Executive summary:

The recommendations that result from the study are to add the topics to budget analysis of Bangladesh and Australia.From the collected information, I analyzed different sectors and aspects of budget of two countries and make comparison of those. On the basis of the comparison, I find that there is a huge difference between two countries budget in different respective sectors.Despite the fact that Bangladesh is a developing country, it skipping many of the possible sectors in comparison to Australia and Bangladesh has many impediments to expand its budget like Australia.

OBJECTIVE OF THE THESIS PAPER:

The objectives of the thesis paper is to identify, analyze and standings about the budget of the two different respective countries where one is from the developing countries and another one from the developed countries. How much budget perspective is adopted properly and how and which way these techniques are followed is the main objective of this thesis paper. For identifying the standings budget perspective of two different countries and what is the main bottleneck to adopt and implement the given budget in different sectors of Bangladesh than Australia is the main objective of this thesis paper.

LIMITATION:

Though I gather most of the information, I can not get descriptive information and graph of Bangladesh and Australia’s budget because of secondary source research.

METHODOLOGY:

There are two methodologies to collect information. For this thesis on budget I collect data from secondary sources.

My secondary source was internet and different books which are written based on budget. That’s the way I follow to do this thesis paper.

INTRODUCTION

BUDGET

A budget is a description of a financial plan. It is a list of estimates of revenues to and expenditures by an agent for a stated period of time. Normally a budget describes a period in the future not the past.

The amount by which a government, company, or individual’s spending exceeds its income over a particular period of time also called deficit or deficit spending, opposite of budget surplus.

A government budget is a legal document that is often passed by the legislature, and approved by the chief executive-or president. For health care, only certain types of revenue may be imposed and eaten. Property tax is frequently the basis for municipal and county revenues, while sales tax and/or income tax are the basis for state revenues, and income tax and corporate tax are the basis for national revenues.

The two basic elements of any budget are the revenues and expenses. In the case of the government, revenues are derived primarily from taxes. Government expenses include spending on current goods and services, which economists call government consumption; government investment expenditures such as infrastructure investment or research expenditure; and transfer payments like unemployment or retirement benefits.

Budgets have an economic, political and technical basis. Unlike a pure economic budget, they are not entirely designed to allocate scarce resources for the best economic use. They also have a political basis wherein different interests push and pull in an attempt to obtain benefits and avoid burdens. The technical element is the forecast of the likely levels of revenues and expenses.

OBJECTIVES OF BUDGET PREPARATION

During budget preparation, trade-offs and prioritization among programs must be made to ensure that the budget fits government policies and priorities. Next, the most cost-effective variants must be selected. Finally, means of increasing operational efficiency in government must be sought. None of these can be accomplished unless financial constraints are built into the process from the very start. Accordingly, the budget formulation process has four major dimensions:

# Setting up the fiscal targets and the level of expenditures compatible with these targets. This is the objective of preparing the macro-economic framework.

# Formulating expenditure policies.

# Allocating resources in conformity with both policies and fiscal targets. This is the main objective of the core processes of budget preparation.

# Addressing operational efficiency and performance issues.

CONDITIONS FOR BUDGET PREPARATION

In addition to a multiyear perspective, annual budget preparation calls for making early decisions and for avoiding a number of questionable practices.

1. The need for early decisions

By definition, preparing the budget entails hard choices. These can be made, at a cost, or avoided, at a far greater cost. It is important that the necessary trade-offs be made explicitly when formulating the budget. This will permit a smooth implementation of priority programs, and avoid disrupting program management during budget execution. Political considerations, the avoidance mechanisms mentioned below, and lack of needed information (notably on continuing commitments), often lead to postponing these hard choices until budget execution. The postponement makes the choices harder, not easier, and the consequence is a less efficient budget process.

When revenues are overestimated and the impact of continuing commitments is underestimated, sharp cuts must be made in expenditure when executing the budget. Overestimation of revenue can come from technical factors (such as a bad appraisal of the impact of a change in tax policy or of increased tax expenditures), but often also from the desire of ministries to include or maintain in the budget an excessive number of programs, while downplaying difficulties in financing them. Similarly, while underestimation of expenditures can come from unrealistic assessments of the cost of unfunded liabilities (e.g. benefits granted outside the budget) or the impact of permanent obligations, it can also be a deliberate tactic to launch new programs, with the intention of requesting increased appropriations during budget execution. It is important not to assume that “technical” improvements can by themselves resolve institutional problems of this nature.

An overoptimistic budget leads to accumulation of payment arrears and muddles rules for compliance. Clear signals on the amount of expenditure compatible with financial constraints should be given to spending agencies at the start of the budget preparation process. As will be stressed repeatedly in this volume, it is possible to execute badly a realistic budget, but impossible to execute well an unrealistic budget.

There are no satisfactory mechanisms to correct the effects of an unrealistic budget during budget execution. Thus, across-the-board appropriation “sequestering” leads to inefficiently dispersing scarce resources among an excessive number of activities.

Selective cash rationing politicizes budget execution, and often substitutes supplier priorities for program priorities. Selective appropriation sequestering combined with a mechanism to regulate commitments partly avoids these problems, but still creates difficulties, since spending agencies lack predictability and time to adjust their programs and their commitments.

An initially higher, but more realistic, fiscal deficit target is far preferable to an optimistic target based on overestimated revenues, or underestimated existing expenditure commitments, which will lead to payment delays and arrears. The monetary impact is similar, but arrears create their own inefficiencies and destroy government credibility as well.

To alleviate problems generated by overoptimistic budgets, it is often suggested that a “core program” within the budget be isolated and higher priority given to this program during budget implementation. In times of high uncertainty of available resources

(e.g., very high inflation), this approach could possibly be considered as a secondbest response to the situation. However, it has little to recommend it as general practice, and is vastly inferior to the obvious alternative of a realistic budget to begin with. When applied to current expenditures, the “core program” typically includes personnel expenditures, while the “noncore program” includes a percentage of goods and services. Cuts in the “noncore” program during budget execution would tend to increase inefficiency, and reduce further the meager operations and maintenance budget in most developing countries. The “core/noncore” approach is ineffective also when applied to investment expenditures, since it is difficult to halt a project that is already launched, even when it is “non-core.” Indeed, depending on strong political support, noncore projects may in practice chase out core projects.

2. The need for a hard constraint

Giving a hard constraint to line ministries from the beginning of budget preparation favors a shift from a “needs” mentality to an availability mentality. As discussed in detail later in this chapter, annual budget preparation must be framed within a sound macroeconomic framework, and should be organized along the following lines:

# A top-down approach, consisting of:

(i) defining aggregate resources available for public spending;

(ii) establishing sectoral spending limits that fits government priorities; and

(iii) making these spending limits known to line ministries;

# A bottom-up approach, consisting of formulating and costing sectoral spending programs within the sectoral spending limits; and

# Iteration and reconciliation mechanisms, to produce a constant overall expenditure program.

Although the process must be tailored to each country, it is generally desirable to start with the top-down approach. Implementation of this approach is always necessary for good budgeting, regardless of the time period covered.

3. Avoiding questionable budgeting practices

Certain budgetary practices are widespread but inconsistent with sound budgeting.

The main ones are: “incremental budgeting,” “open-ended” processes, “excessive

bargaining,” and “dual budgeting.”

a. Incremental budgeting

Life itself is incremental. And so, in part, is the budget process, since it has to take into account the current context, continuing policies, and ongoing programs. Except when a major “shock” is required, most structural measures can be implemented only progressively. Carrying out every year a “zero-based” budgeting exercise covering all programs would be an expensive illusion. At the other extreme, however, “incremental budgeting,” understood as a mechanical set of changes in a detailed line-item budget, leads to very poor results. The dialogue between the Ministry of Finance and line ministries is confined to reviewing the different items and to bargaining cuts or

increases, item by item. Discussions focus solely on inputs, without any reference to results, between a Ministry of Finance typically uninformed about sectoral realities and a sector ministry in a negotiating mode. Worse, the negotiation is seen as a zero-sum

game, and usually not approached by either party in good faith. Moreover, incremental budgeting of this sort is not even a good tool for expenditure control, although this was the initial aim of this approach. Line-item incremental budgeting focuses generally on goods and services expenditures, whereas the “budget busters”

are normally entitlements, subsidies, hiring or wage policy or, in many developing countries, expenditure financed with counterpart funds from foreign aid.

Even the most mechanical and inefficient forms of incremental budgeting, however,

are not quite as bad as capricious large swings in budget allocations in response to purely political power shifts.

b. “Open-ended” processes

An open-ended budget preparation process starts from requests made by spending agencies without clear indications of financial constraints. Since these requests express only “needs,” in the aggregate they invariably exceed the available resources.

Spending agencies have no incentive to propose savings, since they have no guarantee that any such savings will give them additional financial room to undertake new activities. New programs are included pell-mell in sectoral budget requests as bargaining chips. Lacking information on the relative merits of proposed expenditures, the Ministry of Finance is led to making arbitrary cuts across the board among sector budget proposals, usually at the last minute when finalizing the budget. At best, a few days before the deadline for presenting the draft budget to the Cabinet, the Ministry of Finance gives firm directives to line ministries, which then redraft their requests hastily, themselves making cuts across the board in the programs of their subordinate agencies. Of course, these cuts are also arbitrary, since the ministries have not has enough time to reconsider their previous budget requests. Further bargaining then taxes place during the review of the budget at the cabinet level, or even during budget execution.

“Open ended” processes are sometimes justified as a “decentralized” approach to budgeting. Actually, they are the very opposite. Since the total demand by the line ministries is inevitably in excess of available resources, the Ministry of Finance in fact has the last word in deciding where increments should be allocated and whether reallocations should be made. The less constrained the process, the greater is the excess of aggregate ministries’ request over available resources, the stronger the role of the central Ministry of Finance in deciding the composition of sectoral programs, and the more illusory the “ownership” of the budget by line ministries.

c. Excessive bargaining and conflict avoidance

There is always an element of bargaining in any budget preparation, as choices must be made among conflicting interests. An “apolitical” budget process is an oxymoron. However, when bargaining drives the process, the only predictable result is inefficiency of resource allocation. Choices are based more on the political power of the different actors than on facts, integrity, or results. Instead of transparent budget appropriations, false compromises are reached, such as increased tax expenditures, creation of earmarked funds, loans, or increased contingent liabilities. A budget preparation process dominated by bargaining can also favor the emergence of escape mechanisms and a shift of key programs outside the budget.

A variety of undesirable compromises are used to avoid internal bureaucratic conflicts—spreading scarce funds among an excessive number of programs in an effort to satisfy everybody, deliberately overestimating revenues, underestimating continuing commitments, postponing hard choices until budget execution, inflating expenditures in the second year of a multiyear expenditure program, etc. These conflict-avoidance mechanisms are frequent in countries with weak cohesion within the government. Consequently, improved processes of policy formulation can have benefits for budget preparation as well, through the greater cohesion generated in the government.

Conflict avoidance may characterize not only the relationships between the Ministry of Finance and line ministries, but also those between line ministries and their subordinate agencies. Indeed, poor cohesion within line ministries is often used by the Ministry of Finance as a justification for its leading role in determining the composition of sectoral programs. Perversely, therefore, the all-around bad habits generated by “open-ended” budget preparation processes may reduce the incentive of the Ministry of Finance itself to push for real improvements in the system.

d. “Dual budgeting”

There is frequent confusion between the separate presentation of current and investment budgets, and the issue of the process by which those two budgets are prepared. The term “dual budgeting” is often used to refer to either the first or the second issue. However, as discussed earlier, a separate presentation is needed. “Dual budgeting” refers therefore only to a dual process of budget preparation, whereby the responsibility for preparing the investment or development budget is assigned to an entity different from the entity that prepares the current budget.

“Dual budgeting” was aimed initially at establishing appropriate mechanisms for giving higher priority to development activity. Alternatively, it was seen as the application of a “golden rule” which would require balancing the recurrent budget and borrowing only for investment. In many developing countries, the organizational arrangements that existed before the advent of the PIP approach in the 1980s (see chapter 12) typically included a separation of budget responsibilities between the key core ministries. The Ministry of Finance was responsible for preparing the recurrent budget; the Ministry of Planning was responsible for the annual development budget and for medium-term planning. The two entities carried out their responsibilities separately on the basis of different criteria, different staff, different bureaucratic dynamics, and, usually, different ideologies. In some cases, at the end of the budget preparation cycle, the Ministry of Finance would simply collate the two budgets into a single document that made up the “budget.” Clearly, such a practice impedes the integrated review of current and investment expenditures that is necessary in any good budget process. (For example, the Ministry of Education will program separately its school construction program and its running costs and try to get the maximum resources for both, while not considering variants that would consist of building fewer schools and buying more books.)

In many cases, coordination between the preparation of the recurrent budget and the development budget is poor not only between core ministries but within the line ministries as well. While the Ministry of Finance deals with the financial department of line ministries, the Ministry of Planning deals with their investment department. This duality may even be reproduced at subnational levels of government. Adequate coordination is particularly difficult because the spending units responsible for

implementing the recurrent budget are administrative divisions, while the development budget is implemented through projects, which may or may not report systematically to their relevant administrative division. (In a few countries, while current expenditures are paid from the Treasury, development expenditures are paid through a separate Development Fund.) The introduction of rolling PIPs was motivated partly by a desire to correct these problems.9

Thus, the crux of the “dual budgeting” issue is the lack of integration of different expenditures contributing to the same policy objectives. This real issue has been clouded, however, by a superficial attribution of deep-seated problems to the “technical” practice of dual-budgeting. For example, dual budgeting is sometimes held responsible for an expansionary bias in government expenditure. Certainly, as emphasized earlier, the initial dual budgeting paradigm was related to a growth model (Harrod-Domar et al) based on a mechanistic relation between the level of investment and GDP growth. This paradigm itself has unquestionably been a cause of public finance overruns and the debt crises inherited in Africa or Latin America from badquality investment “programs” of the 1970s and early 1980s. The implicit disregard for issues of implementation capacity, or efficiency of investment, or mismanagement, corruption and theft, is in hindsight difficult to understand. However, imputing to dual budgeting all problems of bad management or weak governance and corruption is equally simplistic and misleading. Given the same structural, capacity, and political conditions of those years (including the Cold War), the same outcome of wasteful,

and often corrupt, expansion of government spending would have resulted in

developing countries—dual budgeting or not. If only the massive economic

mismanagement in so many countries in the 1970s and early 1980s could be

explained by a single and comforting “technical” problem of budgetary procedure! In

point of fact, the fiscal overruns of the 1970s and early 1980s had little to do with the

visible dual budgeting. They originated instead from a third invisible budget: “black

boxes,” uncontrolled external borrowing, military expenditures, casual guarantees to

public enterprises, etc.

Public investment budgeting is submitted to strong pressures because of particular or regional interest (the so-called pork barrel projects) and because it gives more opportunities for corruption than current expenditures.11 Thus, in countries with poor governance, there are vested interests in keeping separate the process of preparing the investment budget, and a tendency to increase public investment spending.

However, under the same circumstances, to concentrate power and bribe opportunities in the hands of a powerful “unified-budget” baron would hardly improve expenditure management or reduce corruption. On the contrary, it is precisely in these countries that focusing first on improving the integrity of the separate investment programming process may be the only way to assure that some resources are allocated to economically sound projects and to improve over time the budget process as a whole.

