1. INTRODUCTION

1.1. ORIGIN OF PRACTICAL ORIENTATION PROGRAM REPORT

Basically, this report is based on practical data collection method from AB Bank Ltd. as a routine work of making the report. BIBM encourages their students for making the report with completion of theoretical courses of the program of Masters in Bank Management (MBM). In this case I was assigned to complete my Practical Orientation Program in AB Bank. This bank is one of the prominent and the first line Private Bank of Bangladesh. Hence I collected data by on the job training in AB Bank Ltd. Rokeya Soroni Branch, at Shewrapara, Mirpur, Dhaka-1216.

1.2. OBJECTIVE

The first objective of writing the report is fulfilling the requirement of the MBM program. Beside this, the fundamental objectives of the study within this short program are the followings:

- To achieve an overall practical knowledge concerning banking activities.

- To know how a bank operates their various activities in different areas being a single organization.

- To understand how a bank bridges the depositors and borrowers and serves people in general by providing different services

1.3. RESEARCH METHODOLOGY

For carrying out this internship report I had to observe the actual banking operation of AB Bank, Rokeya Soroni Branch, at Shewrapara, Mirpur, Dhaka-1216.Full time practical deskwork and interviewing officers of the bank are the primary material sources of this internship report. Moreover, Annual Report of AB Bank Ltd. training materials books and AB Bank’s website are the secondary sources of our internship report

1.4. SOURCES OF INFORMATION

Primary Sources: Among the primary sources of data, the main sources were:

- To talk with the officials of the Rokeya Soroni branch.

- To observe the daily activities of the officials.

Secondary Sources: Among secondary sources of data, the main sources were:

- Branch Manuals, Annual reports, Web-site of ABBL.

- Different documents and publications regarding Banking functions and activities

- Relevant books.

- The major limitation that I have faced during my internship program was time barrier. Two months for Internship Program was not enough to learn all the banking activities.

- It was also difficult to analyze current performance of the respected department.

- Most of the time organizations restrict to disclose their internal information. So I think it was tough to get all the necessary information to prepare the report.

BANK PROFILE

2.1. BACKGROUND OF AB BANK LIMITED

AB bank is one of the first generation bank (PCBs) under Joint Venture with Dubai Bank Limited, UAE incorporated in Bangladesh on 31st December 1981 and started its operation with effect from April 12, 1982.it incorporated as a public limited under the Companies Act 1913, subsequently replaced by the Companies Act 1994, and governed by the Banking Company Act 1991.

As of December 31, 2007; the Authorized Capital and the Equity (Paid up Capital and Reserve) of the Bank are BDT 2000 million and BDT 4511.59 million respectively. Authorized Capital of the Bank has been increased to BDT 3000 million in the Extra Ordinary General Meeting held on July 16, 2008.

The Sponsor-Shareholders hold 50% of the Share Capital, the General Public Shareholders hold 49.43% and the rest 0.57% Shares are held by the Government of the People’s Republic of Bangladesh. However, no individual sponsor share holder of AB Bank holds more than 10% of its total shares.

The Bank oriented permission to embark upon Merchant Banking from Security and Exchange Commission. It also stared Islamic Banking through its Dhaka Dilkhusha Branch, Dhaka from 21 December 2004 with permission of Bangladesh Bank.

Since beginning, the bank acquired confidence and trust of the public and business houses by rendering high quality services in different areas of banking operations, professional competence and employment of the state of art technology.

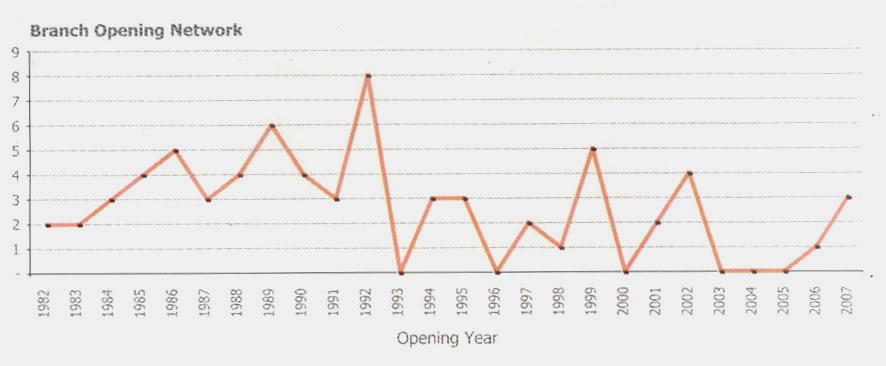

During the last 26 years, AB Bank Limited has opened 70 Branches in different Business Centers of the country, one foreign Branch in Mumbai, India and also established a wholly owned Subsidiary Finance Company in Hong Kong in the name of AB International Finance Limited. To facilitate cross border trade and payment related services, the Bank has correspondent relationship with over 220 international banks of repute across 58 countries of the World. AB Bank Limited, the premier sector bank of the country is making headway with a mark of sustainable growth. The overall performance indicates mark of improvement with Deposit reaching BDT 53375.35 million, which is precisely 26.85% higher than the preceding year. On the Advance side, the Bank has been able to achieve 30.76% increase, thereby raising a total portfolio to BDT 40915.35 million, which places the Bank in the top tier of private sector commercial banks of the country. On account of Foreign Trade, the Bank made a significant headway in respect of import, export and inflow of foreign exchange remittances from abroad.

2.2. VISION & MISSION

Vision Statement

“To be the trendsetter for innovative banking with excellence & perfection”

Mission Statement

“To be the best performing bank in the country

2.3. CORPORATE INFORMATION OF AB BANK LIMITED

2.3.1. Name of the Company

Arab Bangladesh Bank Ltd. Changed its name to AB Bank Limited (ABBL) with effect from 14th November 2007.

2.3.2. The Logo

Effective 1st January, 2008 AB Bank Ltd changed its logo. The coat of arms of the new logo is inspired by traditional ‘shital pati’ or ‘sleeping mat’. The knit and the pattern of interlace in the new logo that echoes the intricate weave of sital pati symbolizes bonding. This boning reflects the new sprit of AB bank.

2.3.3. Legal Form:

A public limited company incorporated on 31st December, 1981 under Companies Act, 1913 and listed in the Dhaka Stock Exchange Ltd and Chittagong Stock Exchange Ltd.

2.3.4. Contact and Communication

| Commencement of Business | 27th February 1982 |

| Registered Office | BCIC Bhaban, 30-31, Dilkusha C/A |

| Dhaka 1000, Bangladesh. | |

| GPO Box : 3522 | |

| Tel: (+8802) 9560312 | |

| Telefax: (+8802) 9564122, 23 | |

| SWIFT: | ABBLBDDH |

| E-mail: | info@abbank.com.bd |

| Web: | www.abbank.com.bd |

| Auditors | ACNABIN (Chartered Accountants) |

| Tax Consultant | K.M. Hassan & Co. (Chartered Accountants) |

| Legal Retainer | A. Rouf & Associates |

2.3.5. Branches of AB Bank Limited

Table 1: Branches of AB Bank Limited (According to the Division)

| Division | Number |

| Dhaka | 26 |

| Chittagong | 23 |

| Khulna | 06 |

| Rajshahi | 06 |

| Sylhet | 08 |

| Barisal | 01 |

| Total | 70 |

Table 2: Branches of Ab Bank Limited (According to Urban/Rural)

| 2006 | 2007 | |

| Urban | 50 | 47 |

| Rural | 20 | 19 |

| Total | 70 | 66 |

2.3.1. Board of Directors

- M. Wahidul Haque (Chairman)

- Salim Ahmed (Vice Chairman)

- Feroz Ahmed (Director)

- M.A. Awal (Director)

- Shishir Ranjan Bose (Director)

- Faheemul Huq (Director)

- Sayeed Alfaz Hasan Uddin (Director)

- Misaal Kabir (Director)

- Md. Salah Uddin (Director)

- Md Masbahul Haque (Director)

- Md Anwar Jamil Siddiqi (Director)

- Dr. M. Imtiaz Hossain (Director)

- Kaiser A. Chowdhury (Director)

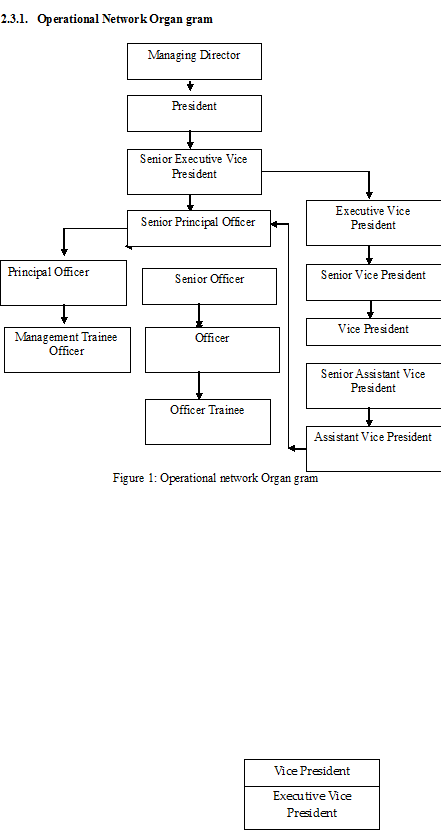

2.3.2. Management Committee

- Kaiser A. Chowdhury President & Managing Director

- Niaz Habib Deputy Managing Director, Corporate

- Faruq M Ahmed Deputy Managing Director, Credit

- Shamim Ahmed Chaudhury Deputy Managing Director, Operations

- M. A. Abdullah Head of Change Management and HRM

- Fazlur Rahman Senior Executive Vice President, Head of Investment Banking

- Badrul H. Khan Senior Executive Vice President,

Chief Finance Officer - Abu Hena Mustafa Kamal Executive Vice President, Head of Financial Institution and Treasury

- Akhtar Hamid Khan Executive Vice President, Head of Risk Asset Management

- Md. Azad Hossain Executive Vice President, Head of Regional Relationship Management – Dhaka Region

- Reazul Islam Senior Vice President, Head of Information Technology

- Amzad Hossain Senior Vice President, Head of Internal Control & Compliance

(Source: Branch Operating Manual’08)

2.1. NATURE OF BUSINESS

The AB Bank Ltd offers full range of banking services that include

- Deposit banking

- Loans & advances

- Local Remittance

- Export

- Import

- Financing inland

- International remittance facilities

The bank offers a full scale commercial banking including

- Foreign Exchange transactions

- Personal

- Credit

- Consumer & Corporate Banking

2.2. PERFORMANCE OF AB BANK LTD.

Table 3: Year-wise Performance of the Bank

(taka in million)

| Particulars | 2007 | 2006 | Changes in % |

| Paid up Capital | 743.26 | 571.74 | 29.9 |

| Total Capital | 4785 | 2664 | 79.61 |

| Capital Surplus | 330 | 67 | 392.5 |

| Total Assets | 63549 | 47989 | 32.42 |

| Total Deposit | 53375 | 42076 | 26.85 |

| Total Loans & Advances | 40915 | 31289 | 30.77 |

| Total Contingent Liabilities | 27287 | 21112 | 29.25 |

| Profit after Tax and provisions | 1903 | 532 | 257.71 |

| Loans classified during the year | 779 | 205 | 280.00 |

| Provision kept against classified loans | 659 | 415 | 58.79 |

| Provision Surplus/(shortage) | 56 | 34 | 64.70 |

| Cost of Fund | 10.54% | 10.04% | 4.98 |

| Interest Earning Assets | 49207 | 36648 | 34.27 |

| Non-interest earning assets | 14342 | 11341 | 26.46 |

| Income from investment | 1734 | 974 | 78.02 |

Table 4: Key Performance Indicators

| Particulars | 2007 | % change | 2006 | 2005 | 2004 | 2003 |

| Earning per share | 256.10 | 4.28 | 93.08 | 31.26 | 18.19 | 3.63 |

| P/E Ratio (times) | 10.00 | 4.28 | 9.59 | 11.68 | 20.95 | 53.89 |

| Book Value per Share (TK.) | 607.00 | 34.37 | 451.74 | 293.76 | 251.22 | 240.96 |

| Return on Equity (ROE-%) | 42.19 | 104.71 | 20.61 | 10.64 | 7.24 | 1.53 |

| Return on Asset (ROA-%) | 3.41 | 207.21 | 1.11 | 0.50 | 0.39 | 0.07 |

| Capital Adequacy Ratio | 10.75 | 16.47 | 9.23 | 9.17 | 9.09 | 9.17 |

| Credit Deposits Ratio (%) | 76.66% | 3.09 | 74.36 | 78.16 | 60.10 | 60.10 |

| Ratio of Classified Loans against total loans and advances | 4.31% | 7.21 | 4.02 | 8.21 | 11.37 | 19.25 |

| Asset Utilization Ratio | 77.43 | 1.39 | 76.37 | 72.60 | 68.48 | 62.58 |

2.5.1. Deposit

The total deposited amount in Ab Bank Ltd. has increased from Tk.47212 mil to Tk. 62341 mil. The growth rate is 26.85%.

2.5.2. Deposit Classification

The deposit sector of AB Bank Ltd is segmented mainly into three parts i.e. Savings Deposit, Current Deposit and Fixed Deposit. Deposit concentration mainly titled towards the high cost deposit while low cost deposit comprise of 37.53%.

2.5.3. Credit

Total loans and advances increased in 2007 from 40915.35 million to 31289.25 million. The growth rate is 30.76%.

2.5.4. Operating Profit

The operating profit of AB Bank Ltd is increasing at a rate 72.27%. The trend of operating profit is given below.

2.5.5. Earning Per Share

Good operational performance enables AB bank Ltd to enhance the shareholders value as the Earning Per Share (EPS) stood up to 175.27 which is 34.67% over last year’s EPS of 134.13.

2.5.6. Interest Income

Net interest income (NIM) at the end of the year was more than doubled compare to last year. As a matter of fact, interest income from loans and advances grew in volume riding on the positive growth in the loans and advances portfolio of the bank. During the year , growth in interest on loans and advances outpaced the growth in interest expanse on deposits. Moreover, bank increased its income from interbank money market operations during the year which has positive impact on NIM.

2.5.7. Islamic Banking Profit

Islamic Banking Business (IBB) has made remarkable progress in its third year of operation in 2007 through its efficient service and products designed to cater to particular segment of customers. The scenario of IBB is given below.

2.6.ONLINE BANKING

AB Bank Ltd. is geared with the latest gadgets of Information Technology to serve their clients. To provide efficient and quick service to its clients AB Bank Ltd provides ‘Composite Network’ among it’s branches through Micro Wave Radio Link.

- Can deposit cash or check in any of the Branches

- Can draw cash of any amount from any of the Branches

- Can deposit money for ATM accounts in any of the Branches

2.7.FUTURE PLAN

To surpass customer expectations, the management likes to turn this bank into a world-class bank so that all banking related services could be provided efficiently and effectively. Automation will play a vital role. All the branches will come under one network so that customers will enjoy the banking services. Corporate clients will be provided banking services at their doorsteps. Mobile ATM services will be introduced so that customers can be served in any corner of the cities. This service will help to ease the tension of carrying large quantity of money during the salary period. Phone banking and internet banking will allow the customers to withdraw and transfer money at any time. More specifically the bank will provide the following:

- Electronic Fund transfer

- Electronic L/Cs

- Mobile ATM service

- Utility bill payment through ATM cards

- One stop service

- SMS Banking.

2. BRANCH PROFILE

3.1. PROFILE OF AB BANK LTD., ROKEYA SORONI BRANCH

AB Bank Ltd., Rokeya Soroni Branch has started its operation on 13thApril 2002. It is non Authorized Dealer branch. To meet up the customers’ need the Branch has efficient human resources. The entire job is assigned properly among the officers. The branch provides one stop banking services by using comprehensive banking software.

Corporate Information

| Address | 923, Rokeya Soroni Road, Shewrapara, Mirpure, Dhaka-1216 |

| Tel: | 9014290, 9012607 |

| Fax: | 9012607 |

| E-mail: | rkys@abbank.com.bd |

| Branch Code | 4022 |

3.2. DEPARTMENT AND SECTIONS

general banking department

- Account Opening

- Local Remittance & Clearing

- Fixed deposit

- Sanchaypatra

- Cash Section

Loans and Advance department

- Credit Service Section

- Credit Administration Section

- Disbursement Section

- Monitoring, Follow up Section and Recovery Section.

foreign trade department

- Import Section

accounts departmen

Table 5: Balance Sheet Analysis

In Lac Taka

| Particulars | Dec-07 | Jul-07 | Jul-08 | Growth % |

| Cash | 62 | 66 | 137 | 106 |

| Loans & Advances | 2835 | 1608 | 3402 | 112 |

| Regular | 2403 | 906 | 3006 | 232 |

| SMA | 55 | 178 | 260 | 46 |

| Classified | 377 | 524 | 136 | (74) |

| ABBL G/A-Taka | 3874 | 3728 | 5864 | 57 |

| Other Assets | 261 | 303 | 222 | (27) |

| Total Assets | 7031 | 5705 | 9625 | 69 |

| Deposits | 6867 | 5581 | 9422 | 69 |

| Current & other demand deposit | 869 | 735 | 1125 | 53 |

| Savings & STD | 1946 | 1629 | 2206 | 35 |

| FDR & other | 4025 | 3217 | 6091 | 89 |

| Other Liabilities | 164 | 124 | 203 | 63 |

| Total Liabilities | 7031 | 5705 | 9625 | 69 |

Table 6: Profit & Loss Account Analysis

In Lac Taka

| Particulars | Dec-06 | Jul-07 | Jul-08 | Growth% |

| Interest income | 178 | 87 | 238 | 174 |

| Pool Interest Income | 443 | 200 | 310 | 55 |

| Interest Expense | 372 | 161 | 366 | 127 |

| Net Interest Income | 249 | 125 | 182 | 45 |

| Non-funded Income | 34 | 16 | 34 | 115 |

| Total income | 283 | 141 | 216 | 53 |

| Salary & Allowance | 53 | 27 | 52 | 95 |

| Other overhead | 42 | 22 | 31 | 40 |

| Net operational income | 188 | 92 | 133 | 44 |

Table 7: Business Analysis

In Lac Taka

| Particulars | Dec-06 | Jul-07 | Jul-08 | Growth% |

| Profit | 188 | 92 | 133 | 44 |

| Deposit | 6867 | 5581 | 9422 | 69 |

| Loan | 2835 | 1608 | 3402 | 112 |

| Import | 731 | 231 | 720 | 212 |

| Guarantee | 340 | 50 | 519 | 946 |

| Past due loan | 432 | 701 | 396 | (44) |

Table 8:Ratio Analysis

| Particulars | Dec-07 | Jul-07 | Jul-08 | Growth% |

| Cost of Deposits | 7.06% | 6.35% | 7.99% | 25.88% |

| Overhead Cost | 1.80% | 1.93% | 1.82% | -5.51% |

| Cost of Fund | 8.86% | 8.27% | 9.81% | 18.57% |

| Average Interest Income (Yield) | 11.21% | 11.00% | 12.77% | 16.08% |

| Average Interest spread | 2.35% | 2.72% | 2.95% | 8.54% |

| Non-funded income over total income | 12.04% | 11.31% | 15.92% | 40.83% |

| Interest margin | 40.13% | 43.74% | 33.19% | -24.11% |

| Cost Income Ratio | 71.21% | 69.49% | 77.19% | 11.10% |

| Loan Deposit Ratio | 41.28% | 28.81% | 36.11% | 25.34% |

| Demand vs Total Deposit | 13.05% | 13.16% | 11.94% | -9.30% |

| Saving & STD vs Total Deposit | 28.34% | 29.18% | 23.41% | -19.78% |

| Time Vs Total Deposit | 58.61% | 57.65% | 64.65% | 12.13% |

| % of Classified Loan | 13.30% | 32.57% | 3.99% | -87.75% |

| Loan vs Total Asset | 40.32% | 28.18% | 35.35% | 25.43% |

| Sallary & Allowances vs Operating Cost | 56.10% | 54.56% | 62.53% | 14.62% |

| Profit per Employee | 8.56 | 4.62 | 5.77 | 24.95% |

| Cost per Employee | 2.43 | 1.34 | 2.27 | 69.65% |

| Number of Employee | 22 | 20 | 23 | 15.00% |

| Recovery Income | 2.84 | 1.12 | 0.08 | -93.13% |

3.3. HEALTH STATUS OF BRANCH

It depends on the three sectors. They are deposit, credit and profit of the branch.

3.3.1. Deposit Section

Both the deposit in amount and number of deposit account are increasing. For deposit amount the growth rate is 35.79% and for the number of deposit account it is 17.96%.

Table 9: Deposit Status of Rokeya Soroni Branch

| Particular | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 |

| Deposit(in lac) | 2746.54 | 1719.85 | 3984.15 | 2975.86 | 3252.11 | 6867 | 9325 |

| No of Deposit | 1097 | 1691 | 2494 | 3009 | 2890 | 3568 | 4209 |

3.3.2. Credit Section

Both the number of credit and the total amount in credit is increasing but in 2005 it started to decrease. But now the credit amount is increasing at a growth rate 19.85% and the number of credit is increasing at a growth rate 31.25%.

Table 10: Credit Status of Rokeya Soroni Branch

| Particular | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 |

| LDOs (in Lac) | 594.05 | 1715 | 2043.07 | 2015 | 1308 | 2836 | 3399 |

| No of LDOs | 135 | 343 | 291 | 270 | 209 | 240 | 315 |

3.3.3. Profit

AB Bandk, Rokeya Sharani Branch has made profit Tk. 197.00 lac during October 2008. During the last year this branch had made profit Tk. 188.00 lac. This next year the branch has targeted to make profit Tk. 300.00 lac. But if the branch continues with this profit figure, it can not able to reach its targeted. The profit history shows that at the end of every quarter the branch makes highest profit than other months and the profit figure goes to the pick at the end of a financial year, i.e., closing the year.

3.4. CONCLUDING REMARKS

In the Rokeya Soroni Branch the time deposit is increasing highly which becomes the main reason behind the high growth of cost in deposit. Though they can manage low overhead cost. Whereas their growth in cost per employee is higher than the growth in profit per employee . This branch can also manage high non funded income. This branch is normally practiced SME and CCS loans for the socioeconomic condition of Shewrapara. That’s why they can manage a good net interest income. The total classified loans have a sharp decreasing rate in last two years. From the above information we can conclude that this branch is improving but at slow growth rate. Due to socio economic condition of Shewrapara this branch is mainly deposit oriented branch where SME products are highlighted.

4. GENERAL BANKING

INTRODUCTION

General Banking is the department, which provides day-to-day services to the customers. It consists with different departments. They are:

- Account opening Section

- FDR and Sanchypatra Section

- Deposit Scheme

- Remittance Section

- Cash Section

ACCOUNT OPENING SECTION

This department is worked as a front desk for the ABBL. From that place any person or corporate body may become a customer by opening a savings or current account or other account. So the legal contractual relationship of banker and customer begins from the Account Opening Department.

Kinds of Account

In broadly I can divide Account into two Parts. They are as follows-

(i) Interest Base (Savings A/C and STD)

(ii) Interest Free (Current A/C)

Savings Deposit Account

The saving deposit account is popular among small-scale savers. Hence, there is a restriction on number of withdrawals and amount to withdraw. The features are

- Interest is paid on this account. AB bank offers 6% rate of interest for SB A/C..

- The number of withdrawals over period of time is limited. Only two withdrawals are permitted per week. If there are more than two withdrawals are made in a week, no interest will be paid for that month.

- If any A/C holder withdraws 10000 he will not get the interest for that month.

- Generally householders, individuals and other small-scale savers are the clients of this account.

- Minimum Balance of Tk 5,000 is to be maintained.

- Interest is paid on daily basis charged half yearly in June and December.

- The service charge for savings account is Tk. 250.00 half yearly.

- Closing charge is normally Tk. 300with 15% VAT. But in case of closing with in three months the charge will be Tk. 500.

Current Deposit Account

As it is a demand deposit account, there is no restriction on withdrawing money from the account. It is basically justified when funds are to be collected and money is to be paid at frequent interval. It is most suitable for private individuals, traders, merchants, importers and exporters, mill and factory owners, limited company’s etc. The general characteristics are

- Bank does not pay any interest to CD Account holders.

- There is no restriction on the number and the amount of withdrawals from a current account.

- Service charge and incidental charges are recovered from the depositors since the bank make payments and collect the bills, drafts, cheques, for any number of times daily.

- Businessmen and companies are the main customers of this product.

- The Banks through current accounts grant the loans and advances

- In practice of ABBL, a minimum balance of TK.10000 has to be maintained.

Short Term Deposit Account (STD)

Normally various big companies, organizations, Government Departments keep money in STD account. the features are

- Customers deposit money for a shorter period of time.

- STD account is treated as semi-term deposit

- The opening balance is 10000.

- In practice, AB bank offers 5.0% rate of interest (half yearly compounding) for STD account on daily minimum balance. Volume of STD A/C is generally high. In AB bank, the minimum balance is 500000 to get the 5% interest.

- Frequent withdrawal is discouraged and requires prior notice.

- the service charge is 250 Tk. Half yearly.

- The charge for closing account is 300 and 500 for closing with in three months of opening.

Basic Requirements for Opening A/C

- A/C Opening form, that is know as KYC (know your customer), duly filling by A/C holder.

A/C opening from contents: –

- Title of A/C

- A/C holder’s Name, Father’s & Mother’s name

- Nationality

- Marital Status

- Present & Permanent Address

- Contract Number.

- Occupation, Personal Income, Source of Income

- Expected Transaction Profile

- Terms & Conditions form

- 2 copies Passport size Photograph attested by the introducer.

- 1 copy Passport size Photograph of Nominee attested by the A/C Holder.

- Nationality Certificate (any one from below) :

- Valid Bangladeshi Passport

- National ID Card

- Commissioner Certificate

- Age proved certificate (any one from below)

i) SSC Certificate,

ii) Valid Passport,

iii) Driving License,

iv) Voter ID card etc

- Five Signatures of A/C Holder

- One Signature of Nominee.

- Introduction of an A/C holder

- Signature in the Signature Specimen Card

- Estimated Transaction Profile

- Initial Deposit

i) For Savings A/C: 5000 Tk.

ii) Current A/C:10000 Tk.

Prerequisite of Opening Different Type of Accounts

A) Individual and Joint Account

Any individual can be account holder of AB bank by fulfilling the above requirements. But minimum two and maximum three can form a joint account. For joint account all above requirements need to be fulfilled by all A/C holders. But only one Nominee can be selected (except the A/C holders) by them.

B) Sole Proprietorship Account

Bedsides the basic requirements the extra documents that needed to open a sole proprietorship account are

- Copy of valid Trade License issued by Local Government authority (City Corporation, Pourashava, Union Parishad etc.)

- Permission from Bangladesh Bank (For Buying House, Indenting or other specific businesses)

- TIN issued by Income Tax Authority

C) Limited Company Account

The requirements to open a Limited Company Account

- Bank’s prescribed Account Opening application form

- Certified copy of the Memorandum & Articles of Association of the Company

- Certificate of incorporation

- Certificate of commencement of Business (For Public Limited Companies only)

- Extract of the Board resolution sanctioning the account opening and signing authority

- List of the Director with address in form – XII.

- Photograph of the signatories

- Copy of valid Trade License

- Introducer’s signature in the A/C opening form and at the back of the photograph(s) of Account holder(s).

- List of names with Appointment letter and Specimen Signature of the Persons authorized to operate the Account.

- The personal identity of all the directors or beneficial owner(s) proprietor of the Firm has to be established by any of the documents as mentioned in Individual or Joint Customer category.

D) Partnership Account

- Bank’s prescribed Account Opening application form signed by the partners in front of BM/RM/CSM

- Certified copy of Partnership Deed/ Agreement

- List of the Partners with Address

- Extract of resolution of the partners Meeting

- Copy of valid Trade License

- Photograph of the signatories/ Partners

- Specimen signature card (To be signed by the signatories in front of BM/RM/CSM

- Introducer’s signature in the A/C opening form and at the back of the photograph(s) of Account holder(s).

- Identity of all Partners/ Directors must be verified in line with the requirements for personal customers. Where a formal partnership agreement exists, a mandate from the partnership authorizing the opening of an account and conferring authority on those who will operate it should be obtained.

- Evidence of the trading address of the business or partnership should be obtained and a copy of the latest report and accounts (audited where applicable).

- An explanation of the nature of the business or partnership should be ascertained (but not necessarily verified from a partnership deed) to ensure that it has a legitimate purpose.

General Practice of AB Bank Ltd. For All Types of Accounts

- Account Opening Register

After fulfilling all the requirements for opening account necessary entries are given in the account opening register. There are several registers for several accounts as SA, CA and STDR etc. Date of opening, name of the account holder, nature of the business, address, initial deposit and introducer’s information are recorded in that register. New accounts number is given from the list of new numbers provided by the Bank.

- Register of Alphabetic

After opening the account, the name of the account holder is maintain and listed in a register according to his/her name’s first alphabet.

- Check Book

Checkbook is issued to the new customer after two or three days of opening account by receiving checkbook requisition slip. Two separate checkbooks are given for current and saving accounts. CA accounts check book consists 20 and 100 leafs, while SA account checkbook has 20 leafs. There has a check book issue register in this regard; where check book number, leaf number, date issue etc. information are kept on the register. After that the check book requisition slip’s numbers are posting in the computer program which is linked with online.

Closing of Accounts:

- To close an account, parties may be requested to send an application along with the un‑used leaves of the Cheque Books if any, issued to them.

- On receipt of the application, the following to be taken:

- Before the account is closed the Manager shall approve the application after ascertaining the liability, if any, and closing charges to be debited to the account.

- Debiting the closing charges to the account, the account‑holder shall be advised to draw the remaining balance from his account. If however, the account is closed due to recovery of half yearly bank charges, the account‑holder shall be advised with a request to return the unused cheque leaves to the Bank.

- The signature of the account‑holder shall be verified and

- The number of unused Cheque Leaves shall be noted thereon.

- Then the officer in charge, who shall write thereon the balance of the account and initial it.

The following entries shall be passed on the recovery of closing charges

Debit: Party’s Account

Credit: Income Account‑closing charges

- After observing all the above formalities the respective account to be marked as closed in the PC.

- The “Account Closed” stamp shall be affixed on the Account Opening Form and Specimen Signature Cards.

- The advice shall be handed over to the account holder or shall be sent to him through cash Department.

- The application shall be filed with the Account Opening Form and the Specimen Signature Cards shall be kept separately under lock and key.

- The unused Cheque leaves shall be destroyed by an Authorized Officer, keeping due record in the Application and Account Open & Closed Register, under his signature.

Inter-Branch Transfer Of Accounts:

In case of transfer of accounts from one branch from another branch, there are several steps to be followed by The ABBL Ltd.

- In case of transfer of account from one Branch to another, letter of request of the accountholder desiring the transfer of the account shall be taken in writing by the transferring Branch as per specimen appended below along with the unused cheque book/leaves returned by the account holder.

- The unused cheque leaves shall be destroyed by the Account Opening Officer and recorded on the Account Opening Form and cheque Book Issued Register.

When on receipt of the letter is requested from the party, transferring account from the Branch will do the following steps.

- Account holder’s signature on the letter of request shall be verified from Specimen Signature recorded on the Specimen Signature Card with the branch. The letter of request shall be sent to the Ledger‑Keeper for writing the balance of the account on the letter under his initials.

- The approval of the Manager to transfer the account must be obtained.

- All the particulars on Account Opening Form especially “Address and introduction” shall be thoroughly checked.

- Signature should be verified by the authorized officers.

- It is required to ensure that the Account Opening Form and other relevant documents have been checked thoroughly; the forwarding letter for transfer of account should be filled in and signed by the Manager only. When the application for transfer is received duly approved from the Manager, the respective Specimen Signature Cards and Account Opening Form will be taken out. The branch transferring the account shall pass the following entries-

Debit: Party’s Account

Credit: ABBL Account (Transferee branch)

FDR SECTION

This branch maintains a separate section for maintaining Fixed Deposit. FDR is found to be 66.4% of the total deposit of this branch. This is the mobilization unit of the Bank.

Features of FDR

- It is done for a fixed period of time.

- The AB Bank ltd issues FDR for different periods with different rate of interest.

- A normally high rate is offered to FDR. So it is known as high cost liability to the bank.

Steps to open FDR

- An KYC form should be filled up by the depositor.

- The specimen signatures of the depositor(s) is taken by the banker

- To open a FDR account the deposit money can be deposited by in cash or in cheque.

- Necessary entries are given in computer system.

- An FDR is then issued to the depositor acknowledging receipt of the sum of money mentioned therein. It also contains the rate of interest & the date on which the deposit will fall due for payment.

Interest Rates on F.D.R

Interest rate differs with different time periods and the amount of deposit. The rate is given below considering these.

Table 11: Interest rate on FDR

| Fixed Deposit (Time Deposits) Interest rate | |

| 3 (three) Months | |

| 000,001 to 10,00,000 | 11.75% |

| 10,00,001 & above | 12.25% |

| 6 (six) Months | |

| 000,001 to 10,00,000 | 12.00% |

| 10,00,001 & above | 12.25% |

| 1 (one) Year | |

| 000,001 to 10,00,000 | 12.50% |

| 10,00,001 & above | 13% |

| 2 (two) Years | 12.75% |

Interest Payment:

- Interest is usually paid annually or on maturity of the fixed deposit. AB bank credits interest on maturity date.

- Depositors have the options to receive interest through his savings or current account, payment order or in cash at his request.

Premature Encashment of FDR:

- With post approval of Head Office the AB bank Ltd. Allows the client premature encashment.

- For premature encashment the saving account’s interest rate is given instead of the FDR interest rate.

- A closing charge of amount Tk 50 is realized from the FDR A/C.

FDR Renew Process:

- FDR holder can renew his FDR after maturity with interest or without interest at his discretion.

- He can renew it for the same period or any other period.

- FDR is automatically renewed after the date of its maturity if the holder doesn’t encash the same. In case of auto renewal, maturity period remains same.

In Case of Loss

If the instrument is lost from the possession of the holder, the holder is asked to fulfill the following requirements-

- Holder should inform the bank immediately

- Record a GD (General Diary) in the nearest Police Station.

- Furnish an Indemnity Bond

On fulfilling the above requirements, AB bank is then issued a duplicate FDR.

SANCHAYPATRA

The following Savings Certificates of different denominations are available at the Branch:

- Bangladesh Sanchayapatra (5 years)

- 3 months profit based Sanchayapatra (3 years)

Table 12: Interest Rate on Sanchaypatra

SL | Type of Sanchayapatra | Rate of interest |

| 01 | 3 months profit based Sanchayapatra (3 years) | 11.5% |

| 02 | Bangladesh Sanchayapatra (5 years) | 12.50% |

DEPOSIT SCHEME

MSDS

MSDS means “Monthly Saving Deposit Scheme”. If the client hasn’t any account in the bank he or she can open a MSDS account. MSDS can be opened in different amounts for different time period. The interest rate also differs for different time periods. The rate is given below

Table 13 : Interest Rate on Different Time Period

| Amount | Time Period | Interest Rates |

| Minimum 500 Tk to |

Maximum 5000 Tk5 years11%Minimum 500 Tk to

Maximum 5000 Tk10 years11.5%

The monthly subscription shall be deposited by 10th (calendar date) of each month. If he/she fails to deposit within the time, he/she has to pay the penalty amount and it is 10% of the monthly subscription.

Troimashik Munafa Hisab (TMH)

This product is introduced in this branch in 1st August. It is a fixed deposit account with minimum of Th. 25000/- and in multiple of Tk. 5000/-. Interest income is payable on Quarterly basis to the depositor. The objective to introduce this scheme is to increase the deposit base of AB Bank Ltd. at least by 1% in 2008.

