In macroeconomics, the focus is on the demand and supply of all goods and services produced by an economy. In macroeconomics, aggregate demand (AD) or domestic final demand (DFD) is the total demand for final goods and services in an economy at a given time. It is expressed as the total amount of money exchanged for those goods and services at a specific price level and point in time. It is often called effective demand, though at other times this term is distinguished. This is the demand for the gross domestic product of a country. It’s usually reported for a specific time period, such as a month, quarter, or year. It represents the total demand for goods and services at any given price level in a given period. It specifies the number of goods and services that will be purchased at all possible price levels. It consists of all consumer goods, capital goods (factories and equipment), exports, imports, and government spending.

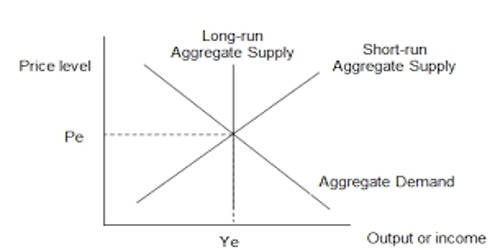

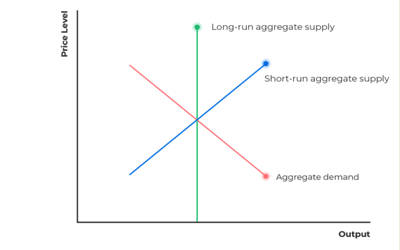

Aggregate demand is the demand for all goods and services in an economy. The aggregate demand curve represents the total quantity of all goods (and services) demanded by the economy at different price levels The aggregate demand curve is plotted with real output on the horizontal axis and the price level on the vertical axis. This curve shows the quantity demanded at each price. While it is theorized to be downward sloping, the Sonnenschein–Mantel–Debreu results show that the slope of the curve cannot be mathematically derived from assumptions about individual rational behavior. It’s used to show how a country’s demand changes in response to all prices. Instead, the downward sloping aggregate demand curve is derived with the help of three macroeconomic assumptions about the functioning of markets: Pigou’s wealth effect, Keynes’ interest-rate effect, and the Mundell–Fleming exchange-rate effect.

The Pigou effect states that a higher price level implies lower real wealth and therefore lower consumer spending, giving a lower quantity of goods demanded in the aggregate. That shows how the quantity of one good or service changes in response to price. A change in the price level implies that many prices are changing, including the wages paid to workers. The Keynes effect states that a higher price level implies a lower real money supply and therefore higher interest rates resulting from financial market equilibrium, in turn resulting in lower investment spending on new physical capital and hence a lower quantity of goods being demanded in the aggregate. Changes in aggregate demand are not caused by changes in the price level.