Findings

From the Topic Analysis and Description Chapter of this Report, the overall process and the analysis of individual departments have been clarified. Now in the Findings Chapter, the Report will focus on the actual outcome that was the result of the topic analysis. This section of the Report will contain

The Industry Analysis which includes Industry Life Cycle Model, Porter’s Five Forces Model, The Role of the Key External Forces that have an impact on the Business Environment of ONE Bank Limited, Marketing Strategies of Bank Services implemented by ONE Bank Limited, Stages in Consumer Decision Making and Evaluation of Services, Service Development and Design of ONE Bank Limited, Gulshan Branch

4.1 Industry Analysis

An Industry can be defined as a group of companies offering products or services that are close substitutes for each other. Close substitutes here refer to products or services that satisfy the same basic consumer needs. In order to understand an entity’s business, one needs to take a closer look at the industry where the entity is operating. Here, the banking industry of Bangladesh will be analyzed through the usage of two models, namely Industry Life Cycle Model and the Porter’s Five Forces Model.

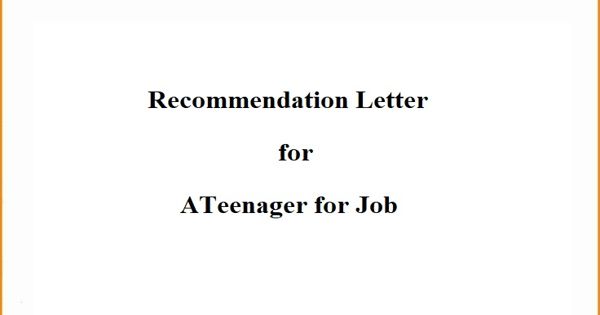

4.1.1 The Industry Life Cycle Model

The Industry Life Cycle Model is a useful tool for analyzing the effects of an industry’s evolution on competitive forces. Using this model, we can identify five industry environments, each linked to a distinct stage of an industry’s evolution. The stages are:

- Embryonic Industry Environment

- Growth Industry Environment

- Shakeout Industry Environment

- Mature Industry Environment

- Declining Industry Environment

It is very important for a business entity to have a clear idea regarding the industry life cycle. Each stage of the life cycle requires unique and differentiated strategy formulation. If we analyze all the characteristics of the Life Cycle Model, we can see that the banking industry especially the private commercial banks of Bangladesh are in growth stage.

The Industry Life Cycle Model

ONE Bank Limited falls in the Growth Stage of the Industry Life Cycle. Since its establishment in the year 1999, the bank has passed the Embryonic or the introduction stage. Through its services provided to the clients, OBL has been able to create the customer base required to run the banking services. OBL has developed their market position in the banking industry and have established itself in the Growth Stage of the Industry Life Cycle. (See Figure 35)

In the Growth Stage, OBL is marked by a rapid climb is the sales of the schemes it provides. Early adopters like the services and additional consumers start to buy the services. New competitors enter, attracted by the opportunities. OBL introduces new service features and expand the number of branches

In this stage, OBL uses several strategies to sustain rapid market growth as long as possible. Some of the possible strategies are:

- It improves the product quality that it offers to the client and adds new product features and improved styling of the branches.

- It enters new market segments and look for the opportunities to expand the customer base or the number of clients.

- It opens up new branches in the most attractive business centers, where the bank can create more businesses.

- It lowers price to attract the next layers of price sensitive buyers.

- Implies new and attractive promotional activities to attract the clients to render the services offered by OBL.

In the growth stage, the demand for the industry’s product begins to take off. It is quite evident that the demand for banking services in Bangladesh has increased gradually, throughout the years. The increasing number of banks and their differentiated offerings bolsters this fact. Rivalry among the competing banks is getting intense day by day. However, the rivalry among competitors in a typical growth industry is low. High rivalry begins at the shakeout stage. However, many authors do not distinguish between these two stages. The justification of low rivalry among companies is that all of them keep themselves indulged in market share building. As demand is ample and supply is comparatively low, anyone can enter the market and get their share of the profit. Banks in our country passed through that stage, and now the market is shrinking day by day. The growth rate has fallen, and slowly the demand is approaching the saturation point. Most banks have prepared themselves for the intense competition, which is the core characteristic of the shakeout stage. It is expected that interest rates and service charges for the different banking services will sharply decline in the coming years.

However, the Shakeout stage does not seem too far a reality and in order to maximize the profits and the turnover ration, ONE Bank Limited needs to further develop the strategies and innovate new product offerings for the clients. Creating loyal customer base should be the primary focus and the Marketing Mix identified should support the offerings well enough.

