statements do give a true and fair view. The wording of the opinion expressed indicates that the auditor is of the view that the financial statements give a true and fair view subject to either:

(a) any adjustments that he might have found to be necessary if the scope of his audit work had not been limited, or

(b) any adjustments that might have been necessary if the outcome of the uncertainty had been known.

Except for Qualified Opinion:

“Except for qualified opinion is issued when the auditor is in disagreement with management on a particular matter which is considered material but not fundamental. The opinion will express the auditor’s satisfaction as to the truth and fairness of the financial statements except for the particular matter in dispute.

Disclaimer of Opinion

A disclaimer of opinion is issued in a situation when the auditor’s uncertainty extends to a matter or matters of fundamental importance as a result of which he is unable to satisfy himself as to whether the overall financial statements present a true and fair view. The necessity for disclaiming an opinion may arise because of a severe limitation of the scope of the audit examination, or because it is not possible to identify any particular area or amounts affecting the true and fair view due to uncertainties is pervasive to the financial statements.

Adverse Opinion:

An adverse opinion is expressed only when the auditor believes, after a full investigation, that the overall financial statements are so fundamentally misstated, or are misleading as a whole that they do not present a true and fair view. It is the most extreme form of audit report and is considered as a measure of last resort.

An adverse opinion is distinguished from a disclaimer of opinion in that the latter can arise only from a lack of knowledge by the auditor, whereas to express an adverse opinion the auditor must have knowledge that the financial statements do not present a true and fair view.

Chapter 4

Findings and Analysis

Findings regarding structure of the audit report issued:

Table 4.1 describes the extent of compliance of auditing standards followed by the auditors of the sample companies:

Table-4.1: Extent of compliance as to the standard structure of the audit report:

| SL No. | Structure Component | Description | No. of audit report complied (N=60) | % |

| 1 | Title | Mentioning of “Independent Auditor” in the title | 2 | 3.33 |

| 2 | Addressee | Mentioning like “Shareholders of the XYZ Company (Full name)” | 48 | 80.0 |

| 3 | Opening or Introductory Paragraph | Identification of Financial Statements | 60 | 100 |

| A statement of the responsibility, of the management regarding the financial statements and of the auditor(s) regarding opinion. | 60 | 100 | ||

| 4 | Scope Paragraph (Describing the nature of an audit) | Reference to the BSA or relevant national standards or practices | 60 | 100 |

| Requirement of planning and performance | 60 | 100 | ||

| A description of the work the auditor(s) performed | 60 | 100 | ||

| Reasonable basis of opinion | 60 | 100 | ||

| 5 | Opinion Paragraph | Reference to the financial reporting framework used to prepare the financial statements | 60 | 100 |

| 6 | Date of the report | Mentioning the date of completion | 59 | 98.33 |

| 7 | Auditors’ address | Full address with holding number | 18 | 30.0 |

| City where the audit firm located | 50 | 83.33 | ||

| No address at all | 0 | 0 | ||

| 8 | Auditors’ signature | Signature in the name of the firm | 52 | 86.67 |

| Signature in the name of partner | 8 | 13.33 | ||

| Signature as ‘S/d’ | 10 | 16.67 | ||

| No signature at all | 0 | 0 | ||

| 9 | Heading of the paragraph | Mentioning the head of the paragraph before starting the paragraph | 20 | 33.33 |

Findings of analysis standard structure of the audit report:

From the above analysis we can infer that introductory paragraph, scope paragraph and opinion paragraph were complied fully with the standard practice as guided. But in case of title, addressee, date of the report, auditors’ address, auditors’ signature, heading of the paragraph component of the audit report were not been complied to the fullest extent. The great deviation from standard practice was identified in the ‘title’ component. Only 3.33 percent audit report titled as ‘Independent auditors’ report’. That is (2 audit report out of 60) companies audit report. This companies are Monno ceramic (Audited by Muhammad Shaheedullah & co.) and another is Alhaj Textile Mills Ltd. (Audited by Khan Wahab Shafiq Rahman & Co.) But this compliance should be 100 percent. ‘Auditors’ address’ were given in the audit report almost all cases but only 20 percent audit report inserted the address of the firm with holding number which is directed as standard practice. Auditors’ signature was given almost all cases but 13.33 percent of the audit report was issued with the signature in the name of partner concerned and 86.67 percent of the audit report was issued with the signature in the name of audit firm which should be the standard practice. It was observed that 16.67 of the audit report was issued with the signature as ‘S/d’ which should not be the standard practice. It is worthy to mention that one audit report was issued without any signature of the auditors, which is a major violation of the prescribed standard for the structure of the audit report. Substantial part of the audit report studied (80 percent) addressed to the shareholders of the concerned company with the full name of the company but 20 percent did not address to the shareholders of the concerned company with the full name of the company, which could be attributed as the violation of the standard practice. It is a good practice to mention the name of the paragraph before starting each paragraph in the audit report to indicate specific segment of the audit report for the good understandability of the message of the report to the users. But only 20 percent of the audit reports studied mentioned the name of the paragraph before starting each paragraph.

Finding regarding the nature of the audit report issued:

The findings in relation to the nature of the audit report are presented in the following table:

Table-4.2.: Nature of the audit report issued for the listed companies studied

| Name of the Companies | Nature of the audit reports studied | ||||

| Unqualified | Emphasis of matter | Qualified | Disclaimer | Adverse | |

| Bank and Financial Institute: | |||||

| AB Bank Ltd. | ü | ||||

| Bank Asia Ltd. | ü | ||||

| City Bank Ltd. | ü | ||||

| Dhaka Bank Ltd. | ü | ||||

| Dutch Bangla Bank Ltd. | ü | ||||

| Al-Arafha Islami Bank Ltd. | ü | ||||

| Trust Bank Ltd. | ü | ||||

| IFIC Bank Ltd. | ü | ||||

| Exim Bank Ltd. | ü | ||||

| Prime Bank Ltd. | ü | ||||

| Standard Bank Ltd. | ü | ||||

| IDLC Ltd. | ü | ||||

| People’s Leasing | ü | ||||

| MIDAS Financing | ü | ||||

| Phoenix Finance & Inv. | ü | ||||

| ENGINEERING: | |||||

| Aftab Automobiles | ü |

|

| ||

| Anwar Galvanizing | ü |

|

| ||

| Atlas Bangladesh |

|

| ü | ||

| Aziz Pipes Ltd. | ü |

|

| ||

| BD. Auto cars Ltd. | ü |

|

| ||

| Name of the Companies | Nature of the audit reports studied | ||||

| Unqualified | Emphasis of matter | Qualified | Disclaimer | Adverse | |

| Food and Allied Products: | |||||

| AMCL(Pran) | ü | ||||

| Olympic Industries Ltd. | ü | ||||

| Apex Foods Ltd. | ü | ||||

| Dhaka Fisheries | ü | ||||

| Gulf Foods Ltd. | ü | ||||

| Fu-Wang Foods | ü | ||||

| Meghna Cond.Milk | ü | ||||

| National Tea Co. | ü | ||||

| Rahim Food | ü | ||||

| Zeal Bangla | ü | ||||

| Fuel and Power: | |||||

| DESCO | ü | ||||

| BD. Welding | ü | ||||

| Jute: | |||||

| Jute Spinners Ltd. | ü | ||||

| Textile: |

|

|

| ||

| Al-Haj Textile | ü |

|

| ||

| Altex Industries | ü |

|

| ||

| Apex Spinning | ü |

|

| ||

| Beximco Textile Ltd. | ü |

|

| ||

| H R Textile | ü |

|

| ||

| Name of the Companies | Nature of the audit reports studied | ||||

| Unqualified | Emphasis of matter | Qualified | Disclaimer | Adverse | |

| Pharma & Chemical: | |||||

| ACI Limited | ü | ||||

| Beximco Pharma | ü | ||||

| Paper and Packaging: | |||||

| Hakkani Pulp & Paper | ü | ||||

| Service: | |||||

| Eastern Housing | ü | ||||

| Summit Alliance Port | ü | ||||

| Cement: | |||||

| Meghna Cement | ü | ||||

| Lafarge Surma Cement | ü | ||||

| IT: | |||||

| Daffodil Computers | ü | ||||

| In Tech Online | ü | ||||

| Tannery: | |||||

| Apex Tannery | ü | ||||

| Ceramic: |

|

|

| ||

| Monno Ceramic | ü |

|

| ||

| Insurance: |

|

|

| ||

| Asia Ins. Ltd. | ü |

|

| ||

| Asia Pacific Gen. Ins. | ü |

|

| ||

| Delta Life Insurance |

|

| ü | ||

| Name of the Companies | Nature of the audit reports studied | ||||

| Unqualified | Emphasis of matter | Qualified | Disclaimer | Adverse | |

| Islami Insurance | ü | ||||

| Janata Insurance | ü | ||||

| Meghna Life Insurance | ü | ||||

| Popular Life Insurance | ü | ||||

| Green Delta Insurance | ü | ||||

| Rupali Insurance | ü | ||||

| Republic Ins. Co. Ltd. | ü | ||||

| Miscellaneous: | |||||

| Beximco Ltd. | ü | ||||

| TOTAL

| 51 (85%) | 0 | 9 (15%) | 0 | 0 |

A chart has been inserted depict the nature of the audit report issued:

Chart-4.1

Findings of analysis nature of the audit report:

From the above analysis we can infer that substantial part (75% of the total sample) of the audit reports studied was issued as ‘Unqualified’. A small portion of the audit reports studied was issued as ‘Qualified’ mentioning the standard indications of qualified audit report of ‘Except for’ and ‘Subject to’ in the opinion paragraph of the audit report. Olympic Industries Limited, National Tea Company Limited, Fu-Wang Foods Limited, Zeal Bangla Sugar Mills Limited, Meghna Cond.Milk, Gulf Foods Limited, Atlas Bangladesh, Delta Life Insurance, Islami Insurance those companies audit reports are qualified audit report. Auditors identified the material uncertainty in the reference notes stated with the financial statements. In Olympic Industries Limited, auditors identify the material misstatement in the reference note no -10(b) regarding the investment in the share of Tripti Industries Limited. In Gulf Foods Limited auditors identified the material misstatement the company’s depreciation and amortization charges. In National Tea Company Limited, auditors identified the material uncertainty in realizing the debtors’ amount in scope paragraph. They had taken the company’s pre-tax profit into consideration as would have been Tk.31699189 instead of Tk. 81993398 thereby overstating the pre-tax profit to the extent of Tk. 50294209. In Fu-Wang Food Limited, auditors identified the material misstatement in the ref.no.-10 that the company did not follow BAS-12 for computation of the deferred tax liabilities or assets. In Meghna Cond.Milk, auditors identified the material misstatement the can not maintained proper book of account. In Zeal Bangla Sugar Mills, auditors identified the material misstatement ref. note no-11 TK.23214014 as unrealized for more than three years. In Islami Insurance, auditors identified the material misstatement on evaluation of fixed assets. In Atlas Bangladesh, they can not provide proper evidence of audit.

In Delta Life Insurance, auditors identified the material misstatement of their capital fund allocation.

On the other hand, no audit report was issued as ‘Adverse opinion’, or “Disclaimer”.

So, it can be made on this regard for finding out the independence of the auditor engaged in auditing for the Bangladeshi listed companies as the economic condition indicates for issuance of more number of qualified, disclaimer and adverse audit report.

Chapter 5

Recommendation

The following points are recommended after the study:

The auditor should give more emphasis on the guidelines suggested by BSA 700.

In carrying out their responsibilities as professionals, members should exercise sensitive professional and moral judgments in all their activities.