Features of TMH Deposit Scheme

- A fixed deposit to yield interest every three months

- Minimum deposit Tk. 25000/-

- Tenure of the scheme will be for 3 years. The tenure will be effective exactly from the date of opening the deposit and not for calendar months.

- Rate of interest will be 12%.

- Any citizen of Bangladesh of age 18 years or more, minor (in which case it will be operated by there legal guardians) and institution are eligible to open THM.

- The depositor shall have to maintain a savings/ current / STD account with same branch for disbursement of quarterly interest payable for the TMH. Account maintenance charges for such accounts (for new customers) will be waived.

- The account holder must nominate one person. Nomination will not be required if operated on “Either or Survivor” basis in case of joint accounts.

- Govt. tax at source and excise duty shall be borne by the depositor.

- Loan/ overdraft facility may be allowed up to 90% of the deposited amount.

Premature Encashment of TMH

If withdraw prematurely the following rates will be applicable:

- Before six months no interest will be paid.

- After six months and before one year interest will be paid as per saving account rate but only for completed months.

- After 1st year and before 2nd year 9.00%

- After 2nd year and before 3rd year 10%

Target Group for TMH

The primary target customers for this product would be Existing AB Customer, Salaried Individual, Senior Citizen, Self-employed Professionals , Proprietorships and Partnership firm.

Product Details of Ogrim Munafa Patra (OMP)

This product is introduced in this branch in 1st August It is a fixed deposit where interest is paid at the time of deposit. A depositor may purchase an OMP certificate for full amount; however the interest should be paid in advance. The objective to introduce this scheme is to increase the deposit base of AB Bank Ltd. at least by 1% in 2008.

3.4.6 Features of OMP Deposit Scheme

- The deposit will be minimum for 25000/- or it’s multiple.

- Interest must be credited into the customer account

- OMP will be available only for the following maturity tenors:

3-months, 6-monthe & 12-monthe

- Interest rate for 3-months and 6-months OMP will be 12% p. a.

- Interest rate for 12-months OMP will be 11.50% p.a.

- Any citizen of Bangladesh of age 18 years or more, minor (in which case it will be operated by there legal guardians) and institution are eligible to open OMP.

- The account holder must nominate one person. Nomination will not be required if operated on “Either or Survivor” basis in case of joint accounts.

- Prevailing Govt. tax and excise duty shall be deducted at source at the time of payment of advance interest. In case of premature

- Loan overdraft facility may be allowed up to 75% of the face value of the instrument.

Premature Encashment of OMP

In case of premature encashment the account holder or nominee should be paid after deduction of interest already paid to the account holder.

Target Group for OMP

- The primary target customers for this product would be Existing AB Customer, Salaried Individual, Senior Citizen, Self-employed Professionals , Proprietorships, Partnership firm and SME companies.

Table 14: Schedule of Examples of Earnings on OMP

| Tenure | 3-months | 6-months | 12-months |

| Interest rate, p.a. | 12% | 12% | 11.50% |

| Face value, BDT | 100,000 | 100,000 | 100,000 |

| Interest Payment, BDT | 3000 | 6000 | 11500 |

| Effective Rate of Interest, p.a. | 12.37% | 12.77% | 12.99% |

Millionaire Scheme Account (MSA)

It is a regular savings account with provision monthly savings for getting the one million on maturity. The monthly savings amount will be fixed based on the tenure of the scheme amount for accumulating deposit for one million. The objective to introduce this scheme is to increase the deposit base of AB Bank Ltd. at least by 2% in 2008.

3.4.10Features of MSA Deposit Scheme

- The depositor will deposit subscription/installment in every month.

- The monthly subscription shall be deposited by 6th (calendar date) of each month.

- Monthly deposit (installment) will be calculated based on tenure and interest rate including Govt. income @ 10%.

- At the end of the respective tenure total savings with interest after deducting of govt. tax will be approximately one million taka.

- Penalty for failing a month’s payment would be Tk. 400/-, Tk. 300/-, Tk. 250/- and Tk. 200/- per month for MSA of 3,4,5 and 6 year respectively. Failure to deposit monthly subscription for consecutive three months will lead to auto closure of the account. However if the depositor can justify and clear the arrears the branch manager may allow to continuation of the scheme.

- Customer will have to maintain a savings/ current/ std account with the same branch for making payment through standing instruction. Charge for such instruction and account maintenance charges on such such accounts(for a new customers) will be waived.

- The tenure of the scheme will be minimum 3 years to maximum 6 years.

- 12% for MSA for 3-4 years and 11.5% for MSA for 5-6 years, compounded annually.

- Any citizen of Bangladesh of age 18 years or more, minor (in which case it will be operated by there legal guardians) and institution are eligible to open MSA.

- The account holder must nominate one person. Nomination will not be required if operated on “Either or Survivor” basis in case of joint accounts.

- Govt. tax at source and excise tax shall be born by the depositor. Excise will be realized at the time of monthly payment of the last month of the year as an added amount.

- Loan/ overdraft facility may be allowed up to 90% of the deposited amount.

Table 15: Premature Encashment of MSA

| Encashment time since the first period | Applicable Interest Rate |

| Below 6 months | Nil |

| 6-months and more | Saving Accounts Interest Rate |

Table 16: Schedule of Earnings (Annual Compounding)

| Interest rate | Tenor (years) | Monthly savings | Total payment by customer | Gross interest earning | Approx Advance Income Tax (AIT) @ 10% | Approx Excise Duty | Customers returns net of AIT & Excise |

| 12% | 3 | 23602.00 | 849672 | 167039 | 16704 | 1,000,007 | 1250 |

| 12% | 4 | 16766.00 | 804768 | 216980 | 21698 | 1,000,050 | 1550 |

| 11.50% | 5 | 12836.00 | 770160 | 255426 | 25543 | 1,000,044 | 1800 |

| 11.50% | 6 | 12836.00 | 729936 | 300148 | 30015 | 1,000,070 | 2050 |

Procedure to open TMH, OMP & MSA

The procedure to open MSA will be same as DPS & MSDS. But for opening OMP & THM scheme AB bank follows the process to open a DPS account.

REMITTANCE SECTION

Local Remittance

AB Bank Ltd. sells and purchase P.O. and D.D. to its customers only. It does not offer remittance service frequently to those other than its customer.

Pay Order (P.O.)

Pay order is and instrument that is used to remit money within a city through banking channel the instruments are generally safe as most of them are crossed.

The procedure for selling P.O. is as follows:

- Purchaser deposits money with P.O. application form.

- Give necessary entry in the Bills Payable (P.O.) register;

- Prepare the instrument.

- After scrutinizing, two authorized officers sign the instrument and delivered to customer. Signature of customer is taken in the counterpart.

Charges for Issuing P.O.:

Table 17: Service Charge

| Tk. 1 to Tk. 10,000 ð Tk. 25/- |

| Tk. 10,001 to Tk. 1,00,000 ð Tk. 50/- |

| Tk. 1, 00,001 to Tk. 5, 00,000 ð Tk. 75/- |

| Tk. 5, 00,001 to above ð Tk. 100/- |

| Vat: ð 15% on commission amount |

Loss of Pay Order

If the instrument is lost, the holder is asked to fulfill the following requirements-

a) Holder should inform the bank immediately.

b) Record a GD (General Diary) in the nearest Police Station.

c) Furnish an Indemnity Bond.

On fulfilling the above requirements, AB bank is then issued a duplicate pay order and marked ‘In lieu of’. Banker will also mark ‘stop payment’ on the Bills Payable Register.

Collection of Pay Order

If the payee is a customer of Respective branch, he will deposit it for collection. Then the branch gives necessary endorsement as a collecting bank. Then the instrument places the issuing bank through clearing house.

Demand Draft (D.D.)

Demand Draft is very much popular instrument for remitting money from one corner of a country to another. The instrument is basically used for transfer and payment. Difference between pay order and demand draft is in terms of place only P.O. is used for remitting money within the AB whereas D.D. is used for within the country. D.D. too constitutes current liability on the part of a bank.

Procedures for issuing a DD:

- DD application from filled in and money deposited by the customer.

- Necessary entries are given in DD issue register. A number, which is taken from this register, is known as “Controlling number.”

- A test number is given to each DD based on its amount.

- A DD is signed by two authorized officers.

- DD is usually crossed “Account payee only”.

Charges for Issuing D.D.:

Service Charge:

| Tk. 1 to Tk. 10,000 | Tk. 10/- |

| Above Tk. 10,000 | 1 Tk. for every 1,000 |

| Vat | 15% of service charge amount |

CASH SECTION

Cash section demonstrates liquidity strength of a bank. It also sensitive as it deals with liquid money. Maximum concentration is given while wording on this section. As far as safety is concerned special precaution is also taken. Tense situation prevails if there is any imbalance in the case account.

Vault

All cash, instruments (P.O., D.D. and Check) and other valuables are kept in the vault is insured up to Tk. 60 Lac with local insurance company. If cash stock goes beyond its limit of Tk.60 Lac, the excess money is transferred to Bangladesh Bank if there is shortage of cash during transaction period money is transferred to drawn from the central bank. There are three keys of the vault, which are given to three seniors most officers. Daily, as estimated amount of cash brought out from the vault, for transaction purpose. No more than Tk. 4 crore brought at once from the vault, on a single day.

