About Cash Book

Cashbook’s Chief Executive Greg Coulter comments “The market has been waiting for a truly integrated payment solution for diverse business units for a long time. Combining Cashbook’s ERP knowledge with Travelex’s extensive international payments experience will give Treasurers and Controllers a significant opportunity to better manage their cash balances, hugely simplifying the ERP to Bank payment process.”

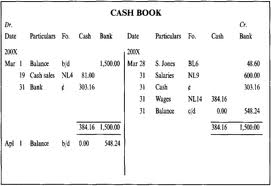

cash book sample

Will Beattie, Alliance & Partnership Manager, comments “On behalf of Travelex we are delighted to be working with Cashbook. Having discussed with Greg, Cashbook’s global client list I am certain we are going to offer Cashbook users some significant benefits, especially in the area of international payments and currency exposure.”

At a glance, Globalpay from Travelex allows you to proactively manage your currency exposure for payments that are coming up. On a single screen you can see your scheduled incoming and outgoing payments across all currencies, allowing you to make decisions about your cash flow and currency exposure quickly and easily.

REVOLVING FUND CASH BOOK

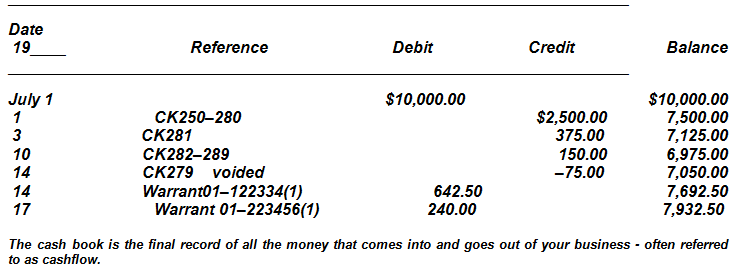

Bank Book

Gerhard Dieterle, Adviser in the Bank’s Agriculture and Rural Development unit and one of the authors and editors, said one of the volume’s “strong motivations” was the US$50 billion annual losses in global forest resources through illegal activities. The grand total of outside forest assistance, including the World Bank’s, is only US$1.7 billion, he said.

General Ledger

The ledger is the most important book of account and is the destination of the entries made in the Journal or Sub-divided Journals. It is a collection of all the three types of accounts –Personal, Real and Nominal. In ledger we maintain accounts. Each account is allotted one or more pages depending upon the requirement. Ledger is usually ruled in anyone of the following two alternatives. First alternative is followed in those cases where balance is required to be ascertained after every transaction e.g. Banks.

Balance sheet

In financial accounting, a balance sheet or statement of financial position is a summary of a person’s or organization’s balances. Assets, liabilities and ownership equity are listed as of a specific date, such as the end of its financial year. A balance sheet is often described as a snapshot of a company’s financial condition. Of the four basic financial statements, the balance sheet is the only statement which applies to a single point in time.A company balance sheet has three parts: assets, liabilities and ownership equity. The main categories of assets are usually listed first and are followed by the liabilities. The difference between the assets and the liabilities is known as equity or the net assets or the net worth of the company; according to the accounting equation, net worth must equal assets minus liabilities.

Income & Expenditure

This publication presents information about Canada’s National Economic and Financial Accounts (NEFA). These accounts portray the evolution of the Canadian economy on a quarterly basis. They record the components of income and expenditure, saving and investment, and borrowing and lending of each of four broad sectors of the economy: (i) persons and unincorporated businesses, (ii) corporate and government business enterprises, (iii) government and (iv) non-residents. Some information is also provided for sub-sectors of the second and third sectors. The sum of the final (non-transfer) income or the final (non-intermediate) expenditure of all domestic sectors equals gross domestic product at market prices, the market value of total production in Canada.

Receipt for payment

The receipt and payment of materials and services is as important as ordering itself. This section discusses what is undertaken to ensure that the items and services WHOI ordered are the items and services we received and paid.

Unlike other organizations you may be familiar with, WHOI does not separate the ordering and payment processing. The Procurement Office is responsible for the traditional functions performed at other institutions by Purchasing and Accounts Payable. This gives our Procurement Team member a unique view of the entire transaction, creating an environment where the person responsible for processing the payment also has intimate knowledge of what was ordered.

The profit and loss

The Balance Sheet is a snap shot in time of a company’s overall worth. The Profit & Loss Account (P&L) is a report of the company’s profit on the sale of their goods or the provision of their service over a trading period, normally one year.

Trade blance

Trade balance is usually decomposed by product and by country (bilateral trade balances). Relevant is the degree of concentration of the imbalance in trade caused by one or few commodities. If concentration is high, a targeted industrial policy could improve the balance (e.g. reduce the imbalance).On the other hand, if a deficit is due only to few partners, proactive and consensus-based trade negotiations with them could fairly quickly set the problem. Although less general than trade balance, which includes both goods and services, the “merchandise balance”, which includes only goods and not services, is sometime used because of better data availability.