Value of risk (VOR) is the financial gain that a risk-taking operation can offer to an organization’s stakeholders. Value of risk refers to the economic profit that a company can benefit by performing a risk-taking operation. Businesses carry out numerous operations at all times, such as the start of a new product line, the opening of a new retail store, the entrance into a new geographical market, etc., all of which carry a certain amount of risk. It needs the organization to choose whether an activity would assist with carrying it closer to accomplishing its objectives. The danger level engaged with any activity relies upon the organization’s capacity to recuperate all the costs brought about in endeavor the action.

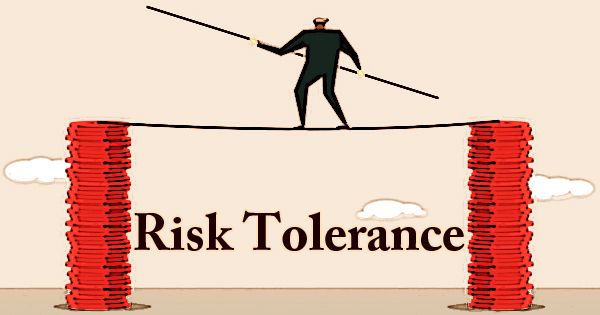

Corporations do not have any risk preferences in financial theory, but the corporation’s shareholders and stakeholders do. Each activity often carries a different degree of risk, and management is responsible for deciding whether a chosen activity can help the organization achieve the desired goals. Value of risk considers the individual segments of the expense of danger to decide whether a risk-taking movement adds to the investor esteem. The amount of risk depends on the type of activity and the possibility that the business will not be able to recover costs, with the additional understanding that spending money on one activity brings with it a cost of opportunity, i.e. the money cannot be used by the company on anything else.

(Value of Risk)

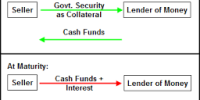

Organizations face restricted assets, and the administration must settle on keen choices to create returns for speculators. Value of risk requires an organization to look at the different segments of the expense of risk. These components include the actual cost of damages incurred; the cost of financing losses for bonds, insurance, or reinsurance; the cost of minimizing the risks that could cause the company to suffer a loss; and the cost of administering a program for risk management and loss prevention. The administration must take determined actions on the danger of taking exercises that the business decides to actualize. Whether or not the exercises will be a triumph or disappointment, the estimation of danger incorporates a component of chance expense.

Value of risk treats each portion of the risk cost as an investment option. The components must demonstrate a return on investment, just as with a stock or a bond. The opportunity cost of time is the spending of resources on one task and the money expended, i.e., the money spent will not be used on another activity. For instance, if an organization puts $50 million of every another product offering and the product offering neglects to create the normal returns, the open door cost lost speaks to all the exercises that the business could’ve accomplished with the $50 million capital.

Another example is a business that begins a department of risk management incurring a large staff cost. Through monitoring insurance and reinsurance reserves, detecting possible risks, and designing strategies to minimize risk exposure, the department will be able to lower the company’s loss exposure. On the off chance that the danger the executive’s office can’t do this, at that point it isn’t adding to investor esteem. In the event that an organization’s normal profit are higher than the expense brought about to decrease hazard, at that point the danger decreases speculation is a positive one.

Businesses need to weigh the possibility of external factors and the potential profitability of operations when undertaking risk-taking activities. For almost all of their operations, many companies, especially financial ones, measure a risk value, along with approximate levels of confidence that the risk taken would be worth the reward. Yet, these calculations are just tantamount to the information and presumptions credited. Business hazard is the introduction of a business to any elements that may cause a decrease in its income. It incorporates any components that compromise the organization’s capacity to accomplish its objective monetary objectives.

The risks can come from within the business or because of external factors that it cannot regulate. Although businesses may not be able to fully shield themselves from the threats they face, there are measures they can take to adapt adequately and reduce risk exposure.

Information Sources: