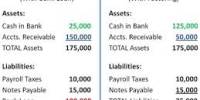

By controlling a company’s exposure to financial risk, particularly operational risk, credit risk, and market risk, among other more specialized variants not listed here, financial risk management is the practice of preserving an organization’s economic value. Regarding risk management in general, financial risk management entails locating risk sources, assessing them, and developing plans to deal with them.

The process of identifying, evaluating, and mitigating potential risks that could have a negative impact on an organization’s financial health is known as financial risk management. It’s essential to managing a business or investment portfolio because it helps guard against unforeseen circumstances that might result in monetary losses. Here are some essential ideas and tactics for managing financial risk:

Types of Financial Risks:

- Market Risk: Arises from changes in market prices, such as interest rates, exchange rates, and commodity prices.

- Credit Risk: The risk that a borrower or counterparty will fail to fulfill their financial obligations.

- Liquidity Risk: The risk of not being able to buy or sell assets quickly without significantly affecting their prices.

- Operational Risk: Arises from internal processes, systems, and human errors that can result in financial losses.

- Reputation Risk: The potential for negative public perception that could harm a company’s brand and financial standing.

Risk Management Strategies:

- Risk Identification: Identify and assess potential risks that could impact the organization’s financial stability.

- Risk Assessment: Evaluate the likelihood and potential impact of each risk on the organization’s financial objectives.

- Risk Mitigation: Implement strategies to reduce or eliminate risks. This could involve diversification, hedging, and setting risk limits.

- Risk Transfer: Transfer the risk to another party, such as through insurance or financial derivatives.

- Risk Avoidance: Refrain from engaging in activities that carry high levels of risk.

- Risk Monitoring and Review: Continuously monitor the financial environment and update risk management strategies as needed.

Tools and Techniques:

- Diversification: Spreading investments across different assets to reduce the impact of a single asset’s poor performance.

- Hedging: Using financial derivatives like options and futures to offset potential losses due to price fluctuations.

- Value at Risk (VaR): A statistical measure used to quantify the potential loss an investment or portfolio might face over a specific time horizon at a given confidence level.

- Stress Testing: Simulating extreme market conditions to assess how well an investment or portfolio would perform in adverse scenarios.

- Scenario Analysis: Evaluating the impact of various scenarios on an investment or portfolio’s value.

- Credit Scoring Models: Assessing the creditworthiness of borrowers based on various financial and non-financial factors.

Importance of Financial Risk Management:

- Preservation of Capital: Preventing significant financial losses that could impair the organization’s financial health.

- Stability: Enhancing the stability and predictability of financial outcomes.

- Regulatory Compliance: Meeting regulatory requirements related to risk management and reporting.

- Investor Confidence: Demonstrating responsible risk management practices to attract and retain investors.

Overall, effective financial risk management involves a combination of thorough analysis, strategic planning, and proactive decision-making to ensure the long-term financial health of an organization or investment portfolio.