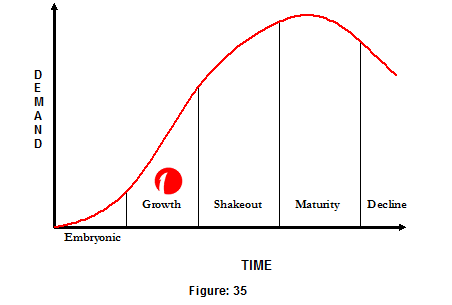

Competitive Analysis : Porter’s Five Forces Model and the key External Forces having an effect on ONE Bank Limited

4.1.2 Porter’s Five Forces Model

Porter’s Five Forces Model of competitive analysis is a widely used approach for developing strategies in many industries. The intensity among firms varies widely across different industries. In the banking industry, the competition level among the different pubic and private banks is also seen. Due to the emergence of many commercial banks in Bangladesh, there exists a competitive environment as all the banks try their level best to stay in the challenging competitive environment. (See Figure 36)

I have also considered the Porter’s Five Forces Model and the key external factors that effect the operations of ONE Bank Limited.

According to Porter, the nature of competitiveness in a given industry can be viewed as a composite of five forces. They five forces of Porter’s Model that have the effect on the operations of ONE Bank Limited are as follows:

4.1.2.1 Rivalry among Competing Firms

4.1.2.2 Threat of New Entrants

4.1.2.3 Bargaining Power of Buyers

4.1.2.4 Bargaining Power of Suppliers

4.1.2.5 Threat of New Substitutes

Porter argues that the stronger each of these forces is, the more limited is the ability of established companies to raise prices and earn greater profits. Thus, a strong competitive force can be regarded as a threat since it depresses profit. Similarly, a weak competitive force can be viewed as an opportunity, for it allows a company to earn greater profits.

4.1.2.1 Rivalry among Competing Firms

Rivalry among competing firms is usually the most powerful of the five competitive forces. The strategies pursued by one firm can be successful only to the extent that they provide competitive advantage over the strategies pursued by rival firms. Changes in strategy by one firm may be met with retaliatory countermoves, such as lowering prices, enhancing quality of services, adding features to the existing services and increasing promotional tools to attract customers.

The intensity of rivalry among competing firms tends to increase as the number of competitors increases. Such as the case for the banks in Bangladesh, where the competition is having effect on the banking industry and this environment is growing day by day. As the emergence of many new commercial banks has taken place, therefore the banks are trying to get the competitive advantage over their rival banks. By introducing new schemes and attracting customers through promotional activities, the banks are having a close and interactive competition in the industry.

Such is the case for ONE Bank Limited also. In the years of operation, since its establishment, the bank has faced stiff competition from the competing banks. To stay in the market, OBL has to concentrate on improving the quality of service and introduce attractive schemes and packages to attract new and retail the existing clients. Therefore continuous development and market research regarding the services offered has to be conducted.

The extent of rivalry among established companies within an industry is largely a function of three factors:

a) The Industry’s Competitive Structure

b) Demand conditions

c) The height of exit barriers in the industry

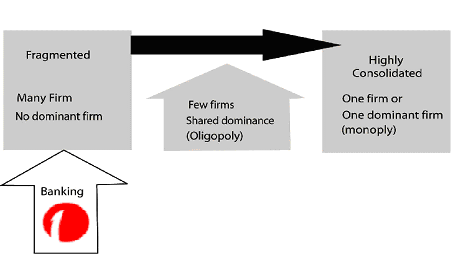

4.1.2.1.1 The Competitive Structure

Competitive structure refers to the number and size distribution of companies in an industry. Structures vary from fragmented to consolidated and have different implications for rivalry. (See Figure 37). A fragmented industry contains a large number of small or medium-sized companies, none of which is in a position to dominate the industry. A consolidated industry may be dominated by a small number of large companies (oligopoly) or in extreme cases, by just one company (a monopoly). In many countries, banking is a consolidated industry, with a few major players in the market. But in our country, the industry is very much fragmented, as a whole.

Competitive Structure of the Banking Sector

The prime characteristics of a fragmented industry are low entry barriers and identical product offering from the firms. Such is the case in our banking industry. Banks operate with pre-fixed and unanimously agreed interest rates, and their offerings are somewhat identical. The only way to differentiate product offerings from those of the competitors is to lower prices. Such phenomenon occurs as new entrants flood into a booming fragmented industry. This also creates excess capacity. A vicious price war is usually followed by the situation of excess capacity. It can be expected that our banking industry will experience severe price cuts in the following years. As a whole, a fragmented industry increases competition, and it also depresses overall industrial profitability.

4.1.2.1.2 Demand Conditions

An industry’s demand conditions are another determinant of the intensity of rivalry among established companies. Growing demand from either new customers or additional purchases by existing customers tends to moderate competition by providing greater room for expansion. Growing demand tends to reduce the rivalry because all companies can sell more without taking market share away from other companies. In the case of banking, the demand has been growing at a satisfactory rate, throughout the last decade. However, it is not certain whether the trend will sustain or not.

4.1.2.1.3 Exit Barriers

Exit barriers are economic, strategic and emotional factors that keep companies in an industry even when returns are low. If exit barriers are high, companies can become locked into an unprofitable industry in which overall demand is static or declining. The common exit barriers are:

- Investment in plant and equipment that have no alternative uses and cannot be sold off.

- High fixed costs of exit

- Emotional attachments to an industry

- Economic dependence on the industry

In order to keep up-to-date with today’s complicated banking practices, a bank needs to invest on computers, software, secured vaults, security systems and different other controlling and monitoring measures. Most of these assets are customized, and therefore serves the purposes of the intended organization, only. This customization invalidates the resell value of these assets.High fixed costs of exit can appear in the form of employee severance payments, and also in the form of government penalties, etc.

Many local banks of our country have become part of our everyday lives. Thus many people, both within the government and the mass have emotional attachments with these banks. This acts as a serious exit barrier for these banks. So, in spite of being highly inefficient and loss bearing, some banks are still operating.

Some banks are so big that shutting any of them will give a serious blow to our foreign and domestic trade. Such an occurrence can impact the whole economy.

4.1.2.2 Threat of New Entrants

Whenever new firms can easily enter a particular industry, the intensity of competitiveness among firm increases. New Entrants are companies that are not currently competing in an industry but have the capability to do so if they choose. The banking industry in our country is still in its growth stage. So the threat of potential New Entrants is quite high. Usually the existing companies try to deter potential competitors by setting certain entry barriers. Barriers to entry are factors that make it costly for companies to enter an industry. The common barriers to entry are Brand Loyalty, Absolute Cost Advantage, Learning Curve Effect, Economies of Scale and Government Regulations. In Bangladesh, the question of Brand Loyalty is somewhat evident in the banking industry. A person who is a loyal customer of a local or government owned bank usually does not prefer an account in a multinational bank, whatever lucrative the benefits seem. This creates barriers for new entrants. No bank enjoys an absolute cost advantage, due to the fragmented nature of the industry. Most of the government banks and some local banks enjoy learning curve effect as well as the scale of economy; due to the fact that they have been doing business for quite a long time, they have gathered a long time experience of operating in Bangladeshi environment, and they have branches all over the country. The multinational banks are also on the process of achieving scale of economy. The increasing number of branches supports this statement. Government regulation is quite supportive towards the formation and operation of new banks. So this factor is not a significant entry barrier in this sector. For ONE Bank Limited, there also exist Threats of New Entrants as these new banks sometimes enter the banking industry with higher quality products, lower prices and substantial marketing resources. Therefore, OBL has to concentrate on the current and future market condition so that new entrants do not penetrate the market and take the market share.

4.1.2.3 Bargaining Power of Buyers

When customers are concentrated or large or buy the products services in volume, their bargaining power represents a major force affecting the intensity of competition in an industry. Rival firms may offer extended warranties or special services to gain customer loyalty whenever the bargaining power of consumers is substantial. Bargaining power of consumers also is higher when the products being purchased are standard or undifferentiated. Bargaining power of the buyer can be viewed as a competitive threat when they are in a position to demand lower prices from the company or when they are in a position to demand better service that can increase operating costs. On the other hand, when buyers are weak, a company can raise its prices and earn greater profits. For the banking industry buyer means customers who take loan from the banks. The bargaining power of the buyers depends on the following factors

4.1.2.3.1 Number of Loan Applicants

There are more than 50 banks in our banking sector including multinational and nationalized banks. There are not enough original business loan applicants in our country. Investment opportunities are not growing as well; for lots of other factors. So, banks are setting with their idle money for giving loans; mostly in the form of personal credits. As a result, competition for doing business is increasing day by day among these established Banks.

4.1.2.3.2 Switching Cost

Switching cost is very low in banking industry. Every bank is giving the similar types of loan at similar interest rate. So, an individual who wants to take loan from banks can switch easily to other banks if he or she does not like the terms and conditions. Customers of many banks are switching to other banks because of low interest rate and lots of other reasons. Lower switching cost makes the industry more competitive.

4.1.2.3.3 Threat of Backward Integration

In banking industry, there is always a chance for threat of backward integrations. Big multinational companies or corporations can give threats to the commercial banks that they will arrange their funds by forming another bank by themselves, where the cost of fund is low compared to other banks. For this reason, giant customers of this industry always possess more power than their banks. However, the individual non-corporate clients do not possess this type of bargaining power.

