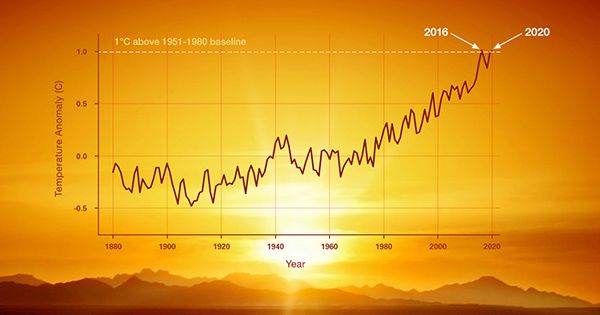

Last week’s COP26 in Glasgow averted calamity while also emphasizing the private sector’s critical role in combating climate change. Aside from a few major government victories to address methane leaks and revitalize stale bilateral collaboration, new private sector initiatives may hold the most potential. In 2006, Al Gore’s film “An Inconvenient Truth” sparked a $25 billion investment in clean technology venture capital, particularly in the solar and ethanol sectors. Despite the confidence of investors, most of this cash dried up only a few years later, and as a result, many venture capitalists shied away from cleantech for the better part of a decade.

We are naturally bullish about the role of venture capital in helping fund and grow game-changing cleantech solutions, thanks to our accomplishments in the first cleantech wave. With the world relying on the quick adoption of cleantech to combat climate change, it is critical that we grasp VC’s future promise — as well as its limitations — as we emerge from COP26.

The venture model, at its finest, allows fledgling firms to take risks with emerging technologies and pursue innovation in ways that huge corporations cannot. It may seem contradictory, but venture-backed startups frequently outspend much larger and better-funded corporations. This is due to the magic generated by their high-performing founders and organizations.

For a decade, Tesla, then a startup, easily outspent and outthought VW, Ford, and the rest of the big manufacturers when it came to engineering, manufacturing, and producing electric vehicles (EVs). Similarly, in the field of electric vertical takeoff (eVTOL) aircraft, startups Joby Aviation and Lilium are outperforming Boeing and Airbus, while QuantumScape is leading in next-generation solid-state batteries.

Due to their short-term objectives, CEOs of major corporations focused on incremental growth, cost reductions, and other “market-driven” imperatives, and they are unable to stomach the risks associated with developing and commercializing disruptive innovation. Despite the fact that history is littered with vivid examples of disruption, major corporate CEOs continue to fail to lead.

Therefore, we continue to identify sectors where long time horizons, significant risks, and a lack of leadership produce possibilities that are specifically adapted to venture capital. For example, 20 years after Tesla, there is still electrification potential in the transportation area. For example, with the EV revolution well started, the need to recycle EVs and their batteries is becoming vital to sustaining development; once again, a company, Redwood Materials, is at the front of this embryonic effort to recycle batteries.

Many legacy sectors can benefit from climate-friendly disruption, thanks to venture capitalists. Consider the chemical and manufacturing industries. In these and other heavy sectors, incumbent corporations are sluggish to react and culturally weak at dealing with innovation.

VC money, on the other hand, is assisting in the development of technologies that will force them to adapt, such as sourcing hydrocarbons sustainably by using renewable energy to separate hydrogen from water and carbon from air and then combining these elements into all of the chemicals that have previously made from coal, oil, and gas. Electric Hydrogen and Twelve, two young firms, are accomplishing just that.

Venture Capital is also ideally positioned to support experimental technologies such as fusion energy. Outside of government, there are hardly any incumbent corporations in this industry, and there are no neighboring companies courageous enough to grab the day, hence the field is reliant on newcomers. Helion Energy and Commonwealth Fusion Systems, for example, have each received more than $500 million in venture funding this year.