General Banking:

(Department in Elephant Road Branch):

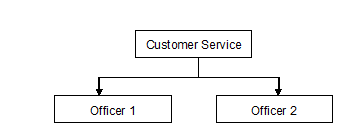

Customer Service

This department mainly gives service to their customer. The officers of this department always solve the problem of their customer. Provide information and aware people about the products of ABBL are the main jobs of the officers.

The main function of customer service department

Information provide to the customer about the product.

Account opening

Account closing

Cheque Book issue

Cheque received

Pay Order and Pay Clip issue

Customers attend

Customers phone call attend

Give account statement to the customer

Give account information to the customer

A/C Opening & Cheque Management:

This department involves certain stepwise work flow and observance of separate documentation formalities for each type of account as well as deferent categories of customers.

Generally they have to fill some forms are required for opening of an account.

Such as—

Account Opening Application Form.

Specimen Signature Card.

Cheqe Book Requisition slip

Deposit Slip Book

Terms & Conditions

ETP ( Expected Transaction Profiles)

KYC ( Know your Customer) Form

Mandates Form, if the account is desired to be operated by a third party Also.

Before opening an A/c the bank should obtain satisfactory evidence of the identity of the person intended to open the account as per section 19 Ka of the Prevention of money Laundering Act 2002 & perform due diligence. This process is completed by fulfilling the documentation requirements (Account Application, bank References, Source of Fund & Identification etc.) and also a “Know Your Customer” profile which is used to record a client’s source of wealth, expected trasaction activity at its most basic level.

The prospective client has to submit necessarily, further documents as per guidelines of Bangladesh Bank & banking practice, which veries with regard to the type or pattern of the account. Like—

Two copies passport size photo of the account holders

Signature of the account holders

Nominee sign & photo

An Introducer (an employee of OBL)

Copy of Passport / Word commissioner’s certificate’s / National ID /

Driving License.

When the person intended to open an account submit all necessary forms and supprting documents and make initial cash deposit as per requirement an account is opened in his/her name. Soon after opening the account a letter of thanks is issued to the customer as per prescribed perform under registered post with A/D.

Additional documents to be obtained from the customer depending on the type or constitution of the account. Like—

- Sole Proprietorship Account:

Copy of valid Trade License issued by Local Govt. authority(City Corporation, Pourashava, Union Parishad etc.).

Permission from Bangladesh Bank ( For Buying House, Indenting or other specific businesses)

TIN issued by Income Tax Authority.

The personal identity of the proprietor of the firm has to be established by any of the documents as mentioned in Individual or Joint Customer Category.

- Limited Company Account:

Certified copy of the Memorandum & Articles of Association of the Company. Certificate of incorporation. Certificate of commencement of Business( For Public Limited Companies Only)

Extract of the Board resolution sanctioning the account opening and signing authority.

List of the Director with address in form- Xll.

Copy of valid Trade License.

The personal identity of the Directors or beneficial owner(s) proprietor of

the firm has to be established by any of the documents as mentioned in

Individual or Joint Customer Category.

- Partnership Account:

Certified Copy of Partnership Agreement.

List of the Partners with address.

Extract of resolution of the partners meeting

Copy of valid Trade License.

Identity of all Partners

Evidence of the trading address of the business.

An explanation of the nature of the business.

Cash:

The Cash Department manages all of incoming and outgoing cash payments.

The main function of cash department

Maintenance of Specimen Signature Cards.

Receive the money.

Receiving of cheqes.

Verified the notes.

Pay the money.

When branch need money, this department collect money from principal branch.

When branch has excess of money, send the money to the principal branch.

Cash Limit (In NER Branch):

| Volt Limit | 50 Lac |

| Counter Limit | 15 Lac |

| Transit Limit | 75 Lac |

Clearing

Collection of cheques, drafts etc. on behalf of its customers is one of the basic function of a commercial bank. The department which performs this function is known as Clearing Department. Clearing stands for mutual settlement of claims made in between member banks at an agrees time and place in respect of instruments drawn on each other within the same clearing house.

Types of Clearing:

Outward Clearing:

Outward clearing means when a particular branch receives instrument drawn on the other bank with in the clearing zone and sends those instruments for collection through the clearing arrangement is considered as outward clearing for that particular branch.

Inward Clearing:

When a particular branch receives instruments which are on themselves and sent by other member bank for collection are treated as inward clearing of that branch.

Outward Returned:

Clearing return (outward) includes those cheques which were presented to us the preceding clearing by other banks but we have to return them unpaid to the collecting bank owing to various reason. Return of the 1st clearing are exchange in the special clearing.

Inward Returned:

Clearing Returns (inward) consists of those instruments which were presented by us to other banks for payment in the preceding clearing but we have been returned unpaid by them due to one reason or the other through the Clearing House.

Remittance:

Among different services rendered by a commercial bank to its customers, remittance facilities are very important and popular to the customer. It is an important part of GB. Banks extended these facilities by providing quick services towards its clients by means of receiving money from one branch of the Bank and making arrangement for payment to another branch with the country.

There are mainly two types of remittance —

- Inward.

- Outward.

The remittance facilities of a commercial bank enable its clients-

- Remittance means sending of money from one place to another.

- Remittance facility is extended to the customers to enable them to avoid risk arising out of theft, loss etc. in carrying of cash money from one place to another.

Banks take the risk and ensure payment to the beneficiary by charging the customer “Exchange” or “Commission”.

Considering the urgency and nature of transaction the method of remittance may be categorized under:

- Payment order

- Demand Draft

- Telegraphic Transfer

- Traveler’s Cheque

- Mail Transfer

Finance Control:

This department performs daily functions of collecting and accounting for taxes, receipt of grants and other income, preparing deposits, account analysis, payroll, and processing purchase orders, check requests, paying vendors, monitoring and reporting on grants and budgets and various other projects to assist tribal members, staff and directors with accounting administration.

The main function of Finance Controls

Budget Preparation

Procurement & Payment

Payroll

Financial Statements

Account analysis

Monthly, half yearly and yearly closing

Interest updated

Govt. vat and tax send to the Head Office

Daly transfer execute

Credit:

The credit department approves the loan of Corporate Banking division. The approval is mainly based on the risk analysis of the corporate clients done by the Corporate Banking division. The main function is monitoring credit facilities granted by the corporate banking unit. Its function is to make sure that credit has been provided in a right manner. This department ensures that internal controls of the corporate relations are maintained.

The main function of Credit department is,

To manage ABBL credit portfolio.

Processing of credit applications and approvals

Aware people about the credit scheme.

Credit disbursement

Investigating and resolving unauthorized deductions

To encourage loan repayment loan.

Collecting from billed customers.

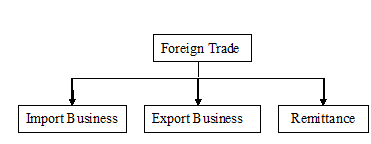

Trade Finance:

The foreign exchange department transfers wherever one currency is traded for another. Foreign exchange held abroad by foreign nationals or foreign business houses, expect to the extent responding earning abroad in respect of business conducted in Bangladesh or service rendered while in Bangladesh.

The main function of Foreign Exchange department is,

To open import L/C (letter of credit) and make payment their against.

Verified master L/C and open back to back L/C their against.

Issue exports L/C.

Received and payment foreign remittance

Send all types of statement (foreign exchange related) to Bangladesh Bank.

Consumer Banking:

Their aim to satisfy all clients, regardless of how big or small they may be. Individuals are counseled on the best type of accounts suitable to them such as Current, Savings, Short Term Deposits, Fixed Deposits, Consumer Asset and Liability Products, etc.

Apart from the conventional banking operations ABBL strives to introduce an array of products and services and already launched a number of consumer banking products with the aim of popularizing consumer banking operations and offer higher return to its clients.

Consumer Banking Products are:

Saving Deposit

Current Deposit

Fixed Deposit

Short Term Deposit

Monthly Savings Deposit

Monthly Income Deposit

Deposit Double Scheme

Millionaire Scheme Deposit

Quarterly Basis Deposit Scheme

Profit First Deposit Scheme

Saving Deposit Account:

Savings account generally opened by individuals for saving purposes depositing over a period of time. This type of accounts earns interest at a prescribed rate.

Account is eligible for individual’s savings, transaction, investment, loans repayment and payroll purpose. Requirement for personal account: savings and access (single) and graduate account.

AOF: The account opening form (AOF) completed properly.

Introduction: Duly introduced by an existing accounting holder having satisfactorily relationship with AB Bank for at least six months

Photograph: Two copy of account holder photograph duly signed by introducer.

Nominee: Signature of nominee on the AOF along with the relevant portion and also with a photo duly attested by applicant.

Document: Valid passport/ driving license/, voter ID card,/ reference letter by the first class gazette officer and one copy photo of the account holder signed by officer(affidavit is not acceptable), organizational photo ID.(commissioner certificate, certificate from Gazette officer is not acceptable )

Any kind of over writing must be signed by applicant in AOF. Name, father’s name, mother’s name, date of birth, address, have to match with supplied documents. Transaction profile and important document are the essential parts of all account opening.

Requirement:

Completed AOF with Personal declaration

- Resent Photograph Two copies of A/C holder.

- Nominee Photograph one copy attested by A/C holder.

- Introduction.

- Passport / Word Commission certificate/ Employee certificate/ Driving license/ Employee ID card.

- Initial deposit (TK 10000).

Current Deposit:

Current account is an efficient and convenient way of handling their daily finances. A frequent transaction of the account that provides customer convenience and flexibility. Put an end to people’s worries about carrying large sums of money when they need it. In the current account, the account holder does not get any interest on deposit money. The account holder can withdraw and deposit his money any branch of ABBL. The minimum deposit is Tk. 5000 to open a current account. A current account may be opened by any firms , companies, clubs, association, corporate body, trust, liquidators etc.

Requirement for current account and access (single) and graduate account.

AOF: The account opening form (AOF) completed properly.

Introduction: Duly introduced by an existing accounting holder having satisfactorily relationship with AB Bank for at least six months

Photograph: Two copy of account holder photograph duly signed by introducer.

Nominee: Signature of nominee on the AOF along with the relevant portion and also with a photo duly attested by applicant.

Document: Valid passport/ driving license/, voter ID card,/ reference letter by the first class gazette officer and one copy photo of the account holder signed by officer(affidavit is not acceptable), organizational photo ID.(commissioner certificate, certificate from Gazette officer is not acceptable )

Any kind of over writing must be signed by applicant in AOF. Name, father’s name, mother’s name, date of birth, address, have to match with supplied documents. Transaction profile and important document are the essential parts of all account opening.

Sole proprietor, partnership, NGOs:

Requirement:

Completed AOF with sole proprietorship declaration

- Resent Passport Size Two copies Photographs.

- Nominee Photograph one copy attested by A/C holder.

- Introduction.

- Passport / Word Commission certificate/ Employee certificate/ Driving license/ Employee ID card.

- Initial deposit (TK 5000).

- Seal/ Rubber stamp.

- Proprietorship Agreement Form.

- Up-to-Date Trade License.

- Tin Certificate.

- Vat Certificate.

In case of Partnership all the above mentioned entry in addition with-

Deed in case of partnership

Passport of all partners

EPT and Terms & Conditions

KYC (Know your customer from which fill up by the officer) required for all partner)

Fixed Deposit:

Fixed deposit is the same as a term or time deposit. Money may be placed with a bank, merchant bank, building society or credit union for a fixed term at a fixed rate of interest which remains unchanged during the period of the deposit. Depositors may have to accept an interest penalty if they break the deposit, ie, ask to take the money out before the agreed period has expired.

ABBL fixed deposit interest rate is made through the rules of Bangladeshi Government. The minimum opening balance of FDR is Tk. 1000. Customers have the freedom to choose the desire period from 3 months to 3 years or above and carry interest at varying interest rates according to the period of maturity as may be prescribed by the head office from time to time. If any one wants, they can auto renew their fixed deposit. The interest rates are given below—

| Fixed Deposit Receipt | Rate of |

Interest

Range

3 (Three) Months11.75%0,00,0001-10,00,00 12.25%10,00,001- 20,00,000 12.50%20,00,001 – 30,00,000 12.75%30,00,001- 100,00,000 13.00%100,00,001 & above6 ( Six) Months 12.00%0,00,0001-10,00,00 12.50%10,00,001- 20,00,000 12.75%20,00,001 – 30,00,000 13.00%30,00,001- 100,00,000 13.25%100,00,001 & above1( One) Year 12.50%0,00,0001-10,00,00 13.00%10,00,001- 30,00,000 13.25%30,00,001 – 50,00,000 13.50%50,00,001& above2( two) Years 13.00% ————

If the customers need money before the end of their fixed deposit period they can withdraw their money.

For this purpose, the customer needs to give an application to the branch manager of ABBL. The customer does not get the interest of the fixed deposit; but they get the interest rate of saving deposit. Some charge will cut from the customer as an excise duty and but no service charge will taken. The charges are given below;-

Fixed Deposit | Excise Duty |

5,000 to 100,000 | Tk. 120 |

100,001 to 10,00,000 | Tk 250 |

10,00,001 to 1 crore | Tk 550 |

1 core to 5 crore | Tk 2500 |

5 crore to above | Tk 5000 |

Short Term Deposit:

Short Term Deposit (STD) account heid in this type of accounts shall be payable on short term notice for 7 days or 30 days. Short term deposits are opened by sector corporations, limited companies, firms, NGOs, societies or financial services or institutions etc. These are interest bearing accounts. The rate of interest is fixed by head office. Interest is calculated on daily basis. No overdraft is allowed against STD. Such as, interest rate on the deposit (5%), affordable minimum balance (Tk. 5.00 lac & above) any branch banking.

Requirement (Sole proprietor, partnership, NGOs):

Completed AOF with sole proprietorship declaration

- Trade License.

- Tin certificate

- Passport of proprietor/ main signatory

- Two copy of photograph

- Company Seal

In case of Partnership all the above mentioned entry in addition with-

Deed in case of partnership

Passport of all partners

KYC (Know your customer from which fill up by the officer)

required for all partner

Monthly Saving Deposit Scheme (MSDS):

Monthly savings deposit scheme is a liability product where existing and prospective customers can open an account in his/ her name or in the name of minor with an amount of TK. 500/- or its multiple. The client shall have to agree to deposit similar amount on monthly basis for tenure as per the terms agreed upon. The product will be designed by H.O. from time to time.

Terms and Condition

Deposit will be Tk. 500; 1000; 2000; 5000 and multiples of Tk. 5000 thereof.

Amount shall come into effect from the 1st week of the month or the subsequent months.

Consumer can select a period of 5or10 years, depending on his or her convenience.

Customer is eligible to open more than one account in the same branch.

Monthly installment of any plan will be debited from customer’s saving or current account as auto transfer arrangement.

If the customer fail to pay 3 consecutive installments then the plan will cease to function and payment will be made as per as following clause.

For premature encashment, interest will be paid as per prevailing saving rate but no interest will be paid if enchased with in one year.

In cash of death ,deposit will be encashed will applicable interest and

Loan Advantage

The customer can avail loan up to 75% of the deposited amount against lien of this plan will be Tk. 15,

Monthly Income Deposit Scheme (MIDS) :

Monthly Income Deposit Scheme is a liability product where the existing customer as well as the prospective customer can create term deposit in his/ her name with a principal amount of TK. 1,00,000/- or its multiple for a tenure of 03 or 05 years and shall be entitled to receive a fixed income on monthly basis as per the terms and conditions of the product. Interest for 3 Years will be 12% & for 5 Years will be 12.24%.

Terms and Condition

Any individual, NGO, Education Institution, Trust, Society etc. may invest their saving in this plan. The customer may open more than one account in the same branch.

Minimum deposit is Tk. 1, 00, 000 or in multiples thereof. Subject to a maximum amount of TK. 50, 00, 000 either singly or jointly.

Duration will be 3 years and 5 years.

For premature encashment, interest will be paid as per prevailing saving rate but no interest will be paid if encashed with in one year.

Monthly is subject to tax & other duties which The Govt. of Bangladesh may impose from time to time.

Two Photographs will be required for the deposit under this scheme, alongwith a photograph of nominees duly attested by the depositor.

In case of death, deposit will be encashed will applicable interest and paid to nominee(s).

Loan Advantage

The customer can avail loan up to 80% of the deposited amount but minimum loan amount against this plan will be Tk. 25,000.

Deposit Double Scheme (DDS):

“Double your Deposit” scheme allows a customer to double his/ her deposit in 6 Six years at a market competitive rate. The product offers the flexibility of premature encashment at a predetermined. Interest will be paid 12.25% for 6 years.

Terms and Condition

Initial deposit of ABBL DDS is TK. 50,000.00 or its multiples thereof. Subject to a maximum amount of TK. 5, 00,000.00 either singly or jointly.

Duration will be 6 years.

For premature encashment, interest will be paid as per prevailing STD rate for 6 months, Saving rate for 1 year, 10.50% for 2 years, 11.00% for 3 years, 11.50% for 4 years & 11.75% for 5 years.

Monthly is subject to tax & other duties which The Govt. of Bangladesh may impose from time to time.

Two Photographs will be required for the deposit under this scheme, alongwith a photograph of nominees duly attested by the depositor.

In case of death, deposit will be encashed will applicable interest and paid to nominee(s).

Loan Advantage

The loan may be allowed up-to 80% of the principal amount.

Millionaire Scheme Deposit:

“Millionaire Scheme Deposit” is a regular savings account with provision for monthly savings for getting the one million on maturity. The monthly savings amount will be fixed based on the tenure of the Scheme account for accumulating deposit for one million. The tenure of the scheme will be Minimum 3 years to 6 years.

Terms and Condition:

Any individual, NGO, Education Institution, Trust, Society etc. may invest their saving in this plan.

Consumer can select a period of 3/4/5/6 years.

Customer is eligible to open more than one account in the same branch.

Monthly installment income will be debited from the customer saving or current account.

For premature encashment, interest will be paid as per prevailing saving rate but no interest will be paid if encashed with in one year.

In case of death, deposit will be encashed will applicable interest and paid to nominee(s).

Loan Advantage:

The customer can avail loan up to 90% of the deposited amount but the facility will be allowed after one year of opening the A/C.

Quarterly Basis Deposit Scheme:

‘Quarterly Basis Deposit Scheme’ is a fixed deposit account. To increase the deposit base of ABBL at least by 1.00%in 2008. Interest Income is payable on Quarterly basis to the depositor. The tenure of the scheme will be 3 years. The tenor of the deposit will be effective exactly from the date of opening the deposit & not for calendar months. The deposit will be minimum TK. 25000.00. The interest rate of this account is 12.00% . This account also Called ‘Troimashik Munafa Hishab’.

Terms and Condition:

Any Existing AB customer, Salaried individuals, Senior citizens, self- employed professionals, Proprietorships, Partnerships etc.

The depositor shall have to maintain a Savings / Current / STD account with same branch for disbursement of quarterly interest payable for this account.

Govt. Tax at source and Excise Duty shall be borne by the depositor.

For premature encashment, before six months no interest will be paid, after six months & before one year interest will be paid as per savings account rate, after one year & before two years interest will be 9.00%, after two years & before three years interest will be 10.00%.

In case of death, deposit will be encashed will applicable interest and paid to nominee(s).

Loan Advantage:

The customer can avail loan up to 90% of the deposited amount but the facility will be allowed after one year of opening the A/C.

Profit First Deposit Scheme:

‘Profit First Deposit Scheme’ is a fixed deposit account where interest is paid at the time of deposit. This deposit is also called ‘Ogrim Munafa Patra’ (OMP). A depositor may purchase an OMP certificate by depositing a discounting value. To increase the deposit base of ABBL at least by 1.00%in 2008. The tenure of the scheme will be 12 months. The tenor of the deposit will be effective exactly from the date of opening the deposit & not for calendar months. The deposit will be minimum TK. 25000.00. The interest rate of this account is 12.00%.

Terms and Condition:

Any Existing AB customer, Salaried individuals, Senior citizens, self- employed professionals, Proprietorships, Partnerships etc.

The depositor may purchase an OMP by depositing a discount value

Tenure of this account is 3/6/12 months.

Govt. Tax at source and Excise Duty shall be borne by the depositor.

In case of death, deposit will be encashed will applicable interest and paid to nominee(s).

Loan Advantage:

The customer can avail loan up to 90% of the deposited amount.

Trade Finance:

MTB provides a wide range of banking services to all types of commercial concerns such as Import & Export Finance and Services, Investment Advice, Foreign Remittance and other specialized services as required. Although they are a private commercial Bank, they have a strong global network that helps them to undertake international trade smoothly and efficiently.

Import Business

AB Bank supports its customers by providing facilities throughout the import process to ensure smooth running of their business. The facilities are:

Import Letter of Credit

Post Import Financing (LIM,LTR etc)

Import collection services & Shipping Guarantees

Export Business

AB Bank offers extra cover to its customers for the entire export process to speed up receipt of proceeds. The facilities are:

Export Letters of Credit advising

Pre-shipment Export Financing

Export documents negotiation

Letters of Credit confirmation

Remittance

AB Bank provides to its customers the following services:

Inward/ Outward Remittance Services

TT/ DD Issue

DD/ Cheque collection

Endorsements

Travelers Cheque Issuance

On-line Banking:

AB Bank is playing a pioneering role among its competitors in providing real time online banking facilities to its customers. AB Bank online banking offers a customer to deposit or withdraw any sum of money from any branch anywhere. Any account holder having a checking account with the bank can avail this service.

The Software

Based on two-tier client-server architecture, the banking software works basically on central server approach providing the fastest possible access time to any client database from any branch as well as updating the transaction. The branch level server keeping the up to date transaction history of the client ensures the offline transaction ability in case of any failure in the remote communication. Using Microsoft’s enterprise version of SQL Server 2000 as data reservoir, the software ensures the highest level of security at application, network, database and operating systems level ascertaining the confidentiality and security of customer’s personal and account’s information.

Hardware

In order to ensure the safety and accessibility of mission critical data, the Central Data Center of AB Bank is equipped with the state of the art Servers. The recently procured Dell 6600 Server, powered by 4 Xeon processors (RAID5 volume fault tolerance implemented) has been employed as the primary data reservoir of the bank. As a disaster recovery preparation, they have deployed Dell 4300 series Server as Backup server, powered by 2 Xeon processors, which ensures quick fail over of the primary server and smooth operation of online transactions.

The Wireless Network

In order to provide data communication to ensure seamless operation of online banking system, all the branches of the AB Bank (except two rural branches) are

connected with the central server at its Head Office through Radio Link of 3.5 Frame Relay network and Fiber Optics provided by the country’s leading data communication service provider X-Net Limited, a joint venture company with GrameenPhone. The Bank has recently adopted V-SAT communication system to bring its rural branches under the online branch banking facilities. The V-SAT connectivity is being provided by Square Informatics Ltd.

Swift Service:

The Society for Worldwide Interbank Financial Telecommunication or S.W.I.F.T. is a worldwide community. 7,800 financial institutions in 200 countries connected to one another through SWIFT.

In their own word SWIFT “consistently delivers quantifiable business value and proven technical excellence to its members through its comprehensive messaging standards, the security, reliability and ‘five nines’ availability of its messaging platform and its role in advancing STP.

The guiding principles of SWIFT are clear: to offer the financial services industry a common platform of advanced technology and access to shared solutions through which each member can build its competitive edge.

AB Bank has already become the member of SWIFT community and has started its operation from March 2002. With introduction of SWIFT, AB Bank ensures its customers the quickest and most secured financial transaction around the world.

The SWIFT address of AB Bank is: ABBL BD DH

Some Additional Service:

ATM/Debit Card Service

A debit card is a plastic card which provides an alternative payment method to cash when making purchases. Its functionality is more similar to writing a check as the funds are withdrawn directly from either the cardholder’s bank account (often referred to as a check card).

ABBL debit card is start from the 3rd August. The ABBL customer can use the booth of Duch Bangla bank Ltd. Every Debit card has an expiry date. It as well requires replacements. The request for debit card (with prior notification) is dealt by the account service department. Customer collects the card after 5 working days. Customer can easily withdraw cash and make purchases whenever he/she wants using this Debit card.

Statement and certificate preparation

Statement is send to the correspondence address of the account holder in two times a year (June & December). Some time customer need bank statement on urgent basic for some purpose. Then the account holder come to any branch of ABBL and can take the statement. The statement is given when he or she can prove that he or is the account holder or the authorized person of the account holder. He or she can get this statement is office working hour. It is charged from customer’s account.

Account Service

Address change

Customers sometime want to change mailing and permanent address. They have to fill up a form and give supporting documents for address alteration (in case of permanent address change). Supporting documents should be photo id (passport/driving license/ voter id) and one copy of photograph of the account holder is required to change any kinds of account service form. This is free of cost.

Signatory change (Delegation of authority)

Sometime customer wants to add new person or nominee as joint signatory. Customers have to fill up a form and a signatory card where new applicant’s signature (duly attested by him or her), a copy of passport or voter ID or driving license is required.

Signature change

If a customer wants to change his signature he has to provide his previous valid documents (which were supplied at the time of account opening) and Write an application and copy of photograph with a complete form.

Account Maintaining

If a customer wants to maintain his account he has to pay Bank some charges. For savings and current account- Charge is TK. 500 and VAT is TK. 75 for per six month.

Account Closing

Customers have to surrender his cheque-book at the time of closing or surrendering the account. Closing charge is Tk. 300 and VAT is TK.45 for savings and current account.

Account Transfer

Customer can transfer their account from one branch to another branch of ABBL. For this purpose he or she has to submit an application. The new branch opens a new account with a new account number. This transfer takes maximum 3 days. The transfer charge is TK. 200.

Locker Service

Bank provides safety locker service to its customers. Any account holder can obtain it. Account holder needs to fill up a form with specimen signatory card. Signatory may not be more than three. In the form, locker holder must mention the account number from where locker charge will be debited. After clarifications all documents allocation of a locker and key takes place.

Type Annual charge

Small 1500

Medium 2000

Large 3000

Locker holder can visit the locker any time within 9 a.m to 5 p. m- from Sunday to Thursday. Customers had to sign the visiting record and locker’s custodian verifies it. If any one wants to surrender the locker, he or she needs to surrender the locker key and visit the locker finally with custodian. The manager keeps the key in the volt and reallocates it. If any one lost the key of the locker, he or she has to pay one thousand take as punishment or for the new key.

Credit Management (Loans&

Advances):

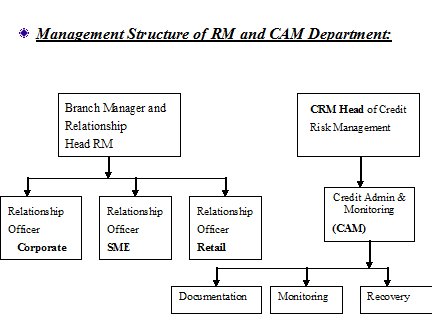

The credit department approves the loans and advances of Corporate Banking division. The approval is mainly based on the risk analysis of the corporate clients done by the Corporate Banking division. The main function is monitoring credit facilities granted by the corporate banking unit. Its function is to make sure that credit has been provided in a right manner and also ensures that internal controls of the corporate relations are maintained.

Advances by commercial banks are made in different such as loan, cash credit, overdrafts, bills purchased, bills discounted etc. These are generally short-term. Advance may be granted against tangible security or in special deserving cases on an unsecured or clean basis.

In a loan account, the entire amount, the entire amount is paid to the debtor at one time, either in cash or by transfer to the current account. No subsequent debit is ordinarily allowed expect by way of interest, incidental charges, insurance premium, expenses incurred for the protection of the security etc. Sometimes, repayment is providing for by installment without allowing the demand character of the loan to be affected in any way. Interest is charge on the debit balance, usually with quarterly rests unless there is an arrangement to the contrary. No cheque book is issued. The security may be personal or in the form of shares, debentures, Government papers, immovable property, fixed deposit receipts, life insurance policies, goods etc.

Credit Department banking business primarily involves accepting deposits from the public and investing or lending the same and thereby making profit out of it. No single bank can lend out more than its excess reserves, the entire banking system can create a multiple volume of deposit money through credit creation. However, lending money is not without risk and therefore banks make loans and advances to farmers, traders, businessmen and industrialist against either tangible (land, building, stock etc.) or intangible security. Even then, the banks run the risk of default in repayment. Therefore, the banks follow cautious measures while lending money to others. This core function of a Bank is performed by the Credit Department of the bank.

At AB bank This Department is known as Relationship Management (RM) and Credit Administration & Monitoring (CAM).

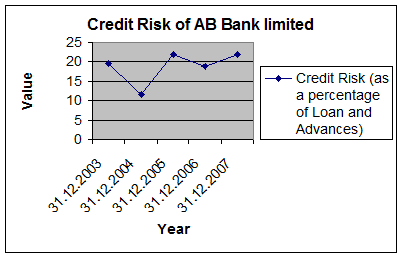

The objective of the credit management is to maximize the performing asset and the minimization of the non-performing asset as well as ensuring the optimal point of loan and advance and their efficient management. Credit management is a dynamic field where a certain standard of long-range planning is needed to allocate the fund in diverse field and to minimize the risk and maximizing the return on the invested fund. Continuous supervision, monitoring and follow-up are highly required for ensuring the timely repayment and minimizing the default. Actually the credit portfolio is not only constituted the banks asset structure but also a vital factor of the bank’s success. The overall success in credit management depends on the banks credit policy, portfolio of credit, monitoring, supervision and follow-up of the loan and advance.

Types of Credit Facilities:

Modem banking operations touch almost every sphere of economic activity. The extension of bank credit is necessary for expansion of business operations. Bank credit is a catalyst for bringing about economic development. Without adequate finance there can be no growth or maintenance of a stable output. Bank lending is important to the economy for it makes possible the financing of agricultural, commercial and industrial activities of a nation. The credit facilities are generally allowed by the bank may be in two broad categories.

Overdraft:

When a current account holder is permitted by the banker to draw more than what stands to his credit, such an advance is called an overdraft. The banker may take some collateral security or may grant such advance on the personal security of the borrower. ABBL has given this overdraft facility to its clients.

Eligibility: Overdraft facilities are generally granted to businessmen for expansion of their business, against the securities of stock-in-trade, shares, debenture, Government promissory notes, fixed deposit, life policies, gold and gold ornaments etc.

Nature – short term loan

Interest rate: 14% – 17%

Terms and Conditions:

- Bank may cancel / alter the sanction without assigning any reason whatsoever.

- In case of client failure to pay the Bank’s dues within the validity of the limit bank may en cash client pledge without any prior intimation to client.

Consumer credit:

Consumer credit, popularly referred to as Consumer Banking, is high value personal banking catering to particular need aspects of individuals, professionals, businessmen among others. Through its large branch network AB has been successful in propagating this personalized banking service to the desired customers. Your Bank’s consumer banking has many diversified products to fulfill customer needs which include Personal Loan, Personal Overdraft, Education Loan, Auto Loan, House Furnishing/Renovation Loan, Home Loan, etc.

In the coming months, few more products will be launched for the target group of service holders, entrepreneurs and businessmen in mind. AB recently signed up with a reputed private university to provide Education Loans to students. This particular model will be replicated to other institutions gradually. Recently, your Bank also joined hands with a big name in the jewellery market to re-Launch its product named “Gold Grace”.

At present, AB’s clientele base in this segment comprises of 7200 customers having a portfolio size of over Taka 350.0 crore.

Eligibility: The borrower must be confirmed official of any of the following organizations:

- Government Organization

- Semi-Government Organization

- Multinational Organization

- Bank and Insurance companies

- Reputed Commercial Organization

- Professionals

Nature: Mid-Term micro credit.

Interest Rate: 17.5%

Terms and Conditions:

- Clients will procure the specified articles from the dealer/agent/shop(s) acceptable to bank.

- All the papers/cash memos etc. related to the procurement of the goods will be in the name of the Bank ensuring. Ownership of the goods. Where applicable, the ownership shall be transferred in the name of the clients after full adjustment of Bank’s dues.

- The client shall have to bear all the expenses of License, Registration, Insurance etc. of the articles wherever necessary.

- The client shall have to bear the cost of Repair and Maintenance of the acquired articles.

Time Loan:

When an advance is made in a lump sum repayable either in fixed monthly installments or in lump sum and no subsequent debit is ordinarily allowed except by way of interest, incidental charges, etc. it is called a Time loan. The whole amount of loan is debited to the consumer’s name on a loan account to be opened in the ledger, and, is paid to the borrower either in cash or by way of credit to current/savings account.

Eligibility: Loans are normally allowed to those parties who have either fixed source of income or who desire to pay it in lump-sum.

Interest Rate: 15% – 16%

Terms and Conditions:

- Disbursement will be made after completion of all formalities.

- Bank reserve the right to cancel or amend the terms and condition partly or wholly at is direction without assigning any reason whatsoever.

- When the principal debtor defaults in fulfilling the obligation or promise liability bestow on guarantor.

Term Loan:

Term Loan is only provided in selective cases in Bank. The basic characteristic of the loan is almost the same as Time loan except that the repayment period is more than one year.

Interest rate: 15%- 17%

Trust Receipt Facility (T.R):

This type of loan is also connected with import facility and is only provided to very selective clients only.

Sometimes as per earlier arrangement or under compelling situation we allowed our valued clients to retire the L/C documents without adjusting the demand loan or outstanding BLC. The documents are provided to the client after transferring the outstanding liabilities to T.R account.

Eligibility: Loan against trust receipt is generally granted to Exporter for exportation of goods.

Interest rate: 15% – 16%

Terms and Conditions:

- Disbursement will be made after completion of all formalities as per sanction terms.

- Suppliers credit report to be obtained before opening of L/C’s.

- Excess drawing over the sanction limit is strictly prohibited.

- Excess drawing over the sanction limit is strictly prohibited

- Customer will maintain effective and constant supervision and follow up to ensure timely adjustment of the loan to avoid overdue.

Letter of Credit:

Opening or issuing letter of credit is one of the important services provided by ABBL. A letter of credit is a document authorizing a bank to pay the bearer a specified sum of money; it provides a useful means of settlement for a foreign trade transaction, the purchaser establishing a credit in favor of his credit at a bank.

Letter of Credit is of two types:

- Traveler’s letter of credit issued for the convenience of the traveling public, and

- Letter of commercial credit issued for the purpose of facilitating trade transaction.

Eligibility: Letter of credit facilities are given to exporter, manufacturers/producers.

Terms and Conditions:

- It should stipulate the name of the loan/credit/Grant.

- It should bear the name of the designated bank.

- Items mentioned in the LCA form must contain with the permissible items.

- The bank officers periodically inspect the goods and verify that they conform to the quantity and quality etc. as mentioned the particular letter of credit.

- In case of first class customers, the facility may, however be granted against form contracts with overseas buyers.

Letter of Guarantee:

A letter of guarantee has special significance in the business of banking as a means to ensure safety of funds lent to the customers. In case, the borrower is unable to provide the security of tangible assets or, the vale of the assets falls below the amount of the loans, and the borrower’s personal security is not considered sufficient, an additional security is sought by the banker in the form of a guarantee given by a third person.

Terms and Conditions:

- The banks legal adviser must verify all the security documents.

- When the principal debtor defaults in fulfilling this obligation or promise the liability bestow on guarantor.

- Bank reserves the right to cancel or amend the terms and condition partly or wholly at its direction without assigning any reason whatsoever.

These facilities of credit department of ABBL are divided into three parts: Corporate, SME & Retail.

Corporate:

AB Bank provides complete range of solutions to meet Corporate Customers’ requirement. Corporate Banking solutions include a broad spectrum of products and services backed by proven, modern technologies.

Corporate Lending

ABBL specialist teams offer a comprehensive service providing finance to large and medium-sized businesses based in Bangladesh.

Structured Finance

ABBL have a specialist Structured Finance Team who arrange and underwrite finance solutions including Debt and Equity Syndication for financial sponsors, management teams and corporate. Also we provide corporate advisory services.

We aim to provide tailored financing solutions with a dedicated team who can rapidly respond to client needs.

Following are some of the products and financial tools of Corporate Banking:

- Project Finance

- Working Capital Finance

- Trade Finance

- Cash Management

- Syndicated Finance, both onshore & off-shore

- Equity Finance, both onshore & off-shore

- Corporate Advisory Service

Large Loan & Project Finance:

- In order to cater the demand of client AB Bank has segmented its portfolio in terms of loan size. As per this segmentation any loan over Tk. 10.00 Crore falls under the purview of Large Loan Unit.

- In AB Bank, there is also a separate Project Finance unit who evaluate the business. The unit is entrusted to handle the portfolio in a focused manner. AB Bank is always in fore front to support establishment of new projects of diverse nature which will help to broaden the manufacturing arena vis-à-vis to generate to employment.

- At the moment AB Bank ‘s exposure in Large Loan & Project Finance portfolio is distributed in the following sectors:

| SL | Sector | ABBL Exposure (Limit) |

| 1 | Agro- Business | 12,717.56 |

| 2 | Cement Power, Glass | 38,691.92 |

| 3 | Consumer Products | 21,855.00 |

| 4 | Edible Oil | 36,057.53 |

| 5 | Engineering & Construction | 18,106.42 |

| 6 | Financial Institution | 1,414.70 |

| 7 | Food & Beverage | 27,044.24 |

| 8 | Hotel | 2,505.26 |

| 9 | Health Care | 3,928.62 |

| 10 | Printing & Packaging | 11,867.61 |

| 11 | Real Estate | 10,451.49 |

| 12 | Micro-finance | 5,763.15 |

| 13 | Export | 9,441.63 |

| 14 | RMG & Backward Linkage | 94,826.13 |

| 15 | Ship Breaking | 18,029.20 |

| 16 | Steel | 42,824.97 |

| 17 | Telecom & Computer Accessories | 11,479.89 |

| 18 | Trading | 77,579.89 |

| Total ( including syndicated exposure) | 444,585.21 | |

| Less Syndicated Exposure | 51,560.29 | |

| Total Large Loan & Project Finance portfolio without syndicated exposure | 3930,24.92 |

Loan Syndication:

- Syndication or club financing is a growing concept in Banking Arena of Bangladesh. Syndicated finance diversifies the risk of one bank on a single borrower and increases the quality of loan through consensus or cumulative judgment and monitoring of different banks / financial institutions.

- AB Bank, the first bank in the private sector also took initiative to adapt to this growing concept.

- In 1997, AB Bank for the first time arranged a club financing with Dhaka Bank Ltd to raise Tk. 6700 lac – out of which ABBL financed Tk. 5700 Lac and Dhaka bank financed Tk. 1000 Lac.

- In 1999, AB Bank arranged its second syndicated credit facility with IPDC to raise Tk 3563 Lac.

- Since then AB Bank did not look back.

- Since 1997 to 2007 (till date), AB Bank has raised total Tk. 25989.56 Lac as Lead Arranger. The following banks from time to time have been our partners in these syndications: Dhaka Bank, IPDC, AB Bank, Bank Asia, Oriental Bank, NCC Bank, The City Bank, Trust Bank, and Bank Asia.

- AB Bank has also participated in different syndications arranged by other Banks, out of which till date 6 (six) syndication has successfully been completed. AB Bank exposure in these completed syndications was Tk. 4700 Lac.

- At the moment AB has participation in 19 (nineteen) syndicated facilities. AB Bank’s exposure in the ongoing syndication is Tk. 51560.29 Lac which is diversified in the following ten sectors:

| SL | Sector | ABBL Participation |

| 1 | Textile | 9,533.57 |

| 2 | Micro-finance | 3,000.00 |

| 3 | Cement | 7,990.00 |

| 4 | Energy & Power | 11,997.00 |

| 5 | Telephone (PSTN) | 5,500.00 |

| 6 | Glass | 900.00 |

| 7 | Sugar | 900.00 |

| 8 | Steel Mills | 9081.72 |

| 9 | Paper | 1158.00 |

| 10 | Chemical | 1,500.00 |

| Total | 51,560.29 |

Lending Rates:

| Products | Mid Rate | Interest rate Band W.E.F. 01 November, 2007 |

| 1) Agriculture | ||

| i) Loan to Primary producer | 13.25% | 11.75% – 14.75% |

| ii) Loan to Agricultural Input | 13.75% | 12.25% – 15.25% |

| 2) Large & Medium Scale Industry | ||

| i) Large and Medium Scale Industry (Term Loan below Tk.10.00 Crore) | 14.75% | 13.25% – 16.25% |

| ii) Large & Medium Scale Industry (Term Loan Tk.10.00 Crore & above) | 14.75% | 13.25% – 16.25% |

| 3) Working Capital | ||

| i) Small & Medium (upto Tk. 10 Crore) | 14.50% | 13.00% – 16.00% |

| ii) Large (above Tk.10 Crore) | 14.50% | 13.00% – 16.00% |

| 4) Exports | ||

| i) Jute & Jute Goods Export | 7.00% | 7.00% |

| ii) Other Export | 7.00% | 7.00% |

| 5) Commercial Lending | ||

| i) Commercial Lending (General) | 15.50% | 14.00% – 17.00% |

| ii) Commercial Lending (Large) | 15.00% | 13.50% – 16.50% |

| 6) Small & Cottage Industry (Term Loan) | 14.75% | 13.25% – 16.25% |

| 7) Consumer Credit | ||

| i) Customer Unsecred | 16.00% | 14.50% – 17.50% |

| ii) Staff Unsacred | 15.50% | 14.00% – 17.00% |

| 8) Debit Card Overdraft (Staff) | 16.95% | 16.95% |

| 9) Credit Card | 2.00% per month | 2.00% per month |

| 10) Urban housing | ||

| i) Real Estate (Commercial) | 15.00% | 13.50% – 16.50% |

| ii) HouseBuilding (Non-Commercial) | 15.25% | 13.75% – 16.75% |

| 11) Others | ||

| i) Cash Collateral – ABBL FDR | ||

| Time Loan for 3m | 13.50% | 12.00% – 15.00% |

| Time Loan for 6m | 14.00% | 12.50% – 15.50% |

| OD | 14.50% | 13.00% – 16.00% |

| ii) Cash Collateral – Other Banks FDR/WDB | ||

| Time Loan for 3m | 14.00% | 12.50% – 15.50% |

| Time Loan for 6m | 14.50% | 13.00% – 16.00% |

| OD | 15.00% | 13.50% – 16.50% |

Notes:

- Interest rate on overdraft (OD) under Working Capital & Commercial Lending categories will be higher by 0.50% than that of other funded limits availed by same customer.

- For lending against ABBL FDR, the rate is 2.00% above the rate of the instrument subject to minimum 13.00%.

- Exposure under cash collateral of other banks requires clearance from Financial Institutions.

Credit Assessment:

A thorough credit and risk assessment is conducted by ABBL prior to the granting of loans, and at least annually thereafter for all facilities. The results of this assessment are presented in a Credit Application that originates from the relationship manager (“RM”), and is approved by Credit Risk Management (CRM). The RM is the owner of the customer relationship, and must be held responsible to ensure the accuracy of the entire credit application submitted for approval. RMs are familiar with the ABBL’s Lending Guidelines and conduct due diligence on new borrowers, principals, and guarantors.

It is essential that RMs know their customers and conduct due diligence on new,” borrowers. Principals and guarantors to ensure such parties are in fact who they represent themselves to be. ABBL have established Know Your Customer (KYC) and Money Laundering guidelines which is adhered to at all times.

Credit Applications summarize the results of the RMs risk assessment and include, as a minimum, the following details:

- Amount and type of loan(s) proposed.

- Purpose of loans.

- Loan Structure (Tenor, Covenants, Repayment Schedule, Interest)

- Security Arrangements

In addition, the following risk areas are also addressed by ABBL:

* Borrower Analysis:

The majority shareholders, management team and group or affiliate companies are assessed. Any issues regarding lack of management depth, complicated ownership structures or inter-group transactions are addressed, and risks mitigated by ABBL.

* Industry Analysis:

The key risk factors of the borrower’s industry are assessed. Any issues regarding the borrower’s position in the industry, overall industry concerns or competitive forces are addressed and the strengths and weaknesses of the borrower relative to its competition are identified.

* Supplier/Buyer Analysis:

Any customer or supplier concentration is addressed, as these could have a significant impact on the future viability of the borrower.

* Historical Financial Analysis:

An analysis of a minimum of 3 years historical financial statements of the borrower is presented. Where reliance is placed on a corporate guarantor, guarantor financial statements are also analyzed. The analysis addresses the quality and sustainability of earnings, cash flow and the strength of the borrower’s balance sheet. Specifically, cash flow, leverage and profitability are analyzed.

* Projected Financial Performance:

Where term facilities (tenor> 1 year) are being proposed, a projection of the borrower’s future financial performance is provided, indicating an analysis of the sufficiency of cash flow to service debt repayments. Loans are not granted if projected cash flow is insufficient to repay debts.

* Account Conduct:

For existing borrowers, the historic performance in meeting repayment obligations (trade payments, cheques, interest and principal payments, etc) is assessed.

* Adherence to Lending Guidelines:

Credit Applications clearly state whether or not the proposed application is in compliance with the ABBL’s Credit Policies. The Bank’s Head of Credit or Managing Director/CEO approve Credit Applications that do not adhere to the bank’s Credit Policies.

* Mitigating Factors:

Mitigating factors for risks identified in the credit assessment are identified. Possible risks include, but are not limited to: margin sustainability and/or volatility, high debt load (leverage/gearing), overstocking or debtor issues; rapid growth, acquisition or expansion; new business line/product expansion; management changes or succession issues; customer or supplier concentrations; and lack of transparency or industry issues.

*Loan Structure:

The amounts and tenors of financing proposed are justified by ABBL, based on the projected repayment ability and loan purpose. Excessive tenor or amount relative to business ABBL increases the risk of fund diversion and adversely impact the borrower’s repayment ability.

* Security:

A current valuation of collateral is obtained and the quality and priority of security being proposed are properly assessed. Loans are not granted by ABBL, based solely on security. Adequacy and the extent of the insurance coverage are assessed.

* Name Lending:

Credit proposals are not unduly influenced by an over reliance on the sponsoring principal’s reputation, reported independent means, or their perceived willingness to inject funds into various business enterprises in case of need. These situations are discouraged and treated with great caution. Rather, credit proposals and the granting of loans are based on sound fundamentals, supported by a thorough financial and risk analysis.

³Small & Medium Enterprise (SME):

SME finance in keeping strengthens with the prevailing economic policy of the country. The bank is financing in different sectors of SME sector of the country to a great extent. SMEs are defined in accordance with the prudential regulations or the guidelines of Bangladesh Bank.

Small Enterprise means an entity, ideally not a public limited company, does not employ more than 60 persons (if it is manufacturing concern) and 20 persons (if it is a trading concern) and 30 persons (if it is a service concern) and also fulfills the following criteria:

Service concern: Total assets Tk. 50,000 to 30 Lac (excluding land & building cost)

Trading concern: Total assets Tk. 50,000 to 50 Lac (excluding land & building cost)

Manufacturing concern: Total assets Tk. 50,000 to 1 Crore (excluding land & building cost)

Medium Enterprise means an entity, ideally not a public limited company, does not employ more than 100 persons (if it is manufacturing concern) and 50 persons (if it is a trading concern) and 50 persons (if it is a service concern) and also fulfills the following criteria:

Service concern: Total assets Tk. 30.00 to 100.00 Lac (excluding land & building cost)

Trading concern: Total assets Tk. 50.00 to 200.00 Lac (excluding land & building cost)

Manufacturing concern: Total assets Tk. 100.00 to 500.00 Lac (excluding land & building cost)

SME is also defined by the AB Bank.

Small Enterprise means an entity, ideally not a public limited company, does not employ more than 75 persons (if it is manufacturing concern) and 30 persons (if it is a trading concern) and 30 persons (if it is a service concern) and also fulfills the following criteria:

Service concern: Total Turnover upto TK. 500.00 Lac, Total assets upto Tk. 100.00 Lac & Loan Size upto TK. 50.00 Lac. (excluding land & building cost)

Trading concern: Total Turnover upto TK. 500.00 Lac, Total assets upto Tk. 100.00 Lac & Loan Size upto TK. 50.00 Lac. (excluding land & building cost)

Manufacturing concern: Total Turnover upto TK. 500.00 Lac, Total assets upto Tk. 200.00 Lac & Loan Size upto TK. 50.00 Lac. (excluding land & building cost)

Medium Enterprise means an entity, ideally not a public limited company, does not employ more than 500 persons (if it is manufacturing concern) and 100 persons (if it is a trading concern) and 100 persons (if it is a service concern) and also fulfills the following criteria:

Service concern: Total Turnover upto TK.1500.00 Lac, Total assets upto TK.500.00 & Loan Size upto TK. 500.00 Lac.( excluding land & building)

Trading concern: Total Turnover upto TK. 2500.00 Lac, Total assets upto TK. 500.000 Lac & Loan Size upto TK. 500.00 Lac. (excluding land & building)

Manufacturing concern: Total Turnover upto TK. 2000.00 Lac, Total Assets upto TK. 1000.00 Lac & Loan Size TK. 500.00 Lac ( excluding land & building)

Trading concern: Total assets Tk. 50.00 to 200.00 Lac (excluding land & building cost)

Manufacturing concern: Total assets Tk. 100.00 to 500.00 Lac (excluding land & building cost)

Product name of SME:

Following are some of the products and financial tools of SME—

‘Gati’ Loan

‘Prosshar’ Loan

‘Digun’ Loan

‘Sathi’ Loan

‘Chhoto Puji’ Loan

‘Odor’ Loan

‘Awparajita’ Loan

Features of Products:

“Gati Loan”

A loan facility for meeting regular as well as additional requirement of businesses; i.e. it will be part of working capital of the business.

| Basic Terms | Purpose |

| Maximum Loan Amount: | * Maximum TK. 50.00 lac |

* Limit will be determined by the stock and/ or volume of sales.

* Maximum 80% of the stock value to be financed.Interest Rate:15% p.a. to 17% p.a.Service Charge:1.00%Tenor: Maximum 3 YearsRepayment: Through EMI/Lump sumSecurity or Collateral:

- Hypothecation of stock or receivables

- Registered Mortgage of land and buildings or Tripartite agreement for shop or business premises or any other collateral

“Proshar Loan”

It is long term finance for infrastructure development/ capacity building etc.; i.e. Term loan for expansion.

| Basic Terms | Purpose |

| Maximum Loan Amount: |

|

| Interest Rate: | 15% p.a.—17% p.a. |

| Service Charge: | 1.00% |

| Tenor: | Maximum 3 Years |

| Repayment: | Through EMI |

(Moratorium period: Maximum 6 months)Security or Collateral:

- Hypothecation of stock and/ or receivables and/ or machineries and/ or furniture and fixture etc.

- Registered Mortgage of land and building and/or Tripartite agreement for shop or business premises or any other Collateral.

“Digun Loan”

Double amount of loan against value of the savings instrument ‘ ABBL FDR, DDS ‘ to meet any type of business requirement.

| Basic Terms | Purpose |

| Loan Amount: | TK. 10.00 lac to TK. 50.00 lac |

| Interest Rate: | 8.00% above the instrument interest rate p.a. subject to minimum loan interest rate of 17.00% p.a. |

| Service Charge: | 1.00% |

| Tenor: | Maximum 3 Years |

| Repayment: | Through EMI/ Lump sum. |

| Security or Collateral: |

|

“Sathi Loan”

Term loan for CNG Refueling conversion/ Light Engineering/ project finance ‘Package deal including Non- funded’.

| Basic Terms | Purpose |

| Loan Amount: |

|

| Interest Rate: | 15.00% p.a. to 17.00% p.a. |

| Service Charge: | 1.00% |

| Tenor: | Maximum 3 Years |

| Repayment: | Through EMI |

| Security or Collateral: |

PG of the Directors. |

“Chhoto Puji Loan”

Mortgage free Term Loan for working capital/ fixed investment requirement.

| Basic Terms | Purpose |

| Loan Amount: |

|

| Interest Rate: | 17.00% p.a. |

| Service Charge: | 2.00% |

| Tenor: | Maximum 3 Years |

| Repayment: | Through EMI |

| Security or Collateral: |

PG of the Directors. |

“Uddog Loan”

Loan for New entrepreneur/ businesss. (Working capital as well as fixed capital investment.)

| Basic Terms | Purpose |

| Loan Amount: |

|

| Interest Rate: | 15.00% p.a. to 17.00% p.a. |

| Service Charge: | 2.00% |

| Tenor: | Maximum 3 Years |

| Repayment: | Through EMI |

| Security or Collateral: |

|

“Awparajita Loan”

A Loan facility for meting working capital requirement as well fixed investment in businesses for women entrepreneurs.

| Basic Terms | Purpose |

| Loan Amount: |

|

| Interest Rate: | 14.00% p.a. to 16.00% p.a. |

| Service Charge: | 1.00% |

| Tenor: | Maximum 3 Years. |

| Repayment: | Through EMI/ Lump sum. |

| Security or Collateral: |

Tripartite agreement for shop or business premises.

|

Retail Banking:

Retail Banking provide mainly two types of loan-

Secured Loan

Unsecured Loan

Secured Loan:

A secured loan is a loan in which the borrower pledges some asset (e.g. a car or property) as collateral for the loan, which then becomes a secured debt owed to the creditor who gives the loan.

Feature of Product:

Personal Loan

| Target Customer | All Clients of ABBL. |

| Purpose | To meet personal requirement of fund |

| Loan Amount | Maximum 95% of the present value of the security |

| Charges | Processing fee: 1000 |

| Tenor | Minimum 12 months or Maximum 36 months. |

| Rate of Interest | 15.00% p.a. – 16.50% p.a. (subject to type of the security). 2% spread must be maintained in case of own bank FDR. |

| Security | Hypothecation of the product to be purchased. Two personal guarantees (as per our list of eligible guarantors) |

Personal Overdraft

| Target Customer | All Clients of ABBL. |

| Purpose | To meet personal requirement of fund |

| Loan Amount | Maximum 95% of the present value of the security |

| Charges | Processing fee: 1000 |

| Tenor | Revolving with annual review. |

| Rate of Interest | 13.50% p.a. – 16.50% p.a. (subject to type of the security). 2% spread must be maintained in case of own bank FDR. |

| Security | Lien over FDR, BSP, ICB Unit Certificate, RFCD, NFCD, CD account(s) etc. One personal guarantee in case of third party cash collateral (as per our list of eligible guarantors) |

Secured Loans are allowed against the following securities:

- Shares of various Companies approved by Head Office from time to time and listed in the Stock Exchange.

- Term Deposit Receipts issued by any Branch of our Bank.

- Lien on balance in Savings NC, Current Ale. and other Savings Schemes Government Promissory Notes .

- Various Sanchaya Patras

- Surrender value of Life Insurance Policies.

- WEDB

- Assignment of bills against work orders/supply orders and receivables

- Stock of goods in trade (Permissible goods only) pledged or hypothecated

- Hypothecation of power driven vehicles or watercrafts.

- Hypothecation of capital Machineries and equipments.

- Immovable Property.

- Imported merchandise – pledged or hypothecated

- Trust Receipts.

- Bills Purchased

- Scheduled Bank/Insurance Guarantees

- Export Bills gghghgyghghgghhjh

- Inland Bills.

- Personal Guarantee

- Corporate Guarantee

Unsecured Loan:

An unsecured loan is one, which is granted to a constituent without obtaining any security subject to restrictions imposed from time to time by Bangladesh Bank or any competent authority. In such case only charge documents are held.

Personal Loan

| Target Customer | Employees of reputed Local Corporate, MNCs, NGOs, Airlines, Private Universities, Schools and Colleges, International Aid Agencies and UN bodies, Government Employees, Self-employed Professionals (Doctors, Engineers, Chartered Accountants, Architects, Consultants), Businessmen. |

| Purpose | Marriages in the family, Purchase of office equipment / accessories, Purchase of miscellaneous household appliances, Purchase of Personal Computers, Purchase of audio-video equipment, Purchase of furniture. |

| Loan Amount | MinimumTk.25,000.00 & Maximum Tk. 5,00,000.00 |

| Charges | Application fee TK. 500.00 |

Processing fee: 1% on the approved loan amount or Tk. 2000.00 whichever is higherTenorMinimum12months, Maximum 36 months.Rate of Interest15.00% p.a. – 16.50% p.a.SecurityHypothecation of the product to be purchased. Two personal guarantees (as per our list of eligible guarantors)

Auto Loan

| Target Customer | Employees of reputed Local Corporate, MNCs, NGOs, Airlines, PrivateUniversities, Schools and Colleges, International Aid Agencies and UN bodies, Government Employees, Self-employed Professionals (Doctors, Engineers, Chartered Accountants, Architects, Consultants), Businessmen |

| Purpose | To purchase Brand new vehicle, non-registered reconditioned vehicle. |

| Loan Amount | 70%for the brand new car 60% for the reconditioned car but must not exceed TK.1.00 lac. |

| Charges | Application fee: Tk. 500.00 |

Processing fee: 1% on the approved loan amount or Tk. 5000.00 whichever is higherTenorFor Reconditioned Car: Max 36 months

For Brand new Car: Max 60 monthsRate of Interest15.00% p.a. – 16.00% p.a.SecurityHypothecation of the vehicle to be purchased. Two personal guarantees (as per our list of eligible guarantors)

Easy Loan for Executives

| Target Customer | Employees of reputed Banks & Leasing companies, Local Corporate, MNCs, NGOs, Airlines, Private Universities, Schools and Colleges, International Aid Agencies and UN bodies, Government Employees, Self-employed Professionals (Doctors, Engineers, Chartered Accountants, Architects, Consultants), |

| Purpose | Marriages in the family, Purchase of office equipment / accessories, Purchase of miscellaneous household appliances, Purchase of Personal Computers, Purchase of audio-video equipment, Purchase of furniture, Advance rental payment, Trips abroad, Admission/Education fee of Children etc. |

| Loan Amount | MinimumTk.50,000.00 & Maximum Tk. 3,00,000.00 |

| Charges | Applicationfee:Tk.500.00 |

Processing fee: 1% on the approved loan amount or Tk. 1000.00 whichever is higher.TenorMinimum12months &Maximum 36 months.Rate of Interest15.00% p.a. – 16.50% p.a.SecurityLetter of confirmation from the employer. One personal guarantee (as per our list of eligible guarantors)

Gold Grace( Jewelry Loan)

| Target Customer | The loan is specially designed for salaried women who are employed in different reputed companies |

| Purpose | To purchase ornaments/Jewelry for personal use only. |

| Loan Amount | MinimumTk.50,000.00 & Maximum Tk. 3,00,000.00 |

| Charges | Application fee: Tk. 500.00 |

Processing fee: 1% on the approved loan amount or Tk. 1000.00 whichever is higher.TenorMinimm12months & Maximum 36 months.Rate of Interest15.00% to 16.50% p.a.SecurityLetter of confirmation from the employer. Personal guarantee from the parents and spouse (if married)

