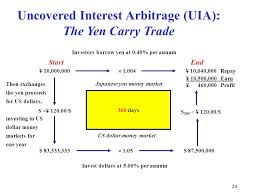

Uncovered Interest Arbitrage is a form of arbitrage that involves switching at a domestic currency that includes a lower interest rate into a foreign currency that offers a higher interest on deposits. There is a forex risk implicit in this transaction since the investor or speculator should convert the foreign currency deposit proceeds back into the domestic currency some time in the foreseeable future. The term “uncovered” on this arbitrage refers to the belief that this foreign exchange risk is just not covered through a frontward or futures contract.

Uncovered Interest Arbitrage