Crowdfunding is an excellent approach to raise capital for a new business. There are numerous advantages that business owners can get by raising funds through equity crowdfunding. Popular crowdfunding services such as Kickstarter and GoFundMe are vulnerable to hacking, which can result in harm and losses for crowdfunding investors. This means that crowdfunding investors may be unable to sell their firm’s shares unless they sell them at a significant discount. As a result of this issue, equity crowdfunding may become a less appealing option for startup enterprises seeking investment.

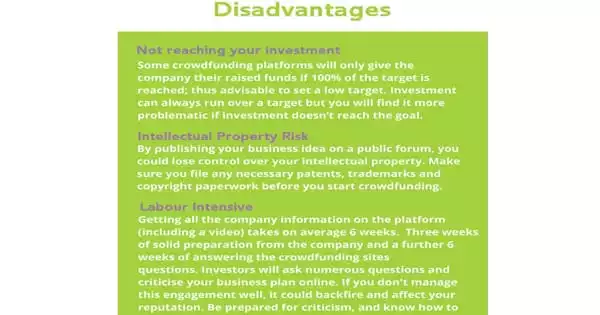

Risks with Equity Crowdfunding –

Any party that is willing to participate in equity crowdfunding must be aware of the risks that are associated with it. Some of these risks include the following:

- Equity dilution

Because equity crowdfunding involves the issuance of new shares, current shareholders’ positions will be eroded. It will not necessarily be a simpler process when compared to more traditional methods of gathering funds because not all projects that apply to crowdfunding sites are accepted. If you do not meet your financing goal, any funds promised will usually be returned to your investors, and you will receive nothing.

- High risk of failure

Startups, as previously stated, are incredibly risky undertakings. As a result, there is a strong probability that the company will collapse. When you’re on your chosen platform, you’ll need to perform a lot of work to generate interest before launching the project – major resources (money and/or time) may be required. Failed initiatives endanger your company’s reputation as well as the people who have pledged money to you.

- Low liquidity

Potential investors should be informed that securities obtained through equity crowdfunding platforms are extremely illiquid. As a result, exit choices are limited or may not exist at all. If you get the rewards or returns incorrect, you may end up handing away too much of your company to investors. Crowdfunding investors, like traditional venture capitalists, may have to wait several years for their investment to pay off.

- Risk of fraud

In the equity crowdfunding process, investors must also be careful of potential fraud schemes. To fool investors, fraudsters may leverage asymmetric information as well as regulatory gaps. If you haven’t safeguarded your business idea with a patent or copyright, someone else might find it on a crowdfunding site and steal your idea. Crowdfunding platform businesses, on the other hand, work hard to check the information presented by companies seeking cash backing.

Furthermore, some critics are concerned about the Securities and Exchange Commission’s ability to monitor fraudulent securities offerings made by smaller companies using crowdsourcing. Investing in business startups through equity crowdfunding is not limited to accredited investors; less sophisticated investors can be exploited owing to a lack of investing knowledge.

Less sophisticated investors, unlike accredited investors, do not request financial reports that offer vital information about a company. As a result, they are vulnerable to fraud and significant financial losses. The Securities and Exchange Commission requires companies that employ equity crowdfunding to follow financial reporting regulations in order to reduce the financial losses of less accredited investors.