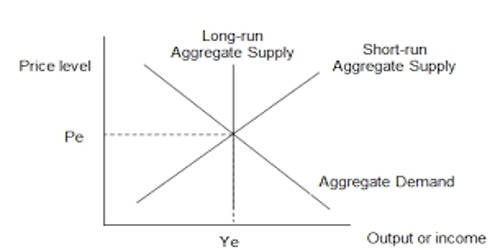

Demand-Pull Inflation is a type of inflation that occurs when aggregate demand for products and services outruns aggregate supply due to monetary factors and/or real factors. It is a tenet of Keynesian economics that describes the effects of an imbalance in aggregate supply and demand. When the aggregate demand in an economy strongly outweighs the aggregate supply, prices go up. It occurs when economic growth is too fast.

Demand-Pull Inflation starts with a rise in consumer demand. Sellers meet such rise with more supply. But when additional supply is unavailable, sellers raise their prices. That ends up in rising prices. It’s the foremost common explanation for inflation. The opposite reason, cost-push inflation, is rarer. It starts with a decrease in total supply or rise within the cost of that offer. Suppliers raise prices because they know consumers pay for it. That situation is named inelastic demand.

Demand-pull inflation means:

- Excess demand and ‘too much money chasing too few goods.’

- The economy is at (or very close to) full employment/full capacity.

- The economy will be growing at a rate faster than the long-run trend rate.

- A falling unemployment rate.

In Keynesian economic theory, an increase in employment leads to an increase in aggregate demand for consumer goods. In response to the demand, companies hire more people so that they can increase their output. The more people firms hire, the more employment increases. Eventually, the demand for consumer goods outpaces the ability of manufacturers to supply them.

The long trend rate of economics is the sustainable rate of economic growth; it is the rate of the economy without any demand-pull inflation. If economic growth exceeds this long-run trend rate, then it will cause inflationary pressures.

Causes of Demand-Pull Inflation –

There are five causes for demand-pull inflation:

- A growing economy – When families feel confident, they spend more rather than saving. They expect to induce raises and better jobs. They know their homes and other investments will increase in value. They feel that the govt. is doing the proper thing in guiding the economy. They’re going to also borrow more, either with auto or home loans, or credit cards. If they do not borrow an excessive amount of, this is often a healthy explanation for inflation. It creates gradual and steady price increases.

- The expectation of inflation – Once people expect inflation, they will buy things now to avoid higher future prices. That increases demand, which then creates demand-pull inflation. Once the expectation of inflation sets in, it’s hard to eradicate.

- Asset inflation – A sudden rise in exports forces an undervaluation of the currencies involved. That occurs when the government prints too much money. It does this to pay off its debt. Oversupply of money is the primary driver of hyperinflation. It can also occur if the Fed puts too much credit into the banking system.

- Government spending – Government spending drives up demand according to Keynesian economic theory. For example, military spending raises prices for military equipment. When the government lowers taxes, it also drives demand. Consumers have more discretionary income to spend on goods and services. When that increases faster than supply, it creates inflation.

- Technological innovation – A company that makes a replacement technology owns the market until other companies work out the way to copy it. People will demand products with technologies that make a real improvements in their daily lives. The new technology also creates a cachet for those that must own the most recent gadget. As an example, Tesla’s electric sports car was a technological breakthrough. It used new advanced motors, power trains, and battery packs. It’s so successful that it sells these parts to other auto companies.

In recent years, demand-pull inflation has become quite rare. The little rises in inflation were primarily because of cost-push factors. In recent decades, we’ve not witnessed any significant demand-pull inflation. This is due to several factors –

- Independent Central Banks responsible for monetary policy and keeping inflation to a target of 2%

- Secular stagnation. Lower rates of economic growth

- Downward pressure on prices from the global economy. Deflation of manufactured goods in Asia.

- New technology leading to lower prices.

Actually, the term demand-pull inflation usually describes a widespread phenomenon. That is, when consumer demand outpaces the available supply of the many sorts of commodities, inflation sets in, forcing an overall increase within the cost of living.

Information Sources: