Concept of Variance Analysis

Variance analysis is the quantitative investigation of the difference between actual and planned behavior. The terms variance refers to the deviation of the actual costs from the standard costs due to various causes. This is typically involves the isolation of different causes for the variation in income and expenses over a given period from the budgeted standards.

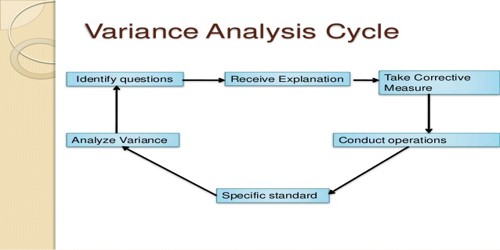

Variance analysis is the process of calculating the deviation of the actual costs from the standards and of interpreting the results. Variance analysis helps to ascertain the magnitude of each of the variances and causes of variance so that corrective actions can be taken.

So for example, if direct wages had been budgeted to cost $100,000 actually cost $200,000 during a period, variance analysis shall aim to identify how much of the increase in direct wages is attributable to:

- Increase in the wage rate (adverse labor rate variance);

- Decline in the productivity of workforce (adverse labor efficiency variance);

- Unanticipated idle time (labor idle time variance);

- More wages incurred due to higher production than the budget (favorable sales volume variance).

For three main elements of costs, variances are to be calculated and analyzed- material, labor and overheads. Commonly measured variances include direct labor rate variance, direct labor efficiency variance, direct material price variance, and direct material quantity variance. These variance analyses compare expected results to actual results.

Variance analysis facilitates performance measurement and control at the level of responsibility centers (e.g. a department, division, designation, etc). For example, procurement department shall be answerable in case of a substantial increase in the purchasing cost of raw materials (i.e. adverse material price variance) whereas the production department shall be held responsible with respect to an increase in the usage of raw materials (i.e. adverse material usage variance). Therefore, the performance of each responsibility centre is measured and evaluated against budgetary standards with respect to only those areas which are within their direct control.

Types of Variances

- Material Variance

- material cost variance

- material price variance

- material usage variance

- material mix variance

- material yield variance

- Labor Variance

- labor cost variance

- labor rate variance

- labor efficiency variance

- labor idle time variance

- labor mix variance

- labor yield variance

Information Source: