A delinquent mortgage is a home loan on which, as required in the loan documents, the borrower has failed to make payments. If a scheduled payment is not received on or before the due date, a mortgage is deemed overdue or late. On the off chance that the borrower keeps on falling behind, the bank may abandon the property, taking it back from the borrower. There are different alternatives to determine the borrower’s wrongdoing, including adjusting the credit to make it simpler to stay aware of installments. Excessively indebted mortgages risk going into default and foreclosure of the house. Often, when they become delinquent, lenders may negotiate with borrowers to prevent default.

A mortgage is a drawn-out credit that permits a borrower to purchase a home or other land without following through on the full buy cost forthright and to repay the sum throughout a set timeframe, with interest. The property the individual is purchasing is collateral for the loan, and if the borrower does not keep up with monthly payments and sells it to take back what the borrower owes, the lender has the right to repossess it. For overdue payments, late fees are normally applied. The measure of the late charge relies on the loan specialist, just as the particulars of the borrower’s mortgage. On the off chance that a late charge isn’t applied at first, that doesn’t imply that the home loan isn’t deficient; a few moneylenders may decide to stand by until an installment is over 30 days late prior to starting assortment systems.

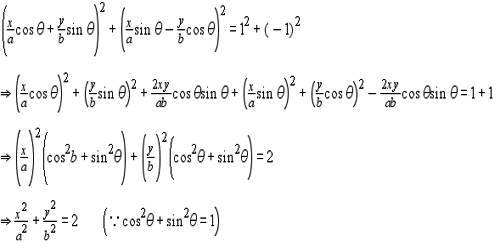

Example of Delinquent Mortgage

Like any other unpaid debt, a delinquent mortgage will harm the credit of the entity. Some lenders grant borrowers an extension until declaring the mortgage overdue, typically 60 days, to catch up. They likewise may offer a credit alteration, which expands the life of the advance and lessens installments, making it simpler for the borrower to get current on the advance and evade wrongdoing. If the borrower’s financial problems are temporary, a forbearance arrangement is a possible solution to foreclosure. The lender temporarily allows the borrower to avoid making payments, or to pay less than the regular monthly payment, under a forbearance arrangement.

In the event that a borrower presumes that they won’t have the option to pay on schedule, it is basic that they contact their loan specialist instantly. At times, the moneylender may have approaches to assist the borrower with maintaining a strategic distance from a deficient home loan out and out. Yet a repayment plan is another option. The lender might consent to a short sale if it doesn’t work and the borrower still can’t keep up, enabling the borrower to sell the home for less than what is owed. The bank some of the time excuses the distinction, contingent upon state laws. A property holder with a deficient home loan, who doesn’t think his monetary troubles are impermanent however who needs to keep away from dispossession, may persuade the bank to consent to a short deal.

A borrower who has been delinquent for a while or even years, yet who has not been dispossessed, may consent to a reimbursement plan with the bank to in the end get current on the mortgage and not lose the home. By modifying the principal owing, the loan term, or the interest rate so that the borrower can afford the monthly payments, the lender may also agree to change the loan. Refinancing to a fixed-rate one may be an option if a borrower has an adjustable-rate mortgage.

Information Sources: