Executive Summary:

Against the backdrop of worldwide unfavorable economic outlook, Bangladesh had to face a challenging task for a sustainable growth in all spheres of economy. As Bangladesh is a developing country, Medical Equipment Solutions sector has a high potentiality here. The growth of this sector is more or less depends on the growth of the economy.

The health industry in Bangladesh has significant importance to the 140 million people and its economy. Modern private hospitals have been setup with well-trained manpower. This has created further demand of higher grade medical equipment in Bangladesh. In Bangladesh more than 600 medical centers including MedicalCollegeHospitals and Health Complexes are functioning with sophisticated electro-medical equipment. The equipment demands safe operation, maintenance, monitoring, repair and development. Sound maintenance is an essential part of the return on the investment of health care equipment.

TRADEVISION Limited is one of the leading and trusted names in our country for excellent clinical solutions for Medical Diagnostic Imaging and Therapy Systems. TRADEVISION Limited is providing solutions through excellent quality products and best uptime service in the country. TVL Medical Solutions supports a wide range of health care facilities in Bangladesh, supplying and installing the latest diagnostic equipment to aid medical practitioners. Their contributions to the advancement of Medical care with efficient and cutting – edge technology of diagnostic and therapeutic systems have helped to transform hospitals. They have made increased life expectancy, higher quality of life and a significant cost reduction in health services reality. TVL’s comprehensive medical solutions not only increase efficiency but also will help keep Bangladesh on the world map for global excellence in healthcare in near future. At the moment the firm is manned by 70 employees with a highly qualified service team who are specially deputed for service support. They have served hundreds of industries countrywide which include heavy industries, Garments, Hospitals & Clinics, Cold Storage, Defense Service, Textile Mills and many others. In Medical Field they served all most all the tertiary level referral Medical College hospitals, District hospitals, secondary level 250 bed Project hospitals, most of the clinics, diagnostic centers throughout the country. They have installed more than 350 industrial diesel power generating sets till today.

This report “Performance Analysis & Budgetary Control Activities of TRADEVISION LIMITED” is prepared to fulfill the partial requirement of Bachelor of Business Administration Program of Bangladesh University of Business & Technology (BUBT). The topic of dissertation was selected upon consultation with course instructor of respective department.

The scope of this paper is to explore the financial performance and budgetary control mechanism of TRADEVISION Limited. Besides these the overall overview of the company, control & management in the organization’s financial resources, training & development, use of resources, accountability, improving existing procedures, managing & measuring performance in a systematic approach has also been presented. The main aim of this report is to find out the financial situation and the financial trend of TRADEVISION Limited and justify the result from investor and creditor’s point of view. On the other hand to find out the effective and efficient budgetary control activities performed by the company was another main focus. To do so I have analyzed the financial performance of the years 2004 – 2005 to 2007 – 2008 from the company’s audited financial statement and the budgets of the financial year 2007 – 2008 to 2008 – 2009. After the analyzing the different ratios of TVL it is found that the liquidity, activity, debt and profitability ratios are following a decreasing trend from past two fiscal years. From the analysis it is also clear that TVL has failed to use its asset efficiently. This position has a bad impact on investor view as well as creditors view. From the sources of information there was no financial information of other companies or industry average and that’s why I can’t compare those ratios. For this I can’t actually say that those ratios were good or bad. It is just my observation and findings from the ratios I have been calculated.

On the other side the Budgetary Control activities of the company is very poor. They do not prepare all the required budgets and some of those which they prepare do not fulfill any formal procedure or standard. They do not perform the variance analysis or do not have any contingencies. It is said that budgets are very powerful tool for effective and efficient performance and control mechanism so the reason behind the poor performance of the company may be due to neglected budgetary practice. Despite of the poor financial performance the company is going to diversify their business in to manufacturing concern and this step may become very risky for them if the do not act now.

1.0) Introduction

4.3) Introduction:

Experience is as much essential for academic education that enables someone to be successful business executive in the competitive business environment. In order to gather knowledge and exposure regarding the organizational culture & behavior; the business students has to go for Internship or Thesis after the successful completion of their Business degree. Now-a-days theoretical knowledge is much more practical oriented in business education. It is providing the opportunity to gather knowledge with practical experience. It enables us to gather practical knowledge in the applied filed of business directly.

The last semester of BBA Program has been designed for the fulfillment of this purpose. I have been attached with the company named Trade Vision Ltd., (Head Office – Finance Division). I was assigned to conduct my study on “Performance Analysis & Budgetary Control Activities of TRADEVISION LIMITED”. This report emphasized on the profit planning activities performed by TRADEVISION LIMITED.

It was a great opportunity for me to work in this organization with full of experience and exciting moments. I hope my effort will benefit the organization and will strengthen reader’s view on effective and efficient management of budgetary activities as well as better performance.

4.4) Background of the Study:

Only curriculum activity is not enough for handling the real business situation for any business school student, therefore it is an opportunity for the students to know about the field of business through the internship program. An internship program is a perfect blend of the theoretical and practical knowledge.

This report is originated to fulfill the requirement of the assigned internship report on – “Performance Analysis & Budgetary Control Activities of TRADEVISION LIMITED.”

It has been prepared under the supervision and guidance of Ms. Kanij Fahmida, Assistant Professor, Faculty of Business, Bangladesh University of Business and Technology. In this regard an organizational attachment at Mohakhali DOHS Branch of TRADEVISION has been given to me for a period of three months commencing from 15th November, 2008 to 15th February, 2009. During this period I learned how the host organization works with the help of the internal supervisor.

1.3) Significance of the Study:

Internship Program is a complement of the BBA program as it provides practical knowledge to the out going students as they are going to participate in the Management of different organizations. BBA degree which reveals not only read but also realizes the subject deeply and knowledge has no value. The practical experience also helps the learners to gather new idea and techniques. Through this report an individual can expect to have a good knowledge and understanding on the “Performance Analysis & Budgetary Control Activities of TRADEVISION LIMITED”. Therefore, it is obvious that the significance of Internship is clearly justified as the crucial requirement of four year BBA completion.

1.4) Scope of the Report:

The whole report is divided, mainly into five parts. In the very First Part, I have focused on the company’s background, management style, present status and specially the products etc. The second part is focused on the Literal Review. In the Third Part SWOT analysis of TRADEVISION, Ratio analysis, Trend analyses are done along with the analysis of budgetary Control Activities of TVL. In the Fourth Part the Findings have been analyzed and assessed. Recommendations are in the very last portion of the report.

1.5) Objectives of the Study:

As Internship Program is an office orientation for the interns so the basic objective of this program is to signify the practical organizational practice and different official works. This report is the outcome of such organizational attachment. The broad objective of the report is to identify Performance Analysis & Budgetary Practice of TRADEVISION but besides this there were other requirements. Accordingly the study was conducted to achieve the following objectives:

- Broad Objective:

Prepare an internship report on “Performance Analysis & Budgetary Practice of TRADEVISION LIMITED” as per the requirement of the Internship program.

- Short Objective:

To understand the organizational culture of TVL.

To identify different products of the company.

To analyze the performance through time series analysis.

SWOT analysis of TRADEVISION Limited.

To understand different budgets of TRADEVISION Limited.

To find out the variance between the actual and projected budgets.

To present the major findings that I have gathered through internship program and preparing the report.

To recommend the actions that should be taken by the company to improve the efficiency and effectiveness of the financial activities.

1.6) Methodology:

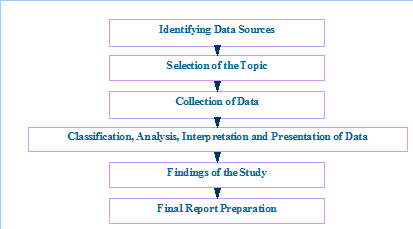

Research refers to the systematic method consisting of enunciating the problem, formulating a hypothesis, and collecting the facts or data, analyzing the facts and reaching certain conclusions either in the form of solutions towards the concerned problem or in certain generalizations for some theoretical formulation. Research is the process of gathering, recording and analyzing critical and relevant facts about any problem in any branch of human activity. It refers to a critical and searches into study and investigation of problem, a proposed course of action a hypothesis or a theory. The data & information of the report will be collected from primary sources, secondary sources and through personal interview. In order to prepare theoretical and qualitative framework of report, we use existing elements such as text book, power point slides, class lecture sheets, journals, annual report and others necessary elements. This overall process of methodology is given in the following page in the form of flowchart that has been followed in the study.

Figure 1: Flow Chart of Methodology

a) Research Design:

This is an Exploratory Research, which briefly reveals and analyzes the “Performance Analysis & Budgetary Control Activities of TRADEVISION LIMITED.”

b) Sources of Data Collection:

There are generally two types of data found and used in conducting the study. Information collected to furnish this report has been collected from both primary and secondary sources.

- The Primary Sources are:

ü Practical desk work

ü Face to face conversation with the officers

ü Face to face conversation with the clients

ü Relevant file study as provided by the concerned officer

- The Secondary Sources are:

ü Different official documents and company memorandum of TVL

ü Annual Reports (2005, 2006, 2007 and 2008) of TVL

ü Publications obtained from different libraries and from internet

c) Data Collection Procedure:

i. Primary data:

I have collected primary data by interviewing the Directors, Manager, employees and clients of TRADEVISION Ltd. The data had been collated through personal interviews and discussions with the officials of various departments, through visiting departments in a scheduled manner. Clarification of issues from different concerned officials of TRADEVISION Ltd I have collected primary data in the following way-

Observation

Face to face conversation with the officers

Practical desk work

Relevant file study as provided by the concerned officers

ii. Secondary data:

In order to collect the secondary data different related printed materials like TVL Annual Report, TVL website, different daily newspaper has been used. Moreover, library sources and textbooks also have been used as secondary sources of collecting early mentioned data and information. The methods of collecting the secondary data’s are like – Browsing Internet, Borrowing books from the library. I have to go investigate many books and references to enrich my report.

d) Data Analysis and Reporting:

Both the qualitative (such as SWOT analysis) and quantitative (such as Ratio analysis, Trend Analysis) tools are used to analyze the gathered data. Different tables and graphs were used to make the data meaningful and comparable. Different types of computer software are used for reporting the gathered information from the analysis, such as – Microsoft Word, Microsoft Excel, and Paint etc. Necessary percentages and averages were calculated and the analyzed results were described step by step.

1.3) Scope of the Study:

Scope of the study is quite clear. The purpose of the study is to analyze the performance over time and also the budgetary practice of the company which has been collected from the finance and HR Division. The span of the study is as given below:

Concept of financial ratios and its impact in the overall financial health of the company.

Trend analyses of the calculated ratios.

Importance of budgets and budgetary control activities.

Analyzing different budgets in respect with TVL.

1.4) Limitations of the Study:

Lack of knowledge of the respondents was the major problem that created many confusions regarding verification of conceptual question.

Limitation of time was one of the most important factors that shortened the present study. Due to time limitation many aspect could not be discussed in the present study.

Confidentiality of data was another important barrier that was faced during the conduct of this study. Every organization has their own secrecy that is not revealed to others. While collecting data on TVL, personnel did not disclose enough information for the sake of confidentiality of the organization.

Rush hours and business was another reason that acts as an obstacle while gathering data.

Observing and analyzing the broad performances and analyze the profit planning activities of a company is not an easy job by this short duration of time (only three months).

However, omitting this, the report will help us understand the whole customer oriented departments of the bank.

2.0) Company Profile

2.1) Company Information:

| Name of the Company | TRADEVISION LIMITED |

| Legal Status | Private Limited Company Incorporated under the Company Act (XVIII) 1994 |

| Year of Foundation | 1985 (24 Years) |

| Member of Local Chamber | Dhaka Chamber of Commerce & Industries |

| Managing Director | Mir Mahaboob Ali |

| Board of Directors | Mir Mahaboob Ali, Mahmud Hassan, Md. Shahidul Hassan and Andalib Islam |

| Number of Employees | 70 Employees |

| Service Centers | ServiceCenter – In Dhaka Head Office |

ServiceCenter – In Chittagong Branch OfficeTrading Particulars ActivitiesTrading exclusively on Medical Equipment Power Generating sets (Diesel & Gas) And with necessary spares support and Engineering service. Professional Laundry and Kitchen Equipments.Sales TerritoryThroughout BangladeshNumber of Shares3,00,000 Ordinary Shares of Taka 100 eachIssued, Subscribed & Paid up Share Capital10,000 Ordinary Shares of Taka 100 eachAnnual TurnoverTaka 835,673,928 (Average)Net Profit After TaxTaka 63,930,246 (Average)AddressHouse # 454 Road # 31; New DOHS Mohakhali; Dhaka –1206; Bangladesh.ContactTelephone: ++ 880 – 2 – 8711840 – 2

Table – 1: Company Overview

2.2) An Overview to TRADEVISION Limited:

TRADEVISION Limited is a technology company dealing with Electro – Medical Equipments, Power Generating Equipments and Hygiene Systems for more than 23 years. It was established on 1985 duly registered with Joint Stock Company in Bangladesh. The company’s vision is to bring Hi Tech and cost effective technology towards the Health Care Services and in the medical equipments they choose quality first and mainly dealing with the company who has factory around Europe and US having CE & FDA certificate. On the other hand in Power Generation, their products are providing excellent service support, which is required. They also deal with Industrial type UPS. Besides Hygiene is another new diversified area where they take care in establishing modern and Hygiene Kitchen & Laundry systems for Hospital, Hotels and Airport Catering House and Washing Plant. TVL has continuous effort to upgrade its Human Resource to face the challenge for providing optimum service to the customers in all respect. Lastly TVL has Vision to bring New and affordable Technology to life.

2.3) History:

TRADEVISION Limited (TVL) is a service oriented private limited company in operation since 1985. In the opinion of those it has served, if not the best, one of the best, in the field of Power generator and Electro Medical Equipment supply & Installation in Bangladesh. The Company started its activities with general trading. In 1991 it switched over to medical equipment supply & installation. While that remains it’s principal business. TVL entered into the field of Industrial Power generation – supply & installation in 1994. In Medical Field the company has served all most all the tertiary level referral MedicalCollege hospitals, District hospitals, most of the clinics, diagnostic centers throughout the country. They have served several hundreds of industries countrywide, which include heavy industries, Garments, Hospitals, Cold Storage, Defense Service, Textile Mills and many others. TVL efficiently serving country’s health and power sector almost two decades.

2.4) Vision:

“To maintain leadership in the field of Health and Power Equipment sector through continuous technology & efficiency transfer, sorting useful technology for our people, venturing into newer horizons and be the leading light in the industry.”

2.5) Mission:

The mission of TRADEVISION Limited (TVL) is each of the activities must achieve benefits to its stakeholders. They definitely believe that, in the final analysis they are accountable to each of the components with whom they interact; that is to say: their employees, their customers, their business associates, their fellow citizens and their shareholders.

2.6) Objectives of TRADEVISION Limited:

The objectives of the TRADEVISION Limited (TVL) are specific and targeted to its vision and to position itself in the mindset of the people as a company with difference. The objectives of the TVL are as follows:

To serve the nation with advanced medical equipment product and service.

To serve power generation service at a low start up cost.

To diversify the business into new product group.

To diversify business in real-estate industry.

To develop the country’s industry sector and contribute to the economic development.

2.7) Branches of TVL:

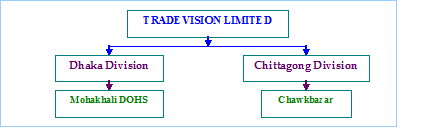

TRADEVISION Limited (TVL) is the second largest company for medical equipments and also in power generator in our country. It has its head office in Dhaka and one branch office in Chittagong throughout the country till now. The branches are presented in a graph below:

Figure – 2: Branches of TVL

2.1) Shareholders of TRADEVISION Limited:

There are four shareholders having 3, 00,000 ordinary shares of taka 100 each. The name of the shareholders and their share percentage are as below:

Name | Ownership Percentage |

| Md. Mir Mahaboob Ali | 30 |

| Md. Andalib Islam | 10 |

| Md. Mahmud Hassan | 30 |

| Md. Shahidul Hassan | 30 |

Table – 2: Shareholders of TVL

2.2) Directors of TRADEVISION Limited:

Name | Designation |

| Md. Mir Mahaboob Ali | Managing Director |

| Md. Andalib Islam | Director (Finance & Commercial) |

| Md. Mahmud Hassan | Director (Medical Division) |

| Md. Shahidul Hassan | Director (Power Division) |

Table – 3: Directors of TVL

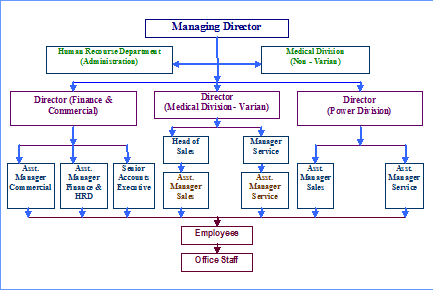

2.3) Management Committee:

The Management Committee consists of the Managing Director, Directors and Head Office Executives. They discuss about the progress on portfolio functions. Different ideas and decisions and guidelines are the main concern of this committee. All these committees meet on a regular basis for discussing various issues and proposals submitted for decisions.

Name | Designation | Division / Department |

| Md. Mir Mahaboob Ali | Chairman | Managing Director |

| Md. Shahidul Hassan | Chairman | Director (Power Division) |

| Md. Mahmud Hassan | Member | Director |

| Md. Andalib Islam | Member | Director (Finance & Commercial) |

| Md. Gautom Kumer | Member | Medical Division (Manager Service) |

| Md. N. A. Chowdhury | Member | Deputy Manager (Chittagong Branch In charge) |

| Md. Masud Karim | Member | Medical Division (Head of Sales) |

| Md. Eng. Jakir Hossain | Member | Power Division |

| Md. Zakir Hossain Sheikh | Secretary | Finance / HRD |

| Md. Rafiqul Islam | Member | Commercial |

Table – 4: Management Committee of TVL

2.4) Organizational Hierarchy:

Figure – 3: Management Hierarchy of TRADEVISION Limited

2.1) Departments of TVL:

If the jobs are not organized considering their interrelationship and are not allocated in a particular department, it would be very difficult to control the system effectively. If the departmentalization is not fitted for the particular works there would be haphazard situation and the performance of a particular department would not be measured. TRADEVISION Limited has done this work very well.

- Finance Department:

Financials Administration Division mainly deals with the accounts and finance side of the company. It deals with all the Head Office transactions with banks, customers and its Branches. The activities of this division are as below:

Income, Expenditure Posting

Cash generation and allocation works for office operations and miscellaneous payments.

Bills preparation and payment

Maintenance of Employee Provident Fund

Budgeting Activities and Working Capital Management

Profits forecast and take necessary actions to meet the goal

Prepare contingency planning

- Commercial Department:

Receiving proposals for transaction

Appraising and Getting approval for the transaction

Setting price for credit and ensuring effectiveness of it

Preparing various statements for onward submission to Bangladesh Bank

Opening LC (From preparation to completion of the LC and follow up its proper management)

Maintaining correspondence relationship

Monitoring foreign exchange, returns & statements

Bank guarantee, Loan against trust receipt and other follow up.

- Human Resource Department:

HRD performs all kind of administrative and personnel related matters. The broad functions of the division are as follows:

Selection & Recruitment of new personnel.

Preparation for all formalities regarding appointment and joining of the successful candidates.

Placement of manpower.

Dealing with the transfer, promotion and leave of the employees.

Activities regarding remunerations, incentives, bonus and others.

Training & Development.

Termination and retrenchment of the employees.

Keeping records and personal file of every employee of the company.

Performance appraisal and management.

Employee welfare fund running.

Arranges workshops & trainings for employee & executives.

- Medical Department:

The efficient and dynamic leadership in management are cooperated with the company to develop such a good system toward increasing work efficiency, spirit and confidence. TVL has adopted the following system to ensure proper customer service: –

Free Routine Maintenance and Monitoring

On calls / Emergency Service

Warranty, Contractual & Post Warranty Service

Fixing day work schedule for Sales and Service

Fixing follow up programs for Sales and Service

Sharing experience on Sales and Service

Making progress report on Sales and Service

- Power Department:

TVL commissioning teams are fully experienced with a wide range of operating systems, equipment and controls. Commissioning engineers are available to assist with all stages of final run up to full operation of the complete installation including training of client personnel in operation and programmed maintenance. The general work done by this division is:

Power Service – Installation and Commissioning

Power Service – Maintenance

Free routine maintenance and Monitoring

Warranty, Contractual & Post Warranty service

This division maintains individual register book to support above-mentioned services. TVL offers priority response to this category customer’s and try to maintain spare parts stock as much as possible against these category machines. They also offer routine & preventive maintenance for these customer’s.

- Sales and Service Under Medical & Power Division:

Medical Equipment Marketing: Marketing of Medical Equipment refers to marketing of various kinds of electro – medical equipment to the customers like doctors, hospitals, diagnosis centers etc. In-order to perform this job, they often visit to the target customers and attract then to buy their product.

Power Generator Marketing: The process of Power Generator Marketing is more or less same as Medical Equipment marketing. In this case different organizations having the requirement of power generator services are identified and convinced to buy the product offered by Traded Vision.

Hygiene Systems Marketing: The marketing processes of Hygiene Systems are as same as the medical equipments and power generators.

After Sales Service: After sales service is their prime feature, which convince their buyers to buy the second Equipment form them. Their Company provides top priority on Service. Manufacturer trains most of the Engineers & they are prepared to handle service problems from minor to major extend. The philosophy is to be the partner of the buyer rather to be a seller only.

2.2) Bankers of TRADEVISION Ltd:

| Uttra Bank Limited | Sonali Bank Limited |

| Arab Bangladesh Bank Limited | Jamuna Bank Limited |

| Standard Charted Bank Limited | Janata Bank Limited |

| United Commercial Bank Limited | BRAC Bank Limited |

Table – 5: Bankers of TRADEVISION Ltd.

2.3) Auditor and Legal Advisor:

Rahman Mostafa Alam & Company (Chartered Accountants) is the internal Auditor as well as the legal advisor of the company.

2.4) Training and Development:

i. Overseas Trainings: The service engineers are trained from different manufacturers of UK, China, Sweden, Switzerland, India, and Germany, Australia, Singapore. The manufacturer arranges these highly professional, well equipped and skilled training.

ii. Local Trainings: Manufacturers also send their Trainers/ Experts every year (once or twice) to Bangladesh for training and up gradation of our sales and service team on their products. This practice is very much regular with a keen objective from the part of Manufacturer to keep the whole team well concern on all their recent updates and capable to provide satisfied customer support.

2.5) Product Line:

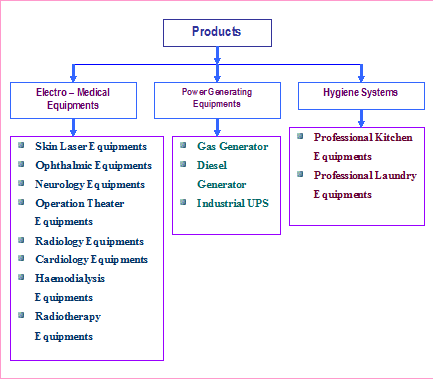

Every company creates value by offering different types of goods and services and delivering them in a pleasing and convenient fashion at an acceptable price. In return, customers give more sell, goodwill and trust in the primary form and later on by telling others to get services from TVL. If the memorandum and articles of association of the TRADEVISION Limited is revised then it will be found that its area of operation is clearly written. The product of TVL is targeted to fulfill that aim. There are mainly three product lines of TVL and these are given below:

Figure – 4: Product lines of TRADEVISION Limited

2.1) Turn Over in Last Fiscal Years:

| Last Fiscal Years | Medical Business | Power Business | Total Turnover |

2004-05 | 98,871,798 Million | 3,404,753 Million | 102,276,551 Million |

2005-06 | 157,678,720 Million | 19,423,389 Million | 177,102,109 Million |

2006-07 | 160,037,840 Million | 7,838,780 Million | 167,876,620 Million |

2007-08 | 217,544,570 Million | 163,035,298 Million | 380,579,868 Million |

Table – 6: Turn Over of TVL

2.2) Global Partners:

Trade Vision Imports and sells products from different leading companies of different countries around the world as below:

| Electro – Medical Equipments | Varian Medical Systems, USA, DEL Medical Systems Group, USA, Heidelberg Engineering, Germany, Haag-Streit AG, Switzerland, Smith Medical PM Inc., USA, Eschmann Holdings Ltd., UK, WaveLight Technologies AG, Germany, Ophthalmic Technologies Inc. (OTI), Canada, Moller Wedel GmbH, Germany, D.O.R.C. International, Holland, CHISON Medical Imaging Co. Ltd., China, Datascope Medical Co.,USA, Gambro Renal Products, Sweden, BIOMED Devices Inc. , USA. |

| Power Generator | Braodcrown Ltd., UK, Jinan Diesel Engine Co. Ltd. , China, DB Power Electronics (P) Limited, India, Shin – Nippon Co. Inc. , Japan, Newage Electrical India Ltd. , India, Chloride Industrial Systems, France, Cummins Generator Technologies, UK. |

| Hygiene Systems | Electrolux, USA, Zanussi Professional, Italy, Molteni, France |

Table – 7: Global Partners

2.3) Major Competitors of TVL:

Product Category | Name of the Competitors |

| Electro – Medical Equipments | Siemens, General Electronics, Biponon, Sunny Trading, Medetronex etc. |

| Power Generator | Bangla CAT, Energy Pack, Electro Machine, Rahim Afroz, Navana Group, Orion Group etc. |

| Hygiene Systems | Top One, Modern Erection etc. |

Table – 8: Major Competitors

2.4) Concerns of TRADEVISION Limited:

TRADEVISION Distribution Company Limited (TDCL):

TVL is going to introduce their new concern by the end of 2009. The product of this company will be electric bulb. They are initially importing the product from “Surya” – an Indian company. They have the ambition to move to manufacture bulb by the end of this year or next year.

3.0) Literary Overview

3.1) Accounting:

Every business organization has the aim to maximize its profit throw satisfying its customers and the goal of Accounting is to support this corporate goal by wealth maximization. Accounting “links” decision makers with economic activities and with the results of their decisions.

So it can be said that Accounting is an information system that identifies, records, and communicates the economic events of an organization to interested users.

3.2) Financial Ratio Analysis:

When it comes to investing, analyzing financial statement information is one of the most important elements in the fundamental analysis process. Ratio Analysis involves the methods of calculating and interpreting financial ratios in order to assess the firm’s performance and status. Ratio analysis of a firm financial statement is of interest to share holder’s creditors and the firms own management. Ratio analysis is not merely the application of a formula to financial data to calculate a given ratio. The important thing is the interpretation of ratio value.

3.3) Importance of Ratio Analysis:

Ratio analysis of a firm’s financial statements is of interest to shareholders, creditors, & the firm’s own management. Both present and prospective shareholders are interested in the firm’s current and future level of risk and return, which directly affect share price. The firm’s creditors are primarily interested in the short-term liquidity of the company and its ability to make interest and principal payments. A secondary concern of creditors is the firm’s profitability; they want assurance that the business is healthy and will continue to be successful. Management, like stockholders, is concerned with all aspects of the firm’s financial situation. Thus, it attempts to produce financial ratios that will be considered favorable by both owners and creditors. In addition, management uses ratios to monitor the firm’s performance from period to period. Any unexpected changes are examined, to isolate developing problems.

3.4) Types of Ratio Comparisons:

Ratio analysis is not merely the application of a formula to financial data to calculate a given ratio. More important is the interpretation of the ratio value. To answer such questions as is it too high or too low? Is it good or bad? a meaningful basis for comparisons is needed. Two types of ratio comparisons can be made: Cross-sectional & Time-series analysis.

- Cross Sectional Analysis:

Cross-sectional analysis involves the comparison of different firm’s financial ratios at the same point in time. The typical business is interested in how well it has performed in relation to other firms in its industry. Often, the reported financial statements of competing firms will be available for analysis. Frequently, a firm will compare its ratio values to those of a key competitor or group of competitors that it wishes to emulate. This type of cross-sectional analysis, called benchmarking, has become very popular. By comparing the firm’s ratios to those of the benchmark company or companies, it can identify areas in which it excels and, more importantly, areas for improvement.

- Time-Series Analysis:

Time-series analysis evaluates performance over time. Comparison of current to past performance, using ratios, allows the firm to determine whether it is progressing as planned. Developing trends can be seen by using multiyear comparisons, and knowledge of these trends can assist the firm in planning future operations. As in cross-sectional analysis, any significant year-to-year changes should be evaluated to assess whether they are symptomatic of major problem. Additionally, time-series analysis is often helpful in checking the reasonableness of a firm’s projected financial statements. A comparison of current and past ratios to those resulting from an analysis of projected statements may reveal discrepancies or over optimism.

Combined Analysis:

The most informative approach to ratio analysis is one that combines cross-sectional and time-series analysis. A combined view permits assessment of the trend in the behavior of the ratio in relation to the trend for the industry.

3.5) Groups of Financial Ratios:

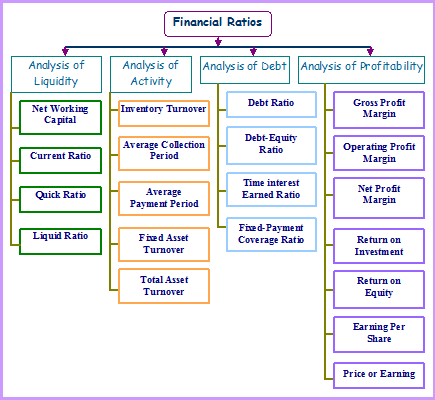

Financial ratios can be divided into four basic groups or categories:

1. Liquidity ratios

2. Activity ratios

3. Debt ratios &

4. Profitability ratios

Liquidity, activity, and debt ratios primarily measure risk; profitability ratios measure return. In the near term, the important categories are liquidity, activity, and profitability, because these provide the information that is critical to the short-run operation of the firm. Debt ratios are useful primarily when the analyst is sure that the firm will successfully weather the short run.

Figure – 6: Types of financial Ratios

i. Analyzing Liquidity:

The liquidity of a business firm is measured by its ability to satisfy its short-term obligations as they come due. Liquidity refers to the solvency of the firm’s overall financial position. The three basic measures of liquidity are-

Net Working Capital: Net Working Capital, although not actually a ratio. It is a common measure of a firm’s overall liquidity. A measure of liquidity is calculated by subtracting total current liabilities from total current assets.

Net Working Capital = Total Current Assets- Total Current Liabilities.

Current Ratio: One of the most general and frequently used of these liquidity ratios is the current ratio. Organizations use current ratio to measure the firm’s ability to meet short-term obligations. Current assets divided by current liabilities. It shows a firm’s ability to cover its current liabilities with its current assets.

Current Ratio = Current Assets / Current Liabilities

Quick Ratio/Acid Test: A measure of liquidity is calculated by divining the firm’s current assets minus inventory by current liabilities. The quick ratio provides a greater measure of overall liquidity only when a firm’s inventory can’t be easily converted into cash.

Quick Ratio/ Acid Test = (Current Assets – Inventory) / Current Liabilities

Current Cash Debt Coverage Ratio: This ratio indicates the short-term debt-paying ability of a business. It is calculated as follows:

Cash Provided by operations / Current Liabilities

ii. Analyzing Activity:

Activity ratios measure the speed with which accounts are converted into sale or cash. Measures of liquidity are generally inadequate because differences in the composition of a firm’s current accounts can significantly affect its true liquidity. A number of ratios are available for measuring the activity of the most important current accounts which includes inventory, accounts receivable, and account payable.

Inventory Turnover: Inventory turnover commonly measures the activity, or liquidity, of a firm’s inventory. It is calculated as follows:

Inventory Turnover = Cost of Goods Sold / Inventory

Average Collection Period: Average collection period is useful in evaluating credit and collection policies. It is arrived at by dividing the average daily sales into the accounts receivable balance:

Average Collection Period = Accounts Receivable/Average Sales per Day.

Or, Accounts Receivable/ (Annual Sales/360)

Average Payment Period: The Average Payment period is calculated in the same manner as the average collection period:

Average Payment Period = Accounts Payable/Average Purchases Per Day.

= Accounts payable / (annual purchases /360)

Fixed Assets Turnover: The fixed asset turnover measures the efficiency with which the firm has been using its fixed assets to generate sales.

Fixed Asset Turnover = Sales / Net Fixed Assets

Total Asset Turnover: The total asset turnover indicates the efficiency with which the firm is able to use all its assets to generate sales.

Total Asset Turnover = Sales/Total Assets

iii. Analyzing Debt:

The debt position of the firm indicates the amount of other people’s money being used in attempting to generate profits. In general, the more debt a firm uses in relation to its total assets, the greater its financial leverage, a term used to describe the magnification of risk and return introduced through the use of fixed-cost financing such as debt and preferred stock.

Debt Ratio: The debt ratio measures the proportion of total assets provided by the firm’s creditors.

Debt Ratio = Total Liabilities / Total Assets

Debt-Equity Ratio: The debt-equity ratio indicates the relationship between the long-term funds provided by creditors and those provided by the firm’s owners.

Debt-Equity Ratio = Long-Term Debt/Stockholder’s Equity

Time Interest Earned Ratio: The Time interest Earned Ratio measures the ability to meet contractual interest payments.

Time interest Earned Ratio = EBIT / Interest

Fixed-Payment Coverage Ratio: The Fixed-Payment Coverage ratio measures the ability to meet all fixed-payment obligations.

Fixed-Payment Coverage Ratio = EBIT / Interest + {(Principal Payments + Preferred Stock Dividend) X [1/ (1-T)}

iv. Analyzing Profitability:

There are many measures of profitability. As a group, these measures evaluate the firm’s earnings with respect to a given level of sales, a certain level of assets, the owners’ investment, or share value. Without profits, a firm could not attract outside capital. Moreover, present owners and creditors would become concerned about the company’s future and attempt to recover their funds. Owners, creditors, and management pay close attention to boosting profits due to the great importance placed on earnings in the marketplace.

Gross Profit Margin: The gross profit margin indicates the percentage of each sales dollar remaining after the firm has paid for its goods. The higher the gross profit margin the better, and the lower the relative cost of merchandise sold. The gross profit margin is calculated as follows:

Gross Profit Margin = (Sale-Cost of Goods Sold)/Sales

Or, Gross Profits / Sales

Operating Profit Margin: The Operating Profit margin represents what are often called the pure profits earned on each sales dollar. A higher operating profit margin is preferred. The operating profit margin is calculated as follows:

Operating Profit Margin = Operating Profit / Sales

Net Profit Margin: The net profit margin measures the percentage of each sales dollar remaining after all expenses, including taxes, have deducted. The higher the firm’s net profit margin is better. The net profit margin is a commonly cited measure of the corporation’s success with respect to earnings on sales. The operating profit margin is calculated as follows:

Net Profit Margin = Net Profit after Taxes / Sales

Return on Investment (ROI): The Return on investment (ROI), which is often called the firm’s return on total assets, measures the overall effectiveness of management in generating profits with its available assets.

Return on Investment (ROI) = Net Profit after Taxes / Total Assets

Return on Equity (ROE): The Return of Equity (ROE) measures the return earned on the owner’s (both preferred and common stockholders’) investment. Generally, the higher this return, the better off the owner’s.

Return on Equity (ROE) = Net Profit after Taxes /Stockholders’ Equity

Earning Per Share (EPS): The firm’s Earning per share (EPS) are generally of interest to present or prospective stockholders and management. The Earning per share represent the number of dollars earned on behalf of each outstanding share of common stock. The Earnings per share is calculated as follows:

Earning Per Share = Earnings Attributable to the Ordinary Shareholder /

Weighted Average Number of Ordinary Shares Outstanding During the Years

Price or Earning Ratio (P/E): The Price or Earning (P/E) ratio is commonly used to assess the owner’s appraisal of share value. The P/E represents the amount investors are willing to pay for each dollar of the firm’s earnings. The higher the P/E ratio, the greater investor confidence in the firm’s future. The Price or Earning (P/E) ratio is calculated as follows:

Price or Earning (P/E) = Market Price per Share of Common Stock / EPS

3.1) Profit Planning:

Profit planning can be defined as the set of steps that are taken by firms to achieve the desired level of profit. Planning is accomplished through the preparation of a number of budgets, which, when brought through, from an integrated business plan known as master budget. The master budget is an essential management tool that communicates management’s plan throughout the organization, allocates resources, and coordinates activities. A budget is a detailed plan for acquiring and using financial and other resources over a specified period of time. It represents a plan for the future expressed in formal quantitative terms. The act of preparing a budget is called budgeting. The use of budgeting to control a firm’s activities is called budgetary control. Master budget is a summary of a company’s plan that sets specific targets for sales, production, distribution, and financing activities. It generally culminates in cash budget, a budgeted income statement, and a balance sheet. In short, it represents a comprehensive expression of management’s plans for the future and how these plans are to be accomplished.

3.2) Responsibility Accounting:

The basic idea behind responsibility accounting is that a manager should be responsible for those items that the managers can actually control to a significant extent. Each item in the budget is made the responsibility of a manager and that manager is held responsible for subsequent deviations between budgeted goals and actual results. The basic idea is that large diversified organizations are difficult, if not impossible to manage as a single segment, thus they must be decentralized or separated into manageable parts. These parts or segments are referred to as responsibility centers which include Revenue centers, Cost centers, Profit centers and Investment centers. This functional approach allows responsibility to be assigned to the segment managers that have the greatest amount of influence over the key elements to be managed.

Being held responsible for costs does not mean that the manager is penalized if the actual results do not measure up to the budgeted goals. The point of an effective responsibility system is to make sure that the organization reacts quickly and appropriately to deviations from its plans, and that the organization learns from the feedback it gets by comparing budgeted goals to actual results. The point is not to penalize individuals for missing targets.

3.3) Budgeting:

Budgeting is a quantitative expression of a plan of action and also considered as the Basis for Planning and Control. A budget is a comprehensive financial plan for achieving the financial and operational goals of an organization. Through budgets management team initiate short term and long term plan, implement the plan, analyze the performance and evaluate the performance through feedback and revise.

From the above discussion it can be said that Budgeting involves planning for the various revenue producing and cost generating activities of an organization. The importance of budgeting is emphasized by an old saying, “Failing to plan is like planning to fail.”

3.4) Budget Period:

Operating budgets ordinarily cover one year period corresponding to the company’s fiscal year. Many companies divide their budget year into four quarters. The first quarter is then divided into months, and normally budgets are developed. These near term figures can often be established with considerable accuracy. The last three quarters may be carried in the budget at quarterly totals only. As the year progress, the figures of the second quarter is broken down into monthly amounts, then the third quarter figures are broken down, and so forth. This approach has the advantage of requiring periodic review and reappraisal of budget data through out the year.

3.5) Imposed Budgets Versus Participatory Budgets:

The success of a budget program will be determined in large part by the way in which the budget is developed. In the most successful budget programs, managers with cost control responsibilities actively participate in preparing their own budgets. This is in contrast to the approach in which the budgets are imposed from the top management. This process of budgeting is called Imposed Budgets and with this approach the managers are resentment and unwell instead of cooperative and committed. The participative approach in preparing budget is a major issue if the budget is to be used to control and evaluate the performance of the management. On the other side the budgeting approach in which managers prepare their own estimates is called a Self – Imposed Budget or Participative Budget. This budget is prepared with the participation of the managers of all level and also considered to be the most effective way to prepare budgets. There are several advantages of preparing self – imposed budget as given below –

Obtain information from those persons most familiar with the needs and constraints of the organizational units.

Integrates knowledge that is diffused among various levels of management.

Provides a means to develop fiscal responsibility and budgetary skills of employees.

Develop a high degree of acceptance of and commitment to organizational goals and objectives by operating management and are generally more realistic.

3.6) The Budget Committee:

Many medium to large organization have a budget committee, made up of executives from each department, to co-ordinate and review the departmental budgets in relation to the company policies. However to make budgeting to be successful top management must be involved in the administration of budgets. The objectives of a budget committee are appended below:

Identifies budget objectives and review external conditions such as economic conditions for the ensuing period;

Reconciles differences of opinion between departmental managers

Reviews department budgets and making recommendations;

Examines periodic reports showing actual performance compared with the budget Significant variances are identified and recommendation made on actions to be taken;

3.7) Zero Base Budgeting:

Zero based budgeting is an alternative approach that is sometimes used particularly in government and not for profit sectors of the economy. Under zero based budgeting managers are required to justify all budgeted expenditures, not just changes in the budget from the previous year. The base line is zero rather than last year’s budget. A zero based budgeting requires considerable documentation. In addition to all of the schedules in the usual master budget, the manager must prepare a series of decision packages in which all of the activities of the department are ranked according to their relative importance and the cost of each activity is identified. Higher level managers can then review the decision packages and cut back in those areas that appear to be less critical or whose costs do not appear to be justified. Zero based budgeting is a good idea. Under zero based budgeting, the review is performed every year. Critics of zero based budgeting charge that properly executed zero based budgeting is too time consuming and too costly to justify on an annual basis. In addition, it is argued that annual reviews are a matter of judgment. In some situations, annual zero based reviews may be justified; in other situations they may not because of the time and cost involved. However, most managers would at least agree that on occasion zero based reviews can be very helpful.

3.8) The Master Budget:

The master budget is a summary of company’s plans that sets specific targets for sales, production, distribution and financing activities. It generally culminates in a cash budget, a budgeted income statement and a budgeted balance sheet. In short a master budget represents a comprehensive expression of management’s plans for future and how these plans are to be accomplished. These interdependent budgets that make up a master budget have been discussed as given below:

a) Sales Budget:

The sales budget is the starting point in preparing the master budget. A sales budget is a detailed schedule showing the expected sales for the budget period. The sales budget will help determine how many units will have to be produced. Thus, the production budget is prepared after the sales budget. The production budget in turn is used to determine the budgets for manufacturing costs including the direct materials budget, the direct labor budget, and the manufacturing overhead budget. These budgets are then combined to cash budget. In essence the sales budget triggers a chain reaction that leads to the development of the other budgets. In a sales budget budgeted sales are multiplied by the unit sales price.

b) Production Budget:

The production budget is prepared after the sales budget. The production budget lists the number of units that must be produced during each budget period to meet sales needs and to provide for the desired ending inventory. Production requirements for a period are influenced by the desired level of ending inventory. Inventories should be carefully planned. Excessive inventories tie up funds and create storage problems. Insufficient inventories can lead to lost sales or crash production efforts in the following period.

c) Direct Material Budget:

When the level of production has been computed, a direct material budget should be constructed to show how much material will be required for production and how much material must be purchased to meet this production requirement. Non-manufacturing firms or merchandising firms prepare a merchandise purchase budget instead of a production budget. It shows the amount of goods to be purchased from its suppliers during the period. Merchandising firms have the same basic format of merchandise purchase budget as a production budget of manufacturing firm.

d) Direct Labor Budget:

The production requirements as set forth in the production budget also provide the starting point for the preparation of the direct labor budget. To compute direct labor requirements, expected production volume for each period is multiplied by the number of direct labor hours required to produce a single unit. The direct labor hours to meet production requirements are then multiplied by the (standard) direct labor cost per hour to obtain budgeted total direct labor costs.

e) Factory Overhead Budget:

The factory overhead budget should provide a schedule of all manufacturing costs other than direct materials and direct labor. Using the contribution approach to budgeting requires the cash budget, we must remember that depreciation does not entail a cash outlay and therefore must be deducted from the total factory overhead in computing cash disbursement for factory overhead.

f) The Ending Finished Goods Inventory Budget:

A budget showing the carrying cost of the unsold units remaining in inventory.

g) Selling and Administrative Expense Budget:

The selling and administrative expense budget lists the budgeted expenses for areas other than manufacturing. In large organizations this budget would be compilation of many smaller, individual budgets submitted by department heads and other persons responsible for selling and administrative expenses. For example, the marketing manager in a large organization would submit a budget detailing the advertising expenses for each budget period. The selling and administrative budget is necessary for preparing a budgeted income statement.

h) Cash Budgeting:

The cash budget is composed of four major sections as

1) The receipts section,

2) The disbursements section,

3) The cash excess or deficiency section and

4) The financing section.

The cash receipts section consists of a listing of all of the cash inflows, except for financing, expected during the budgeting period. Generally, the major source of receipts will be from sales. The disbursement section consists of all cash payment that is planned for the budgeted period. These payments will include raw materials purchases, direct labor payments, manufacturing overhead costs, and so on as contained in their respective budgets. I addition other cash disbursements such as equipment purchase, dividends, and other cash withdrawals by owners are listed. If there is a cash deficiency during any period, the company will need to borrow funds. If there is cash excess during any budgeted period, funds borrowed in previous periods can be repaid or the excess funds can be invested. The financing section deals the borrowings and repayments projected to take place during the budget period. It also includes interest payments that will be due on money borrowed.

i) Budgeted Income Statement:

This statement is prepared from the data found from sales to cash budget. The Budgeted Income Statement is one of the key schedules in the budget process. It shows the company’s planned profit for the upcoming budget period and it stands as a bench-mark against which subsequent company performance can be measured.

j) Budgeted Balance Sheet:

The Budgeted Balance Sheet is developed by beginning with the current balance sheet and adjusting it for the data contained in the other budgets.

3.9) Problems Associated with Budgeting:

Budgeting is a time consuming process.

Budgets are only as good as the data being used.

Budgets need to be changed as the circumstances changes.

Managers can get too anxious with setting and reviewing budgets which may lead to forgetting the real issue of winning customers.

Sometimes budgets create rivalry relations among the departments.

![Thesis Paper on Performance Analysis and Budgetary Control Activities of Trade Vision Limited [Part-1]](https://assignmentpoint.com/wp-content/uploads/2013/04/images-18.jpg)

![Thesis Paper on Performance Analysis and Budgetary Control Activities of Trade Vision Limited [Part-2]](https://assignmentpoint.com/wp-content/uploads/2013/04/images-18-200x100.jpg)