Stock Valuation of Prime Bank Limited

This paper has been prepared in order to present an evaluation of financial performances as well as the stock valuation of Prime Bank Ltd. The subsequent report covers the evaluation of financial performance through some ratio analysis (i.e., return on equity, return on asset, net interest margin, earning per share, net bank operating margin) and valuation of stock of the company (i.e. the determination of the current market rate of interest, risk free rate, respective beta value of the company, etc.). The analysis of profitability includes determination of the growth rate, required rate of return and the intrinsic value.

Finally, the comparison of the intrinsic value with the market price has been made to evaluate whether the common stocks are overpriced or underpriced, along with the possible reasons for its being so. In conclusion, the paper evaluates the reasons for over or undervaluation of the common stock of the Prime Bank Ltd.

Objective of the report

Broad Objective:

- To get an overall idea about the financial performance and the capital market exposure of Prime Bank Limited.

- To relate the theoretical knowledge to the original financial data of Prime Bank Limited.

Specific Objective:

- To know the financial performance of Prime Bank Limited in the last few years.

- To determine the common stock of the company whether it is overvalued or undervalued.

Introduction of Prime Bank

Prime Bank Limited “A bank with a difference” is perfectly applicable. Within a short period, acquiring the position at the top slot in terms of quality service to the customers prove its accuracy. Prime Bank was created and commencement of business started on 17th April 1995. The sponsors are reputed personalities in the field of trade and commerce and their stake ranges from shipping to textile and finance to energy etc. Prime Bank has already made significant progress within a very short period of its existence. The bank has been graded as a top class bank in the country through internationally accepted CAMELS rating. The bank has already occupied an enviable position among its competitors after achieving success in all areas of business operation.

As a fully licensed commercial bank, Prime Bank is being managed by a highly professional and dedicated team with long experience in banking. They constantly focus on understanding and anticipating customer needs. As the banking scenario undergoes changes so is the bank and it repositions itself in the changed market condition.

Prime Bank offers all kinds of Commercial Corporate and Personal Banking services covering all segments of society within the framework of Banking Company Act and rules and regulations laid down by our central bank. Diversification of products and services include Corporate Banking, Retail Banking and Consumer Banking right from industry to agriculture, and real state to software.

Prime Bank, since its beginning has attached more importance in technology integration. In order to retain competitive edge, investment in technology is always a top agenda and under constant focus. Keeping the network within a reasonable limit, our strategy is to serve the customers through capacity building across multi-delivery channels. Our past performance gives an indication of our strength. We are better placed and poised to take our customers through fast changing times and enable them compete more effectively in the market they operate.

Subsidiaries of Prime Bank Limited

Prime Exchange Co. Pte Ltd: Prime Bank Limited established its fully-owned subsidiary “Prime Exchange Co. Pte Ltd.” to offer remittance services to Bangladeshi nationals in Singapore, which started its operation from 8th July, 2006, under remittance license received from Monetary Authority of Singapore (MAS) and approval of Bangladesh Bank. Mr. Azam J Chowdhury, Chairman of the Board of Directors of Prime Bank Ltd., is the Chairman of Prime Exchange Co. Pte Ltd. while Mr. M Ehsanul Haque, Managing Director of the Bank, is the Director of the Prime Exchange Co. Pte Ltd. Opening of the fully owned subsidiary in Singapore to offer remittance services to Bangladeshi nationals will add new dimension to the Bank’s remittance operation PBL Exchange (UK) Limited: PBL Exchange (UK) Limited is committed to deliver remittances from Bangladeshi expatriates in UK to each and every corner of Bangladesh swiftly and safely with best competitive exchange rate. To fulfill the cherished desires of banking and assessing the continuous need of the banking services, this holistic endeavor of Prime Bank Limited has taken banking to the next level for the mass customers segment of the country. This footstep of PBL would act as nation building initiative to accelerate the socio-economic development of Bangladesh.

Prime Bank Investment Limited: Prime Bank has been operating in the Capital Market since1996 as a division of Prime Bank Ltd. It acquired full-fledged Merchant Banking License from the Securities and Exchange Commission (SEC) in 2001. It started full-fledged operation from 2006. It started branch operations to provide Portfolio Management Services in major locations of Dhaka City and Sylhet in 2008. It became a subsidiary of Prime Bank Ltd. in 2010 with a paid-up capital of Tk. 300 crore. It is the Sponsor and Director of Prime Bank Securities Ltd., a subsidiary of Prime Bank Ltd. having both DSE & CSE membership license.

Prime Bank Foundation: Prime Bank Foundation has continued to engage in a range of activities that are benefiting priority target groups throughout the country with increased across to higher education, affordable values-oriented quality primary level English medium education in Dhaka, and increased access to secondary level education in the country’s hard-to-reach district like Shariatpur. This report highlights the impacts of the programs that demonstrate how the foundation is fully leveraging its unique capabilities to deliver value to those target people and places most in needs.

Prime Bank Finance (Hong Kong) Limited: In 2010, PBL has received permission from Bangladesh Bank for opening a fully owned subsidiary in Hong Kong under the proposed name of PBL Finance (Hong Kong) Limited.

Prime Bank Securities: Prime Bank Securities Limited (DSE Member # 219) has got Stock Dealer Registration Certificate No. REG.-3.1/DSE-219/2010/430 dated September 16, 2010.

Product/Service Offering

In the field of retail banking Prime Bank Limited presents a wide variety of services. They always try to ensure the best quality retail banking services for their customers. In their retail banking service the number of services they have are given belowDeposit

Products: Under this section there are also many products and services of Prime Bank Limited. They are-

- Prime Millionaire Scheme

- Double Benefit Scheme

- Lakhopoti Deposit Scheme

- Monthly Profit Based Scheme

- Contributory Saving Scheme

- Education Savings Scheme

Retail Loan: Under retail loan services there are a number of products and services. They are-

- Car Loan

- CNG Conversion Loan

- Doctor’s Loan

- Marriage Loan

- Travel Loan

- Loan Against Salary

- Household Durables Loan

- Hospitalization loan

- Home Loan (SwapnaNeer)

- Education loan

- Any purpose Loan

Performance Evaluation of Prime Bank Ltd. from 2009-2013

A company’s performance is evaluated through the analysis of its financial statements. Financial statement analysis involves a comparison of a firm’s performance with that of other firms in the same line of business, which usually is identified by the firm’s industry Classification. Generally speaking, the analysis is used to determine the firm’s financial position so as to identify its current strengths and weakness and to suggest action the firm might pursue to take advantage of the strength and correct any weakness.

Analysis

The financial performance analysis of Prime Bank of the last five years (2009-2013) is given below:

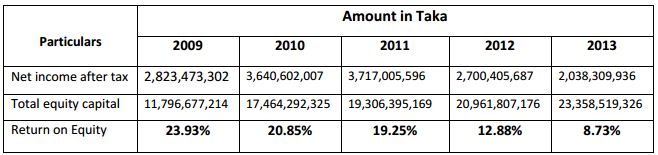

Return on Equity

This ratio shows the amount of net income returned as a percentage of shareholders equity. Return on equity measures a corporation’s profitability by revealing how much profit a company generates with the money shareholders have invested. It indicates a firm’s efficiency in applying common-stockholders’ (ordinary-shareholders’) money.

The return on equity was 23.93% in 2009. After that it started to decrease and became 12.88% in 2012. Then the situation went worst and it turns into 8.73% in 2013. The fall was caused by a lower net profit margin resulting from a lower interest rate spread and increased provisions and operating expenses. Profitability fell due to a domestic economic turndown, combined with the global economic crisis.

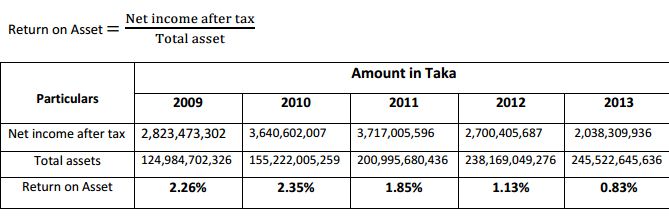

Return on Asset

ROA is an indicator of a company’s profitability. ROA is calculated by dividing a company’s net income (after tax) in a fiscal year by its total assets. It is known as a profitability or productivity ratio, because it provides information about the management’s performance in using the assets of the small business to generate income.

Return on asset follows a cyclic trend. It was 2.26% in 2009. In 2010 it increased to 2.35%. After the increase in 2010 it started drastically decreasing and turns into 0.83% in 2013. The fall in 2013 was caused by an economic downturn, coupled with a reduced interest spread and a lower net profit after tax, relative to total interest revenue.