House/ Office/Furnishing/ Renovation Loan

| Target Customer | Expatriate Bangladeshi nationals who are in business or service holders. Employees of reputed Banks & Leasing companies, reputed Local Corporate, MNCs, NGOs, Airlines, PrivateUniversities, Schools and Colleges, International Aid Agencies and UN bodies. Government Employees. Self-employed Professionals (Doctors, Engineers, Chartered Accountants, Architects, Consultants). Reputed and highly respectable Businessmen with a reliable source of income |

| Purpose | House/Office Furnishing/ Renovation, For interior decoration / Titles Stones, Electrical fittings, wooden cabinets / Overall furnishing and all types of House/Office Renovation, purchase/furnishing of apartments etc. |

| Loan Amount | MinimumTk.1.00 lac & Maximum Tk. 10.00 lac. |

| Charges | Application fee: Tk. 500.00 |

Processing fee: 1% on the approved loan amount or Tk. 2000.00 whichever is higher.TenorMinimum12months & Maximum 48 months.Rate of Interest15.50% to 16.50% p.a.SecurityTitle deed of the House/Office to be furnished/renovated along with memorandum of deposit of title deed duly supported by a notarized power of attorney to be kept by the bank as a matter of comfort. Two personal guarantees (as per our list of eligible guarantors). Registered mortgaged of the property if the loan amount is more than Tk. 5.00 lac

Education Loan

| Target Customer | Students of repotted Educational Institutions- Public & Private Universities, Medical colleges, Engineering Institutions. |

Undergraduate & Post graduate Level

Professional degrees like -CA, ICMA, MBA, MBM, PHD, FCPs etc.

PurposeTo financially assist the parents:Loan AmountMinimumTK50,000.00 & MaximumTK. 3,00,000.00ChargesApplicationfee:Tk.500.00

Processing fee: 1% on the approved loan amount or Tk. 2000.00 whichever is higherTenorMinimum12months & Maximum 36 months.Rate of Interest14.00% to 17.00% p.a.SecurityOffer latter from related institutions. Original Certificates, Conformation from Head of Deptt. /Dean/Principal, One guarantor to be same level or higher than the customer. Age must be 17 to 40 years, Names of referees acceptable to the Bank.

Staff Loan

| Target Customer | All permanent employees of ABBL |

| Purpose | Marriages in the family, Purchase of office equipment / accessories, Purchase of miscellaneous household appliances, Purchase of Personal Computers, Purchase of audio-video equipment, Purchase of furniture |

| Loan Amount | According to the debt burden ration and other criteria |

| Charges | Processing fee: 1% on the approved loan amount |

| Tenor | Minimm12months & Maximum 36 months |

| Rate of Interest | 15.50% p.a. |

| Security | Hypothecation of the product to be purchased |

VISA Credit Card

| Target Customer | All Clients of VISA Credit Card of ABBL. |

| Purpose | Any Prpose. |

| Loan Amount | For VISA Classic TK.0.10 lac to 0.50 lac & for VISA Gold TK. 0.51 lac to 5.00 lac. |

| Charges | Processing fee: 1% on the approved loan amount |

| Tenor | 36 months & renewable. |

| Rate of Interest | 2.000% p.a. |

| Security | Hypothecation of the product to be purchased. |

Processing of Credit Proposals:

A secured credit facility may be allowed to a customer only after getting a limit sanctioned by the authorized officials. AB bank follows some systematic process of Credit Proposal, those are given below-

Application for loan:

Applicant applies for the loan in the prescribed form of Bank. The purpose of this forms is to eliminate the unwanted borrowers at the first sight and select those who have the potential to utilize the credit and pay it back in due time.

Getting Credit information:

Then the bank collects credit information about the borrower from the following sources:

- Personal Investigation.

- Confidential report from other bank/ Head office/Branch/Chamber of commerce.

- CIB report from central bank

Scrutinizing and Investigation:

Bank then starts examination that whether the loan applied for is complying with its lending policy. If comply, than it examines the documents submitted and the credit worthiness. Credit worthiness analyses, i.e. analysis of financial conditions of the loan applicant are very important. Then bank goes for Credit Risk Grading (CRG) and spreadsheet analysis, which are recently introduced by Bangladesh Bank. According to Bangladesh Bank rule, CRG and SA is must for the loan exceeding Dhaka core.

If these two analyses reflect favorable condition and documents submitted for the loan appears to be satisfactory then, bank goes for further action.

CIB Report From Central Bank:

Credit Information Bureau (CIB) of Bangladesh bank has a central database for all the lenders of Bangladesh. It contains the total credit history of a client and act as the most dependable source to analyze the credit worthiness of a prospective client. Obtaining the CIB clearance is a precondition of fund disbursement and all type of Retail, SME and corporate loan require CIB report before disbursement. For some retail unsecured assets, BBL obtains post-facto CIB clearance. However, in most cases AOD obtains the CIB for a client before disbursement of fund.

To obtain a CIB report, AOD fills up the following Bangladesh bank prescribed forms for each loan application:

I. Inquiry Form: CIB – 1A: For each individual/ institution

II. Inquiry Form: CIB – 2A: Owner information if borrower is institution

III. Inquiry Form: CIB – 3A: Group/ related business information of borrower

IV. CIB Undertaking form “KA”: For each individual/proprietor/director/partner

These forms are filled up by the business units and sent to the CIB segment of AOD. CIB segment maintains a central database for all the CIB inquiry forms. Each form is registered under a Head Office serial number and a Branch/ Unit office serial number. Therefore AOD prepares a forwarding letter with reference to 20 such inquiry forms, and sent them to Credit Information Bureau of BB once in a day.

Usually the CIB reports are received within 7-10 working days.

After receiving the reports from BB, AOD prepares a summary of the report and put that as reference in the loan file along with the photocopy of the CIB inquiry forms, undertaking and copy of the original CIB report.

For any mistakes made in the forms, writing wrong spelling, incomplete name of individuals or institutions, CIB report may show error as mismatch exists there. Those CIB inquiry forms require to be sent again correcting the facts. CIB reports are usually updated quarterly and half-yearly. Therefore most updated CIB reports are required to be obtained and CIB report is also require for the same client for repeat loan.

All forms need to be supported by the Applicant’s Undertaking and all the forms are signed by designated officers of the business division; e.g.

- Relationship manager for Corporate Application.

- Sales Manager for Retail Application.

- Credit Risk Officer for SME Application.

The designated officers also require to attest the undertaking form “KA” filled up by the loan applicant (individual/ institution/ group). CIB information for Group is mainly required for the corporate loan applications.

CIB is a regulatory requirement for Loan Documentation.

The following Papers/documents are to be submitted by the Branch Managers along with the proposals:

- Request for Credit limit of customers.

- Project Profile / Profile of Business.

- Copy of Trade License duly attested.

- Copy of TIN Certificate.

- Certified copy of Memorandum and Articles of Association. Certificate of Incorporation, Certificate of commencement of business in case of Public Ltd. Co. Resolution of Board of Director, Partnership Deed, (where applicable)

- Personal Net worth Statement of the Owner/ Director/ Partner/ Proprietor in Bank’s Format.

- Valuation Certificate in Bank’s Format along with photograph of collateral security (land & building with detail particulars on the back duly authenticated by the Branch Manager.

- In case the value of the property offered as security exceed Tk.5O.OO lac, the value to be assessed by bank’s enlisted surveyor and report thereof to be obtained.

- 3 years Balance sheet and profit and loss A/C.

- cm Enquiry Form duly filled in (For proposal of Tk.l0.00 lac and above) CJ Lending Risk Analysis for Credit facilities of Tk.50.00 lac and above.

- Inspection/Visit Report of Factory/Establishment/Business premises of the customer.

- Stock Report duly verified (where applicable)

- Credit Report from other Banks.

- Indent/Proforma Invoice/Quotation (Where applicable)

- Price verification report (where applicable)

- Statement of A/C (CD/SB/CC) for the last 12 months. In case the customer maintaining account with other Bank, Statement of Account for the last 12 months of the concerned Bank should be furnished.

- In case of renewal/ enhancement of credit facility, Debit Turnover, Credit Turnover Highest drawing, lowest drawing, and Total income earned detailed position of existing liabilities of the customer i.e. Date of sanction. Date of expiry, Present outstanding, Remarks, if any.