Analysis of Financial performance of BASIC Bank

BASIC Bank Limited is a state owned bank however operates like a private bank. It was established in order to progress the industrial sector of Bangladesh. For more information I have prepared a report that starts with the synopsis of Banking Industry in Bangladesh followed by some more information regarding the history of BASIC Bank limited. A progress chart of BASIC Bank Ltd. is provided in the report. In the later Chapter the General Banking Department of this particular bank is elucidated in an elaborate manner. The types of work of this department, the imperative documents to open an account are described in a very comprehensive way. Along with that what are the products and service they offer, type of loans can also be establish in this report. In the forthcoming chapter my three months‟ internship experience and my activities can be found. In addition to that the most important chapter that consists of the analysis regarding financial performance of BASIC Bank Limited is also prepared in very careful manner. Trend analysis and cross-sectional analysis is conducted taking the years 2011, 2012 and 2013 respectively. A assessment is also done with a similar type of bank that is Bangladesh Development Bank Limited. Lastly the report ends with various beneficial recommendations provided which can benefit the bank to improve its effectiveness and along with it a brief conclusion.

CSR activities of BASIC BANK LTD

As such in broadly defining, CSR refers to the voluntary role of business towards building a better society and cleaner environment beyond its financial commitments and regulatory obligations. Some CSR activities and donations made by BASIC bank are given bellow:

Reduce poverty

With a view to widen the access to finance by the poor and ultra-poor community, BASIC Bank Limited has been financing NGOs for quite since 1995 at privileged rates of interest (between 7.00% and 13.00%). So far the bank has financed 65 NGOs of various categories and capacities from small to large and also from local/regional to national/international. Such activities also contributed to generation of income and employment as well

Women empowerment

As half of the population is woman, a sustainable national progress can‟t be attained, if women are left aside. Considering this reality the bank has been mobilizing credit facilities to the capable women entrepreneurs at a reduced rate of interest. So far the bank has financed several woman entrepreneurs and it will gain due momentum in the days to come.

Environment pollution

To reduce environmental pollution, this bank has financed 26 CNG refueling stations. Again, most of their office vehicles have already been converted to CNG fueling system. Use of CNG fuel also helps save hard earned foreign currency. Environmental issues are taken into account while assessing credit proposal for the industrial projects.

Sports and Cultural Activities

During the year 2011, the Bank extended financial support Tk.1.00 crore each to Sheikh Russel Krira Chakra and Sheikh Jamal Dhanmondi Club towards development of games and sports. In the year 2011, an amount of Tk.8.00 lac was contributed for making documentary exhibition and archive of scarce footage of our great independence war. The Bank also contributed Tk.10.00 lac to Bangladesh Table Tennis Federation in the year 2011. In the year 2011, the Bank sponsored Tk.4.00 lac to arrange Baishakhi Fair. The Bank also sponsored 25th to 31st National Junior Chess Championship by contributing Tk.1.00 lac in each year. BASIC has been patronizing the Handball Federation by arranging BASIC Bank Limited Inter-district National Women Handball Tournament. The Bank also donated a fund of Tk.1.00 lac to Krishibid Institution for organizing their national convention. In the year 2006 the Bank sponsored Tk.1.00 lac for organizing the SME fair.

Disaster management

In the year 2011, the Bank donated 25,000 pieces of blankets to Prime Minister ‟s Relief and Welfare Fund. In the previous year the Bank donated an amount Tk.1.00 crore to the same Fund for the rehabilitation of the victims of the Nimtoli Fire Tragedy.

Encourage Entrepreneurship

The promoters of the Bank envisaged fostering entrepreneurship amongst the potential, new and small entrepreneurs and generating employment through financing Small and Medium Scale Industries (SMIs) towards industrialization actually needed for economic growth of the country. Keeping the dream in mind, the bank always remained stick to the triple bottom line: People, Planet & Profit and focused attention to the SMIs which is ultimately promotion of SMEs. In this way, a lot of entrepreneurs have grown with us through which employment opportunities are created for a large number of people.

Access to healthcare facilities is one of the fundamental rights of every human being. BASIC Bank Limited is committed to assist those poor people, who have no way to secure basic treatment. In the year 2011, the Bank distributed about Tk.3.00 lac amongst different disadvantaged individuals. In the year 2010, the Bank patronizes some organizations, which work for improvement of public health. Also in 2009 the bank donated SANDHANI & Lions Eye Hospital in organizing their free treatment campaign held at different places across the country. The Bank also extended its assistance to some acid victims directly.

Education

During 2011, the Bank distributed Tk.5.00 lac among the meritorious students of Gopalganj Zilla Samity. In 2010, BASIC Bank Limited donated a fund of Tk.50.00 lac to the aggrieved families of the two late secretaries of the Government of Bangladesh for maintaining the educational expenditure of their children. In 2009 BASIC Bank Limited donated Tk.2.00 lac to Bangladesh Asiatic Society for publishing Bengali version of the largest National encyclopedia of Bangladesh. In publishing the first edition (English version) of the encyclopedia, BASIC Bank Limited donated Tk.5.00 lac as well. „BASIC Bank Limited Gold Medal ‟ was introduced in collaboration with the Banking Department, University of Dhaka for the students of the department with outstanding academic achievements.

Awareness

Generation of awareness is a very useful tool to combat social evils, like drug addiction, smoking, pollution, terrorism, population etc. For this purpose, the Bank has continue to display banner, festoon sticker, display board and use such other communication channels for discouraging drug, smoking, pollution, population growth etc. The Bank kept continued such awareness building activities for the year 2011. In 2010, the Bank donated a sum of Tk.0.50 lac to Sundarban Supporters Committee for creating awareness to elect Sundarban as the new eleven Wonders of the World.

In the future the Bank has an active plan to establish a charitable organization in the name of “BASIC Bank Foundation” to augment CSR activities through expanding both nature and magnitude towards implementation of social obligations in an organized manner for a better.

Objective of the project

To analyze the financial condition of BASIC BANK LTD there are two types of data they are

- What is the financial position of this bank

- How the bank works.

- Products and service it offers

- The banking environment

- Responsibilities of a bank

Methodology

- Primary data

- Secondary data

Primary datas are collected by personal observation and interviewing clints the employees of the bank and the secondary datas are collected from books, online articals and banks annual reports.

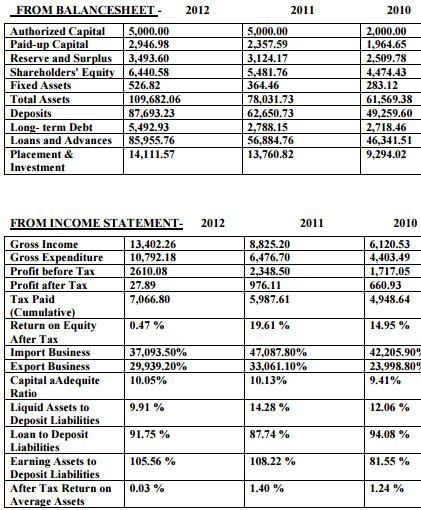

Important Valus Of BASIC BANK LTD From its Income Statement and Balance sheet

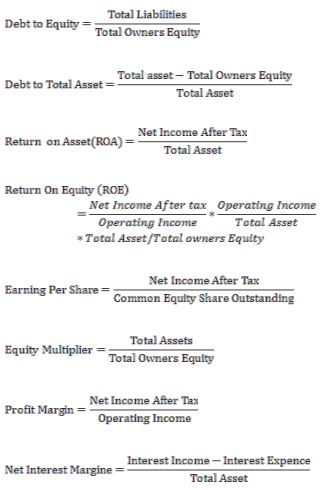

Formulas To Calculate The Ratios

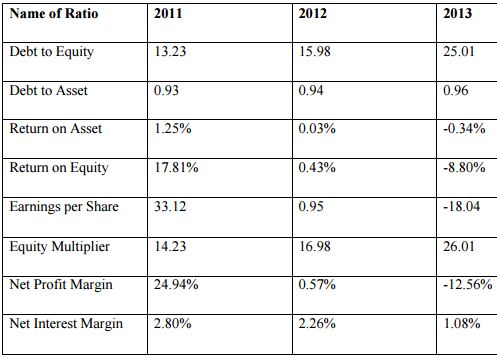

Financial Ratios of BASIC bank LTD

To get hold of a swift hint of the performance of a financial institution ratio analysis is used frequently. This tool is used by investors, creditors, managers and different regulators. For investing decisions investors often rely on this effective tool. A financial institution itself can have a clue of its financial position in the industry by doing trend analysis and cross-sectional or peer analysis. These are the two important analyses I have conduct in order to acquire how well BASIC Bank Ltd. is performing and what are its future movements in comparing with its competitors and with itself from time to time. The ratios I have used are classified as Short-term Solvency Ratios, Debt Management Ratios, Asset Management Ratios, Profitability Ratios, and Market Value Ratios. For cross-sectional analysis I have taken Bangladesh development Bank Limited which is also a specialized bank like BASIC Bank Ltd.

Financial Analysis

Debt to Equity

The debt to equity ratio is a financial, liquidity ratio that compares total debt to total equity. It is calculated by dividing total liability with total owner‟s equity. For a bank loans are assets that they distribute and deposits are liabilities that they acquire from their customers. The following scenario shows against TK. 1 as equity BASIC Bank used TK. 13.23, TK. 15.98 and TK. 25.01 as debt in the years 2011, 2012 & 2013 respectively. The trend indicates that BASIC Bank is adding more debt in its capital structure every year and it is rising significantly which puts the bank in a riskier position. So the debt to equity ratio of BASIC Bank does not show that the bank has a good planning on deciding its capital structure.

Debt to Asset

Debt-to-assets ratio or simply debt ratio is the ratio of total liabilities to total assets. It is calculated by dividing total liabilities to total asset. It is a solvency ratio and it measures the portion of the assets which are financed through debt. Debt ratio ranges from 0.00 to 1.00. Lower value of debt ratio is favorable and a higher value indicates that higher portion of asset is financed through debt which indicates a bank is not that solvent. Debt ratio of 0.5 means that half of the company’s assets are financed through debts. BASIC Ban0k is highly debt financed as the debt ratio is increasing that is 0.93, 0.94 and 0.96 consistently. This means more than half of BASIC Bank‟s total asset was debt financed in the years 2011, 2012 & 2013 respectively.

Return on Asset

Return on assets is the ratio of annual net income to total assets during a financial year. It measures efficiency of a bank in using its assets to generate net income. It is a profitability ratio. It is based on accounting book values not on market values. Higher values of return on assets the more profitable the bank is. An increasing trend of ROA indicates that the profitability is improving. Conversely, a decreasing trend means that profitability is deteriorating. In the year 2011 and 2012 BASIC Bank was generating 1.25% and 0.03% of profit to every 1 Tk. of asset. As BASIC Bank has incurred loss of 0.34% for every 1 Tk. of asset, management should think of ways to improve its efficiency in using its assets.

Return on Equity

Return on equity or return on capital is the ratio of net income during a year to its stockholders’ equity during that year. It is a measure of profitability of stockholders’ investments. It shows net income as percentage of shareholder equity. Return on equity is an important measure of profitability. Higher return on equity indicates that the bank is efficient enough to generate profit for every new investment. 2011 profitability is 17.81% . In the year 2013 the ROE of BASIC bank shows a negative figure which means shareholders are losing their money instead of gaining. This is because the bank had a huge amount of loss in the year 2013.

Earnings per Share

Earnings per share, also called net income per share, is a market prospect ratio that measures the amount of net income earned per share of stock outstanding. In other words, this is the amount of money each share of stock would receive if all of the profits were distributed to the outstanding shares at the end of the year. Earnings per share or basic earnings per share is calculated by subtracting preferred dividends from net income and dividing by the weighted average common shares outstanding. Higher earnings per share, always better than a lower ratio because this means a bank is more profitable and it has more profits to distribute to its shareholders. The earning per share of BASIC Bank fluctuates a lot.. BASIC Bank had TK. 33.12 as EPS in the year 2011 However, in the year 2012 there was a sudden fall in the EPS of BASIC Bank. The scenario was worse for BASIC Bank in the previous year as it had a loss per share of TK. 18.04.

Equity Multiplier

The equity multiplier is a financial leverage ratio that measures the amount of assets that are financed by shareholders. It is calculated by dividing total assets with total shareholder’s equity. This ratio indicates how much of a bank‟s asset is owned by the creditors. Higher the equity multiplier, higher the risk is. This also means a bank has high debt servicing cost. In the year 2011, the equity multiplier of BASIC bank was 14.23 Since year 2011 BASIC Bank has used a very huge amount of debt to finance its assets as in year 2012 and 2013. It has increased using debt to a higher level in year 2013. It is of a great concern to the shareholders of the bank.

Net Profit Margin

Net profit margin is the percentage of revenue remaining after all operating expenses, interest, taxes and preferred stock dividends excluding the common stock dividends have been deducted from a company’s total revenue. The profit margin ratio is a profitability ratio that measures how well a bank is turning its revenue into profits for its shareholders. BASIC Bank year 2011 shows that the management was efficient enough to turn revenue into profit however in year 2012 the ratio has a sudden fall which is 0.57%. This means for every 1 Tk. BASIC bank had a profit margin of only 0.0057 Tk. This situation worsens when the bank had not made any profit in year 2013 rather faced loss of 12.56 Tk. for every 1 Tk.

Net Interest Margin

Net interest margin tells how successful a bank‟s investment decisions are compared to its debt situations. A negative value signifies that the firm did not make an ideal decision, since interest expenses were greater than the amount of returns generated by investments. In year 2011, 2012 and 2013 the net interest margin of BASIC Bank is 2.8%, 2.26% and 1.08% respectively. This means their investment decision or giving loans to clients was not ideal enough so they had a decreasing ratio consistently.

Recommendation

Once an outstanding BASIC Bank Ltd is now facing a huge amount of loss. The Bank that used to be a standard itself is now in a fragile situation. Although not every branch of this Bank is not at fault, for some branches, overall performance is not meeting up the standards nowadays. There can be so many reasons behind this bad performance. However If I was told to recommend some steps to recover this situation I would have suggest the followings:

- The bank should introduce some new products as there are a few to attract new clients. Even though it is a state owned bank it operates like a private bank. Hence, to compete in this modern era of banking where private banks are leading, it‟s a duty of BASIC Bank to enhance its products and services. New products should be included in its portfolio.

- For marketing these products BASIC Bank should find out a proper way so that the general people get to know about it. In this case they may go for door to door operations. In this way new clients will be interested to take deposit scheme in the bank.

- Introducing and marketing new products will not attract customers if the bank does not give guarantee of proper and well-organized services. For this the bank needs to make sure that whenever withdrawing money it has enough cash reserve.

- Using technology is always of great help whenever there is a need for providing faster services. BASIC Bank should use more computerized and internet based.

- Research and development activities should be taken into consideration.

- Loan portfolio should be designed in such a way that there is chance of defaulting. For this, they can rely on different renowned credit rating companies so that the loss of bad debt can be removed to some extent.

- Effective strategies must be undertaken against defaulters.

- Office should be fully decorated to attract clients to take its services.

- The bank should unconditionally continue to follow its own rules and procedures.

- The bank can introduce reward system for good borrowers as well as punishment for bad borrowers.

- Management must try to think how to increase the profit or shareholder‟s value. They must try to work freely without any influence

Conclusion

BASIC Bank limited although a state-owned bank, operates like a private bank. The name itself contains a meaning that is to develop the small industries in Bangladesh. Though it is not confined only in the improvement of industrial sector, it has also scattered its activities in green banking and different CSR activities. This is very sorry to say that despite all its activities the bank has to find itself in a very bad situation recently. However if precautionary steps are taken the bank can regain its previous form. Working in General Banking Department helped me to learn a lot and made my internship programe complete. I have learnt how a bank operates, how clients are handled, how calmly a situation is controlled and many more. To conclude, I would like to say that BASIC Bank will surely come out of its recent status only if they try to be more careful in disbursing its loans. To bring back its strong existence the management must think of revolutionary initiatives so that this inconvenience will never be there to bother in future.