4.1.2.4 Bargaining Power of Suppliers

The bargaining power of suppliers affects the intensity of competition in an industry, especially when there is a large number of suppliers, when there are only a few good substitute products or when the cost of switching the services is especially costly. Bargaining power of suppliers can be viewed as a threat when the suppliers are capable of forcing up the price that a company must pay for its inputs or reduce the quality of the inputs they supply, thereby depressing the company’s profitability. On the other hand, if suppliers are weak, this gives the company the opportunity to force down prices and demand higher input quality. For the bank the main supplier of fund is the depositor. Bank also gets its funds from the directors. So, the strength of the suppliers depends on the following factors:

4.1.2.4.1 Number of Supplier

Bargaining power of the fund suppliers is low in banking industry because there are lots of individual savings in the economy but banks don’t have too many opportunities for investment.

4.1.2.4.2 Threat of Forward Integration

Sometimes suppliers of funds can give threat to the bank as well. Corporations or big multinational companies can give threat to the private bank that they will form another bank for depositing their money. They will not supply any fund to other banks. We all know that bank makes money by investing other’s money. So, this can lead to a higher competition in procurement of fund.

Therefore, OBL have to be concerned about the issues of the suppliers in carrying out the day to day operations regarding the services provided to its valuable clients.

4.1.2.5 Threat of New Substitutes

In many industries, firms are in close competition with producers of substitute products and services in other industries. Competitive pressures arising from substitute products increase as the relative price of substitute products declines and as consumer’s switching costs decrease. Substitute products are those of industries that serve consumer needs in a way that is similar to those being served by the industry. Loans, the major banking product, have some substitutes. All informal sources and channels of financing are treated as viable substitutes. Some wealthy individuals lend out money at a very high interest rates. These loans do not often require securities, and also do not require any special conditions, e.g. age, certain service time, set monthly income, etc. which makes them a very lucrative option. However, most of these activities are illegal, and therefore bears high risk. For this reason, most people tend to avoid these channels. Thus it appears that the threat of substitute products is not that much prevalent in the banking sector of Bangladesh, till date.

4.1.3 The Role of the Key External Forces that have an impact on the Business Environment of ONE Bank Limited

The banking industry is not a self-contained entity. It is embedded in a wider macro environment

The External Forces that have an impact on the Business Environment can be divided into five broad categories. They are:

4.1.3.1 The Macro Economic Environment

4.1.3.2 The Technological Environment

4.1.3.3 The Social & Cultural Environment

4.1.3.4 The Demographic Environment

4.1.3.5 The Political/ Government/ Legal Environment

Changes in the macro environment can have a direct impact on the banking sector, improving or deteriorating the profitability of the sector, permanently or temporarily.

4.1.3.1 The Macro Economic Environment

The Economic Factors have a direct impact on the potential attractiveness of various strategies. The state of the macroeconomic environment determines the general health and well being of the economy. This in turn affects a company’s ability to earn an adequate rate of return. The four most important factors in the macro economy are:

4.1.3.1.1 The Growth Rate of the Economy

4.1.3.1.2 Interest Rates

4.1.3.1.3 Currency Exchange Rates

4.1.3.1.4 Inflation Rates

4.1.3.1.1 The Growth Rate

If the growth rate of the economy is high, consumer expenditure increases, which helps most businesses. However, the growth rate of our economy is moderate, which provides moderate opportunities for the banks to expand their operations and earn higher profits.

4.1.3.1.2 Interest Rates

Interest rate is very significant for the banking industry. At the moment, interest rate is quite high in our country, compared to neighboring countries. Most personal loans bear an interest rate of at least 12 to 14% and above. This high interest rate is increasing the short-term profitability of the industry, but in the long run, it is also acting as a hindrance towards building a better customer base.

4.1.3.1.3 Currency Exchange Rates

Movement in currency exchange rates has a direct impact on the competitiveness of a company’s product, especially in the global market place. Providing “Trade Services”, e.g. processing export-import documents, maintaining export and import formalities, etc. is a major business of the country’s banks. Thus the exchange rates of the major currencies, e.g. Dollar; Euro, Pound Sterling, etc. have a direct impact on the banking industry.

4.1.3.1.4 Inflation Rates

Inflation can destabilize the economy, producing slower economic growth, higher interest rates, and volatile currency movements. Throughout the last decade, the inflation rate has come under control in our country, making its detrimental effects less significant. Thus the banking industry is not experiencing that much of difficulties due to inflation.

4.1.3.2 The Technological Environment

Revolutionary technological changes and discoveries are having a dramatic impact on organizations.

The Internet is acting as a national and even global economic engine that is spurring productivity, a critical factor in a country’s ability to improve living standards and it is saving companies billions of dollars in distribution and transaction costs from direct sales to self service systems.

The Internet is changing the very nature of opportunities and threats by alternating the life cycles of products, increasing the speed of distribution, creating new products and service, erasing limitations of traditional geographic markets and changing the historical trade off between production standardization and flexibility.

Technological forces represent major opportunities and threats that must be considered in formulating strategies. Technological advancements can create new markets, result in a proliferation of new and improved products, change the relative competitive cost positions in an industry and render existing products and services obsolete. Technological changes can reduce or eliminate cost barriers between businesses, create shorter production runs, creates shortages in technical skills and result in changing values and expectations of employees, managers and customers. No company or industry today is insulated against emerging technological developments.

Technological changes can act as a barrier to entry in an industry. Previously, the usage of computers and electronic databases were unknown to most people of our country. But the scenario has changed a lot in the last 8 to 10 years. After the elimination of duties on computers and accessories, the price of personal computers fell sharply. This created a boom in the computer industry. Most households in Dhaka now have at least one personal computer. Nowadays, people expect swift, hassle free service from the banks. Even the old and nationalized banks are realizing this fact. Installing all the modern banking equipments and computer systems can result in high fixed costs. Thus technological environment acts as a high entry barrier, due to the increased cost for entrepreneurs to setup their own banks, in our country

Due to the innovation of new technological equipments and processes, ONE Bank Limited has also developed their practices with technologies. Online Banking, ATM, Swift, etc are all run by new technologies and the transactions are carried out and monitored through the bank’s software. Therefore in order to keep up with the pace of other banking houses, OBL needs to have a strong technological structure to assist the modern day banking service to its clients.

4.1.3.3 The Social & Cultural Environment

Social, cultural and environmental trends are the shaping the way people live in a country. New trends are creating a different type of consumer and consequently a need for different products, different services and different strategies.

As with technological change, social change creates opportunities and threats. Due to changes in cultural values and education, people trust the banks more than ever. Previously, bank loans were perceived as a mean of getting bankrupt, through paying excessive interests. But today’s 4 years installment personal loans are gaining popularity. Borrowers are still paying interests, but they are not being obliged to live with the loan burden for 10 to 15 years—it’s all over within a brief time frame. All these factors are contributing positively towards the banking industry.

In the last few years the trends in the banking industry have been evitable. New short term and long term schemes have been offered by different banks. The banks have focused strongly on the different saving schemes and ONE Bank Limited is also emphasizing to develop the new practice among the clients to take up these schemes. Young entrepreneurs are encouraged to take up loans, as SME Banking is turning out to be very popular among the schemes. In one way, the loan which acts as an investment by the borrower is contributing towards the development of the economy and on the other hand the bank is getting the profit out the interest charged against the loan issued by the borrower.

So, the Social and the Cultural Factors are also having an impact on the operations of the banks and the banks need to focus strongly on improving the service quality offered to the society.

4.1.3.4 The Demographic Environment

The Demographic changes have a major impact upon virtually all products, services, markets and customers. Small, large, profit and non-profit organizations in all industries are being staggered and challenges by the opportunities and threats arising from changes in demographic variables.

Currently, individuals are getting established at a younger age. These individuals are the prime targets of many of the banking services like credit cards, personal loans, car loans etc. Being younger in age, these individuals tend to spend more in luxury items, and they need to take loans in order to fulfill their desires. Realizing this opportunity, the banks cleverly brought out different loan schemes. This change in demographic environment has proven to be a great opportunity for the banks operating in Bangladesh and ONE Bank Limited is encouraging new individuals and entrepreneurs to take up loans to start up new ventures.

4.1.3.5 The Political/ Government/ Legal Environment

Federal, state, local and foreign governments are major regulators, deregulators, subsidizers, employers and customers of organizations. Political, government and legal factors therefore can represent key opportunities or threats for both small and large organizations. Changes in government rules and regulations can have an impact on the overall performance of the business. Banks are also affected due to the changes in policies and rules.

The political and legal environment of Bangladesh has never been impressive. This volatile environment creates a lot of difficulties for banks. Due to lack of law enforcement, the percentage of defaulted business loans had been historically high in our country. American Express Bank was compelled to shut down their corporate banking due to high number of defaulted loans. They simply got fed up while dealing with such troublesome customers. It is easy to recover loan money from small customers than from big companies, who are generally favored by the corrupt law enforcement agents of our country. This has become a very frustrating scenario for both the banks and for those people who genuinely need money for doing business. Neither party can fully trust the other. Unwanted strikes, hartals and political unrests have harmed the business of the banks as well. If the political and legal environment does not improve significantly, the banking industry’s performance will definitely be below par, in future.

ONE Bank Limited, being a commercial bank in our country, is also entitled to follow the set of rules and procedures given by Bangladesh Bank and the local government. So, changes in the Political/ Government/ Legal Environment have to be faced by the bank and take measures according to the rules given by the authority.

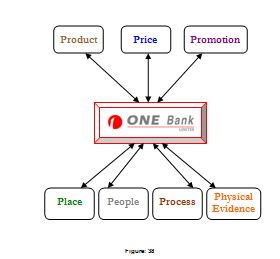

4.2 Marketing Strategies of Bank Services implemented by ONE Bank Limited

Marketing of bank services refers to the process of gearing the operation of a bank to serve the needs of its customers, potential customers and general public. It is the entire banking operation looked at from the standpoint of the customers, potential customers and the general people. Thus marketing of bank services does not mean development of new services only, but it is to make endeavor to produce and provide services to the customers according to their needs and satisfaction, whether new or existing.

Marketing Strategies are being followed by OBL as well as any other firm. Marketing strategies are the key factors in achieving a bank’s goals and objectives by way of giving various services to its customers, potential customers and general people. It is very important for a bank to determine its marketing strategy critically and more rationally so that the strategies formulated and implemented are realistic and practical in nature.

The Banks are engaged in marketing their services; so banking is categorized under the service marketing strategy. (See Figure 38)

The service marketing strategy follows 7 Ps of Marketing Mix. They are:

Product

Price

Place

Promotion

People

Process

Physical Evidence

Marketing Strategies of ONE Bank Limited

4.2.1 Product

All business concerns earn a profit through selling either a product or a service. A bank does not produce any tangible product to sell but does offer a variety of financial services to its customers. Similarly ONE Bank Limited offers the desired services to its clients as the other banks. General banking is the starting point of all the banking operations. It is the department, which provides day-to-day services to the customers. Everyday it receives deposits from the customers and meets their demand for cash by honoring Cheques. It opens new accounts, remit funds, issue bank drafts and pay orders etc. The credit department of the OBL offers several attractive credit facilities to give financial support to the customers. To facilitate the import and export procedure the Foreign Exchange department offers many other financial services.

All the banks offer similar products or services. But the challenge is, how to differentiate these similar services compared to others and how to make these services attractive to the customers. For this purpose, the Banks are trying to improve their service quality as well as providing timely service.

4.2.2 Price

Price is a vital issue for in case of providing banking services. Almost all banks offers similar price. So the competition among the banks regarding price is very high. Each bank tries to attract the customers by reducing their price of services. But it is quite tough to gain profit by reducing price in the banking sector. So number of well-known banks are trying to provide high quality service in a timely manner and charging a reasonably higher price to earn profit. Being a third generation bank where there are many private commercial banks operating, the area is very competitive. To stay up with the competition with the other banks, OBL also tries to fix the price of the services at the reasonable price compared to other banks. Competition based pricing method is usually followed by the bank, where the services are standard across the other commercial banks.

4.2.3 Place

Place is the branches and head office where the customer can get the service. At present ONE Bank Limited has 25 branches, 12 branches are situated within Dhaka City and the remaining 13 branches are situated in different commercial areas of the country, which reflects that OBL are eager to provide their services all around Bangladesh. In Dhaka city all of the branches are situated in the commercial and busy areas where people can render the financial services most. As the main commercial zones attract new and existing businesses, therefore in order to facilitate trade and commerce in respective areas, OBL has established branches to provide the financial services to the clients. ONE Bank Limited, Gulshan Branch is considered to be one of the most priority and important branch in terms of trade and financial services to the clients. Considering the importance of the location OBL has established their branches and in future the bank is looking forward in setting up more branches in the business highlighted zones.

4.2.4 Promotion

The application and use of modern day promotional tools are considered to be very important for any organization. Especially in Banking Services promotion plays a major role in marketing the services to the clients. The clients are being known about the services offered by the banks through the awareness programs created by the banks. Without having a proper promotional campaign and awareness programs, it becomes difficult for any bank to attract the customer. Similarly, ONE Bank Limited also carries out promotions to make the new and existing customers aware of the different schemes and packages. In different occasions of the bank, OBL gives advertisements in the newspapers, provides press release to the paper to inform the citizens what they are now doing at moment. In different areas they provide billboards, this step is taken to fulfill its objective to popularize the bank. Leaflets and brochures are also being supplied to the clients to make them aware of the new schemes and packages offered by OBL. In Gulshan Branch, customers are often given leaflets and any queries of the customers are answered by the respective employees. Personal Selling through the Retail Banking Department is also carried out in ONE Bank Limited, Gulshan Branch. Organized steps regarding the promotional activities can be beneficial for the bank.

