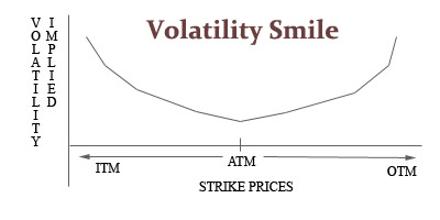

Volatility Smile is an implied volatility curve where options away from the at-the-money price have higher implied volatility than the at-the-money options. It is a geographical pattern of implied volatility for a series of options that has the same expiration date. It reflects the heightened demand for these options relative to the at-the-money options. Volatility smiles should never occur based on standard Black-Scholes option theory, which normally requires a completely flat volatility curve.

Volatility Smile