4.0) Findings and Analysis:

4.1) Qualitative Analysis:

4.1.1) SWOT Analysis of TRADEVISION Limited:

SWOT Analysis is a strategic planning method used to evaluate the Strengths, Weaknesses, Opportunities, and Threats involved in a project or in a business venture. It involves specifying the objective of the business venture or project and identifying the internal and external factors that are favorable and unfavorable to achieving that objective.

“S” = Strengths – Attributes helpful for achieving the objective.

“W” = Weaknesses – Attributes harmful for achieving the objective.

“O” = Opportunities – External conditions that are helpful for achieving the objective.

“T” = Threats – External conditions that may harm the business’s performance.

The SWOT Analysis of TRADEVISION Limited is presented in a table below:

STRENGTHS |

| Distinct Operating Procedures |

Distinct Schedule of Work

Strong Employee Bonding & Belongingness

Efficient Performance

Young Enthusiastic Workforce

No Communication Barriers

Own Distribution Channel

Own financing

Only Agent of Several Well Known Company

Maximum Buyers are Satisfied

Employee Turnover is Lower than other Competitors

High job security

WEAKNESS

Absence of Strong Marketing Activities

Low Remuneration Package

Advertising is not Creative

The Quality of Delivering Services is not Dynamic as other Competitors

Limited geographic coverage

There is a very little practice for increasing motivation in the workers by the management

One of the greatest weakness for TVL is shortage of manpower in every division except sells Division

The role of the middle managers in decision making process is very limited

Resistance to change and modernization

OPPORTUNITIES

A lucrative market that has a never ending demand

High demand of Medical Equipment And Power Generator

More Experienced & Managerial know-how

Opportunity to expand geographically within Bangladesh.

Customers are looking for good quality and have the willingness to buy the product of TVL

THREATS

New restrictions or law enforce by the Government

Price war among competitors

Lose of Customers

Devaluation of Currency

Non-availability of funds

Non-co-operation of government

New competitors will enter in the business market

Increasing Price of Product or Spear Parts

Political and Economical instability

Existing Companies have Good Acceptance in Consumer Market

Table – 9: SWOT Analysis of TVL

4.2) Quantitative Analysis:

This Internship Report was designed both to find out the Performance Analysis and also to analyze the Budgetary Practice of TRADEVISION Limited. From my point of view, it is very important to find out the financial performance of a company over time. On the other side the budgetary control activities, the gap between expectation and perception of the budgets and also analysis of the variance also has significant role to play. Through this study, I tried my best to find out and analyze these facts as nearby to the company. The Performance Analysis and Budgetary Practice done by TRADEVISION Limited as per my observation and study are presented below.

4.2.1) Performance Evaluation TRADEVISION Limited:

While doing the performance evaluation scholars prefer to work with relative data return than absolute one. Relative data normalize each balance relative to its relevant variable. Thus, it gives better insight about the change incurred in the entity. Analysis must in corporate both of them together to find in the changes in variable relative to its relevant variable and the changes overtime. Thus, I turned my analysis to ratio analysis that automatically incorporates both the necessary features for better inside and prediction.

4.2.2) Ratio Analysis:

Ratio analysis is the starting point in developing the information desired by the analyst. Ratio analysis provides only a single snapshot, the analysis being for one given point or period in time. In the ratio analysis it is possible to define the company ratio with a standard one. Ratio analysis of a firm’s financial statements is of interest to shareholders, creditors and firm’s own management. Ratio analysis is the starting point in developing the information desired by the analyst. Ratio analysis provides only a single snapshot, the analysis being for one given point or period in time. In ratio analysis it is possible to compare the company ratio with a standard one.

While doing the ratio analysis, I have focused on the Time–Series Analysis. I did it on the Years 2005, 2006, 2007 & 2008.

i. Analyzing Liquidity:

The liquidity of a business firm is measured by its ability to satisfy its short-term obligations as they come due. Liquidity refers to the solvency of the firm’s overall financial position. The basic measures of liquidity are-

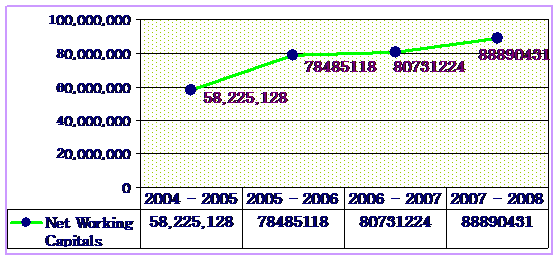

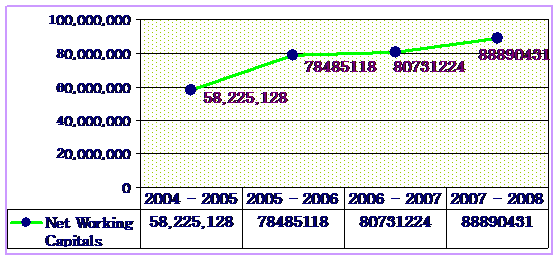

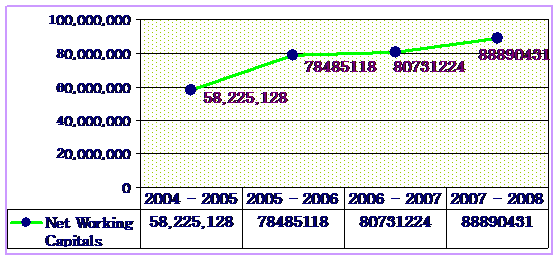

a. Net Working Capital:

Net Working Capital is a common measure of a firm’s overall liquidity. A measure of liquidity can be calculated by subtracting total current liabilities from total current assets.

Net Working Capital = Total Current Assets- Total Current Liabilities.

Year | Current Assets | Current Liabilities | Net Working Capital |

2004 – 2005 | 105182804 | 46957676 | 58225128 |

2005 – 2006 | 116737449 | 38252331 | 78485118 |

2006 – 2007 | 177802581 | 97071357 | 80731224 |

2007 – 2008 | 201162401 | 112271970 | 88890431 |

Table – 10: Net Working Capital

Figure – 10: Net Working Capitals

Interpretation:

The Net Working Capital TRADEVISION Limited had been increased gradually in the preceding 4 years. So, the company’s net working capital is fair. The company should retain this trend because it is useful for internal control. A time series comparison of the company’s net working capital is often helpful in evaluation its operations.

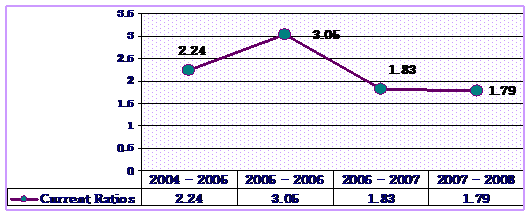

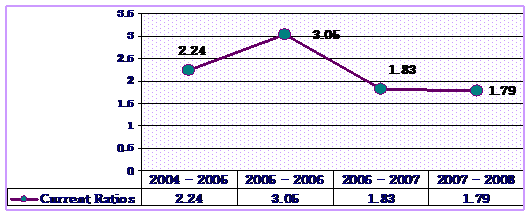

a. Current Ratio:

One of the most general and frequently used of liquidity ratios is the current ratio. Organizations use current ratio to measure the firm’s ability to meet short-term obligations. It shows a firm’s ability to cover its current liabilities with its current assets.

Current Ratio = Current Assets / Current Liabilities

Year | Current Assets | Current Liabilities | Current Ratio |

2004 – 2005 | 105182804 | 46957676 | 2.24 |

2005 – 2006 | 116737449 | 38252331 | 3.05 |

2006 – 2007 | 177802581 | 97071357 | 1.83 |

2007 – 2008 | 201162401 | 112271970 | 1.79 |

Table – 11: Current Ratio

Figure – 11: Current Ratios

Interpretation:

The firm has the capacity of paying Taka 1.79 to pay off Taka 1 of its current liability. The current ratio of TVL is declining from past two year which is not a good sign. It indicates that the firm is loosing its solvency.

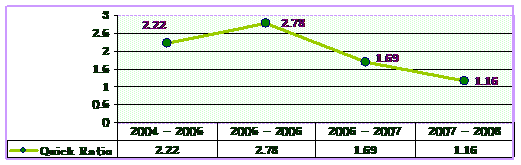

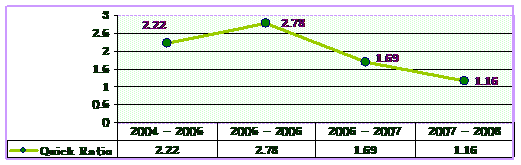

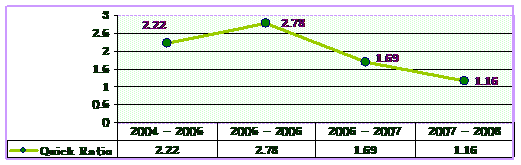

a. Quick Ratio /Acid Test:

A measure of liquidity is calculated by divining the firm’s current assets minus inventory by current liabilities. The quick ratio provides a greater measure of overall liquidity only when a firm’s inventory can’t be easily converted into cash.

Quick Ratio/ Acid Test = (Current assets – Inventory) / Current liabilities

Year | Current Assets | Inventories | Current Liabilities | Quick Ratio |

2004 – 2005 | 105182804 | 1152350 | 46957676 | 2.22 |

2005 – 2006 | 116737449 | 10517800 | 38252331 | 2.78 |

2006 – 2007 | 177802581 | 14032122 | 97071357 | 1.69 |

2007 – 2008 | 201162401 | 331969143 | 112271970 | 1.16 |

Table – 12: Quick Ratio

Figure – 12: Quick Ratios

Interpretation:

A quick ratio of 1.0 or greater is occasionally recommended. Since the company has a quick ratio more than 1 but the five years quick ratio shows a decreasing trend, so it is not a good sign for the company. It indicates that the company is not capable of efficiently converting their inventory into cash.

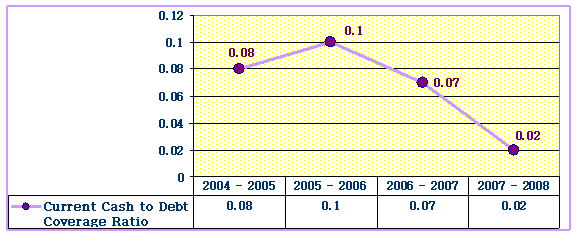

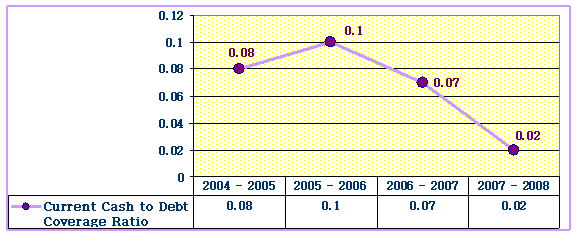

a. Current Cash Debt Coverage Ratio:

Current cash debt coverage ratio is the most cautious of analyzing liquidity position. The use of the current or quick ratio absolutely understand that the current asset will be changed into cash, but in reality it does not happened in the current asset to pay the current liabilities. For that reasons Current cash debt it’s really vital to look how much cash has in hand or in Bank to get together its financial obligations.

Current Cash to Debt Coverage Ratio = Cash / Current Liabilities

Year | Cash | Current Liabilities | Current Cash to Debt Coverage Ratio |

2004 – 2005 | 3799570 | 46957676 | 0.08 |

2005 – 2006 | 3911218 | 38252331 | 0.10 |

2006 – 2007 | 6788518 | 97071357 | 0.07 |

2007 – 2008 | 2364942 | 112271970 | 0.02 |

Table – 13: Current Cash to Debt Coverage Ratio

Figure – 13: Current Cash to Debt Coverage Ratio

Interpretation:

The ratio has decreased over the years 2007 and 2008 which is not good from investor points of view. Current cash has increase about 1.03 times in 2006, 1.73 times in 2007 and decrease by 0.35 in the year 2008. It indicates that the company does not have good reserve to meet its current obligations.

i. Analyzing Activity:

Activity ratios measure the speed with which accounts are converted into sale or cash. It can be measured through:

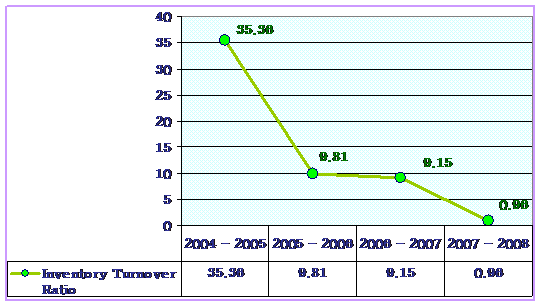

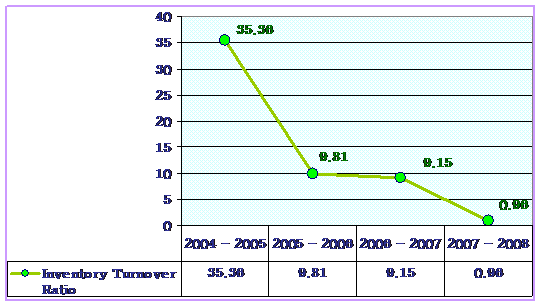

Inventory Turnover:

Inventory turnover commonly measures the activity or liquidity of a firm’s inventory. It is calculated as follows:

Inventory Turnover = Cost of Goods Sold / Inventory

Year | Cost of Goods Sold | Inventory | Inventory Turnover Ratio |

2004 – 2005 | 40745750 | 1152350 | 35.36 |

2005 – 2006 | 103144963 | 10517800 | 9.81 |

2006 – 2007 | 128349538 | 14032122 | 9.15 |

2007 – 2008 | 319098443 | 331969143 | 0.96 |

Table – 14: Inventory Turnover Ratio

Figure – 14: Inventory Turnover Ratios

Interpretation:

The inventory turnover ratio for TVL shows a gradually falling trend over the last three years. In 2004-2005 the ratio was 35.36, but within the next three years the ratio declined to 9.81, 9.15 and .96 respectively. As we know greater the inventory turnover ratio it is more efficient. So, the company’s turnover ratio is not so efficient and very fluctuates too.

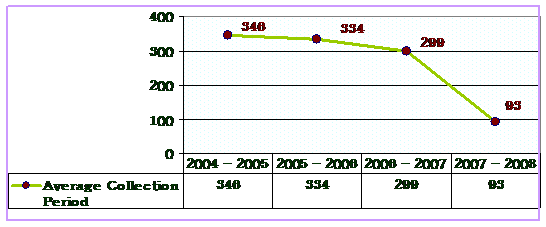

Average Collection Period:

Average collection period is useful in evaluating credit and collection policies. It is arrived at by dividing the average daily sales into the accounts receivable balance:

Average Collection Period = Accounts Receivable/Average Sales per Day

Year | Accounts Receivable | Sales | Annual Sales per Day | Average Collection Period |

2004 – 2005 | 98402417 | 102276551 | 284102 | 346 |

2005 – 2006 | 164607283 | 177102109 | 491950 | 334 |

2006 – 2007 | 145923684 | 175715400 | 488098 | 299 |

2007 – 2008 | 97957620 | 380579868 | 1057166 | 93 |

Table – 15: Average Collection Period

Figure – 15: Average Collection Period

Interpretation:

The average collection period of the firm is decreasing day by day. As we know the lower the average collection period, it is more efficient. So, the average collection period is good. They should keep this trend.

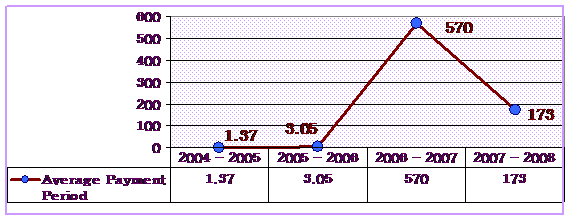

Average Payment Period:

The Average Payment period is calculated in the same manner as the average collection period:

Average Payment Period = Accounts Payable/Average Purchases Per Day

Year | Accounts Payable | Purchase | Annual Purchase Per Day | Average Payment Period |

2004 – 2005 | 460000 | 121313042 | 336981 | 1.37 |

2005 – 2006 | 2459280 | 290377428 | 806604 | 3.05 |

2006 – 2007 | 63549645 | 40113943 | 111428 | 570 |

2007 – 2008 | 53473043 | 111279834 | 309111 | 173 |

Table – 16: Average Payment Period

Figure – 16: Average Payment Period

Interpretation:

From the years 2004 – 2005 to 2005 – 2006 the average payment period of the firm deviates between 1.37 to 3.05 days. As we know the higher the average payment period, it is more efficient. So, the average payment period of TVL is not so good. It shows an increase in the year 2006 – 2007 and again decreased in the year 2007 – 2008. Their payment time should be increased to make this ratio efficient.

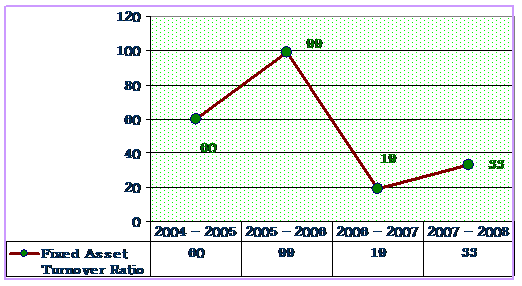

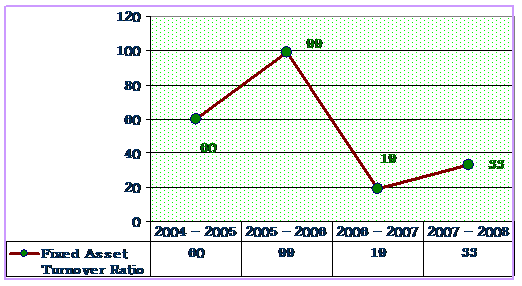

Fixed Assets Turnover:

The fixed asset turnover measures the efficiency with which the firm has been using its fixed assets to generate sales.

Fixed Asset Turnover Ratio = Sales / Net Fixed Assets

Year | Sales | Net Fixed Assets | Fixed Asset Turnover Ratio |

2004 – 2005 | 102276551 | 1691677 | 60 |

2005 – 2006 | 177102109 | 1790176 | 99 |

2006 – 2007 | 175715400 | 8711018 | 19 |

2007 – 2008 | 380579868 | 11367153 | 33 |

Table – 17: Fixed Asset Turnover

Figure – 17: Fixed Asset Turnover

Interpretation:

The company’s fixed asset turnover ratio fluctuates from 60 to 33 days. The more it is greater it is more efficient. So, the fixed asset turnover of TVL is satisfactory. The firm should use its fixed assets more efficiently to generate more sales.

Total Asset Turnover:

The total asset turnover indicates the efficiency with which the firm is able to use all its assets to generate sales.

Total Asset Turnover = Sales/Total Assets

Year | Sales | Total Assets | Total Asset Turnover Ratio |

2004 – 2005 | 102276551 | 106874481 | 0.96 |

2005 – 2006 | 177102109 | 118527625 | 1.49 |

2006 – 2007 | 175715400 | 186513598 | 0.90 |

2007 – 2008 | 380579868 | 212529554 | 1.79 |

Table – 18: Total Asset Turnover

Figure – 18: Total Asset Turnover

Interpretation:

The company’s total asset turnover ratio fluctuates from 0.96 to 1.79. The more it is greater it is more efficient. So, the total asset turnover of TVL is poor. The company should take steps to increase the efficiency of using total assets to generate sales.

i. Analyzing Debt:

It shows the extent to which the firm is financial by debt. The debt position of the firm indicates the amount of other people’s money being used in attempting to generate profits. There are two general types of debt measures of the degree of indebtedness and measures of the ability to service debts.

The Degree of Indebtedness:

It indicates how much debt is used by the organization.

Debt Ratio:

The debt ratio measures the proportion of total assets provided by the firm’s creditors.

Debt Ratio = Total Liabilities / Total Assets

Year | Total Liabilities | Total Assets | Debt Ratio |

2004 – 2005 | 46957676 | 106874481 | 0.44 |

2005 – 2006 | 38252331 | 118527625 | 0.32 |

2006 – 2007 | 97071357 | 186513598 | 0.52 |

2007 – 2008 | 112271970 | 212529554 | 0.53 |

Table – 19: Debt Ratio

Figure – 19: Debt Ratio

Interpretation:

The debt ratio of the firm’s fluctuates from 0.44 to 0.53. The lower, it is more efficient. So, the debt ratio is satisfactory of TVL. The company should try to keep it lower as the year 2005 and 2006.

Debt-Equity:

The debt-equity ratio indicates the relationship between the funds provided by creditors and those provided by the firm’s owners.

Debt-Equity Ratio = Total Liabilities – Debt/Stockholder’s Equity

Year | Total Liabilities | Stockholder’s Equity | Debt-Equity Ratio |

2004 – 2005 | 46957676 | 1000000 | 46.96 |

2005 – 2006 | 38252331 | 1000000 | 38.25 |

2006 – 2007 | 97071357 | 1000000 | 97.07 |

2007 – 2008 | 112271970 | 1000000 | 112.27 |

Table – 20: Debt – Equity Ratio

Figure – 20: Debt – Equity Ratio

Interpretation:

After having a careful view on the graph, we can see that the company has financed on an average of above 79.615% of its total debt with assets. This indicates that TVL has more debt than equity in the capital structure which is not a good sign.

The Ability to Service Debt:

It indicates whether the firm is able to meet up the interest & principle against the debt when due. The ratios are:

Time Interest Earned Ratio:

Fixed-Payment Coverage Ratio:

As TVL has no interest expense or long term debt so these two ratios are not applicable here.

ii. Analyzing Profitability:

It measure the income or operating success of an enterprise for a given period of time. There are many measures of profitability, which relate the returns of the firm to its sales, assets, or equity. As a group, these measures allow the analyst to evaluate the firm’s earnings with respect to a given level of sales, a certain level of assets, or the owners’ investment. This ratio specify the capacity of the company to survive difficult circumstances, which might occur from a number of basis, such as declining price, increasing cost and declining sale.

Gross Profit margin:

The gross profit margin indicates the percentage of each sales dollar remaining after the firm has paid for its goods. The higher the gross profit margin the better, and the lower the relative cost of merchandise sold. The gross profit margin is calculated as follows:

Gross Profit Margin = Gross Profits / Sales.

Year | Gross Profits | Sales | Gross Profit Margin |

2004 – 2005 | 61530801 | 102276551 | 0.60 |

2005 – 2006 | 73957146 | 177102109 | 0.42 |

2006 – 2007 | 47365862 | 175715400 | 0.28 |

2007 – 2008 | 61481425 | 380579868 | 0.16 |

Table – 21: Gross Profit Margin

Figure – 21: Gross Profit Margin

Interpretation:

The firm’s gross profit margin fluctuates from 60% to 16.71% in the preceding 4 years (2005-2008). More the ratio is the more the company’s profitability. The gross profit margin has a decreasing trend, which is not desirable. So, the company should try to increase the gross profit margin.

Operating Profit Margin:

The Operating Profit margin represents what are often called the pure profits earned on each sales dollar. A higher operating profit margin is preferred. The operating profit margin is calculated as follows:

Operating Profit Margin = Operating Profit / Sales

Year | Operating Profit | Sales | Operating Profit Margin |

2004 – 2005 | 21743146 | 102276551 | 0.21 |

2005 – 2006 | 33930815 | 177102109 | 0.19 |

2006 – 2007 | 15278245 | 175715400 | 0.09 |

2007 – 2008 | 33304550 | 380579868 | 0.09 |

Table – 22: Operating Profit Margin

Figure – 22: Operating Profit Margin

Interpretation:

The firm’s operating profit margin fluctuates from 21% to 9% in the preceding 4 years (2005-2008). The operating profit margin has also a decreasing trend as gross profit margin, which is not desirable. The company should try to increase the gross profit margin and maintain.

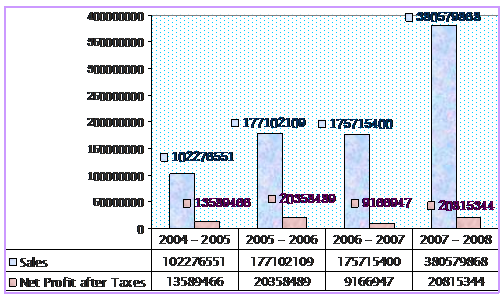

c. Net Profit Margin:

The net profit margin measures the percentage of each sales dollar remaining after all expenses, including taxes, have deducted. The higher the firm’s net profit margin is better. The net profit margin is a commonly cited measure of the corporation’s success with respect to earnings on sales. The operating profit margin is calculated as follows:

Net Profit Margin = Net Profit after Taxes / Sales

Year | Net Profit after Taxes | Sales | Net Profit Margin |

2004 – 2005 | 13589466 | 102276551 | 0.13 |

2005 – 2006 | 20358489 | 177102109 | 0.11 |

2006 – 2007 | 9166947 | 175715400 | 0.05 |

2007 – 2008 | 20815344 | 380579868 | 0.05 |

Table – 23: Net Profit Margin

Figure – 23: Net Profit Margin

Interpretation:

The firm’s net profit margin fluctuates from 13% to 5% in the preceding 4 years (2005-2008). With no exception TVL has a decreasing trend net profit margin too. Therefore, it should be recovered to sustain profitability.

Return on Investment (ROI):

The Return on Investment (ROI), which is often called the firm’s return on total assets, measures the overall effectiveness of management in generating profits with its available assets. Higher the ratio betters the profit.

Return on Investment (ROI) = Net Profit after Taxes / Total Assets

Year | Net Profit after Taxes | Total Assets | Return on Investment |

2004 – 2005 | 13589466 | 106874481 | 0.127 |

2005 – 2006 | 20358489 | 118527625 | 0.172 |

2006 – 2007 | 9166947 | 186513598 | 0.049 |

2007 – 2008 | 20815344 | 212529554 | 0.098 |

Table – 24: Return on Investment (ROI)

Figure – 24: Return on Investment (ROI)

Interpretation:

The firm’s return on investment deviates from 12.7% to 9.8% in the preceding 4 years (2005-2008). The return on investment of TVL was increase from 12 to 17% in the year 2006 but falls in 2007 and again increased in 2008. The management should work hard to keep this increasing trend the return associated with investment.

Return on Equity (ROE):

The Return of Equity (ROE) measures the return earned on the owner’s investment. Generally, the higher this return, the better off the owner’s.

Return on Equity (ROE) = Net Profit after Taxes /Stockholders’ Equity

Year | Net Profit after Taxes | Stockholder’s Equity | Return on Equity |

2004 – 2005 | 13589466 | 1000000 | 13.59 |

2005 – 2006 | 20358489 | 1000000 | 20.36 |

2006 – 2007 | 9166947 | 1000000 | 9.17 |

2007 – 2008 | 20815344 | 1000000 | 20.82 |

Table – 25: Return on Equity (ROE)

Figure – 25: Return on Equity (ROE)

Interpretation:

The firm’s return on equity deviates from 13% to 20% in the preceding 4 years (2005-2008). The return on equity of TVL is very fluctuating. The ROE was 13% in the year 2005 which increased to 20% in the year 2006. It decreased in the year 2007 into 9% and again increased in 20% in the year 2008 which is not desirable. So, the management should work hard to increase the return on equity and keep a stable trend.

4.2.4) Performance Analysis (Investors Point of View):

We know that the life of a company is the fund provided by the investors. We can also imagine that investors invest in a company to get some return at the end of each accounting period. On the other hand TVL has made a leading position in the Medical Equipments and Power Generating Equipments market. They are diversifying their business which requires new investment. At the end of fiscal year 2008 one new investor has invested his fund in this company and several are willing to invest.

So from the Investors’ Point of View the growth of this company is discussed below based on the 4 years summarized data:

i. Authorized Capital:

From the year of 1985 to 2008 (23 years) TRADEVISION Limited has its authorized capital of Taka 30,000,000.

ii. Issued, Subscribed & Paid up Share Capital:

The last 23 years paid up capital is constant to Taka 1,000,000.

iii. New Products for 2009:

One new product has been added to the existing products portfolio. TVL is going to introduce it by the end of this fiscal year. The new product of the company is “Electric Bulb”. Initially they will import this from India but their main plan is to manufacture this bulb in near future.

iv. Shareholders Equity:

Total shareholders equity is Taka 1000000 at the end of fiscal year 2007 – 2008. It is the same from the origin of the company.

v. Net Turnover:

The turnovers of the last four fiscal years of TVL shows an average increasing trend as presented below:

| Last Fiscal Years | Medical Business | Power Business | Total Turnover |

2004-05 | 98,871,798 Million | 3,404,753 Million | 102,276,551 Million |

2005-06 | 157,678,720 Million | 19,423,389 Million | 177,102,109 Million |

2006-07 | 160,037,840 Million | 7,838,780 Million | 167,876,620 Million |

2007-08 | 217,544,570 Million | 163,035,298 Million | 380,579,868 Million |

Table – 26: Turnovers of TVL

vi. Gross Tangible Assets:

.

Gross Tangible Assets of TVL have an increasing trend in the preceding four years. The data are presented in the table below:

Year | Tangible Assets |

2004 – 2005 | 59,916,805 |

2005 – 2006 | 80,275,294 |

2006 – 2007 | 89,442,241 |

2007 – 2008 | 110,257,585 |

Table – 27: Gross Tangible Assets of TVL

vii. Contribution to Government Treasury:

During the years of 2005 to 2006 TRADEVISION Limited has to contributed TK. 10.77 million to national exchequer in the form of import related taxes value added tax and sales tax.

viii. Net Profit:

Although net sales increased in the years 2005 to 2008 but the net profits show unsatisfactory trends. We can easily understand the sales and profitability of this company from the following graph.

Figure 26: Comparison between Sales & Net Profit

4.2.5) Performance Analysis (Creditors Point of View):

Creditors are those people who lend money to the organization for better running in the competitive market. Their money is used in the company as a capital. They get interest against to their loan. The people from whom the company purchases material on credit are also the creditor of the company. Creditors mainly gave emphasize on Liquidity dimension and Debt utilization. Some time they also observe activity dimension. The ratios those creditor pay attentions to lend money are:

| Current Ratio |

Quick Ratio

Cash Ratio Account payable Turnover

Debt Ratio

Return on Investments

All of these ratios mainly give result that whether the company is able to pay their liability or not, how they are performing in the market and what is their liability position related with their total asset. The types of creditors TRADEVISION Limited as per its audited report are: Creditors against Purchase, Margin Deposit – LC, Over Invoice Account, Short term borrowing form Bank and Other Creditors. On the other side as they are going to manufacture Electric Bulb the company will need huge financing to build the manufacturing plant and start production.

a. Current Ratio:

In case of TVL the current ratio of last year is 1.79 times, which means that the company has almost double ability to meet its current liability and this is quite attractive for any company from creditor’s point of view.

Year | Current Ratio |

2004 – 2005 | 2.24 |

2005 – 2006 | 3.05 |

2006 – 2007 | 1.83 |

2007 – 2008 | 1.79 |

Table – 28: Current Ratios of TVL

The ratio was higher in the years 2004 to 2006 which is following a decreasing trend. It might raise doubt on the operational efficiency of the company.

b. Quick and Cash Ratio:

The quick ratio and cash ratio bears the same result. In 2004 – 2005 quick ratio was 2.22 times and cash ratio was .08 times but in the years 2006 – 2008 both of these ratios followed the declining trend. This indicates that the liquidity position of this company is in danger. In this position no one will be interested to invest money in this organization. The company should pay attention to increase liquidity ratio as soon as possible because this situation is very much risky. In this condition there is a good chance for any company to become bankrupt.

Year | Quick Ratio | Current Cash to Debt Coverage Ratio |

2004 – 2005 | 2.22 | 0.08 |

2005 – 2006 | 2.78 | 0.10 |

2006 – 2007 | 1.69 | 0.07 |

2007 – 2008 | 1.16 | 0.02 |

Table – 29: Quick & Current Cash to Debt Coverage Ratio TVL

c. Accounts Payable Turnover in Days and Debt Ratio:

In 2004 – 2005 Accounts Payable turnover in days is only 1.37 days. It means that the firm pays its debt very quickly. During the years 2006 – 2008 the ratio has been increased to 372 days in average. On the other side in debt ratio we see that there is a continuous increase of debt ratio except the year 2005 – 2006. In 2001 the debt ratio was 44% but in the year 2007 – 2008 it stands at 53%. It means that 53% of total asset is financed by creditor which is not good for any company.

Year | Average Payment Period | Debt Ratio |

2004 – 2005 | 1.37 | 0.44 |

2005 – 2006 | 3.05 | 0.32 |

2006 – 2007 | 570 | 0.52 |

2007 – 2008 | 173 | 0.53 |

Table – 30: Current Ratios of TVL

By analyzing all sorts of these things we can say that the company’s overall situation is not good from a creditor’s point of view. The company is not holding good position either from an investor’s point or creditor’s point of view. It has to be careful about its liquidity and liability to build a good image.

4.2.6) Overall Financial Summary of TVL:

The findings in respect of various analysis of financial performance of TRADEVISION Limited are presented below:

Particulars | 2004 – 2005 | 2005 – 2006 | 2006 – 2007 | 2007 – 2008 |

| Net Working Capital | 58225128 | 78485118 | 80731224 | 88890431 |

| Current Ratio | 2.24 | 3.05 | 1.83 | 1.79 |

| Quick Ratio | 2.22 | 2.78 | 1.69 | 1.16 |

| Inventory Turnover Ratio | 35.36 | 9.81 | 9.15 | 0.96 |

| Average Collection Period | 346 | 334 | 299 | 93 |

| Average Payment Period | 1.37 | 3.05 | 570 | 173 |

| Fixed Asset Turnover | 60 | 99 | 19 | 33 |

| Total Asset Turnover | 0.96 | 1.49 | 0.90 | 1.79 |

| Debt Ratio | 0.44 | 0.32 | 0.52 | 0.53 |

| Debt – Equity Ratio | 46.96 | 38.25 | 97.07 | 112.27 |

| Gross Profit Margin | 60% | 42% | 28% | 16% |

| Operating Profit Margin | 21% | 19% | 9% | 9% |

| Net Profit Margin | 13% | 11% | 5% | 5% |

| Return on Investment | 12.7% | 17.2% | 4.9% | 9.8% |

| Return on Equity | 13.59 | 20.36 | 9.17 | 20.82 |

Table – 31: Financial Ratios of TVL

From the total analysis, we can summarize that the financial health of TRADEVISION Limited is not doing well through out the years. It is true that last year there return was upward but it is still unsatisfactory. Therefore, I can conclude that TVL is a good enough company with experience and very attractive market. The management should work hard to solve the above mentioned facts.

Budgetary Control Activities of TRADEVISION Limited

4.3) Practice of Budgeting & Budgetary Control in TRADEVISION Limited:

A budget is defined as s comprehensive and coordinated plan, expressed in financial terms, for the operations and resources of an enterprise for a given future period. The Profit Planning activities are accomplished through the preparation of a number of budgets from an integrated business plan known as master budget. Budgeting is a means of planning and evaluating. TRADEVISION Limited prepares their budget every year. They actually don’t follow any formal rule or procedure to prepare the budget. They prepare as they need and they feel. The nature, procedure and controlling activities of the company is dicussed below :-

4.4) Practice of Responsibility Accounting:

Basically TVL is a type of organization where the delegation of authority and responsibility is performed in a centralized manner. The directors take the maximum decision and managers are only meant to follow those decision. Their voices over the decisions are limited. The managers are asked to fulfill the plans taken by the higher authority and if they succeed then they get certain incentives or reward or otherwise vise versa. Responsibility accounting is not practiced in TRADEVISION from any segment.

4.5) Time Horizone of Preparing Budget:

The budget of TVL is prepared every year. The budget is divided into two quarter. The first quarter starts from July and ends at December and after that the second quarter starts from January and ends at June.

4.6) Procedure of Preparing Budget:

In today’s world where organizations are more likely to delegate their authority and responsibility, where powers are decentralized; TRADEVISION Ltd is a company where some old fashion management style is practiced. The budget preparation procedure of TVL is imposed budget. Mainly the finance director gives instruction to the finance and accounts manager for preparing budget. Managers have no say in the budgeting procedure. As they have no authority regarding the budget so they don’t have any responsibility too. All they have to do is to follow the order of the finance director.

4.7) People Involved in Preparing the Budget:

The director of finance, finance manager and the accounts manager is involved in the budget preparation process. Other employees have no role to play in this process and the higher authority does not appreciate their involvement.

4.8) Budgeting Committee:

A budget committee containing people from every department is very useful to organize a fruitful budget. As TVL is not that large organization and the budget preparing process is imposed; they do not feel the necessity to categorize any budget committee.

4.9) The Master Budget:

Master Budget usually consists of a number of separate but interdependent budgets. One budget estimates affects other budget estimates because the figures of one budget are usually used in the preparation of other budget. This is the reason why these budgets are called interdependent budgets. As a trading business TVL should have the following components of budgets as:

Sales Budget

Purchase Budget

The Ending Finished Goods Inventory Budget

Selling and Administrative Expense Budget

Cash Budgeting

Budgeted Income Statement

Budgeted Balance Sheet

TRADEVISION Limited actually does not follow any activities to prepare the master budget. They follow some informal procedure for preparing budgets. At the beginning of the financial year they forecast their sales and expected return from those sales and allocate the expense from that expected income in some informal way. In the current fiscal year they have started to formal documentation of their sales and other expenses which they did not used to do in previous years. So the preparations of budgets in respect of my findings from previous fiscal year and current fiscal year are presented below:

i. Sales Budget:

The basic theme of sales budget is to plan the sales and revenue over a specific time period. The first step of preparing this budget is to forecast the sales and schedule of expected cash collection of the budgeted period. In TRADEVISION Limited there was no formal paper work or documentation for such budget. The company has recently started to make sales report showing their expected sales target and actual achievement of sales. The directors of medical and power division along with their sales employees sit together in a meeting at the beginning of each financial year and forecast the sales for the coming two quarters. This forecast is done through taking several measurements like demand and supply, market survey, consumer preference, past years’ trend, previous years purchase orders, sale maturity and so on. The procedure of selling the goods and service and cash collection of the two major product lines of TVL is presented below:

Medical Division:

The sale of medical division is mainly divided into three categories as below:

Tender Sale:

Tender sale means the products sold to government hospitals or projects through tender. Tender sale has two categories as –

Varian Tender: The products of Varian Medical Systems

Non – Varian Tender: The products of other companies

The report prepared for forecasting and achieving sales revenue from these two categories are as follows:

Sales Forecast (Tender) Period – 1st July 2008 to 3oth June 2009 | |

Particulars | Taka |

| Varian Tender | 300,000,000 |

| Non – Varian Tender | 800,000,000 |

| Total Targeted Value for 1st July 2008 to 30th June 2009 (TK) | 1,100,000,000 |

Table – 31: Sales Forecast of TVL (Medical Division)

Sales Report for Medical Division (Tender) Period – 1st July to 31st December 2008 | ||||

Particulars | Targeted Value up to 30th September 2008 (TK) | Sold Value up to 30th September 2008 (TK) | Targeted Value up to 31st December 2008 (TK) | Sold Value up to 31st December 2008 (TK) |

| Varian Tender | 7500000000 | Nil | 15000000000 | Nil |

| Non – Varian Tender | 20000000000 | Nil | 40000000000 | 20363800000 |

Table – 32: Sales Report of TVL (Medical Division – Tender)

Private Sale:

Private sale means the products sold to persons other than government as private hospitals, private clinic, doctors, diagnosis centers etc. The sales generated from private segment are given to individual sales force with certain targets. Sales persons are required to reach at least 70% of the targeted sales. In every quarter the directors sit with their sales force twice for the sales inspection. The sales report and estimates are given below:

Sales Forecast (Private) Period – 1st July 2008 to 3oth June 2009 | |

Name of the Sales Persons | Taka |

| Naushad Choudhury & Mohammad Shahadat (Chittagong Branch) | 180000000 |

| Shahidul Haque | 280000000 |

| Saidur Rahman | 170000000 |

| Jillur Rahman | 100000000 |

| TVL | 230000000 |

| Total Targeted Value for 1st July 2008 to 30th June 2009 (TK) | 960,000,000 |

Table – 33: Sales Forecast of TVL (Medical Division – Private)

Sales Report for Medical Division (Private) Period – 1st July to 31st December 2008 | ||||

Particulars | Targeted Value up to 30th September 2008 (TK) | Sold Value up to 30th September 2008 (TK) | Targeted Value up to 31st December 2008 (TK) | Sold Value up to 31st December 2008 (TK) |

| Naushad Choudhury & Mohammad Shahadat (Chittagong Branch) | 4500000 | 215640 | 9000000 | 1627890 |

| Shahidul Haque | 5500000 | 574400 | 11000000 | 6465848 |

| Saidur Rahman | 4250000 | 4250000 | 8500000 | 2586000 |

| Jillur Rahman | 2500000 | 2500000 | 5000000 | 162000 |

| TVL | 5750000 | 5750000 | 11500000 | 736500 |

Table – 34: Sales Report of TVL (Medical Division – Private)

Service Report:

TVL provides after sales service to its customers for their equipments. They earn service charges when the guarantee or warrantee period of the product expires. The service target and the collection from the target are presented below:

Sales Forecast (Service) Period – 1st July 2008 to 3oth June 2009 | |

Name of the Sales Persons | Taka |

| Total Targeted Value for 1st July 2008 to 30th June 2009 (TK) | 100,000,000 |

Table – 35: Sales Forecast of TVL (Medical Division – Service)

| Particulars | Targeted Value up to 30th September 2008 (TK) | Sold Value up to 30th September 2008 (TK) |

| Service | 5000000 | 4599823 |

Table – 36: Sales Report of TVL (Medical Division – Service)

Power division:

The director of power division also prepares sales report for their expected sales and collection. These reports also do not follow any formal procedure. The reports actually do not have any similarities with sales budget. The reports are presented below:

Sales Forecast (Power Division) Period – 1st July 2008 to 3oth June 2009 | |

Particulars | Taka |

| Diesel | 90,000,000 |

| Gas | 250,000,000 |

| UPS | 80,000,000 |

| PLK | 65,000,000 |

| Tender | 25,000,000 |

| Service | 40,000,000 |

| Total Targeted Value for 1st July 2008 to 30th June 2009 (TK) | 550,000,000 |

Table – 37: Sales Forecast of TVL (Power Division)

Sales Report for (Power Division) Period – 1st July to 31st December 2008 | ||||

| Particulars | Targeted Value up to 30th September 2008 (TK) | Sold Value up to 30th September 2008 (TK) | Targeted Value up to 31st December 2008 (TK) | Sold Value up to 31st December 2008 (TK) |

| Diesel | 22,500,000 | 11,364,452.4 | 45,000,000 | 17,586,472 |

| Gas | 62,500,000 | 7,370,580 | 125,000,000 | 14,132,580 |

| UPS | 20,000,000 | Nil | 40,000,000 | Nil |

| PLK | 16,250,000 | Nil | 32,500,000 | Nil |

| Tender | 6,250,000 | Nil | 12,500,000 | Nil |

| Service | Nil | Nil | 20,000,000 | 10,822,570 |

Table – 38: Sales Report of TVL (Power Division)

ii. The Purchase Budget:

Non-manufacturing firms or merchandising firms prepare a merchandise purchase budget instead of a production budget. It shows the amount of goods to be purchased from its suppliers during the period. TVL do not prepare any estimated purchase budgets. For tender purchase they purchase when they get order and for private sale they initially purchase some products before getting orders but they do not have any formal calculations.

iii. Material Purchase Budget:

Inventory Budget is prepared to estimate the require amount of raw materials or other particulars are must for smooth production or service. As TRADEVISION Limited provides after sales service to its customer; it keeps inventory for necessary spare parts. The company does not make any budgets for their inventory and also do not have proper inventory management.

iv. Selling and Administrative Expense Budget:

The selling and administrative budget shows the expenses occurred other than production. TVL does not prepare administrative budgets. The overall management costs are simple posted to trial balance and the income statement as expense.

v. Cash Budgeting:

The cash budget basically shows the expected cash collection, cash disbursements and the financing properties. TVL’s management has their own style for preparing this budget. They initially calculate the expected cash collection and construct the expected cash expenses. In previous years there were no formal written budgets but from the current year the company has started to formally construct expected income and expenditure and also analyze the budget variances which are a good sign. The cash budget prepared by TVL is as presented below:

TRADEVISION LIMITED |

Sources of Fund / Income |

| Divisions | 2007- 08 | 2008-2009 | ||

| Achievement | ||||

65% of Total TargetTotal TargetAchievement Taka @ 70/% of Total TargetGross Earnings Due (BDE) @ 12%,10%, on achievement after deductionMedical Division861000001,200,000,000840,000,000100,800,000Power Division57400000500,000,000350,000,00035,000,000Total Target143,500,0001,700,000,0001,190,000,000135,800,000Total Receipts in Taka93,012,000 156,300,000

Table – 40: Sources of Fund / Income of TVL

TRADEVISION LIMITED | |||

BUDGET (Application of Fund & Expenditure) | |||

For the Financial Year 2007-2008 | |||

Particulars | Budget | Actual | Variance |

| Advertising Expenses: | |||

| Medical Division | 250,000 | 132,813 | 117,187 |

| Power Division | 250,000 | 598,836 | (348,836) |

| Common Division | 50,000 | 53,257 | (3,257) |

| 550,000 | 784,906 | (234,906) | |

| Bonus Account: | |||

| Medical Division | 435,000 | 397,663 | 37,337 |

| Power Division | 380,000 | 336,664 | 43,336 |

| Finance & Commercial Division | 174,000 | 72,648 | 101,352 |

| Administration Division | 50,000 | 44,520 | 5,480 |

| 1,039,000 | 851,495 | 187,505 | |

| Conveyances Account: | |||

| Medical Division | 370,000 | 422,677 | (52,677) |

| Power Division | 450,000 | 355,557 | 94,443 |

| Commercial Division | 50,000 | 62,779 | (12,779) |

| Finance Division | 25,000 | 18,757 | 6,243 |

| Administration Division | 22,000 | 7,743 | 14,257 |

| 917,000 | 867,513 | 49,487 | |

| Earn Leave Account: | |||

| Medical Division | 45,000 | 34,433 | 10,567 |

| Power Division | 32,000 | 27,353 | 4,647 |

| Finance, Commercial & Administration Division | 30,000 | 12,824 | 17,176 |

| 107,000 | 74,610 | 32,390 | |

| Entertainment Expenses Account: | |||

| Medical Division | 250,000 | 230,286 | 19,714 |

| Power Division | 600,000 | 552,593 | 47,407 |

| Finance & Comm. Division | 30,000 | 13,430 | 16,570 |

| Administration Division | 150,000 | 156,892 | (6,892) |

| 1,030,000 | 953,201 | 76,799 | |

| Tour Allowances:(Foreign) | |||

| Medical Division | 1,800,000 | 2,573,591 | (773,591) |

| Power Division | 800,000 | 542,594 | 257,406 |

| Finance, Comm. Division & Administration Division | – | – | – |

| 2,600,000 | 3,116,185 | (516,185) | |

| Tour Allowances:(Inland) | |||

| Medical Division | 300,000 | 356,455 | (56,455) |

| Power Division | 240,000 | 170,338 | 69,662 |

| Finance, Comm. Division & Administration Division | 24,000 | 13,130 | 10,870 |

| 564,000 | 539,923 | 24,077 | |

| Salary & Allowances: | |||

| Medical Division | 4,900,000 | 3,605,307 | 1,294,693 |

| Power Division | 4,200,000 | 4,067,895 | 132,105 |

| Commercial Division | 800,000 | 653,044 | 146,956 |

| Finance Division | 925,000 | 329,378 | 595,622 |

| Administration Division | 800,000 | 399,298 | 400,702 |

| 11,625,000 | 9,054,922 | 2,570,078 | |

| Others Accounts: | |||

| Over Invoice Payment Account: | |||

| Medical Division | 500,000 | – | 500,000 |

| Power Division | 2,000,000 | 9,637,687 | (7,637,687) |

| Overtime Allowance (Including .Holiday & Overtime) | 120,000 | 161,880 | (41,880) |

| Cleaner Charges | 25,000 | 18,000 | 7,000 |

| 2,645,000 | 9,817,567 | (7,172,567) | |

| Schedule Purchase: | |||

| Medical Division | 180,000 | 95,976 | 84,024 |

| Power Division | 50,000 | 9,000 | 41,000 |

| 230,000 | 104,976 | 125,024 | |

| Labor & other Charges: | |||

| Annual Conference | 180,000 | 148,425 | 31,575 |

| 180,000 | 148,425 | 31,575 | |

| Loans & Advances: | |||

| Loan Account:(Executives) | 150,000 | 146,000 | 4,000 |

| Loan Account:(Directors) | 400,000 | 937,876 | (537,876) |

| Loan Account:(3rd Party) | 2,500,000 | 2,692,590 | (192,590) |

| Bank Loan & Leasing Institution | – | (8,378,120) | 8,378,120 |

| Loan- Car Purchase | – | 2,666,261 | (2,666,261) |

| Loan-PF | 1,000,000 | – | 1,000,000 |

| 4,050,000 | (1,935,393) | 5,985,393 | |

| Repair & Maintenance Account: | |||

| All Repair and Maintenance | 620,000 | 340,570 | 279,430 |

| 620,000 | 340,570 | 279,430 | |

| Service & Installation Expenditure: | |||

| Medical Division | 1,320,000 | 2,276,382 | (956,382) |

| Power Division | 1,020,000 | 538,905 | 481,095 |

| 2,340,000 | 2,815,287 | (475,287) | |

| Office Rent: | |||

| Dhaka Office | 1,500,000 | 1,116,650 | 383,350 |

| Chittagong Office | 120,000 | 132,000 | (12,000) |

| 1,620,000 | 1,248,650 | 371,350 | |

| Telephone Bill: | |||

| Chittagong Office | 50,000 | 44,347 | 5,653 |

| Dhaka Office (Grand Total) | 300,000 | 213,949 | 86,051 |

| 350,000 | 258,296 | 91,704 | |

| Mobile Bill: | |||

| Medical Division | 400,000 | 356,370 | 43,630 |

| Power Division | 300,000 | 238,692 | 61,308 |

| Common Division | 100,000 | 38,037 | 61,963 |

| 800,000 | 633,099 | 166,901 | |

| Fixed Assets Account: | |||

| Motor Cycle Purchase (3pcs) | 200,000 | 107,490 | 92,510 |

| Car Purchase (2 Nos.) | 3,500,000 | 1,682,736 | 1,817,264 |

| Furniture & Fixtures Incl. new decoration) | 180,000 | 154,852 | 25,148 |

| Electrical Equipments + Computer | 180,000 | 412,400 | (232,400) |

| Loose Tools -Med. Div. Service | 100,000 | 189,825 | (89,825) |

| Loose Tools -Power Div. Service | 200,000 | 233,535 | (33,535) |

| Spares for Power Division | 3,000,000 | 13,098,540 | (10,098,540) |

| Spares for Medical Division | 2,000,000 | 1,613,730 | 386,270 |

| Land Investment | – | 3,155,000 | (3,155,000) |

| FDR Investment | – | 10,000,000 | (10,000,000) |

| 9,360,000 | 30,648,108 | (21,288,108) | |

| Communication Bill: | |||

| ISN Card, E-Mail Exp, Fax, Paper Bill, Mobile Card etc. | 168,000 | 144,267 | 23,733 |

| 168,000 | 144,267 | 23,733 | |

| Licenses Renewals Charges: | |||

| IRC, DCCI, FBCCI, Trade License, Atomic, Energy license update exp. | 230,000 | 132,729 | 97,271 |

| 230,000 | 132,729 | 97,271 | |

| Printing & Stationeries Account; | |||

| Medical Division | 100,000 | 81,950 | 18,050 |

| Power Division | 70,000 | 59,061 | 10,939 |

| Common Division | 500,000 | 450,731 | 49,269 |

| 670,000 | 591,742 | 78,258 | |

| Financial Expenses: | |||

| Bank Charges | 50,000 | 34,739 | |

| Bank Commission | 35,000 | 20,542 | 14,458 |

| BG and BG Comm. | 2,000,000 | 490,218 | 1,509,782 |

| Legal Fees. Bank & Others | 100,000 | 93,695 | 6,305 |

| PO and PO Comm. | 1,000,000 | 4,100 | 995,900 |

| Schedule Purchase: | – | – | – |

Medical Division | 180,000 | 95,976 | 84,024 |

Power Division | 30,000 | 9,000 | 21,000 |

| Audit Fees | 200,000 | 219,500 | (19,500) |

| 3,595,000 | 967,770 | 2,611,969 | |

| Common/ Projected Remuneration: | |||

| Projected Remuneration Medical Division | 18,000,000 | 14,667,218 | 3,332,782 |

| Projected Remuneration Power Division | 10,500,000 | 1,288,758 | 9,211,242 |

| 28,500,000 | 15,955,976 | 12,544,024 | |

| Vehicle Account (Including Honda): | |||

| Medical Division | 240,000 | 245,016 | (5,016) |

| Power Division | 240,000 | 467,368 | (227,368) |

| 480,000 | 712,384 | (232,384) | |

| Postage & Courier Services: | |||

| Medical Division | 120,000 | 312,802 | (192,802) |

| Power Division | 100,000 | 216,990 | (116,990) |

| 220,000 | 529,792 | (309,792) | |

| Utility Expenses: | |||

| Electricity Bill | 180,000 | 225,224 | (45,224) |

| Gas Bill | 30,000 | 9,600 | 20,400 |

| Internet Bill | 100,000 | 137,900 | (37,900) |

| ISN Bill | 30,000 | 15,300 | 14,700 |

| WASA Bill | 100,000 | 129,265 | (29,265) |

| 440,000 | 517,289 | (77,289) | |

| Total Expenditure or Total Application of Fund | 74,930,000 | 79,874,289 | (4,959,550) |

| Total (Deficit) or Surplus Budget In Taka | 18,082,000 | (79,874,289) | 4,959,550 |

Table – 41: Cash Budget of TVL

vi. Budgeted Income Statement:

TVL does not prepare budgeted Income Statement. The company has the aim to start as soon as possible

vii. Budgeted Balance Sheet:

TVL also do not have any statement of Budgeted Balance Sheet.

4.10) Budgetary Control of TRADEVISION Limited:

Budgetary Control is a system which uses the budgets for planning and controlling business activities. It quantifies and is financially oriented to guides the managers to achieve certain business objectives. Managers will compare the actual with the budgeted figures and the variances will then be investigated and corrective actions be taken. TVL has started to prepare the necessary budgets from the current fiscal year it will definitely bear good result in their downward profit trend if they effectively and efficiently implement the budget and analyze the variances.

5. Major Findings:

After conducting my observations, findings from previous chapters and other assessments I have tried to found the following facts as presented below:

- The liquidity position of the company is satisfactory, because they meet the standard. The liquidity ratios show that they have the ability to meet the liabilities from their current assets. They are managing their working capitals well.

The company’s current ratio and quick ratio is well but they are in a decreasing trend. If they do not take any action immediately, there is a chance of becoming technically insolvent. They must act now!

The current cash to debt coverage ratio shows that they have very insufficient cash to meet their instant liability.

Activity ratios are not much inspiring in case of TRADEVISION Limited. Close attention should be increased in such areas as Inventory Turnover, Average Collection Period and Total Asset Turnover.

As mentioned before TVL has no long term debt and it makes the company less risky. But the Debt ratio and Debt to Equity ratio do not show good results. Both of these ratios are showing a declining trend is the past four years.

Apart from Gross Profit Ratio to Net Profit Margin, most of the Profitability ratios have actually decreased in the preceding four years. On the other side the Return on Investment and The Return of Equity is very fluctuating. It is an alarming problem for TVL and they need to try to improve these ratios.

Accounting Information System of TVL is not sufficient, organized and modernized.

The financial solvency of the company is alarming.

The efficient and effective allocation and management of resources are not performed here.

The proper inventory is not managed which hampers proper management of after sales service.

There is no formal accounting practice in TVL.

TVL does not look over their financial performances over time.

The auditing work is not accurately done or reviewed.

The company has failed to meet the sales target in the preceding three years.

No standard budgeting technique exists in the company. They make budgets in their own style but the successful implementation or variance analysis is not practiced.

The management does not follow Generally Accepted Accounting Principles (GAAP) and Bangladesh Accounting Standard (BAS) properly.

Responsibility Accounting is not practiced in the company.

Their assets, capitals, reservation trend says that diversify their portfolio will be risky.

The company is not paying tax for four years.

The business documentations and books of accounts are not maintained genuinely.

There is a need of formal environment in the office which some times reduces work effectiveness and efficiency.

Most of the personnel lack business based education. It hampers the investment decisions, sale management, product costing and pricing decision and service delivery process.

They lack the concept of Corporate Social Responsibilities (CSR).

TVL strongly lack manpower. One employee does the work of 2-3 employees. They are very dissatisfied for this because the remuneration package is not designed as per their work.

TVL holds the position after Siemens Medical Solutions in the medical equipment market.

TVL is the market leader for ophthalmic products.

The sales forces are very smart to generate sales for the company.

TVL uses its own distribution channel to distribute its products.

The prices of the products are relatively higher due to better quality.

Office layout of Finance and Accounting department is very congested which sometimes reduces the productivity of the employees.

6. Recommendations

- The following suggestion can be given on the basis of the stated problem or findings:

- The efficient management of liquidity is mandatory for the company.The cash asset should be increased to the satisfactory level.

The average collection period and average payment period should be properly managed.

The company should be more professional in using their total assets for generating their sales.

The company is capable of meeting their debt but the major portion of business is financed by debt which should be reduced.

Proper implication of accounting rules, preparing budgets and variance analysis, different costing methods, proper inventory should be practiced.

The basic reason behind auditing must be realized and corrective actions should be taken.

Effective utilization of the company’s resources should be conformed.

The company should take profitable projects to increase its profitability.

Optimal capital structure should be conformed to sustain profitability.

New policies should be introduced for effective and efficient control of the resources.

All the departments should act together for achieving the company objectives.

The company must prepare standard budgets and proper implementation should be practiced.

The actual cost must be compared with the standard cost and the reason of deficit or surplus should be analyzed.

The company is failing to achieve their sales target. They must set realistic sales target and take necessary steps to achieve it.

The employees must get the voice in budgeting process and resource allocation. In today’s competitive business world it really works to improve performance.

Building and practicing responsibility accounting may help to reduce cost and increase profit.

The company must introduce dividend to attract new investors.

As the company is involved in trading business and they need to import all of their product from abroad so they must consider the terms like Free Alongside Ship (FAS), Free On Board (FOB), Cost And Freight (C & F), Cost, Insurance And Freight (CIF) and others which may sometimes reduce the price of the product and increase profit.

Training is essential for any profession. Most people want to work with a well- run, disciplined organization where the rules, policies, and procedures are clear, uniform and consistently applied. TVL provides training facility to its marketing department only. The higher management must provide these facilities to other departments too for better performance.

They must be fair in documentation and in keeping books of accounts. Honesty is an unbreakable part for better survival.

The organizations providing authority and responsibility to its employees in decision making process are found more productive and efficient. Performance appraisal and creating sense of belongingness has no alternative for better performance.

Organizing executive training program for higher management will improve the performance, minimize the workload & they would be able to get more business.

To provide more efficient and prompt services to customer queries, more observe should be provided to increase the efficiency of after sales service as it generates profits.

Acknowledge the customers’ feelings either tactically or explicitly. This action helps to build rapport, the first step in rebuilding strong relationship.

7. Conclusion

Every business organization has the aim to maximize its profit throw satisfying its customers and the goal of Accounting Information System is to support this corporate goal by wealth maximization. Accounting “links” decision makers with economic activities and with the results of their decisions. Budgeting is a quantitative expression of a plan of action and also considered as the Basis for Planning and Control. A budget is a comprehensive financial plan for achieving the financial and operational goals of an organization. Through budgets management team initiate short term and long term plan, implement the plan, analyze the performance and evaluate the performance through feedback and revise

The overall financial health and budgetary practice of the company is not satisfactory. Their sales are increasing year to year but profit has a negative trend. Proper management of capital is compulsory for the company. TVL is an old company with an experience of 23 years and has recently introduced two new portfolios. In the dynamic environment currently faced by most businesses, the budget is still an important information source. They should be aware of the cost of maintaining this planning and control system and set this against the benefits obtained. So for better survival in the long run the company has to change its policies and practice.

On the other way the budgetary control activities of TVL do not meet any standard rules. They prepare budgets but they do not follow it properly. There are both positive and negative variances in the budgets but these variances are not analyzed. The budgets are imposed which has significant negative influence on the employees. There are potentials in the middle management team but they are not able to utilize their creativity. Besides these the directors does not appreciate to give any authority to the managers regarding the decision making process.

Budgets formulate expected performance and they reflect managerial objectives. Without such objectives, operations lack direction, problems are not foreseen; results lack meaning, and the implications for future policies are dwarfed by the pressure of the present. A budgetary system should emphasize and enlarge the planning role of all levels of management in TVL.

![Thesis Paper on Performance Analysis and Budgetary Control Activities of Trade Vision Limited [Part-2]](https://assignmentpoint.com/wp-content/uploads/2013/04/images-18.jpg)