Floating Exchange Rate Regime

Exchange rates can be understood as the price of one currency in terms of another currency. A floating (or flexible) exchange rate regime is one in which a country’s exchange rate fluctuates in a wider range and the country’s monetary authority makes no attempt to fix it against any base currency. Exchange rate regimes (or systems) are the frame under which that price is determined. It is a regime where the currency price of a nation is set by the forex market based on supply and demand relative to other currencies. A movement in the exchange is either an appreciation or depreciation. This system became more popular after the failure of the gold standard and the Bretton Woods agreement.

A floating exchange rate is one that is determined by supply and demand on the open market. It refers to a currency where the price is determined by supply and demand factors relative to other currencies. These systems mean long-term currency price changes reflect relative economic strength and interest rate differentials between countries. Unlike fixed exchange rates, these currencies float freely, that is, unrestrained by government controls or trade limits. Under this system, increased supply but lower demand means that the price of a currency pair will fall; while increased demand and lower supply mean that the price will rise.

- Free float

Free float, also known as clean float, signifies that a currency’s value is allowed to fluctuate in response to foreign-exchange market mechanisms without government intervention. It is a situation where the government tries to keep the exchange rate within a certain target against other currencies.

- Managed float (or dirty float)

Sometimes, countries are not in an official exchange rate mechanism, but they still do pay attention to the value of the exchange rate. A managed float, also known as dirty float, involves government intervention in the market exchange rate in different forms and degrees, in an attempt to make the exchange rate change in a direction conducive to the economic development of the country, especially during an extreme appreciation or depreciation. For example, in the late 1980s, the UK had a policy of ‘shadowing D-Mark’ as a precursor to joining the ERM.

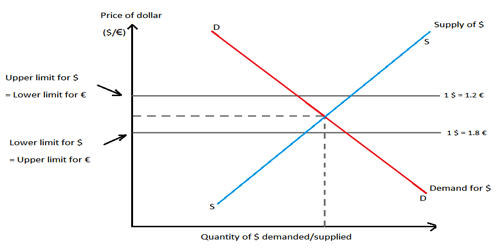

Floating Exchange Rate Regime occurs when governments allow the exchange rate to be determined by market forces and there is no attempt to influence the exchange rate. A monetary authority may, for example, allow the exchange rate to float freely between an upper and lower bound, a price “ceiling” and “floor”.