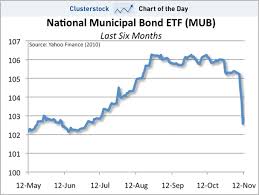

This article focus to Define the Municipal Bonds. Most of times the income generated through the Municipal Bonds by any bondholder is non-taxable. The income generated through Municipal Bonds is exempt from Federal Income tax and State Income tax from the state that issues these individuals. But there are other bonds that may be taxable. However one has to note the fact that provides issued by cities, declares, and other local agencies with the government are not seeing that reliable as corporate bonds. People find investing throughout Municipal bonds remunerative as the income is exempt from federal tax and sometimes also through state and local taxation’s.

Define the Municipal Bonds