By contrast, in countries without major governance weaknesses, dual budgeting often results in practice in insulating current expenditures (and especially salaries) from structural adjustment. Given the macroeconomic and fiscal forecasts and objectives, the resources allocated to public investment have typically been a residual, estimated by deducting recurrent expenditure needs from the expected amount of revenues (given the overall deficit target). The residual character of the domestic funding of development expenditures may even be aggravated during the process of budget execution, when urgent current spending preempts investment spending which can be postponed more easily. In such a situation, dual budgeting yields the opposite problem: unmet domestic investment needs and insufficient counterpart funds for good projects financed on favorable external terms. Insufficient aggregate provision of counterpart funds (which is itself a symptom of a bad investment budgeting process) is a major source of waste of resources.

Recall that the real issue is lack of integration between investment and current expenditure programming, and not the separate processes in themselves. This is important, because to misspecify the issue would lead (and often has) to considering the problem solved by a simple merger of two ministries—even while coordination remains just as weak. A former minister becomes a deputy minister, organizational “boxes” are reshuffled, a few people are promoted and others demoted. But dual budgeting remains alive and well within the bosom of the umbrella ministry. When coordination between two initially separate processes is close and iteration effective, the two budgets end up consistent with each other and with government policies, and “dual budgeting” is no great problem. Thus, when the current and investment budget processes are separate, whether or not they should be unified depends on the institutional characteristics of the country. In countries where the agency responsible for the investment budget is weak, and the Ministry of Finance is not deeply involved in ex-ante line-item control and day-to-day management, transferring responsibilities for the investment budget to the Ministry of Finance would tend to improve budget preparation as a whole. (Whether this option is preferable to the alternative of strengthening the agency responsible for the investment budget can be decided only on a country-specific basis.) In other countries, one should first study carefully the existing processes and administrative capacities. For example, when the budgetary system is strongly oriented toward ex-ante controls, the capacity of the Ministry of Finance to prepare and manage a development budget may be inadequate. A unified budget process would in this case risk dismantling the existing network of civil servants who prepare the investment budget, without adequate replacement. Also, as noted, coordination problems may be as severe between separate departments of a single ministry as between separate ministries. Indeed, the lack of coordination within line ministries between the formulation of the current budget and the formulation of

the capital budget is in many ways the more important dual budgeting issue. Without integration or coordination of current and capital expenditure at line the ministries’ level, integration or coordination at the core ministry level is a misleading illusion.

On balance, however, the general presumption should be in favor of a single entity responsible for both the investment and the annual budget (although that entity must possess the different skills and data required for the two tasks):

Where coherence is at a premium, where any consistent policy may be better than several that cancel each other out, where layers of bureaucracy already frustrate each other, and where a single budget hardly works, choosing two budgets and two sets of officials over one seems strange. The keynote in poor countries should be simplicity. Designs for decisions should be as simple as anyone knows how to make them. The more complicated they are, the less likely they are to work. On this basis, there seems little reason to have several organizations dealing with the same expenditure policies. One good organization would represent an enormous advance. Moreover, choosing the finance ministry puts the burden of reform where it should be—in the budgetary sphere.

BUDGET COMPARISON OF BANGLADESH AND AUSTRALIA

INFLATION CHALLENGES COMPARISON

AUSTRALIA

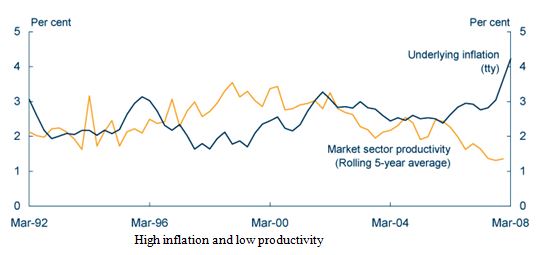

Inflation is high

Prices for many essential items have gone up, putting pressure on the budgets of Australian families.

The build‑up in underlying inflationary pressures is the result of several years of strong growth in demand that has not been met by increases in the supply capacity of the economy.

In response, the Reserve Bank of Australia has lifted official interest rates eight times in just over three years. Australians are feeling the effects of this through their mortgage repayments.

Maintaining sustainable growth

Governments need to avoid wasteful spending that puts unnecessary pressure on the economy and makes the Reserve Bank’s job of controlling inflation harder.

Productivity growth has fallen to its lowest rate in over 17 years, so government spending needs to be firmly focused on measures that boost the economy’s productive potential. This reinforces the economy’s ability to deliver strong and sustainable growth without triggering inflationary pressures.

Government policies

The Government has framed this Budget with these priorities in mind. Tighter monetary and fiscal policies are expected to gradually ease inflation from 16‑year highs.

This Budget delivers for working families and invests in the supply capacity of the economy. Reprioritising spending towards education, health and infrastructure is an investment in Australia’s future.

BANGLADESH

In the wake of lower production of food grains in FY 2007-08 coupled with soaring price of food grains in the international market, It would not hesitate to admit that food inflation has significantly affected the life of the common man. In December 2007, the inflation reached a high of 11.6 percent on a point to point basis. However, it is heartening to note that there has been a downward trend of inflation in Bangladesh of late. We have to bear in mind that there exists a high inflationary trend across the world, including our neighbouring countries.

The Government has been implementing different measures to curb inflation. Short-term measures included ‘Dal-Bhat Programme’ of BDR, open market sale of food grains at subsidized price, withdrawal of customs duty on the import of food grains and edible oil, increasing the amount of food grain imports, lowering of interest rate against import credit of food grains, regular monitoring of markets, and fixation of maximum retail price for edible oil.

Medium-term measures include increase of production and distribution of food grains through creation of wholesale markets in various places including Dhaka and taking initiatives for introducing Consumers’ Rights Protection Ordinance. To contain inflation, Bangladesh Bank is pursuing a production-oriented and market-friendly monetary policy. It is hoped that with the current bumper harvest coupled with the forecast of increased global food grain production by the second half of 2008, the average inflation would come down to 9.0 percent in FY 2008-09.

TAX COMPARISON

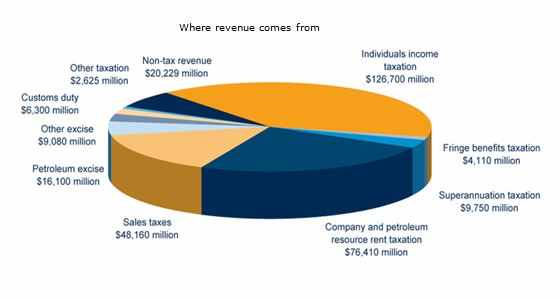

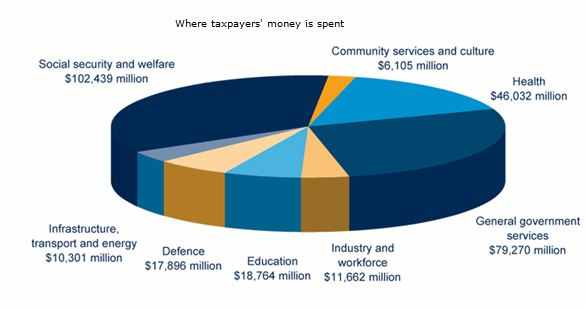

Australian Government

taxation and spending

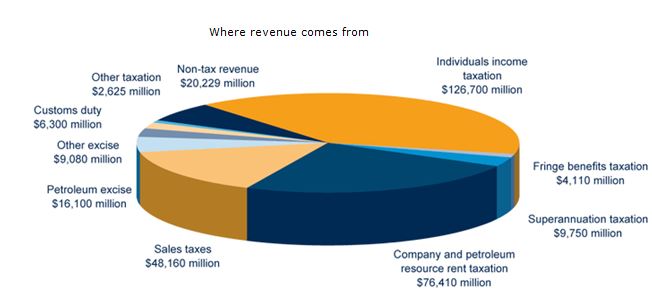

Total revenue for 2008‑09 is expected to be $319.5 billion, an increase of 2.8 per cent on estimated revenue since the Pre‑Election Economic and Fiscal Outlook 2007. Total expenses for 2008‑09 are expected to be $292.5 billion, a decrease of 0.6 per cent on estimated expenses since the Pre‑Election Economic and Fiscal Outlook 2007.

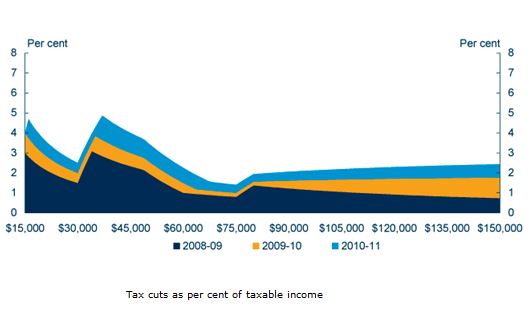

The tax cuts will increase disposable incomes and provide additional incentives to participate in the workforce.

From 1 July 2008:

The 30 per cent threshold will be raised from $30,001 to $34,001

The low income tax offset (LITO) will be increased from $750 to $1,200

The 40 per cent threshold will increase from $75,001 to $80,001

The 45 per cent threshold will increase from $150,001 to $180,001.

Someone earning $50,000 a year will have a tax cut of $1,000 in 2008‑09 compared to the previous year.

From 1 July 2009:

The 30 per cent threshold will be raised to $35,001

The LITO will be increased to $1,350

The 40 per cent tax rate will be reduced to 38 per cent.

From 1 July 2010:

The 30 per cent threshold will be raised to $37,001

The LITO will be increased to $1,500

The 38 per cent rate will be reduced to 37 per cent.

The increase in the LITO creates an effective tax‑free threshold for

low‑income earners of $14,000 in 2008‑09, $15,000 in 2009‑10 and $16,000 in 2010‑11.

From 1 July 2008, senior Australians eligible for the senior Australians tax offset will pay no tax on their annual income up to $28,867 for singles and $24,680 for each member of a couple. By 1 July 2010, these thresholds will rise to $30,685 for singles and $26,680 for each member of a couple.

The Government’s goal is that by 2013‑14 the number of personal income tax rates will be reduced to three (15 per cent, 30 per cent and 40 per cent) and the LITO will be further increased.

Bangladesh’s Taxation

- • The existing boundary for general tax free income, tax rates, income slabs for individuals will remain unaffected in FY2009. Given the high inflation rate at 10 per cent during FY 2007-08 the proposed budget could have considered a mark up to allow for the impact of inflation on earnings of citizens.

- • However, budget proposals for FY2008-09 have extended benefits for certain personal income tax payers such as female and senior citizens which are positive moves. Both India and Pakistan have also increased limit of tax free income for female in their respective budgets for this fiscal year.

- • For female and senior tax payers aged above 70, tax free income up to Tk. 165,000 has been proposed. In case of India, tax free income for female taxpayers is Rupee 180,000 and in case of Pakistan it is Rupee 240,000.

- • Ceiling for taxable income from agriculture has been increased to Tk. 200,000. However, for female and people above 70 years this limit has been set at Tk 215,000.

Table 8 presents the structure of personal income tax.

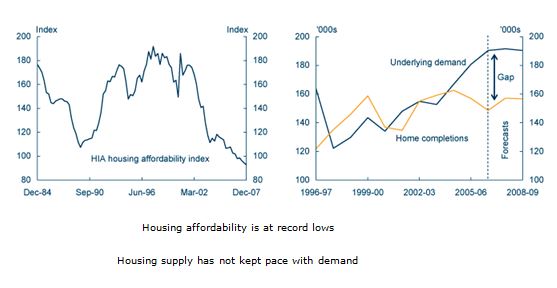

HOUSING COMPARISON

Bangladesh’s Real Estate and Housing Sector

Government has allocated a total of Tk. 2218.7 crore (8.7 per cent of the ADP) for the physical planning, water supply and housing sector in FY08-09 which is 39 per cent higher than the allocation of the previous year. A number of projects has been initiated by the government for housing of limited income people in different regions (Dhaka, Chittagong and Pabna), which will be completed by the next fiscal year. However, such initiatives should be extended for low income people especially for garments workers in the city. During FY2008 1000 flats have been handed over to the shelter-less slum dwellers and low income families and 5000 flats are to be handed over to the underprivileged by December 2008. These initiatives need to be continued in the future. Sri Lanka has allocated Rs. 100 million to complete housing construction activities and Rs.100 million to develop housing facilities of shanty dwellers in ten selected districts. Pakistan government, under a low cost housing scheme will construct about 37000 houses for the low paid employees in this fiscal year. India has increased the amount of subsidy from Rs 25000 to Rs 35000 for per unit housing in plain areas and Rs 27000 to Rs 38500 in hill areas.

In order to reduce the cost of raw materials used for housing, government has withdrawn 15 per cent VAT on importation of mild steel (MS) bar and rod, which will positively contribute to real estate sector. A specific supplementary duty at Tk 1500 per metric ton has been imposed in the budget FY2009 on raw materials for steel products used in the construction sector to stabilize our domestic market. According to DCCI reduction of import tax on MS Rod would encourage the import of fine rod rather than scrap. FBCCI has sought revision of duty structure for importing finished steel bars as same as import of finished rods and steel raw materials. CPD proposed that the current import duty on clinker which is Tk.350 per ton should be reduced to Tk.200 per ton in order to generate competitiveness in the domestic cement industry. According to the budget FY2009, income generated from constructions of multi-storied buildings outside the City Corporations, Cantonment Board, Municipalities of district headquarters, Municipal areas under Dhaka district has been exempted from tax for the next 10 years which might encourage the developers. Without having a proper guideline it would hamper the objectivity of the initiative.

Government should decrease high transfer registration cost to reduce propensity to evade tax and to protect the current revenue intake under this head. For developing the secondary housing market, government may reduce the registration fee that charged on transfer of second-hand homes (e.g. 50 per cent of the tax charged for registration of a new apartment). Government could also think about rationalising the minimum value of flats and buildings for tax purposes reflecting current market prices and locational variations. Government may consider raising the limit for house building loan at reduced rate by enhancing individual’s monthly income limit from Tk 30,000 to Tk 50,000.

Australia Making housing more

affordable

Helping first home buyers

Saving for a deposit is a major barrier to buying a first home.

The Government will provide $1.2 billion over four years in the Budget to assist first home buyers to save for a home.

Enhanced First Home Saver Accounts will provide a simple, tax effective way for Australians to save for their first home. The Government will provide people saving for a first home with direct contributions into the accounts and only tax earnings in the account at a low rate. The first $5,000 of individual contributions to these accounts each year will now attract a 17 per cent Government contribution, providing

more assistance to average income earners. Earnings will be taxed at a low rate of 15 per cent. Withdrawals from the account will be tax free when used to buy or build a first home.

Helping renters and boosting housing supply

The Government is committing $623 million over four years to the National Rental Affordability Scheme to encourage the construction of affordable rental housing.

The Scheme will provide investors with $8,000 annually for ten years for each new dwelling that is rented out to low income tenants at least 20 per cent below the market rate.

The Housing Affordability Fund will help improve housing supply and reduce costs to home buyers by cutting red tape and reducing the costs of providing new housing‑related infrastructure, at a cost of $500 million over five years.

Up to $30 million of the Fund has been committed to rolling out the Electronic Development Assessment project to speed up planning approval processes.

In addition, the Government will identify surplus Commonwealth land that could be used for new housing.

The Government will also establish a National Housing Supply Council, which will assess the adequacy of housing supply over the next 20 years.

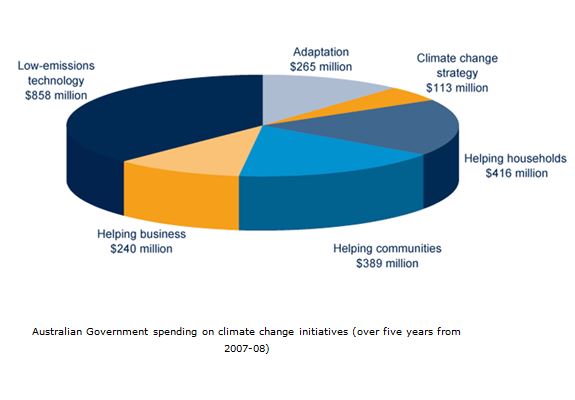

CLIMATE CHANGE MANAGING COMPARISON

Australia

Climate change poses a fundamental environmental and economic challenge. The Government is committed to Australia making a seamless transition to a low‑emissions economy. Ratifying the Kyoto Protocol was the first official act of this Government.

Market mechanisms

The Government will realise its commitment to reduce emissions by 60 per cent on 2000 levels by 2050 by implementing an emissions trading scheme and enacting its 20 per cent by 2020 Renewable Energy Target.

Investing in technology

Innovative technologies will be an important part of the transition to a low‑emissions future. The Government

is investing $500 million over six years in the Renewable Energy Fund, $500 million over eight years for the National Clean Coal Fund, and $150 million over four years for the Energy Innovation Fund.

The Government is encouraging the development of low‑emissions vehicles through the $500 million Green Car Innovation Fund, and will support change in business practices through the Clean Business Australia program, at a cost of $240 million over four years.

Helping households adapt

Changing the way households use energy will be vital. The Government is helping by allocating $300 million over

five years to the Green Loans program, which will help households install solar, water and energy efficient products. A further $150 million over five years will be provided for installing insulation in rental accommodation.

The Energy Efficiency of Electrical Appliances policy will help households choose energy efficient appliances, at a cost of $14 million over four years.

International leadership

The Government has committed $150 million over three years to assist countries in the region to prepare for and adapt to the effects of climate change and will also work with Papua New Guinea to reduce emissions from deforestation and forest degradation.

Bangladesh

Climate Change: Disaster Management and Environment

On 15 November 2007, the super cyclone Sidr wreaked havoc in the Sundarbans and its adjoining coastal areas of southern Bangladesh leaving more than 4,000 people dead or missing and over 50,000 people injured. The estimated loss will be around Tk. 11,500 crore taking into account the damage caused to the houses, cattle heads, crops and other physical installations. Immediately before this disaster, two successive floods caused severe damage to the standing crops, cattle heads and infrastructure. The scale of international assistance to meet these disasters was quite 35

The recent floods and Cyclone Sidr are the inevitable results of global climate change. According to the UN Human Development Report—2007-

08, 18 percent of the land mass would be submerged due to one metre rise in the water of the sea level, affecting 11 percent of the world population. In fact, Bangladesh is potentially one of the most vulnerable countries likely to be exposed to the risks arising from climate change. The Department of

Environment has established a climate change cell which is conducting research to work out strategies to mitigate the adverse impact on the lives and livelihood due to climate change. A new programme has been introduced to ensure people’s participation in environment protection.

We are aware of the fact that we have to live with the risks of disaster arising from climate change. While it is not humanly possible to resist the climatic change, we have to enhance our adaptability to the changes and try to minimize the scale of damage and dislocation. To this end, we propose to create a fund titled Fund for Climate Change and allocate Tk. 300 crore for this purpose in the next year’s budget. We urge upon all development partners and relevant agencies to come forward to contribute to this fund.

Based on our recent experience of floods and cyclones in the country, the Government has taken up a number of significant precautionary measures. Steps have been taken to construct more than 2000 multipurpose cyclone centres. In addition, the Government has planned to establish a Disaster Management Training and Research Centre at the national level. In this centre, research on river erosion, flood, cyclone, earthquake and fire-accidents will be carried out in the first phase. Meanwhile, the Standing Orders on Disaster Management have been revised. Steps have also been taken to prepare a national disaster management plan.

Afforestation reduces the risks of disaster and checks the potential

loss. The total forest area in Bangladesh is 2.52 million hectares which is

36. Only 17 percent of the total land area of the country. Our goal is to bring 20 percent of the total land area under afforestation coverage soon. Since the assumption of office by the present caretaker government, a total of 4,557 hectares of forest lands have been recovered from the illegal occupants. Steps have been taken to bring these lands under an afforestation programme.

REGIONAL DEVELOPMENT COMPARISON

Bangladesh’s Local Government and Regional Development

In Local Government, ADP allocation for FY09 is Tk. 3523.02 which is 13.76% of the total ADP allocation. In FY09 Government has allocated 923.9 crore taka (3.6% of the total ADP) in ADP for the development of Local Government, Chittagong Hill Tracts and development of special region which is a good plan for strengthening local government. For poverty reduction and reducing regional disparity, special allocation has been made for 276 Upazila of 39 poverty stricken districts. Local institutions have received 60 per cent of the total development assistance for this purpose. To ensure balanced regional development, lagging regions received higher allocation in the ADP. Special development assistance in poverty stricken 28 districts allocation is increased from Tk 20.6 crore in FY08 to Tk 40 crore in FY09. However, implementation plans and modalities are yet to be developed. Special allocation of development projects targeting the backward regions are necessary but raising the efficacy of implementation is important. CPD research on regional inequality revealed that two-third of the total inter-region inequality is due to intra-region inequality. Proportion of landless households had a significant negative effect on income inequality at the district level. As such, government needs to take appropriate actions so that less endowed people can have greater access to new productive assets such as solar dryer, power tiller, power pump, harvester, thresher, etc. The Budget has also provided longer tax holiday and greater depreciation for investment in lagged regions such as industries set up in Rajshahi, Khulna, Sylhet and Barisal Divisions and three Hilly Districts.

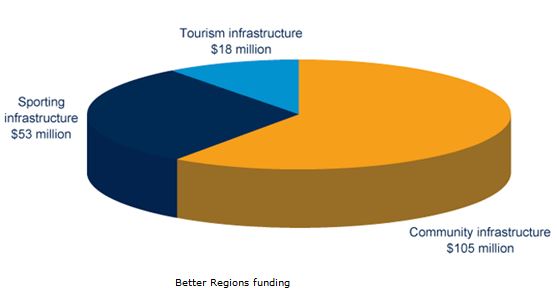

Australia Regional development

for a sustainable future

The Government will spend $176 million to implement its Better Regions election commitments and $130 million to assist the agricultural sector adapt and respond to climate change.

Better infrastructure and services

The Government has established Regional Development Australia to engage with local communities to deliver regional solutions.

This Budget allocates $176 million over four years from 2007‑08 to the Government’s Better Regions initiative, which will improve infrastructure and services in regional Australia, including regional sporting facilities, community infrastructure and tourist attractions.

The Government will provide $271 million over four years to fund the Australian Broadband Guarantee, which will ensure all Australians, particularly those in regional and rural areas, have equitable access to metro‑comparable broadband services.

The Government will continue the Remote Air Service Subsidy Scheme, at a cost of $25 million over four years, to provide 239 remote and isolated communities with services including transport, medicines and fresh food.

The Government will spend $8 million over four years to establish the Office of Northern Australia, with offices in Darwin and Townsville. It will advise the Government on issues relevant to northern Australia, including sustainable development outcomes.

The Building Australia Fund will finance critical national transport and communications infrastructure in regional areas.

Climate adaptation strategies

The Government will provide $130 million over four years for the Australia’s Farming Future initiative to assist the agricultural sector adapt and respond to climate change, including:

$60 million over four years to develop partnerships to help primary producers respond to climate change challenges

$55 million over four years for primary producers experiencing hardship due to climate change

$15 million over four years for adaptation research for primary producers.

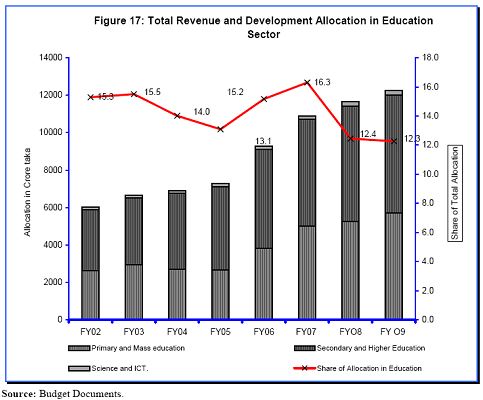

EDUCATION COMPARISON

BD Education and Technology

In FY2009, a total of Tk 12259 crore has been allocated for education and technology (Revenue: Tk 8764 crore, development: Tk 3495 crore) which is 12.3 per cent of the total budget. Allocation in FY2009 is 0.89 per cent lower than FY2008 budget and 4.94 per cent higher than revised budget of FY08 (Figure 17). The budget mainly focused on improving the quality of education. Proposal has been made to allocate another Tk.15 crore as educational research grant in FY09 even though Tk. 10 crore allocated in FY08 remains unutilized. This calls for effective modalities for implementation.

The Budget announced to continue the 6-year Second Primary Education Development Programme (PEDP-II) as part of which 55 lakh primary students are receiving stipends annually. Total outlay for this programme is Tk. 1,800 crore.

A new Stipend Programme for Poor Male Students has been proposed in the budget, to be implemented in 121 upazillas. This has been done with a view to increase the rate of _nrolment of male students in secondary education level. This is a pragmatic initiative which will benefit the marginalized families. Another new programme is proposed to bridge the gap between quality of education of urban and rural areas. 63 schools are primarily selected to be converted into Model High Schools. This is definitely a very good initiative, but proper training of teachers, particularly for English and Science subjects, will be required.

The budget proposed to reduce tariff on Computer and Computer Accessories from 5 per cent to 3 per cent. This is a very good initiative to enhance computer literacy among students.

The Budget has imposed 25 per cent VAT on children’s picture, drawing or coloring books imported from other countries. This measure needs to be revisited as it amounts to taxing knowledge.

Helping with child care

and education costs of Australia

The Budget helps parents care for their children and invest in their education. Access to affordable high quality child care plays an important role in improving children’s education and development, and helps parents who choose to return to work.

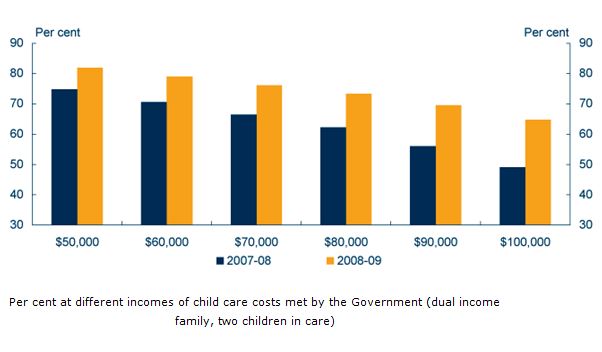

Increase in Child Care Tax Rebate

The Government will increase the Child Care Tax Rebate (CCTR) from 30 per cent to 50 per cent at a cost of $1.6 billion over four years. This will ensure that, in addition to any Child Care Benefit payable, half of a family’s total out‑of‑pocket child care costs will be met every year. The cap on the amount that can be paid each year will also be lifted from the current amount of $4,354 to $7,500 per child.

The Government will also pay the 50 per cent CCTR every three months, instead of once a year, providing support closer to when the bills come in.

Improving access and quality

The Government will invest $115 million over four years to build the first 38 of 260 planned child care centres in priority areas. The remaining 222 centres will form part of a National Partnership agreement with the States.

The Government will invest $22 million over four years to develop new national quality standards for child care.

Education Tax Refund

The Government will provide eligible parents with a 50 per cent Education Tax Refund (ETR) from 1 July 2008, at a cost of $4.4 billion over four years.

Parents who receive Family Tax Benefit Part A with children attending

either primary or secondary school or whose school children receive Youth Allowance or related payment, will be able to claim the ETR every financial year for eligible education expenses. The amount that can be claimed is up to:

$750 for each child attending primary school, giving a refund of up to $375 per child, per year

$1,500 for each child attending secondary school, giving a refund of up to $750 per child, per year.

Families will first receive the ETR when they complete their 2008‑09 income tax returns or lodge a claim with the Australian Taxation Office.

HEALTH COMPARISONS

Health sectors of Bangladesh

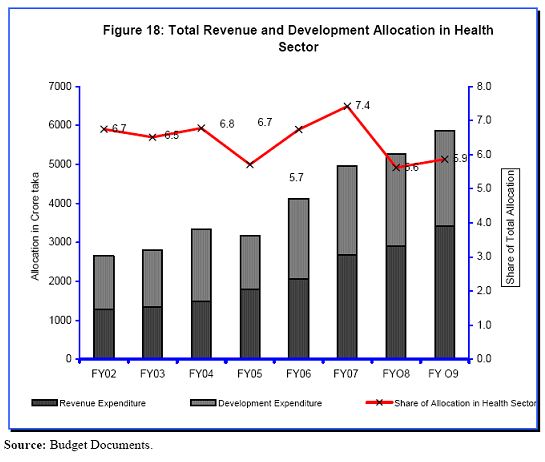

Allocation for the health and family planning is Tk 5862 crore (Revenue: Tk 3423 crore and Development: Tk 2439 crore) which is 5.9 per cent of total budget in FY09 (Figure 18). Allocation for health and family planning in FY2009 is 6.69 per cent higher than budget in FY2008 and 10.25 per cent higher than revised budget in FY2008. Total utilization of the budget for health sector was only 52 per cent in FY08 (July-April), which is very low considering the size of the programme. In view of this, special measures should be taken to ensure effective implementation of the budgetary allocation for heath sector.

The budget proposed “Maternity Allowance for the Poor Lactating Mothers” in urban areas with an allocation of Tk 20 crore. A similar programme for rural areas was introduced in FY08 with an allocation of Tk 17 crore. Until April’08, Tk 16.2 crore was distributed to 45 thousand expecting mothers of 3 thousand unions.

To ensure quality health services and increase the involvement of private sector, implementation of a programme is underway to outsource the management of 342 community clinics and 132 Union Health & Family Welfare Centres and Hospitals to the Private sectors. This may help to improve quality of health but accessibility for the poor remains a concern.

Customs duty is proposed to be reduced to 7 per cent from 25 per cent for Inhaler actuator and withdrawn on drugs used for Thalassaemia. A proposal has been made to impose supplementary duty of 60 per cent on the raw materials for manufacturing of cigarettes and 20 per cent on the papers used in producing, packaging materials of cigarettes. Scented Tobacco (jarda) and Burnt Tobacco (gul) are proposed to bring under the purview of VAT. These are some very good steps for the sake of public health.

Australia: Better hospitals and

health services

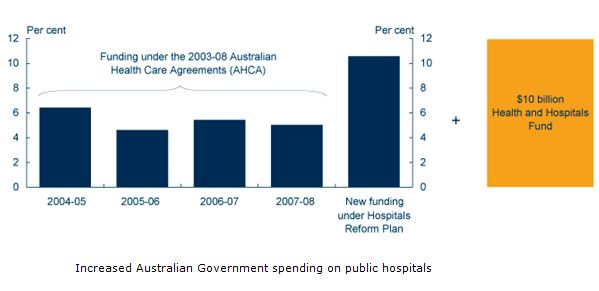

A strong public health system is central to ensuring that all Australians have access to high quality and affordable health care. Working with the States, the Government’s $3.2 billion National Health and Hospitals Reform Plan and other initiatives in the Budget will ensure government spending on health reflects the needs of the broader Australian community. The Government will establish a Health and Hospitals Fund to ensure funding for key priorities into the future.

A strong public health system

The $3.2 billion National Health and Hospitals Reform Plan will revitalise the public health system, with funding to slash elective waiting lists, improve hospital infrastructure and help families meet the costs of dental check‑ups for teenage children through the Teen Dental Plan. The Budget also provides an immediate injection of $1 billion to relieve pressure on public hospitals.

Health and Hospitals Fund

The Government will establish a Health and Hospitals Fund with an initial allocation of $10 billion, to ensure long-term funding for hospitals, medical technology and research facilities and projects.

Improving patient care

GP Super Clinics are a central plank of the reform plan. The $275 million for these clinics will improve access and enhance chronic disease management.

Fighting preventable diseases

Healthy habits today lead to lower risks of disease tomorrow. The Government is addressing the binge drinking epidemic among young Australians.

A National Cancer Plan

The National Cancer Plan provides $249 million for research, screening and clinical and emotional care. This includes $87 million to expand bowel cancer screening to 50 year olds in addition to 55 and 65 year olds.

Fairer Medicare Levy Surcharge

The Government will make the Medicare Levy Surcharge fairer by raising the income thresholds from $50,000 a year to $100,000 for single people and from $100,000 to $150,000 for couples. Singles without private health insurance will save up to $1,000 and couples will save up to $1,500 from these changes. All Australians who choose appropriate health insurance will continue to benefit from the private health insurance rebate.

Boosting the health workforce

The front line of the public health system will be strengthened, with $39 million to bring nurses back into the workforce and $100 million that Queensland will use for health workforce and facilities.

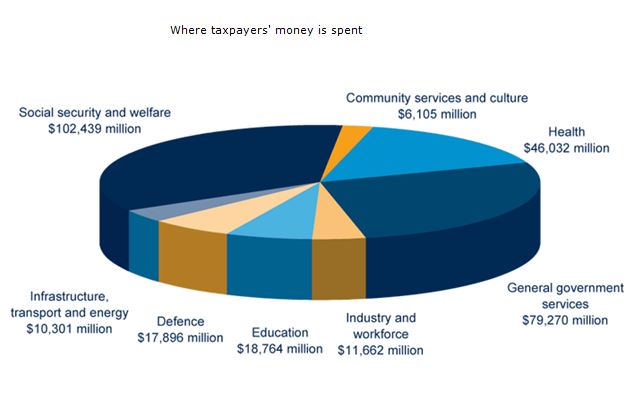

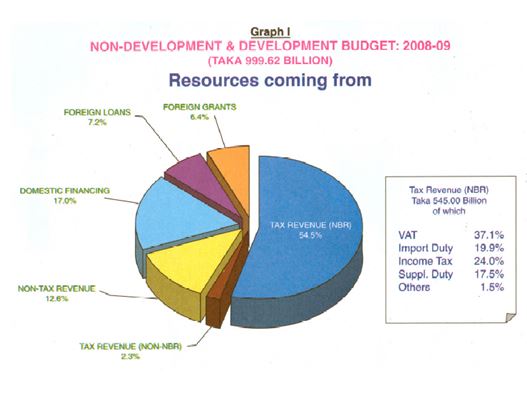

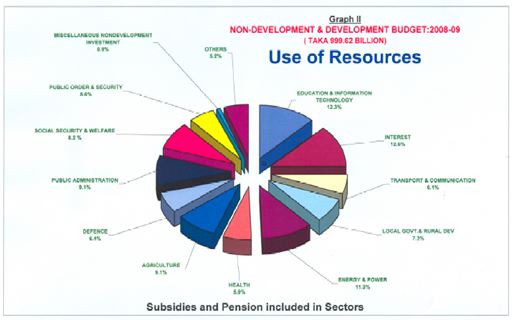

GOVERNMENT TAXATION AND SPENDING COPARISONS

Australian Government

taxation and spending

Bangladesh’s resource and

spending

CHALLENGES OF BANGLADESH REGARDING BUDGET

As was noted above, the Budget document mentions a number of objectives and targets which are in fact key challenges that will need to be addressed in order to implement the various proposals in the Budget FY2009. ‘Overcoming of the Crisis’ will indeed hinge on the efficacy with which the CTG, and subsequently, the newly elected government, is able to address these emergent challenges.

Reigning-in high inflation, particularly food inflation

Although point to point inflation rate posted some decline (about 7 per cent in April, 2008 compared to April 2007), average inflation in FY2008 remained high at double-digit figures. This average figure, however, does not fully capture the implications of price rise for the general consumers since prices of essential items such as rice, wheat, milk powder and vegetable oil, comprising a significant component of household expenditure, outpaced the average food inflation in the past year. Whilst the possibility of reducing the prevailing high prices in any substantial way is unlikely, and will depend on both domestic and global factors, maintaining stability in the food market must be seen as a key objective in implementing the budget in FY2008-09. Both market and non-market interventions will need to be brought into play to achieve this. These will include open market sales, a focused and strengthened role of Trading Corporation of Bangladesh (TCB), inducement to broad base private sector imports, continuous monitoring of the dynamics of supply and demand situation, maintaining appropriate stocks, and carrying out fiscal interventions when required. For essential items such as rice, key to stabilizing price levels will be higher domestic production in the upcoming aman and boro seasons for which availability of good quality seeds and inputs, at affordable prices, on time and in the required amount, will be necessary.

Reducing Income and Regional Inequality

Rising income inequality has undermined Bangladesh’s achievements in reducing poverty. As is evidenced by consecutive Household Income and Expenditure Survey (HIES) reports, in spite of poverty reduction of 1 per cent per annum in the 1990s, and 2 per cent per annum between 2000 and 2005, income inequality (as evidenced by gini-coefficient of income distribution) has been on the rise in Bangladesh. Between 2006 and 2008 both the poverty situation and income distribution has, in all likelihood, deteriorated. According to CPD estimates, up to about 8.5 per cent of households have perhaps experienced income erosion (mainly because of rising food prices) to the extent that they have fallen below the poverty line. Since rising food prices affect poor households disproportionately, it would be logical to pursue that income inequality has exacerbated further. This is notwithstanding the fact that successful largescale public food distribution and safety net programme have targeted hard-core poor. Accordingly, the challenge in FY2009 will be to create earning opportunities through income augmentation and employment creation for people below the poverty line. The emergence of growing regional disparity as a major cause of concern will necessitate targeted regional programmes and projects, and perhaps block allocation through regional development fund (as proposed in the document on regional disparity prepared by the Planning Commission).

More Thrust on Agriculture

In spite of its falling share in GDP, agriculture’s role as major absorber of incremental labor force and its crucial role in terms of food security, will necessitate renewed attention to this key sector of the Bangladesh economy. The High Yielding Variety (HYV) technology has arguably reached a technological frontier, and productivity enhancement would require introduction of a set of new seed-technology combination. Investment in agriculture will need to be given emphasis, both under public sector initiative and also through greater participation of the private sector. In recent times, flow of credit through private sector (in partnership with NGOs) has seen appreciable increase. This will need to be supported through appropriate incentives. Inducements for technology adoption, through fiscal stimuli, strengthened institutional support and more knowledge based support from the extension system, will need to be given high priority. Crop rotation, crop insurance, crop diversification and modern cropping practices will need to be supported through strengthening of public-private partnerships. Agriculture, both crop and non-crop sub-sectors such as fisheries, livestock and poultry, will need to be geared to a pace and level where it is able not only to meet domestic demand but also to access global market opportunities which are likely to emerge as a result of the ongoing negotiations in the WTO on Agreement on Agriculture. Heightened attention will need to be given to SPS-TBT compliance issues if those opportunities are to be realised through enhanced export of agri and agro-processed exports.

