Introduction:

Interest has been most controversial topic in the whole theory of distribution. Economists have differed regarding the nature of interest as well as how it is determined. In fact the subject of interest is sum an unsettled question of economics. The very definition of interest depends on the interest theory which one accepts. Those, who believe in the classical or real theory, regard interest as payment for the use of capital goods. They also believe that interest is necessary to induce people to save. The followers of liquidity preference theory believe that interest is a piece for surrounding liquidity preference. Still others who accept the loan able funds theory hold that interest is the price paid for the use of loan able funds. Just as rent is a payment for the use of land, similarly interest is a payment for the use of capital. In Marshall’s words interest is “the price paid for the use of capital in any market”. Just as wage is the price of the service of labor, similarly, interest is the price of capital. It is expressed as a percentage return on capital invested after allowing for risks of investment. Samuelson define interest thus “the market rate of interest is that percentage return per year which has to be paid on any safe loan of money, which has to be paid on any safe loan money, which has to be yielded by any safe bond or other type of security and which has to be earned on the value of any capital asset (such as a machine, a hotel building, a patent right) in any competitive market where there are no risks or where all risk factors have already been taken care of by special premium payments to protect against risk.”

Interest rate:

Banks are free to fix their deposit and lending rates; however. The Bangladesh bank has been pursuing the banks to reduce highest lending rate to single digit. The Bangladesh Bank revised the Bank rate downward from 6 percent to 5 percent in November 2003. Banks are allowed to differentiate interest rates by 3 percentage points considering comparative risks involved among borrowers in the same lending category. The interest rate policy pursued by the Bangladesh Bank appears to be effective in stimulating economic activities in general. Capital market has registered significant growth in terms of share price index as well as market capitalization. The weighted average deposit tare, lending rate and spread of the banks came down to 5.65, 11.01 and 5.36 percent and 6.06 as of December 2002. This trend is likely to continue and would certainly result in better operational performance of the banks in term of recovery and profitability.

Difference in interest Rate:

There is an element of monopolistic competition in the money market inasmuch as different borrowers are charged different rates of interest. It may be noted, however, that pure interest tends to be the same, if calculated over the same period of time in the same money market. The actual differences that prevail are differences in gross interest. In other words, they are due to difference in the degrees of risk involved and inconveniences suffered by the lenders.

Difference in pure interest

Pure interest may be different in different investments when the market is not the same owing to the following reasons: –

- Difference due to distance: – people are usually more willing to invest their capital nearer home than at a long distance. This may crate difference in supply and demand due to the comparative immobility of capital.

- Difference due to time: – If people have to part with their money for a longer period, they expect higher rate of interest even though risk and other factor are remains same. Of course if money is lend for very short periods and has to be re-lent again and again, the inconvenience of management will increase gross interest. But that will not be net income.

- Difference due to the amount of the loan: – it is generally seen that the rate of interest varies inversely with the amount of the loan. The rate decreases as the amount of the loan increase, and vice versa.

- Differences in liquidity: – By liquidity we mean the ease with which the loan given can be called back or the ease with which an asset like securities can be sold without monetary loss when its owner requires cash. The sale of some securities may involve delay, cost or capital loss, while others may loss. The more liquid securities will carry a lower rate of interest and vice versa.

- Maturity Period: – Other thing being equal, long term loans will carry higher rates of interest than do short term loans, since the long term lenders suffer greater inconvenience and possible financial sacrifice of foregoing alternative uses for their money for a longer period of time.

- Market imperfection: – We can define this by an example, a bank in a small town, which has a monopoly in the local money market, may charge a higher rate of interest from the local people, because there the people find it very inconvenient to “shop around” at banks in distant cities. That means a bank can charge a higher interest if they have a monopoly market.

Difference in gross interest

Difference in gross interest may, in addition to the causes already considered, be due to: –

- Difference in social esteem: – A person with batter reputation or integrity can borrow at lower rates. This is partly due to the elements of lower personal risk already considered.

- Differences in productivity: – Where capital can earn greater reward for the producer, he will be willing to pay higher interest. Such trades are usually more speculative and higher interest can be attributed to higher risks.

How interest rate is determined:

There are mainly three theories to determine the interest rate

- Classical or real theory

- Loan able funds or Neo-classical theory

- Keynesian or liquidity preference theory.

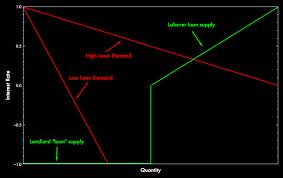

All these theories of interest seek to explain the determination of the rate of interest through the equilibrium between the forces of demand and equilibrium between the forces of demand and supply. In other words, all these three theories of interest are ‘demand and supply theories’ with rate of interest as the mechanism which brings about equilibrium between demand and supply. The difference among the theories of interest lies in the answer to the question: demand for what and supply of what? According to the classical theory of interest, rate of interest is determined by demand for saving to invest and supply of saving. Loanable funds theory seeks to explain the determination of the rate of interest through the equilibrium between demand for loanable funds and supply of lonable funds. Apart from current savings, lonable funds include other things also. Keynesian theory of interest asserts that the rate of interest is determined by the demand for money to hold and the supply of money. Now we discuss Keynes Liquidity preference theory of interest.

Liquidity Preference Theory to determine interest rate: –

In his epoch making book ‘The General Theory of Employment, interest and money”, the late lord Keynes gave a new view of interest. According to him “interest is the reward for parting with liquidity for a specified period”. A man with a given income has to decide first how much of this income he is going to consume and how much to save. The former will depend on what Keynes calls, the propensity to consume. Given this propensity to consume, the individual will save a certain proportion of his given income. He now has to make another decision. How should he hold his savings? How much of his resources will he hold in the form of ready money? This latter decision will depend upon what Keynes calls his “liquidity preference.” Meaning liquidity preference means the demand for money to hold or the desire of the public to hold cash. In the words of Prof. Meyer, “liquidity preference is the preference to have an equal amount of cash rather than of claims against others”. There are three factors that have affected on liquidity preference theory: –

Transaction motive: -the transaction motive of money relates to the ‘medium of exchange’ function of money. According to prof, A.C.L. Day “major elements. The transaction motive can be further split up as (1) the income motive (2) the business motive. The income motive refers to the transaction motive of the consumer and this amount depends upon the size of his income and the intervals of time between the receipt of income and its expenditure. The business motive refers to the transaction motive of the business community. And this amount depends upon the timing and size of personal income and the turnover of business.

Precautionary motive: – Beside holding money balance for transaction motive, people desire t hold money as precautionary store of wealth for some unforeseen contingencies, this motives is represented by the uncertainty in respect of timing and amount of payment. To describe this theory Keynes says that “the desire for security as to the future cash equivalent of a certain proportion of total resource”. Since the estimates of future contingencies do not fluctuate suddenly, the precautionary demand for money remains stable in shot-run. The difference between transaction and precautionary motive is that the amount of money held for the latter purpose can sagely be regarded as varying in direct proportion the value of transaction taking place in a given time in a country, while money holding for precautionary motive varies significantly with the degree of uncertainty.

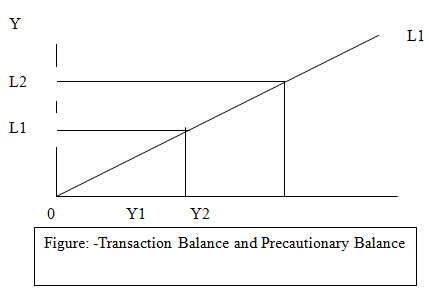

The combined sum of balances held for transaction and precautionary motives, Keynes termed active balances and labeled M1. The demand for active balances can be referred to as L1 and thus L1 =f(Y). This relationship is shown diagrammatically in the following diagram. According to Keynes L1 is directly proportionate to the level of national income. OL1 is the demand for active balances at OY1 of a national income. When the national income increases from OY1 to OY2 the demand for active balance goes up from OL1 to OL2. it should be noted here that the demand for active balances, according to Keynes, is independent of the rate of interest or the demand for active balances with respect to the rate of interest is absolutely inelastic. OM is the demand for active balances, which do not change, weather the rate of interest is 8% or 6%.

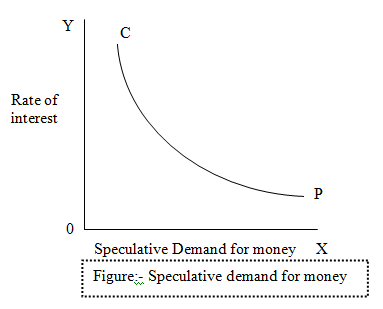

Speculative Motive: –The speculative demand for money represents the demand for liquid balance for being invested readily as the most attractive opportunities for monetary investment appear. It constituents a store of value, a liquid assets by which solder wants to make speculative gains out of the purchase and sale of securities at a right moment. To Keynes, people make capital gains by speculative in securities, hoping to gain from knowing batter than future holds in store. The speculative demand for money, arising from future uncertainty of the rate of interest makes complete break with the classical theory. The demand for money under the speculative motive is a function of the current rate of interest, increasing as the interest rate falls and decreasing as the interest rate rise. In other words, demand for money under this motive in a decreasing function of the rate of interest. This will be clear form the following diagram.

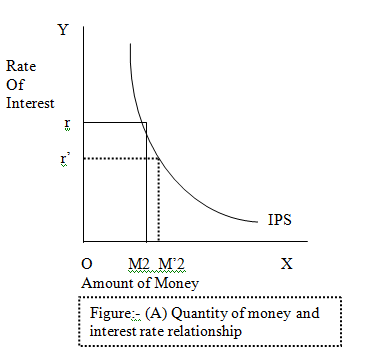

Along OX axis is represented the speculative demand for money and along OY the rate of interest. The liquidity preference schedule ship is a downward sloping curve towards the right signifying that the higher the rate of interest, the lower the demand for speculative motive, and vice versa. The schedule becomes more elastic towards the right end at very low rate of interest.According to Keynes, the demand for money, i.e., the liquidity preference and supply of money determine the rate if interest. It is, in fact, the liquidity preference for speculative motive, which, along with the quantity of money, determine the rate of interest. We have explained above the speculative demand for money in detail. As for the supply of money, it is determined by the policies of the Government and of the central Band of the country. The total supply of money consists of coins plus notes plus band deposits. How the rate of interest is determined by the equilibrium between the liquidity preference for speculative motive and the supply of money is shown in the following figure.

In figure (A) when the quantity of money increases from OM2 to OM’2 the rate of interest falls from Or to Or’ because the new quantity of money OM’2 is in balance with the speculative demand for money at OR’ rate of interest. In this case we move down the curve. Thus given the schedule or curve if liquidity preference for speculative motive, an increase in the quantity of money brings down the rate of interest. But increase in the quantity of money may cause a change in the expectation of the public and thereby cause an upward shift n liquidity schedule or curve for speculative motive pushing the rate of interest up.

But this is not certain. “New developments may only cause wide difference of opinion leading to increased activity in the bond market without necessarily causing any shift in the aggressive speculative demand for money schedule. If the balance of market expectation is changed, there will be a shift in the schedule. Central Bank policy designed to increase the money supply may, therefore, be met by an upward shift of speculative demand function leaving the rate of interest virtually unaffected”.

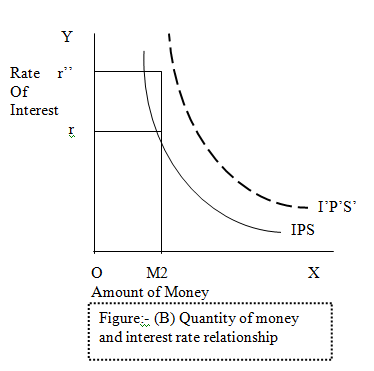

Thus, a large increase in the quantity of money may exert only a small influence on the rate of interest in certain circumstances. It is worth mentioning that shifts in liquidity preferences schedules or curve can be caused by many other factors which affects expectations and might take place independently of change in the quantity function may be either downward or upward dependent on the way in which the public interprets a change in events. If some change in events leads the people on balance to expect a higher rate of interest in the future than they had previously supposed, the liquidity preference for speculative motive will increase, which will bring about an upward shift in the curve of liquidity preference for speculative motive, and will rise the tare of interest.

In figure (B) assuming that the quantity of money remains unchanged at OM2, with the rise in the liquidity preference curve from IPS to I’P’S’ the rate of interest rises from Or to Or’ because at Or’’, the new speculative demand for money is in equilibrium with the supply of money OM2. It is worth nothing that when the liquidity preference for speculative motives rises from IPS to I’P’S’ the amount of money held does not raise it remains as OM2 as before. Only the rate of interest rises form Or to Or’’ to equilibrate the new liquidity preference for speculative motive with the available quantity of money OM2.

Thus, we see that Keynes explained interest forces and not in terms of real forces like productivity of capital and thrift which formed the foundation stone of both classical and lonable fund theories. According to him, demand for money for money determines the rate of interest. He agreed that the marginal revenue product of capital tends to become equal to the rate of interest, but the rate of interest is not determined by marginal revenue productivity of capital. More over according to him interest is not a reward for saving or thriftiness or waiting but for parting with liquidity. Keynes asserted that is not the rat of interest which equalize saving and investment. But this equality is brought about through changes in the level of incomes.