Teller Customer Relationship

In a bank a person who delivers and receives cash from the cash counter is known as teller, a customer meets most of the time in a bank with a teller on the counter. So, teller should hold certain quality

- Should be friendly.

- Provide prompt service.

- Be accurate in his task.

Cash Packing and Handling

Cash packing and handling needs a lot of care as any mistake may lead to disaster. Packing after banking hour when the counter is closed, cash are packed according to denomination. Notes are counted several times and packed in bundle, stetted and stumped with initial.

Evening Banking

“Evening Banking”, a unique service of AB Bank, only for receiving Cash and Documents beyond transaction hours till 6 o’clock in the evening, is available in all important Branches of AB Bank. The service is attractive for those, like shopkeepers, who accumulate cash as sales proceeds in the afternoon when counters of Bank branches usually remain closed.

OTHER FACILITY

Department of Clearing and Collection (C&C)

As far safety is concerned customers get crossed check for the transaction. As I known crossed check cannot be enchased for counter, rather it has through been collected through banking channel i.e. clearing. The clearing is the service that is provided by the bank through which clients can be benefited. It is generally used in collecting money from the different bank. It can be same bank or other bank.

Functions of Clearing and Collection:

- The entire clearing voucher must have to be checked carefully and accurately.

- The entire Inward Clearing Cheaque amount must have to be calculated whether the amount is accurate or not.

- All the things must have to entry in the Clearing and Collection Register respectively.

- Clearing cheaque name and the deposit slip name must be the same.

Agency Services

AB Bank, being a private Bank, has both commercial commitment to its clients and societal commitment to the nation. Besides catering service to its clients at nominal fees/charges the Bank has to provide a plethora of services, free of charges, in respect of transferring money to different benevolent organizations and groups of professionals in far flung areas through its branches in urban and rural areas all over Bangladesh.

Here below is a few of such services AB Bank Ltd. provides:

Collection of Utility bills:

- Telephone bills of T &T Authority without service charges

- CityCell Phone bills with service charge & other charges

- Electric bill of REB without service charges

- Electric bills of DESA without service charges

- Electric bill of PDB without service charges

- Electric bill of DESCO without service charges

- Bills of Railways without service charges

- Gas bill of Titas Gas, T& D Co. ltd without service charges

- Gas bill of Bakhrabad Gas Co. ltd without service charges

- Bill of Oil-bill of Meghna Petrolium Co. Ltd.

Card Division: of ABBL

AB Bank Credit Card is ‘any purpose’ revolving credit facility attached with Visa Card with monthly repayments as per the statements provided monthly. AB Bank Credit Card is issued to Primary or Supplementary Cardholder for use on the credit card account to avail services and/or to purchase goods and/or to draw cash on credit by properly presenting the same at the Merchant Locations/Bank ATM displaying Visa Logo.

Features of ABBL Credit card:

- Credit Limit: 1.0 to 3.0 times of the gross monthly income.

Minimum Tk.10, 000 and Maximum Tk.500, 000

- Interest Rate : 2.5% per month (to be charged monthly)

- Interest Free Period: Cardholders will get interest free period of maximum 50 days and minimum 20 days from the date of transaction.

- Type of Cards:

| Card Type | Minimum Limit | Maximum Limit |

| Visa Classic | Tk. 10,000.00 | Tk. 50,000.00 |

| Visa Gold | Tk.51,000.00 | Tk.500,000.00 |

- Card Validity: 36 months (3 years). Regular cardholders will automatically get renewal card after the period.

- Joint Applicant: Only individuals can apply for Credit Card. There is no provision for joint/co-application.

- Cash Withdrawal: 50% of approved credit limit is available for withdrawal via ATMs.

- Availability of ATMs : Cash withdrawal facility is available at the following types of locations:

a. ABBL ATMs

b. Q-cash ATMs

c. ATMs displaying VISA logo

- Availability of POS (VISA): ABBL Visa Credit Card can be used for purchase of goods or services at more than 10,000 merchant locations across the country. Cardholders need to look for is a Visa logo in front of the shop door or counter.

LOCKER SERVICE:

For safekeeping of customers’ valuables like important documents and goods like jewelries and gold ornaments, AB Bank Locker Service is available in this Branch. There 150 Lockers in this Branch. To open a locker the client should have a saving or current account with the bank.

Table 18: Service charge of Locker

| Nature of Service | Nature of Charges | Rate of Charges |

| Custody of Locker / Safe | Rent | a) Yearly TK.2000/= for small size locker with 15% VAT. b) Yearly TK.2750/= for medium size locker with 15% VAT. c) Yearly TK.6000/= for big size locker with 15% VAT. |

AB bank is providing insurance facilities to its customers. That is

| Locker Size | Insurance Amount |

| Small | 125000/- |

| Medium | 175000/- |

| Large | 250000/- |

Security money for all type of locker is Tk.2000/-, which is refundable.

5. CREDIT

DEFINITION OF CREDIT

In a financial system of any economy, financial surpluses mobilized from surplus economic unit and transferred to the deficit economic unit. In the banking world the bank mobilizes the fund from surplus economic unit as deposit & makes the fund available to the deficit unit. The style of making the fund available to the deficit unit is nothing but creation of credit.

Wealth maximization as well as profit maximization is the main objective of a bank. And to achieve this bank deploy the surplus fund to deficit economic units through credit deployment, so the more recoverable credit is deployed the more profit is gained. In fact this credit deployment process is being run under Loans & Advances department. The Loans & Advances department is very important part of the branch operation that also provides administrative support for the lending activities of the branch.

Factors Related with Credit

Credit policy is in true sense, making provision of fund by one party to another party under certain terms & conditions. Credit is a contractual agreement, in which a borrower receives something of value at present, with the agreement to repay the lender at some date in the future. So factors related to credit are

| Risk | Operating Expense |

| Time | Legal considerations |

| Interest Rate | Inflation |

| Security or Collateral | Finance Charges |

Mode of Credit in AB Bank Ltd

Loan and advances primarily have been divided into three major groups by AB Bank Ltd.

- Corporate Lending

- Small & Medium enterprise Lending

- Retail & Consumer Lending

LOANS AND ADVANCES OFFERED BY AB BANK LTD.

Corporate Lending

The business whose Turnover, Assets and number of employees and loan size is more than that of SME is know as corporate business. The loan facilities to this business unit are more than 5 core. Interest rate to this lending is 14% in 2008. But Rokeya Soroni Branch is not that much popular for corporate lending. Here only term loan under this corporate lending is given. But last year it is decreasing at a rate of 10.63%.Now 29% of the bank’s total loan portfolio is segmented to the corporate lending area.

Small & Medium enterprise Lending

SME has been segregated in two parts

- Small Enterprise (SE)

The client who will fulfill the following criteria shall be categorized as small enterprise

- Service Sector/ others:

| Turnover | Up to Tk. 500.00 Lac |

| Total Asset | Up to Tk. 100.00 Lac |

| No of Employees | Up to 30 |

| Loan Size | Up to Tk. 50.00 Lac |

- Trading

| Turnover | Up to Tk. 500.00 Lac |

| Total Asset | Up to Tk. 100.00 Lac |

| No of Employees | Up to 30 |

| Loan Size | Up to Tk. 50.00 Lac |

- Manufacturing

| Turnover | Up to Tk. 500.00 Lac |

| Total Asset | Up to Tk. 200.00 Lac |

| No of Employees | Up to 75 |

| Loan Size | Up to Tk. 50.00 Lac |

- Medium Enterprise (SE)

The client who will fulfill the following criteria shall be categorized as medium enterprise (ME):

- Service Sector/ others:

| Turnover | Up to Tk. 1500.00 Lac |

| Total Asset | Up to Tk. 500.00 Lac |

| No of Employees | Up to 100 |

| Loan Size | Up to Tk. 500.00 Lac |

- Trading

| Turnover | Up to Tk. 2500.00 Lac |

| Total Asset | Up to Tk. 500.00 Lac |

| No of Employees | Up to 100 |

| Loan Size | Up to Tk. 500.00 Lac |

- Manufacturing

| Turnover | Up to Tk. 2000.00 Lac |

| Total Asset | Up to Tk. 1000.00 Lac |

| No of Employees | Up to 500 |

| Loan Size | Up to Tk. 500.00 Lac |

In this changed scenario of increasing competition in the large loan sector and curtailment of single obligor exposure limit by the Bangladesh bank, it has become necessary to sift dependence from large corporate to the medium and small enterprises.

Presently AB Bank Ltd. is serving the SME clients by their regular loan products namely

- Overdraft

- time loan

- term loan

- Trust receipt

The interest rate by AB bank on the these products (in SME)

| Products | Interest Rate |

| Overdraft | 15% |

| time loan | 16% |

| term loan | 16% |

| Trust receipt | 16% |

In view of the above definition AB bank have segregated Rokeya Soroni Branch as SME branch as here the majority of the client fall in the above criteria. For this the total sanction limit is 20.43 core. The demand for SME loan is increasing day by day in this branch. The growth rate of the SME loan is 29.23%.Now 51.8% of the bank’s total loan portfolio is segmented to the SME lending area. Total interest income in 2008 was Tk.303, 54,000.

