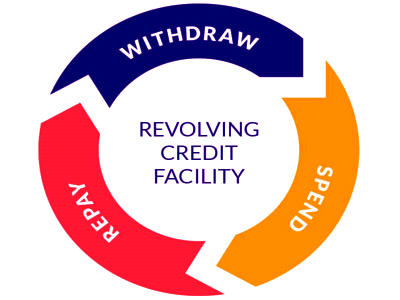

Revolving Credit

A revolving credit account sets a credit limit—a maximum amount you can spend on that account. This refers to a kind of letter of credit-documentary of clean, with the peculiarity that the amount stated therein becomes automatically available for future utilization as soon as it has been utilized once. You can choose either to pay off the balance in full at the end of each billing cycle or to carry over a balance from one month to the next or “revolve” the balance. It can be a flexible way to borrow, but it’s not ideal for every purchase.

Revolving credit refers to a situation where credit replenishes up to the agreed-upon threshold, known as the credit limit, as the customer pays off the debt. It is a type of credit that can be used repeatedly up to a certain limit as long as the account is open and payments are made on time. It offers customer access to money from a financial institution and allows the customer to use the funds when needed. The amount of credit you’re allowed to use each month is your credit line or credit limit. You’re free to use as much or as little of that credit line as you wish on any purchase you could make with cash. It usually is used for operating purposes and the amount drawn can fluctuate each month depending on the customer’s current cash flow needs.

Revolving credit is best when you want the flexibility to spend on credit month over month, without a specific purpose established upfront. The credit limit is the maximum amount you can charge to that account. When you use a portion of your revolving line of credit, you increase your balance on the account. At the same time, you reduce the amount of your available credit. When you make a purchase, you’ll have less available credit. You can reduce your revolving balance by making credit card payments. And every time you make a payment, your available credit goes back up. When you pay down a portion of your balance with your monthly payment, that amount will be added back to your available credit. Keep in mind that your minimum payment might vary from month to month because it’s often calculated based on how much you owe at that time.