Cash Flow Statement

One of the quarterly financial reports any publicly traded company is required to disclose to the SEC and the public. The document provides aggregate data regarding all cash inflows a company receives from both its ongoing operations and external investment sources, as well as all cash outflows that pay for business activities and investments during a given quarter.A statement of cash flows is 1 of the 4 major financial statements prepared by corporations at the end of each accounting period. The goal of the cash flow statement is to provide an accurate picture of the financial health of a company without the cover of accrual-based accounting treatments. The statement is essentially prepared by adjusting the income statement to include only cash-based transactions. Learning how to prepare a statement of cash flows requires a careful examination of the income statement and a few simple calculations.

Expanded Definition

“Follow the money.” You’ll hear TV detectives say this all the time, when they’re tracking down someone who might benefit from a crime. But it’s equally important to you when you want to keep track of a business’s performance.

The cash flow statement shows you, the investor or analyst, how cash is moving through a business. It reconciles net income, which is a non-cash GAAP number, with the actual cash coming into or leaving the business. It shows what the company is doing with its cash; where that cash is from; and how much of it stays within the business at the end of the reporting period.

On this statement, any negative number is cash flowing out of the business (such as buying inventory), while any positive number is cash flowing into the business (such as taking out a loan).

Given an income statement and a balance sheet, it is possible to construct the cash flow statement.

Important point: Interim cash flow statements — those reported between either end of the company’s fiscal year, such as in the second or third quarter — are cumulative from the end of the previous year. In order to determine the various cash flows for that quarter alone, you’ll need to subtract the figures from the previous quarter’s statement.

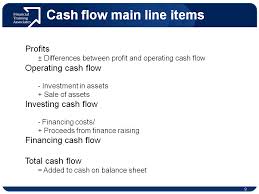

The cash flow statement is broken down into three sections, which are always presented in this order:

- operating activities,

- investing activities, and

- finance activities.

Cash from operating activities

This is presented in two different ways. The indirect method, followed by most U.S. companies, begins with net income. The direct method, followed by many foreign companies, begins with revenue.

Indirect method

For this presentation, this section begins with net income and then adjusts for any and all non-cash income or expenses, ending with cash flow from operations. Adjustments include the following:

- depreciation,

- amortization

- stock-based compensation, and

- working capital changes, which includes changes to:

- accounts payable

- accounts receivable

- inventory

- other, including things like salary payable, prepaid expenses, etc.

Depending on the nature of the item or the direction of the change in the balance sheet accounts, these items are either added or subtracted to net income. After all of that, you are left with net cash from operating activities.

Direct method

Beginning with revenue, this method adds or subtracts all cash expenses (such as salary payments, inventory purchases, or cash receipts from accounts receivable). It ends up at net cash from operating activities. This will be the same amount found by using the indirect method. In fact, if a company reports using the direct method, it must also supply the indirect method as a supplementary report (FAS 95).

Cash from investing activities

This section shows all the cash the business spent on or received from investments. You will see things like capital expenditures, purchase (or sale) of marketable securities, and acquisitions of other businesses.

Cash from financing activities

This section details how the company is raising additional cash (such as from debt or issuing stock) as well as sharing cash with investors (paying dividend) or using cash to pay back debt or for share repurchase. Adding all that up we are left with net cash from financing activities.

Summing up

The net cash from all three sections are then added up to calculate the net change in cash which reflects the change in cash and equivalents on the balance sheet.

Determine the company’s beginning cash balance. The statement of cash flows covers the entire accounting period, and so it begins with the cash balance at the start of the period. This balance can be found on the previous period’s statement of cash flows (where it will be presented as the ending balance). It can also be calculated from the balance sheet.

- To calculate the beginning cash balance from the balance sheet, add together all cash and cash equivalents. Cash equivalents will be listed under the “Current Assets” heading, and can include money market accounts, savings accounts, and certificates of deposit.

Determine the amount of cash the company generated through its operations. The first section of a statement of cash flows is titled “Cash Flow from Operating Activities,” and represents all the cash the company raised through its main operations – generally sales of its products. This section can be constructed by adjusting the company’s net income (obtained from the income statement) to exclude non-cash transactions.

- The basic formula for arriving at operating cash flow from net income is as follows:

- Depreciation expenses should be added back to net income, since they don’t represent a disbursement of cash. A rise in accounts receivable should be subtracted, since they represent cash that hasn’t yet been collected (a fall in receivables should be added). A rise in accounts payable should be added, since they represent cash that hasn’t been disbursed yet.

Determine the amount of cash the company spent through its investing activities.

When a company buys a large asset like a piece of machinery, or when it buys stock in other companies, cash is paid out even though the assets are not immediately presented on the income statement as expenses. The second heading of the cash flow statement, titled “Cash Flow from Investing Activities,” adjusts for these types of assets.

- To arrive at the investing cash flow, simply add together all the capitalized purchases from that accounting period. Any assets that were purchased with cash and are being held on the balance sheet (such as buildings and equipment) as well as any stock purchases should be added together. This amount will generally be negative, as it represents a cash disbursement.

Determine the amount of cash the company raised (or used) through its financing activities.

The third and final heading on the cash flow statement is titled “Cash Flow from Financing Activities.” This section sums all the cash flows from the issuance of debt or stock, the redemption of debt, and dividends paid to shareholders.

- To arrive at the financing cash flow, add together the cash received through the issuance of stock or debt (such as bonds). Subtract any cash paid out to redeem long-term debts, and subtract cash paid to shareholders as dividends.

Compile the statement of cash flows.

After the document’s title, the cash flow statement has 6 essential line items, in this order: beginning cash balance, cash flow from operating activities, cash flow from investing activities, cash flow from financing activities, ending cash balance, and supplemental information. Present the values calculated above in each section to complete the cash flow statement.

- The “Supplemental Information” section should contain notes on any major non-cash transactions (for example, the swap of company stock for bonds). This section should also disclose the amount of interest and income tax paid.