Improving Quality and Enhancing Implementation of ADP

Public sector continues to remain a major source of service delivery in Bangladesh, particularly in areas related to human resource development such as education and health. The sector also plays a crucial role in terms of providing infrastructure and other services that augment private sector investment and create conducive environment for private entrepreneurs. However, in recent years ADP implementation record has tended to be quite discouraging, in the range of 75-80 per cent of even the revised ADP, in most instances. Disbursement of ADP has been particularly low in case of a number of critically important sectors including power and energy which have tended to adversely impact investment and productivity. There is a need to strengthen institutional capacity of the government to properly allocate, implement and monitor the ADP. It may be necessary to revisit the procurement policy to examine whether amendments are required to expedite decision making in the course of ADP implementation.

Augmenting Remittance Flow

As is known, remittance flow has emerged as a major source of forex earning for Bangladesh. Whilst remittance earning was less than $2.0 billion in FY2001, it is expected to exceed $8.0 billion in FY2008. It is currently the singlemost important forex earner (in net term) of Bangladesh. The number of workers leaving Bangladesh has risen three-times over the last four years. Given the demographic dynamics, in coming years the market for service and care-providers is likely to increase manifold in the developed world. Bangladesh lags far behind countries such as Philippines in terms of per capita remittance earnings because only about 3 per cent of her migrant workers belong to the category of professionals, and more than 50 per cent belong to the unskilled category. There is a need to design a comprehensive medium term strategy to augment the skills of the migrant workers. It has been seen that remittance earnings also play a highly positive role in augmenting income of poor households, and reducing income inequality. However, hardcore poor households have not been able to tap into this market because of inability to mobilise the initial capital. There is thus an urgent need to set up an appropriate mechanism (e.g., provide loan against future earnings, impart skills) to enable these households to participate in the overseas labour market. In this context, recent initiative of the Palli Karma Shahayak Foundation (PKSF) to facilitate participation of hardcore poor households calls for careful examination for the purpose of replication.

Energy Security

Energy has emerged as a key constraining factor that inhibits investment in Bangladesh. This is true for both domestic investment and Foreign Direct Investment (FDI). Per capita energy availability is lowest in Bangladesh compared to other regional countries. Potential growth in agriculture, industry and services have been severely limited on account of lack of electricity and gas. What is particularly disturbing is that inspite of having been declared a priority sector, pace of ADP implementation has been consistently low in this sector. There is an urgent need to revisit the energy strategy if Bangladesh is to register high GDP growth rate and ensure high pace of poverty reduction. The draft Coal Policy needs to be finalised speedily. The CTG has initiated offshore bidding process for exploration of gas and oil resources in the Bay of Bengal (28 blocks). It is to be noted that of these blocks 12 have been licensed by India and Myanmar as well. In view of this it will be advisable that Bangladesh initiates a process of consultation with these countries to come to negotiated settlements on disputed issues.

An Effective Safety Net Programme

Bangladesh has passed through a challenging time in FY2007. Consecutive floods, Sidr, production losses and high inflation have led to a situation where food security of people below the poverty line has come under severe strain. It is to Bangladesh’s credit that she has been able to tackle the situation by bringing more than 10 million people under one or other form of safety net programmes. Targeting and entitlement of such programmes need to be improved further to ensure that a speedy and flexible response can be ensured depending on the needs of the hour. There is a need for closer cooperation with local government bodies to raise the effectiveness of such programmes.

Improving Terms of Trade

Bangladesh’s export sector has demonstrated commendable resilience at a time of challenging global environment (declining world trade, recession in major economies, lower consumer spending). However, it is equally true that Bangladesh’s terms of trade has been experiencing a secular fall in the recent past. At a time when global commodity prices are rising, Bangladesh’s average export prices are on the decline. There is an urgent need for intra and extra-RMG diversification as well as diversification of markets to ensure higher value addition, movement up the value chain and better prices in the global market. Technology upgradation, productivity enhancement, process and product modification and design capability improvement are becoming key factors in translating Bangladesh’s comparative advantages into competitive advantages. Realising potential export opportunities in ship-building, pharmaceuticals, light engineering and home textile will require significant investment in technology and skills development. A dedicated ‘Technology Development Fund’ (in line with one in India) needs to be set up towards this.

Higher Mobilisation of Investible Resources

Mobilisation of greater investible resources for the entrepreneurs will be key to higher GDP growth in Bangladesh. It needs to be ensured that government borrowings, particularly from the banking sector, does not crowd-out the private entrepreneurs from the credit market. The current buoyancy in the capital market will need to be supported through appropriate incentives to business enterprises with good track record to get listed in the capital market. Off loading of public sector enterprises, securitisation etc. will need to be encouraged. Of crucial importance will be appropriate monitoring of the securities market to guard against manipulation, insider trading, and creation of ‘boom and bust’ situations. Bangladesh Bank’s monetary policy, particularly interest rate policy, will play an important role in terms of creating an environment that stimulates savings and generates credit and equity for investors.

Moving Ahead with Institutional Reforms

The CTG has set up Better Business Forum (BBF) and Regulatory Reform Commission (RRC) with a view to putting in place an investment-friendly environment for the entrepreneurs. Both the BBF and the RRC have put forward a number of recommendations which relate to introduction of e-commerce, doing away with unnecessary regulatory barriers and putting in place systems that facilitate quality service delivery by state owned entities and, at the same time, are consumer and investor friendly. These initiatives are expected to reduce cost of doing business in Bangladesh and provide encouragement to both domestic and foreign investors. There is a need to vigorously pursue and continue with these reforms. It is hoped that the newly elected democratic government will ensure sustainability of these reforms and continuity of the functioning of these bodies so that reforms towards business-friendly and consumer-friendly environment in Bangladesh remains an ongoing endeavour.

SUGGESTIONS AND RECOMENDATIONS

A recent study indicates that an additional 8.5 per cent people (2.5 million families) could have fallen below the poverty line in recent times (between 2005 and 2008), because of high inflation, particularly of rise in rice prices. The study added that population below the poverty level of income experienced an income erosion of 36.7 per cent during January 2007 to March 2008. Considering the realities, the Finance Adviser has come up with a larger social safety net programme, and initiated special programmes for employment creation for poor and low income group. We do hope that these programmes will be effectively implemented.

Though the Government extended its safety net programmes which expected to help the poor and vulnerable and mitigate the food deprivation of people below the hard core poverty line, further attention is requested to be given in the per capita allowance of such programmes. It is to be noted that, PRS II (Draft) also suggests a floor to the minimum level of allowance at Tk 400 in each of the allowance programmes. Allocations in proposed budget fall short of this. No new programme is offered for RMG workers. The government may reconsider the proposal put forward earlier pertaining to setting up a Contributory Provident Fund (CPF) for RMG workers (with 50:50 contributions by the factory owners and the government). Government may think again over those proposals as many of organizations and individuals demand more attention to this section of the people.

CONCLUDING ANNOTATIONS

It is envisaged that the Budget FY2009 will be implemented by two successive governments, the Caretaker Government, to be followed by a democratically elected government. It will be the responsibility of the CTG to ensure that initiatives envisaged in the present budget get off to a good start from the very beginning. CTG will need to give topmost priority to such areas as ensuring food security through a good aman harvest, effective implementation of large scale safety net programmes, implementation of the various incentives provided in the budget, maintaining an investment-friendly environment and ensuring quality and on time implementation of the ADP. It will be critically important that the CTG is able to maintain the required macroeconomic stability as the country moves towards election at the end of 2008. Implementation of the budgetary proposals will need to be monitored and put under scrutiny on a continuing basis so that necessary mid-course corrections may be undertaken in view of emerging developments, both in the domestic economy, and in the global front. CTG will need to make every effort so that democratic transition takes place in an environment of economic growth and social coherence.