New SME loan products in AB Bank Ltd.

Within the framework of the SME sector, it has been felt that bank should have separate schemes for small and medium enterprises loan to be introduced to provide an impetus to the growth of SME loan portfolio as tapping customers from large enterprises is limited or even non existent. Necessity of such a scheme can be substantiated by the following rationales:

- There is a significant demand for such products in the market and to fill up a segment gap of AB bank’s portfolio

- Maximize the return from each customer by cross selling the new products to existing customers.

- Provide the range of lending products to meet customer’s needs so as to strengthen the banking relationship through the asset products

- Increasing and diversification of the asset portfolio.

- Empirically proven lower default rate of the small and medium size borrowers.

- Increasing borrower base.

- Increasing image of the bank

Substantiated by the above factors, the following loan schemes under the category of small and medium enterprise have been introduced.

| Product Name | Terms | Purpose | |

GATIBasic IdeaA loan facility for meeting regular as well as additional requirements of businesses; i. e, it will be part of working capital of the business.Maximum Loan AmountMaximum Tk.50.00 Lac

- Limit will be determined by the stock and/or volume of sales

- Maximum 80% of the stock value to be financed

Interest rate15% p.a. to 17% p. a.Service charge1.00%TenorMaximum 3 earsRepaymentThrough EMI/ Lump sum (No Moratorium)Security and/or

Collateral

- Hypothecation of stock and/or receivables

- Registered mortgage of land and buildings and/or Tripartite agreement for the shop and/ or business premises and/or any other collateral.

Product Name TermsPurpose

ProsharBasic IdeaIt is a long term financing for infrastructure development / capacity building etc.; i.e.Maximum Loan AmountMaximum Tk.50.00 Lac

- Loan amount will be maximum 80% of the proposed additional investment/expenditure.

Interest rate15% p.a. to 17% p. a.Service charge1.00%TenorMaximum 3 yearsRepaymentThrough EMI

(Moratorium period: Maximum 6 months)Security and/or

CollateralHypothecation of stock and/or receivables and/or machines and/or furniture and fixture etc.

Registered mortgage of land and buildings and/or Tripartite agreement for the shop and/ or business premises and/or any other collateral.

| Product Name | Terms | Purpose |

DigunBasic IdeaDouble amount of loan against value of the savings instrument (AB Bank FDR. DDS)Maximum Loan AmountTk.10 Lac to Tk.50.00 LacInterest rate8.00% above the instrument interest rate p.a. subject to minimu loan interest rate of 17% p.a.Service charge1.00%TenorMaximum 3 yearsRepaymentThrough EMI/lump sumSecurity and/or

Collateral

- Hypothecation of stock and/or receivables

- Lien of savings instrument (AB bank FDR, DDS) covering minimum 50% of loan size.

- Guarantee of the spouse of the borrowers

- One 3rd party guarantee.

ConditionDeposit instrument will not be realized before adjustment of the loan.

| Product Name | Terms | Purpose |

ShathiBasic IdeaTerm loan for CNG refueling conversion, light engineering or project finance (Package Deal including Non-funded)Maximum Loan AmountMaximum Tk.50.00 Lac

- Loan amount will be maximum 90% of the value of the imported and/or locally procured machineries.

Interest rate15% p.a. to 17% p. a.Service charge1.00%TenorMaximum 3 yearsRepaymentThrough EMISecurity and/or

Collateral

- Hypothecation of stock and/or receivables

- Registered Mortgage of project land and building; additional land (if required).

- Guarantee of the spouse of the proprietor/ guarantee of the directors.

| Product Name | Terms | Purpose |

|

Chhoto Puji | Basic Idea | Mortgage free term loan for working capital/ fixed investment requirement. |

| Maximum Loan Amount | Maximum Tk.10.00 Lac(Tk. 10 Lac for urban and Tk. 5 Lac for Rural)

| |

| Interest rate | 17% p. a. | |

| Service charge | 2.00% | |

| Tenor | Maximum 3 years | |

| Repayment | Through EMI | |

| Security and/orCollateral |

| |

| Condition | Letter of comfort from the local trade body/union Parishad to be taken. (format to be vetted by leal advisor) |

| Product Name | Terms | Purpose |

|

Uddog | Basic Idea | Loan for new entrepreneur/ business. (for working capital as well as fixed capital.). |

| Maximum Loan Amount | Maximum Tk.50.00 Lac. | |

| Interest rate | 15% p.a. to 17% p. a. | |

| Service charge | 2.00% | |

| Tenor | Maximum 3 years | |

| Repayment | Through EMI | |

| Security and/orCollateral |

|

| Product Name | Terms | Purpose |

|

Aparajita | Basic Idea | a long facility for meeting working capital requirement as well as fixed investment in business for women entrepreneurs. |

| Maximum Loan Amount | Maximum Tk.50.00 Lac

| |

| Interest rate | 14% p.a. to 16% p. a. | |

| Service charge | 1.00% | |

| Tenor | Maximum 3 years | |

| Repayment | Through EMI/ lump sum.(Moratorium period: Maximum 6 months) | |

| Security and/orCollateral |

|

Case on SME Loan

Mr. Mainul Islam get a revolving time loan of 10 lac and a overdraft facility of 15 lac. His revolving time loan is for three months. For some reason he cannot give payment within the banking hour of the scheduled date. Then he told (over phone) the credit relation officer to adjust the revolving time loan by his overdraft account. He fulfilled the requirement of revolving time loan on time without any hassle. And after the scheduled date he withdrawn the amount and deposited in the overdraft account.

Explanation

In revolving time loan, the borrower can take the same amount loan again as revolving time loan after the full payment of the principle amount and the interest amount. But if he cannot pay on time, he will be marked and for further loan procedure will be harder for him.

Here the borrower was adjusting his OD with the revolving time loan account to get the facility as a good borrower. The credit relation officer did this adjustment through the computer posting. The borrower didn’t need to come to bank. After the day again the officer deposited the due amount in OD account through computer posting.

Here the borrower got the good title without any hassle. He just had to pay the interest on the overdraft amount for one day only. And doing this he can use the loan amount further.

Why the credit officer did this arrangement?

The branch has to give the total health report to the head office after every three months. If he shows that the dues are not cleared on time the branch’s performance as well as the officer’s performance will be marked. On the other hand if he marked the borrower for not payment in due time, the head office will not sanction loan to that borrower very easily. And so the branch may loose the good relation with the customer. That’s why the credit officer is permitted to do this type of adjustment. Normally this adjustment is allowed when it is done by the client himself. But for the betterment of both the client and the branch’s image this type of adjustment by the credit officer is permitted unofficially.

Retail Banking

Retail banking refers to banking in which banks undergo transactions directly with consumers rather than corporations or other banks. Individual loans, retail banking and consumer loans shall be categorized as retail and consumer banking. In Rokeya Soroni Branch this retail banking is providing through Consumer Credit Service. The products under this banking are given below

Unsecured Loans

| Product Name | Personal Loan |

| Target Customer | Employees of reputed Local Corporate, MNCs, NGOs, Airlines, Private Universities, Schools and Colleges, International Aid Agencies and UN bodies, Government Employees, Self-employed Professionals (Doctors, Engineers, Chartered Accountants, Architects, Consultants), Businessmen. |

| Purpose | Marriages in the family, Purchase of office equipment / accessories, Purchase of miscellaneous household appliances, Purchase of Personal Computers, Purchase of audio-video equipment, Purchase of furniture. |

| Loan Amount | Minimum Tk. 25,000.00-Maximum Tk. 5,00,000.00 |

| Charges | Application fee: Tk. 500.00. Processing fee: 1% on the approved loan amount or Tk. 2000.00 whichever is higher |

| Tenor | Min 12 months-Max 36 months |

| Rate of Interest | 14.50% p.a. – 17.50% p.a. |

| Security | Hypothecation of the product to be purchased. Two personal guarantees (as per our list of eligible guarantors) |

| Product Name | Auto Loan |

| Target Customer | Employees of reputed Local Corporate, MNCs, NGOs, Airlines, Private Universities, Schools and Colleges, International Aid Agencies and UN bodies, Government Employees, Self-employed Professionals (Doctors, Engineers, Chartered Accountants, Architects, Consultants), Businessmen |

| Purpose | To purchase Brand new vehicle, non-registered reconditioned vehicle |

| Loan Amount | 70% for the brand new car & 60% for the reconditioned car but must not exceed BDT 10,00,000.00 |

| Charges | Application fee: Tk. 500.00. Processing fee: 1% on the approved loan amount or Tk. 5000.00 whichever is higher |

| Tenor | For Reconditioned Car: Max 36 months & For Brand new Car: Max 60 months |

| Rate of Interest | 14.50% p.a. – 17.50% p.a. |

| Security | Hypothecation of the vehicle to be purchased. Two personal guarantees (as per our list of eligible guarantors) |