4.2.5 People

From the beginning of the bank, the authority of the bank believes that highly qualified, energetic, enthusiastic, cooperative employees can improve the bank’s services in the modern day competition. That is why the authority recruits those people who have these qualities. The recruitment procedure of OBL is therefore done and the employee selection process is carried out in an extensive manner. Once the employees are selected, the bank posts the employees in the respective departments in the different branches based on their skills and qualifications.

The bank also arranges training programmes for the employees to develop their skill and knowledge regarding the subject manner in which the employees work. Similarly, in Gulshan Branch, different levels of employees are offered training programmes at different times. Motivation and rewards are also offered to the employees and good performance at constant level can result for promotion for the employees.

4.2.6 Process

The banking services by nature have very lengthy and time consuming processes and these processes are quite sensitive, because it involves financial transactions and any mistake can cause serious loss as well as can hamper reputation of the Bank. While dealing with the clients and offering services, the employees have to be very careful. To eliminate or reduce the chance of mistakes and provide smooth services ONE Bank Limited is providing latest technology in their branches. Each and every transaction is closely monitored and proper filing of the required documents of the clients is carefully done. In Gulshan Branch, clients have developed a well maintained relationship with the employees, as they have been offered the high services by the employees through the delivery of work. Customer satisfaction is considered to be the primary focus and the employees of Gulshan Branch have tried their level best to achieve the acclamation through the services that are provided.

4.2.7 Physical Evidence

Physical Evidence nowadays has proved greater impact on the organization’s performance. It is the environment in which the service is delivered and where the firm and the customer interact and any tangible components that facilitate performance or communication of the service. The “Servicescape” where the employee of the bank interacts with the customers, is to be considered as a vital component for any bank when they render service to the clients. OBL have given considerable concentration over the years of operation towards the facility design and the equipments used. Red, which is the base color of OBL have been used for the color of furniture available at different branches. This unique color has created a distinctive image in the customer’s mind. Proper signages of the facilities in different branches are maintained in order to make it easier for the customers who are looking for different services. The employees are also well dressed in formal attires for both the male and female employees working in the bank.

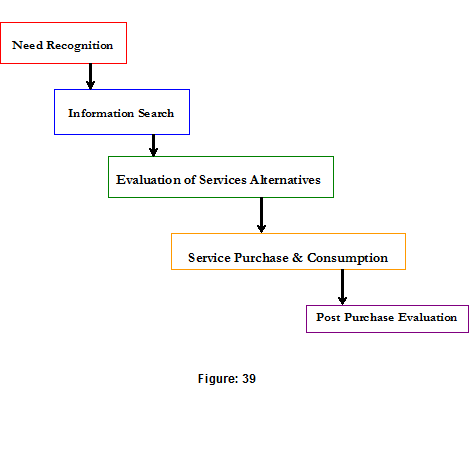

4.3 Stages in Consumer Decision Making and

Evaluation of Services

4.3.1 Need Recognition

The process of buying a service begins with the recognition that a need or want exists. The customers of bank feel the need of their desired services and their need recognition for a particular service or bundled of services arises. When the customers need any kind of financial services, they take the assistance of the services offered by the banks. Similarly, the customers of ONE Bank Limited at the initial stage, recognizes their respective needs and wants.

4.3.2 Information Search

After the customer identifies their respective needs and wants, they obtain information about the desired products and services from the personal sources (like friends, family members or experts) and from non-personal sources (such as mass or selective media). When purchasing services, consumers seek and rely largely on personal sources. Customers of banks usually looks for the service offers such as packages and schemes offered by the banks, compare the interest rates and seek benefits offered by the banks. The customers also evaluate the perceived risks involved for the services that they desire to purchase. After the customers have gathered the information, they now make the choice that which bank offers them better packages at the reasonable price.

4.3.3 Evaluation of Services Alternatives

After the information is gathered, concerning the services offered by the different banks, the customer considers the acceptable option from the group of services. In order to purchase a banking product or services, the customers visit the banks and make the choices based on the personal experience or visit. As there are many banks offering similar kind of products and services in a given geographic area, the customers have many alternatives to choose the desired bank. For example, in the Gulshan Avenue, there are branches of many banks and among the banks; the services are more or less similar. Therefore, the customers have to choose the best possible bank to render the service offered by the bank.