In all matters relating to the assignment, independence in mental attitude is to be maintained by the auditor or auditors.

The company should be flexible to provide proper evidence during the audit.

Chapter 6

Conclusion

The most common way for users to obtain reliable information regarding the financial position and the results of the operation of a business is to have an independent audit performed. The audited information is then used in the decision-making process on the assumption that it is reasonably complete, accurate, and unbiased. Independent audit report expresses an opinion on the fairness of the financial statements presented by the management of the company, indicating the weakness in the internal control system and its application ineffectiveness, if any, resulting in improvement in strong internal auditing environment to foster the corporate governance practice in the company.

Typically, shareholders engage the auditor to provide assurance to users that the financial statements are reliable to use the information contained in the financial statements for making decision. If the financial statements are ultimately determined to be incorrect, the auditor can be sued by both the users and shareholders. Auditors obviously have considerable legal responsibility for their work towards expressing audit report on the fairness of the financial statements.

A measure of uniformity in the form and content of the auditor’s report is desirable because it helps to promote the user’s understanding and to identify unusual circumstances when they occur for taking the decision needed for each user. Auditors should work more independently with the responsibility towards the stakeholders of the respective company to play an important role in flourishing the progressive economy in the country while issuing their audit report to portray the real picture of the balance sheet of the company.

Chapter 7

Bibliography

Ahmad, J.U. (2004), Draft Code of Corporate Governance-Bangladesh, The Bangladesh Accountant, October-December.

Ahmed, M. U. and Yusuf, M. A. (2005), Corporate Governance Bangladesh Perspective, The Cost and Management, Vol.33, No. 6, November –December 2005, pp. 18-26.

Arens, A.A. and Loebbecke, J.K. (2000), Auditing: An Integrated Approach, 8th edition, Prentice Hall International, Inc., USA.

Arens, A. A., Loebbecke, J.K. and Ambanpola, K.B. (1991), Auditing In Singapore-An Integrated Approach, 5th edition, Prentice Hall International, Inc., USA.

Bagrial, A. K. (2000), Company Law, 10th edition, Vikas Publishing House Pvt. Ltd., Delhi.

Boynton, W. C., Johnson, R. N. and Kell, W. G. (2001), Modern Auditing, 7th edition, John Wiley & Sons, Inc., NewYork, USA.

Cadbury, A. (2003), Corporate Governance-An Industry Perspective: Diverse Demands;Disciplined Approach, The Institute of Chartered Accountants of India (Publication of the 12th All India Conference of Chartered Accountants, January, Delhi).

Chowdhury, D. (2004), Incentives, Control and Development-Government in private and Public Sector with Special Reference to Bangladesh, Dhaka Viswavidyalay Prakashana Sangstha, Dhaka.

Committee on Corporate Governance (September 1999), Code of Best Practice for Corporate Governance, Korea.

Corporate Governance Committee (1997), Corporate Governacne Priciples-A

ICAB (2004), Bangladesh Standard on Auditing, Bangladesh.

ICAB (1999), Study Manual on Auditing: Intermediate Group-A, Lesson-1, pp. 1-20.

Japanese View (Interim Report), Corporate Governance Forum of Japan, October 30.

IASB (2006), International Financial Reporting Standards (IFRSs) 2006, London, UK.

Kabir, M. H. (2005) Setting Accounting Standards: Bangladesh and International Perspectives, The Cost and Management, 33(6), pp. 5-17.

Otley, D. and Berry, A. J. (1980) Control, Organization and Accounting, Accounting , Organization and Society, 5(2), 231-244.

McMahon, J. T. and Ivancevich, J. M. (1976) A Study Control in a Manufacturing Organization: Managers and Nonmanagers, Administrative Science Quarterly, March, 66-83.

Tannenbaum, A. S. (1968) Control in Organization, McGraw-Hill, NewYork.

Zikmund, W. G. (2003), Business Research Methods, Thomson Learning, USA.