| Product Name | Easy Loan (For Executives) |

| Target Customer | The loan is specially designed for salaried people who are employed in different reputed companies |

| Purpose | Marriages in the family, Purchase of office equipment / accessories, Purchase of miscellaneous household appliances, Purchase of Personal Computers, Purchase of audio-video equipment, Purchase of furniture, Advance rental payment, Trips abroad, Admission/Education fee of Children etc. |

| Loan Amount | Minimum Tk. 50,000.00-Maximum Tk. 3,00,000.00 |

| Charges | Application fee: Tk. 500.00.Processing fee: 1% on the approved loan amount or Tk. 1000.00 whichever is higher |

| Tenor | Min 12 months-Max 36 months |

| Rate of Interest | 16.00% p.a. |

| Security | Letter of confirmation from the employer. One personal guarantee (as per our list of eligible guarantors) |

| Product Name | House/Office Furnishing/Renovation Loan |

| Target Customer | Expatriate Bangladeshi nationals who are in business or service holders. Employees of reputed Banks & Leasing companies, reputed Local Corporate, MNCs, NGOs, Airlines, Private Universities, Schools and Colleges, International Aid Agencies and UN bodies. Government Employees. Self-employed Professionals (Doctors, Engineers, Chartered Accountants, Architects, Consultants). Reputed and highly respectable Businessmen with a reliable source of income |

| Purpose | House/Office Furnishing/ Renovation, For interior decoration / Titles Stones, Electrical fittings, wooden cabinets / Overall furnishing and all types of House/Office Renovation, purchase/furnishing of apartments etc. |

| Loan Amount | Minimum Tk. 1,00,000.00 Maximum Tk. 10,00,000.00 |

| Charges | Application fee: Tk. 500.00 Processing fee: 1% on the approved loan amount or Tk. 2000.00 whichever is higher |

| Tenor | Min 12 months Max 48 months |

| Rate of Interest | 16.50% p.a. |

| Security | Title deed of the House/Office to be furnished/renovated along with memorandum of deposit of title deed duly supported by a notarized power of attorney to be kept by the bank as a matter of comfort. Two personal guarantees (as per our list of eligible guarantors). Registered mortgaged of the property if the loan amount is more than Tk. 5.00 lac |

| Product Name | Staff Loan |

| Target Customer | All permanent employees of ABBL |

| Purpose | Marriages in the family, Purchase of office equipment / accessories, Purchase of miscellaneous household appliances, Purchase of Personal Computers, Purchase of audio-video equipment, Purchase of furniture |

| Loan Amount | According to the debt burden ration and other criteria |

| Charges | Processing fee: 1% on the approved loan amount |

| Tenor | Min 12 months Max 36 months |

| Rate of Interest | 15.50% p.a. |

| Security | Hypothecation of the product to be purchased |

Secured Loans

| Product Name | Personal Loan |

| Target Customer | All Clients of ABBL |

| Purpose | To meet personal requirement of fund |

| Loan Amount | Maximum 95% of the present value of the security |

| Charges | Processing fee: Tk. 1000.00 |

| Tenor | Min 12 months Max 36 months |

| Rate of Interest | 13.50% p.a. – 16.50% p.a. (subject to type of the security). 2% spread must be maintained in case of own bank FDR |

| Security | Lien over FDR, BSP, ICB Unit Certificate, RFCD, NFCD, CD account(s) etc. One personal guarantee in case of third party cash collateral (as per our list of eligible guarantors) |

| Product Name | Personal Overdraft |

| Target Customer | All Clients of ABBL |

| Purpose | To meet personal requirement of fund |

| Loan Amount | Maximum 95% of the present value of the security |

| Charges | Processing fee: Tk. 1000.00 |

| Tenor | Revolving with annual review |

| Rate of Interest | 13.50% p.a. – 16.50% p.a. (subject to type of the security). 2% spread must be maintained in case of own bank FDR |

| Security | Lien over FDR, BSP, ICB Unit Certificate, RFCD, NFCD, CD account(s) etc. One personal guarantee in case of third party cash collateral (as per our list of eligible guarantors) |

In Rokeya Soroni branch lending under consumer credit service is increasing at a very high rate. Now 19.73% of the bank’s total loan portfolio is segmented to the retail lending area. The reason behind this high rate is the socio economic condition of Shewrapara area.

BASIC FUNCTION OF CREDIT DEPARTMENT:

The most important department of a Bank is Investment/Credit department. Basically this is the main source of income of the bank. All the investment decision is taking by this department. There are three section of the credit department. They are Credit Administration, Credit Processing and Documentation. All these three section of the department run together. The basic functions of this section are discus below.

Credit Administration:

This section at first contract with the prospective client and evaluate the business in which the client is engaged. The main job of Administration section is to flow up the loan accounts and maintain the classification status of the accounts. This section is also liable for recovering the loan. This section classified the loan on the basis of servicing the interest. If the client failed to serve interest 3 quarter consecutively, then the clients are reported as SMA (Special Mention Account), if the client failed to serve another 2 quarter’s interest, then the clients are reported as SS (Suspension Account) then the clients are reported as DF (Doubtful) account and finally the clients are reported as BL (Bad Loss) accounts. So the Stepwise process of loan classification is :

The numeric fig. shows that how many quarters to be need to classify the clients.

Table 19: Quarter-Wise Loan Classification

Quarter | Past due | LDOS | Rate to Ldos |

Mar-07 | 384.35 | 1283.92 | 29.93% |

Jun-07 | 388.82 | 1408.02 | 27.61% |

Sep-07 | 395.56 | 1650.13 | 23.97% |

Dec-07 | 377.13 | 2835.71 | 13.29% |

Form the table we have seen that about 29% of the total loan was reported as Past Due loan in Quarter March-2007 and it become only 12% in the last quarter. But the total amount in the past due papers has increased. The rate has declined due to increase in the total loan amount. It is mentionable that about 95% of the total classified loan goes to only one borrower.

The rate of classified loan has decreased but no significant recovery is made during the respective quarter. The rate has declined due to increase in the total loan amount. They should give all out effort to recover the classified loan.

Credit Processing:

Processing section prepared loan proposal. All the information of the loan client and his/her business are recorded by this section. The list of necessary documents/papers that is required to prepare a credit proposal:

- RFCL, Request For Credit Limit filled by the loan applicant. Basically the credit officer fills the RFCL on behalf of the client in our branch.

- Stock Report of the client

- Up-to-date Trade License and Rent Recite.

- CRG (Credit Risk Grading Score Sheet)

- Financial Statements of the Clients

- last one year transaction history

- Limit Utilization Sheet

- Valuation report of the mortgaged properties (I-20)

- Credit Memorandum

Finally a formal prescribed credit proposal is prepared by the credit officer and forwards the proposal with a forwarding letter duly singed by the Branch Head, Sub-Manager and the Credit in Charge.

Documentation Section

Documentation section is liable to maintain all the necessary documents along with the Mortgage Deed and others. The papers are

- Demand Promissory Note

- Letter of Agreement

- Letter of Hypothecation with Supplementary Documents

- Letter of continuity

- Notarized Irrevocable Power of Attorney

- Deed of Mortgage with Original Title Deed and Other Relevant Documents

- Pares of UP to Date Rent Receipt for the Creation of Registered Mortgage

- Insurance and Undertaking

This section also prepares monthly, quarterly, half yearly and yearly statements. This section cheek the authentication of the papers that has been submitted by the clients. Preparation of the sanction letter and preserve the sanction letter is also an important job for the section. All information regarding the clients is duly recorded in the section.

CREDIT RISK GRADING

Definition

Credit risk grading is a collective definition based on pre-specified scale and reflects the underlying credit risk for a given exposure. It deploys a number/ alphabet/ symbols as a primary indicator of risks associated with a credit exposure. It is the basic module for developing a credit risk management.

Functions of Credit Risk Grading

Well managed credit risk grading credit risk grading systems promote bank safety and soundness by facilitating informed decision-making. Grading systems measure credit risk and differentiate individual credit and groups of credits by the risk they pose. These allow bank management and examiners to monitor changes and trends in risk levels. The process also allows bank management to manage risk to optimize returns.

Use of credit risk grading

- The Credit Risk Grading matrix allows application if uniform standards to credits to ensure a common standardized approach to assess the quality of individual obligor, credit portfolio a unit, line of business, the branch or the bank as a whole.

- As evident, the CRG outputs would be relevant for individual credit selection, where in either a borrower or a particular exposure/ facility is rated. The other decisions would be related to pricing (credit-spread) and specific feature of the credit facility. These would largely constitute obligor level analysis.

- Risk grading would also be relevant for surveillance and monitoring, internal MIS and assessing the aggregate risk profile of a bank. It is relevant for portfolio level analysis.

How to compute credit risk grading

The following step-wise activities outline the detail process for arriving at credit risk grading.

Step-I: identify all the principle risk components

Credit risk for counter partly arises from an aggregation of the following:

- Financial risk

- Business/Industry Risk

- Management Risk

- Security Risk

- Relationship Risk

Each of the above mentioned key risk areas require be evaluating and aggregating to arrive at an overall risk grading measure.