4.3.4 Service Purchase and Consumption

After the customer, evaluate the alternatives and choose the best possible bank, that serves the need of the customer, it is now time for making the decision by the customer to purchase the desired service. When customers visit a bank and seeks all the information available practically, the customer approaches for the actual consumption. For example, a customer is in a requirement of taking a loan for some reasons, may apply to many banks, but choose a particular bank to get the loan as it offers favorable terms and conditions against the loan offer. Therefore, considering the long-term benefits and advantages the customer purchase the services offered by a bank.

4.3.5 Post Purchase Evaluation

After the customer purchase the service offered, the customer now becomes an actual client of a bank. The banks usually treat their clients with the best possible solutions available. To retain the existing clients and attract potential clients in future, have to be evaluated by the bank. The clients always appreciate better quality of service encounters. Favorable interactions of the employees will create brand loyalty and help the bank to increase the brand image.

Clients of ONE Bank Limited are always given the top priority and any problems faced by the clients are solved as early as possible by the bank authority. The new concept Know Your Customer (KYC) is being practiced in ONE Bank Limited where customer details and profiles are kept. This introduction of the concept has been able to make effective post purchase evaluation of the services and in the long run can benefit both the client as well as the bank.

4.4 Service Development and Design of

ONE Bank Limited, Gulshan Branch

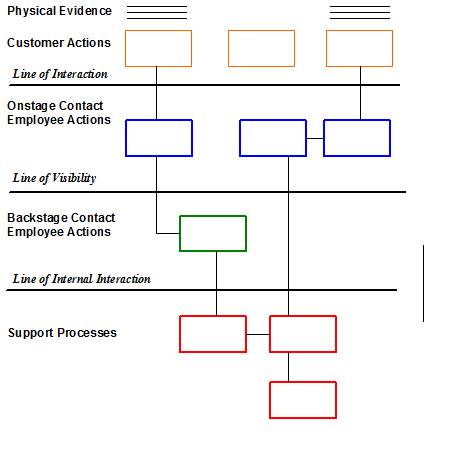

4.4 Service Blueprinting

A service blueprint is a picture or map that accurately portrays the service system so that the different people involved in providing it can understand and deal with it objectively regardless of their roles or their individual point of view. Blueprints are particularly useful at the design and redesign stages of service development. A service blueprint visually displays the service by simultaneously depicting the process of service delivery, the points of customer contact, the roles of customers and employees and the visible elements of the service.

ONE Bank Limited being a service providing organization also maintains Service Blueprint in the branches. The key components of service blueprints followed in the Gulshan Branch are shown in the Figure 40. They are Customer Actions, “Onstage” contact Employee Actions, “Backstage” contact Employee Actions and Support Processes.

Service Blueprint Components

4.4.1 Customer Actions

Customer Action area encompasses the steps, choices, activities, and interactions that the customer performs in the process of purchasing, consuming and evaluating the service. Clients of ONE Bank Limited, Gulshan Branch come to the counters to deposit their money, withdraw cash, write pay order or take any kind of financial service offered by the bank. They meet face to face with the employees and take the required service from the employees.

4.4.2 Onstage Employee Actions

Paralleling the customer actions are two areas of contact employee actions. The steps and activities that the contact employee performs that are visible to the customer are the Onstage Employee Actions. The customers or the account holders of ONE Bank Limited, Gulshan Branch comes in contact with the employees, who are directly interacting with the clients, such as in cash section, general banking, etc.

4.4.3 Backstage Contact Employee Actions

Those contact employee actions that occur behind the scenes to support the onstage activities are the Backstage Contact Employee Actions. In the example of ONE Bank Limited, Gulshan Branch, the employees of the front desk comes into contact with the backstage employees to facilitate the services and provide better assistance to the clients. The front desk employees give the work to the backstage employees, to process the work further for better and faster delivery of output.

4.4.4 Support Processes

The Support Processes section of the blueprint covers the internal services, steps, and interactions that take place to support the contact employees in delivering the service. In ONE Bank Limited, Gulshan Branch, the support process activities are carried out by the higher officials who make the critical decisions regarding any issues. They internally support the employee actions, which are not seen by the customers sometimes.

The four key action areas are separated by three horizontal lines. First is the Line of Interaction, representing direct interactions between the customer and the organization. Anytime a vertical line crosses the horizontal line of interaction, a direct contact or a service encounter between the customer and the bank has occurred. The next line is the critically important Line of Visibility. This line separates all service activities that are visible to the customer from those that are not visible. The third line is the Line of Internal Interaction, which separates contact employee activities from those of other service support activities and people. Vertical lines cutting across the line of internal interaction represent internal service encounters.

![Report on One Bank LTD [Part-3]](https://assignmentpoint.com/wp-content/uploads/2013/03/one-bank1.jpg)