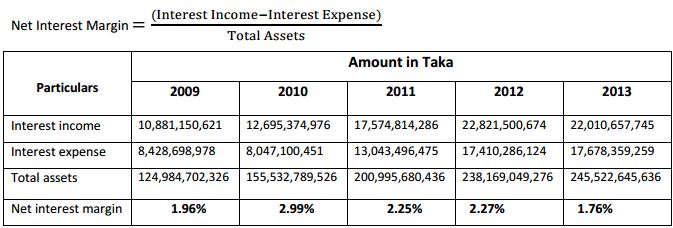

Net Interest Margin

This ratio is a performance metric that examines how successful a firm’s investment decisions are compared to its debt situations. A negative value denotes that the firm did not make an optimal decision, because interest expenses were greater than the amount of returns generated by investments.

After increasing from 2009, net interest margin decreased from 2010 to 2013. The net interest margin was 2.99% in 2010. Then it decreased to 2.25% in 2011 and to 1.76% in 2013.

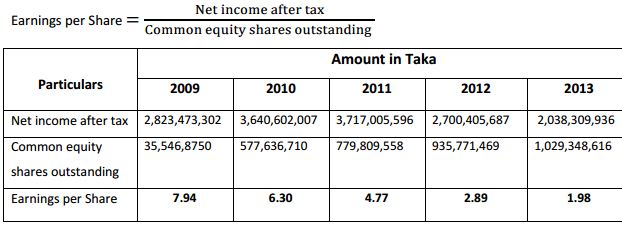

Earning Per Share

Earnings per share gives an investor the return on their investment in a share of stock of a publicly traded firm on a share price basis. Earnings per share is very important among financial ratios as it tells investors how much they have earned on their stock in the company on a share price basis. It is used extensively in the stock market as the standard of stating earnings.

Over the five year earnings per share of Prime Bank follows a decreasing trend. In 2012 and 2013 Prime Bank experiences a negative growth in Net Income. On the other hand, Number of share outstanding is also increased which resulted a lower EPS in 2013.

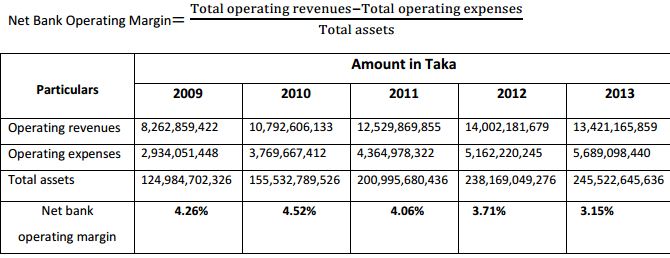

Net Bank Operating Margin

Net bank operating margin is a measure of the difference between the operating revenues generated by banks and the amount of operating expenses paid out, relative to the amount of their assets. It is similar to the gross margin of non-financial companies. It is known as a profitability or productivity ratio, because it provides information about the management’s performance in using the assets of the small business to generate income.

Prime Bank follows a decreasing trend since 2010. It is seen that, total assets increased at a comparatively faster rate than total operating revenues which caused net bank operating margin to decrease. In 2013, it moved down to only 3.15% whereas in 2010 it was 4.52%.

Capital Market Investment & Common Stock Valuation

The capital market is a market for securities, where companies and Governments can raise long-term funds. It is a market in which money is lent for periods longer than a year. The capital market includes the stock market and the bond market. It is the group of interrelated markets, in which capital in financial form is lend or borrowed for medium and long period and in cases such as equities for unspecified periods.

The primary role of the capital market is to raise long-term funds for governments, banks, and corporations while providing a platform for the trading of securities. This fund rising is regulated by the performance of the stock and bond markets within the capital market.

Capital Market Exposure of Prime Bank Ltd.

Capital Market Investment has become a very eye-catching sector for investment by banks around the world. In recent phenomenon in banking industry, this has particularly become important for banks to diversify their investment avenues and opportunities and generate alternate sources of revenues when banks can pour its liquidity in stock market for higher return.

Capital Market Exposure Limit

Banks total exposure in capital market will be limited to 10% of its Total Liabilities. Banks shall have to follow single borrower exposure limit while giving loan facilities to their subsidiaries and others for merchant banking or brokerage activities.

Stock Valuation

In financial markets, stock valuation is the method of calculating theoretical values of companies and their stocks. The main use of these methods is to predict future market prices, or more generally, potential market prices, and thus to profit from price movement. Stocks that are judged undervalued (with respect to their theoretical value) are bought, while stocks that are judged overvalued are sold, in the expectation that undervalued stocks will, on the whole, rise in value, while overvalued stocks will, on the whole, fall.

In the view of fundamental analysis, stock valuation based on fundamentals aims to give an estimate of their intrinsic value of the stock, based on predictions of the future cash flows and profitability of the business. Fundamental analysis may be replaced or augmented by market criteria – what the market will pay for the stock, without any necessary notion of intrinsic value.

In the view of others, such as John Maynard Keynes, stock valuation is not a prediction but a convention, which serves to facilitate investment and ensure that stocks are liquid, despite being underpinned by an illiquid business and its illiquid investments, such as factories.

Stock Valuation Methods

There are various methods of stock valuation. The most common methods used are the discounted cash flow method, the P/E method, and the constant dividend growth model.

a) The discounted cash flow method

A valuation method used to estimate the attractiveness of an investment opportunity. Discounted cash flow (DCF) analysis uses future free cash flow projections and discounts them (most often using the weighted average cost of capital) to arrive at a present value, which is used to evaluate the potential for investment. If the value arrived at through DCF analysis is higher than the current cost of the investment, the opportunity may be a good one.

b) The P/E method

Financial analysts often use a P/E model to estimate common stock value for businesses that are not public. The P/E ratio indicates how much investors are willing to pay for each dollar of a stock’s earnings.

A high P/E ratio indicates that investors believe the stock’s earnings will increase, or that the risk of the stock is low, or both. First, analysts compare the P/E ratios of similar companies within an industry to determine an appropriate P/E ratio for companies in that industry. Second, analysts calculate an appropriate stock price for firms in the industry by multiplying each firm’s earnings per share (EPS) by the industry average P/E ratio.

c) The constant dividend growth model

A model for determining the intrinsic value of a stock, based on a future series of dividends that grow at a constant rate. Given a dividend per share that is payable in one year, and the assumption that the dividend grows at a constant rate in perpetuity, the model solves for the present value of the infinite series of future dividends.

Assumptions & Adjustments

- Face Value –The face value of all the stocks is TK. 10.

- Constant Growth – The dividend growth model of common stock valuation assumes a constant dividend growth rate. This means that dividend paid has grown at a constant rate over the years.

- Risk Free Rate – The risk free rate is assumed to be 4%. This is based on the Treasury Bills rate offered by the Government of the People’s Republic of Bangladesh.

- Return on Market Portfolio – Return on market portfolio has been calculated considering the annual average rate of the DGEN Index from year 2008 to 2012 and the Return on Market Portfolio is 7.97%.

- Beta Coefficient– The beta coefficient value for individual stocks has been taken through the regression analysis considering the rate of return by DGEN and by the company (PBL) from the year of 2008 to 2012. The value of 0.999873778 is taken as β.

- Dividend Growth – The dividend growth rate is calculated based on the cash dividend paid from the year 2008 to the year 2012.

Recommendations

- Some recommendations based on the financial performance and stock valuation of Prime Bank Limited are given below-

- A bank should increase the non-funded income in order to increase the operating income ratio.

- Before giving long-term loan a bank should consider that whether a bank has long term deposit or not. Otherwise the bank will surely face the liquidity problem.

- “Employee Recruitment Process”- should be done in a fare process so that appropriate and talented employees are selected through the recruitment process and increase the productivity and quality of the service.

- The most important thing that has come to my mind concerning their promotional activities is that they should go for print or broad cast media for advertisement to make their customer aware about their range of services and make the strong place in the customers‟ mind.

- To correct an over-valuation, the technique is to reallocate the equity in the company so everyone ends up with a number of shares they should have owned if the Friends and Family investors had invested at a fair valuation.

- The DSE and CSE should take part in the road show process just as a monitor if not the initiator. This can cause more transparency.

Conclusion

Now-a-days, all the banks are contributing much than the previous years for the growth and development of the country. Banking industry is now much organized because of strong vigilance and supervision of Bangladesh Bank. In the industry, Prime Bank Ltd is one of the pioneers in many criteria.

Prime Bank Ltd. is committed towards the excellence in the service with efficiency, accuracy and proficiency. Prime Bank Limited always tried its level best to perform financially well. In spite of trying to do well in some aspects Prime Bank Limited faced some financial problems from time to time. Some of the problems were-excessive bad loans, shortage of loans and advances, scarcity of cash in hands due to vault limit etc. These problems arouse time to time due to economic slowdown, interest rate fluctuation, emerging capital market, inflation in the money market and so on. Fighting with all these problems and competing with other banks every moment the bank is trying to do better to best. If this thing continues we hope that Prime Bank Limited will develop even more in the future. In spite of shortcomings, I tried my level best to make the report Fruitful. I apologize for making errors in the report.