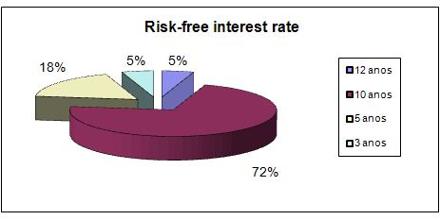

The risk-free interest rate compensates the investor for the temporary sacrifice of consumption. As such a risk-free rate only exists in theory, it can be implemented practically by using government treasury bonds as the benchmark. These bonds still have a very small amount of risk but the likelihood of the government defaulting is very low. The return on any investment with such low risk that the risk is considered to not exist.

Risk-Free Interest Rate