FUNCTIONS OF ICB MUTUAL FUNDS DEPARTMENT:

Mutual portfolio formation and floating decision taken by ICB with the approval of the management EBR department decides holding category considering capital, portfolio risk, income trend, and risk diversified uniform income and growth. After all these decision security to be held are collected from IPO, Debenture issue, Secondary market etc. ICB helps sometime giving security at discount rate or at face value. Then the Fund is registered with SEC and listed with DSE and CSE. However after public issue, the fund portfolio is handed over to funds division for management operation. For purpose the Mutual Fund department has to perform the following activities mainly:

- Renunciation and issue of certificate.

- Maintain the register of the certificate holders.

- Transfer certificate if applied for after verifying transferee signature.

- Register the name of the transferee after getting approval from competent authority.

- Prepare dividend list and issue and mail dividend warrant as decided by the board.

- Record/ correct changes of address if applied.

- Reissue certificate after confirming loss and mark transfer restriction of the lost certificate, if applied for and also inform DSE & CSE on revision of the following document submitted by the loser.

REGULATORY SET-UP OF ICB’S MUTUAL FUNDS:

When ICB took the initiative of floating mutual fund in Bangladesh, there was no organized and recognized regulatory set-up for managing of mutual funds in Bangladesh. ICB had to formulate the necessary regulatory set-up and rules for the management of mutual funds. The regulatory set-up for ICB mutual funds is explicitly explained in the ICB Regulation-1977. The main features of this regulatory set-up are mentioned below:

- The Corporation may from constitute of ICB mutual funds of such denominations and securities in such each case as the board may determine.

- ICB mutual fund certificates will be listed and quoted in the stock exchange in Bangladesh and the board may determine subject to the permission of the stock exchange.

- ICB mutual funds certificate shall be movable property and freely transferable.

- ICB Mutual Fund certificate will be sold or offered for subscription with the prior consent of the government.

MANAGEMENT OF THE FUNDS:

There is a decision making board in order to manage different Mutual Funds. As per board’s decision securities are bought under different Mutual Funds. At the same way securities are sold. In case of new Mutual Fund subscribes for public issue.

ICB authority is made portfolio earlier by its own finance and given it name. After that it is published on any newspaper as prospectus. By studying this prospectus public response whether they will buy the Mutual Fund or not.

FLOATATION OF NEW MUTUAL FUNDS:

When ICB floats a new mutual fund, it is announced through publication of prospectus in two widely circulated newspapers. An investor has to apply for the shares of new mutual fund by filling in prescribed application form that can be collected from ICB officers and other attorney banks. Sometimes allotment is done by lottery draw.10% of any new mutual fund is served for non-Bangladeshi. Any Bangladeshi living abroad can collect from Bangladesh mission abroad or from authorized bank branches or from web site.

HOW TO BUY EXISTING MUTUAL FUNDS:

An investor can purchase any of the existing eight ICB Mutual Funds certificates through the Stock Exchanges at the prevailing Market Price. However, if an investor buys Mutual Fund certificates through the Stock Exchanges he/she must be careful to submit the certificates along with duly filled-in transfer deed at ICB Head Office to ensure that the certificates are registered in his/her name.

ADVANCES AGAINST MUTUAL FUND CERTIFICATES SCHEME:

Advance against ICB Mutual Fund certificates Scheme was introduced in 2003, designed for the ICB Mutual Fund Certificate holders to meet their emergency fund requirement. One can borrow maximum of 50% value of last one year’s weighted average market price of certificates at time of borrowing by depositing his/her certificates under lien arrangement from any of the ICB offices. The rate of interest on the loan is reasonable and also competitive.

MANAGEMENT FEE, CHARGE ETC.:

At present management fee @ 1% on the paid up capital of the Fund is charged annually. No amount is charged on account of custodial and trust services. Part of operating expenses are charged to the respective Mutual Funds on pro rata basis

ASSETS OF ICB MUTUAL FUNDS:

ICB Mutual Funds Certificates holders shall have unfettered ownership in the assets of the Fund to which they are related. In case of winding up of the Corporation the assets belonging to any ICB Mutual Fund shall not be treated as the assets of the Corporation.

TAX CONCESSIONS:

- Ø Investment in Certificates provides the same tax exemptions as an investment qualifying under Section 44 of the Income Tax Ordinance, 1984.

- Ø Capital gains received on investment in the Fund Certificates shall not be included in the total income of a Certificate holder within the limits specified in the Income Tax Ordinance, 1984.

- Ø Dividends received on investment in the Fund will be treated as dividend income under Income Tax Act, and will be exempted from tax with the limits specified in the Act.

- Ø The Fund incomes are to be exempted from all taxes as granted by the Government as per SRO No 80-L/80 dated April, 1980.

DECLARATION OF DIVIDEND:

The net income received on investments of Funds on account of dividend, bonus, interest, capital gain etc. are distributed amongst the Certificate holders as per decision of the Board of Directors of ICB. Board declares such income in the form of dividend at the end of July each year. Dividends declared by ICB in the past on the Mutual Funds were very attractive. The year-wise per certificate dividend performance of the Funds is given below.

Rate of the Dividend per Certificate (Taka)

| Year | Eight Mutual Funds | |||||||

| 1 st | 2 nd | 3 rd | 4 th | 5 th | 6 th | 7 th | 8 th | |

| 1980-81 | 20 | |||||||

| 1981-82 | 20 | |||||||

| 1982-83 | 20 | |||||||

| 1983-84 | 25 | |||||||

| 1984-85 | 35 | 21 | ||||||

| 1985-86 | 38 | 23 | 21 | |||||

| 1986-87 | 41 | 25.5 | 22.5 | 21.5 | ||||

| 1987-88 | 48 | 28 | 25.5 | 23 | 20 | |||

| 1988-89 | 49 | 29 | 26 | 23.5 | 20.5 | 15.5 | ||

| 1989-90 | 49 | 29 | 26 | 23 | 20.5 | 13.25 | ||

| 1990-91 | 35 | 22 | 19 | 17 | 10 | 6 | ||

| 1991-92 | 31 | 22 | 19 | 18 | 11 | 6 | ||

| 1992-93 | 31 | 21 | 18 | 17 | 12 | – | ||

| 1993-94 | 45 | 27 | 22 | 40 | 25 | 16 | ||

| 1994-95 | 50 | 40 | 27 | 41 | 28 | 18 | ||

| 1995-96 | 60 | 42 | 28 | 41 | 30 | 20 | 18 | |

| 1996-97 | 70 | 45 | 38 | 45 | 35 | 24 | 21 | 18 |

| 1997-98 | 70 | 30 | 35 | 32 | 22 | 18 | 14 | 12 |

| 1998-99 | 100 | 32 | 38 | 35 | 20 | 15 | 13 | 12 |

| 1999-2000 | 125 | 35 | 40 | 36 | 21 | 16 | 13.5 | 12.5 |

| 2000-2001 | 170 | 40 | 45 | 38 | 23 | 17 | 14 | 13 |

| 2001-2002 | 175 | 42 | 50 | 40 | 24 | 17.50 | 14.50 | 13.50 |

| 2002-2003 | 180 | 45 | 50 | 40 | 24 | 17.50 | 14.50 | 13.50 |

| 2003-2004 | 200 | 50 | 50 | 45 | 24 | 17.50 | 15 | 14 |

| 2004-2005 | 210 | 55 | 52 | 48 | 27 | 18.50 | 16 | 15 |

| 2005-2006 | 210 | 55 | 52 | 48 | 27 | 18.50 | 16 | 15 |

| 2006-2007 | 190 | 62 | 56 | 52 | 33 | 23 | 22.50 | 18 |

| 2007-2008 | 265 | 75 | 65 | 60 | 45 | 30 | 30 | 25 |

| 2008-2009 | 310 | 95 | 85 | 80 | 56 | 37 | 35 | 32 |

| 2009-2010 | 400 | 200 | 140 | 125 | 100 | 75 | 70 | 65 |

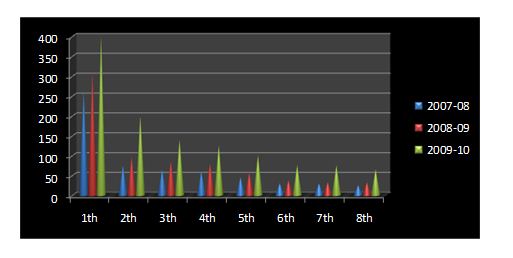

Dividend Performance: (Tk. per Certificate)

Mutual Funds | Financial Year | ||

2007-08 | 2008-09 | 2009-10 | |

| First ICB mutual fund | 265.00 | 310.00 | 400.00 |

| Second ICB mutual fund | 75.00 | 95.00 | 200.00 |

| Third ICB mutual fund | 65.00 | 85.00 | 140.00 |

| Fourth ICB mutual fund | 60.00 | 80.00 | 125.00 |

| Fifth ICB mutual fund | 45.00 | 56.00 | 100.00 |

| Sixth ICB mutual fund | 30.00 | 37.00 | 75.00 |

| Seventh ICB mutual fund | 30.00 | 32.00 | 70.00 |

| Eighth ICB mutual fund | 25.00 | 32.00 | 65.00 |

Here we see that, all Mutual Funds’ in every year increases the dividend. It is a good sign for a company and may be growth day by day. It’s very important things for investors. Sometimes it shows the future growth, and the investors are confident on the fund. In every year 1st ICB Mutual Fund declared the maximum dividend for the share holders.

DETAILS DESCRIPTION OF ICB’S EIGHT MUTUAL FUND:

First ICB Mutual Fund:

The 1st ICB Mutual Fund was floated at 25th April, 1980. It is the most attractive mutual fund among the others.

Dividend and Interest income:

The Fund had earned dividend of Tk. 85.70 lac from 47 securities during 2009-2010 of which a sum of Tk. 74.69 lac (87.15 percent) was received in cash within 30June 2010.

Capital Gains on Sale of Investments:

During 2009-10, the Fund earned Tk. 375.65 lac as capital gains by securities of 78 companies as shown in the following table:

| Sl. No | Name of the company | No. of Securities sold | Capital gain(taka) |

| 1 | Bangladesh Finance & Inv. Co. Ltd. | 1650 | 1101475.18 |

| 2 | Bangladesh Industrial Fin. Co. Ltd. | 100 | 67413.22 |

| 3 | Bay Leasing & Investment Ltd. | 200 | 266800.00 |

| 4 | Delta Brac Housing Fin. Cor. Ltd. | 400 | 683987.48 |

| 5 | Fidelity Assets & Securities Co. Ltd. | 1400 | 298376.93 |

| 6 | First Leasing International Ltd. | 100 | 118762.63 |

| 7 | IPDC | 400 | 68357.24 |

| 8 | IDLC | 700 | 775449.99 |

| 9 | ILFSL | 200 | 230701.88 |

| 10 | National Housing Fin & Investment Ltd | 200 | 198600.00 |

| 11 | PLFSL | 1200 | 413874.98 |

| 12 | Phoenix Fin. & Inv. Ltd. | 1950 | 697621.39 |

| 13 | Premier Leasing & Fin. Ltd. | 1700 | 356453.44 |

| 14 | Union Capital Ld | 4000 | 505879.20 |

| 15 | United Leasing Co. Ltd | 480 | 534669.63 |

| 16 | Al-Arafah Islami Bank Ltd | 1500 | 192477.40 |

| 17 | Bank Asia Ltd | 100 | 43174.41 |

| 18 | Brac Bank Ltd | 500 | 284379.37 |

| 19 | Dhaka Bank Ltd | 400 | 177954.68 |

| 20 | EXIM Bank Ltd | 1800 | 322914.64 |

| 21 | Mercantile Bank Ltd | 800 | 139668.34 |

| 22 | Mutual Trust Bank Ltd | 2300 | 579263.10 |

| 23 | One Bank Ltd | 50 | 22821.58 |

| 24 | Premier Bank Ltd | 3400 | 995594.33 |

| 25 | Shahjalal Islami Bank Ltd | 1400 | 407949.43 |

| 26 | Social Islami Bank Ltd | 300 | 87963.37 |

| 27 | Southeast Bank Ltd | 1600 | 308880.64 |

| 28 | Standard Bank Ltd | 300 | 48704.82 |

| 29 | First Security Islami Bank Ltd | 2600 | 286869.94 |

| 30 | EBL First MF | 56000 | 1029550.00 |

| 31 | Grameen One: Scheme Two | 2000 | 87100.00 |

| 32 | Trust Bank Ltd | 500 | 182614.70 |

| 33 | ICB AMCL Second MF | 150 | 25000.00 |

| 34 | ICB AMCL Second NRB MF | 200 | 23600.00 |

| 35 | Prime Bank First ICB AMCL MF | 2500 | 36250.00 |

| 36 | Prime Finance First MF | 1000 | 34000.00 |

| 37 | Trust Bank First MF | 5000 | 85500.00 |

| 38 | BSRM Steel Ltd | 1500 | 1149037.50 |

| 39 | Golden Son Ltd | 7000 | 324150.00 |

| 40 | Apex Foods Ltd | 945 | 874937.49 |

| 41 | BATBC | 500 | 167902.45 |

| 42 | Rahima Food | 3500 | 402436.25 |

| 43 | BOC | 1700 | 573786.59 |

| 44 | DESCO | 400 | 314453.88 |

| 45 | Jamuna Oil | 17100 | 3093632.74 |

| 46 | Meghna Petroleum | 7500 | 867665.56 |

| 47 | Padma Oil | 200 | 304900.00 |

| 48 | Power Grid | 200 | 114209.86 |

| 49 | Titas Gas | 100 | 50524.10 |

| 50 | AlltexInd. | 1150 | 72253.38 |

| 51 | Makson Spinning | 1000 | 88458.80 |

| 52 | Metro Spinning | 3500 | 236232.40 |

| 53 | Monno Fabrics | 2000 | 50231.70 |

| 54 | Prime Textile Spinning Mills | 3500 | 742123.75 |

| 55 | RN Spinning | 300 | 125800.00 |

| 56 | The Dhaka Dyeing | 14000 | 675500.00 |

| 57 | Beximco Pharma | 1200 | 200646.32 |

| 58 | Glaxo Smithkline BD | 4800 | 3270620.00 |

| 59 | Imam Button | 350 | 201512.50 |

| 60 | Marico BD | 3400 | 767300.00 |

| 61 | Reckitt Benckiser | 2700 | 3176476.37 |

| 62 | Square Pharma | 100 | 89323.65 |

| 63 | Lafarge Surma Cement | 1000 | 69019.90 |

| 64 | Bangladesh Online | 1000 | 103254.30 |

| 65 | RAK Ceramics BD | 400 | 68300.00 |

| 66 | Shinepukur Ceramics | 600 | 8479.98 |

| 67 | Agrani Insurance | 2800 | 265021.44 |

| 68 | Aisa Insurance | 1000 | 393400.00 |

| 69 | Asia Pacific General Insurance | 1200 | 427146.00 |

| 70 | Continental Insurance | 1200 | 368995.72 |

| 71 | Dhaka Insurance | 150 | 127600.00 |

| 72 | Green Delta Insurance | 100 | 35900.00 |

| 73 | Islami Insurance Bd | 350 | 138600.00 |

| 74 | Mercantile Insurance | 100 | 22712.50 |

| 75 | Nitol Insurance | 450 | 108985.72 |

| 76 | Provati Insurance | 150 | 77450.00 |

| 77 | Rupali Life Insurance | 250 | 378962.50 |

| 78 | Grameen Phone | 19400 | 3274820.00 |

| 79 | Bangladesh Shipping Corporation | 400 | 2141750.00 |

| Total | 37565167.38 | ||

Here we see that, the maximum capital gain came from the company of Grameen Phone Ltd. Total no. of securities 19400 and the amount is Tk. 3,274,820.00

Income, Expenses and Distributable Income:

| Particulars | Taka(Lac) | Taka(Lac) |

| Dividend IncomeInterest income on Bank depositsCapital gain & other income Gross Income…… Total expense…… (commission and brokerage, printing and stationery, postage, Bank charges, provision against investments and others) Net income………… Previous year’s undistributed income Net distributable income Distributable income per certificate | 85.707.99375.65

| 469.34 (423.33) |

| 46.01331.57 | ||

| 754.901006.53 |

Dividend:

The Fund declared dividend at the rate of 400 percent per certificate including 310 percent for the previous year. After making provision of Tk. 300 lac for payment of dividend the Fund had an undistributed income of Tk 454.90 lac. The Year –wise dividend performance of the Fund is shown in the following table:

Year –wise dividend Performance

| Financial Year | Dividend Per Certificate | Financial Year | Dividend Per Certificate |

| 1980-81 | 20 | 1995-96 | 55 |

| 1981-82 | 20 | 1996-97 | 60 |

| 1982-83 | 20 | 1995-96 | 60 |

| 1983-84 | 25 | 1996-97 | 70 |

| 1984-85 | 35 | 1997-98 | 70 |

| 1985-86 | 38 | 1998-99 | 100 |

| 1986-87 | 41 | 1999-00 | 125 |

| 1987-88 | 48 | 2000-01 | 170 |

| 1988-89 | 49 | 2001-02 | 175 |

| 1989-90 | 49 | 2002-03 | 180 |

| 1990-91 | 35 | 2003-04 | 200 |

| 1991-92 | 31 | 2004-05 | 210 |

| 1992-93 | 31 | 2005-06 | 210 |

| 1993-94 | 45 | 2006-07 | 190 (1B:2) |

| 1994-95 | 50 | 2007-08 | 265 |

| 2008-09 | 310 | ||

| 2009-10 | 400 |

Portfolio:

During 2009-10, the fund made investments of Tk. 168.43 lac in securities of 24 companies. As on 30 June 2010 the Fund had securities of 122 companies in its portfolio with a total cost of Tk. 887.70 lac, the market value of which was Tk. 7791.87 lac. Details of the portfolio of the Fund as on 30 June 2009 were Tk. 770,047,230.70

The ex-dividend net asset value per certificate of Tk. 100.00 each of First Mutual Fund stood at Tk. 9877.68 as on 30 June 2010.

The opening and closing market price per certificate of First ICB Mutual Fund of Tk. 100.00 each of the fund was Tk.5783.00 and Tk. 8701.00 as respectively in 2009-10.

The number of certificate holders of the fund was 1105 as on 30 June 2010.

Second ICB Mutual Fund:

The 2nd ICB Mutual Fund was floated at 17 June 1984.

Dividend and Interest income:

The Fund had earned an amount of Tk. 29.67 lac as dividend and interest from 44 securities during 2009-2010 of which, Tk. 26.81 lac (90.50 percent) was received in cash within 30June 2010.

Capital Gains on Sale of Investments:

During 2009-10, the Fund earned Tk. 247.65 lac as capital gains by securities of 79 companies and total capital gain is Tk. 24,765,105.64.

Here, the maximum capital gain came from the company of Grameen Phone Ltd. Total no. of securities 14600 and the amount is Tk. 2,494,140.00

Income, Expenses and Distributable Income:

| Particulars | Taka(Lac) | Taka(Lac) |

| Dividend IncomeInterest income on Bank depositsCapital gains & Other income Gross Income……… Total expense……… (commission and brokerage, printing and stationery, postage, Bank charges, provision against investments and others) Net income…………

Previous year’s undistributed income Net distributable income Distributable income per certificate | 29.675.21247.65

| 282.56 (155.10) |

| 127.43 132.46 | ||

| 259.89519.78 |

Dividend:

The Fund declared dividend at the rate of Tk. 200 per certificate of Tk. 100.00 each for the year 2009-10, which was Tk. 95.00 per certificate in the previous year. After making provision of Tk. 100.00 lac for payment of dividend the Fund had an undistributed income of Tk. 159.89 lac .The Year –wise dividend performance of the Fund is shown in the following table

Year –wise dividend Performance

| Financial Year | Dividend Per Certificate | Financial Year | Dividend Per Certificate |

| 1984-85 | 21 | 1997-98 | 30 |

| 1985-86 | 23 | 1998-99 | 32 |

| 1986-87 | 25 | 1999-2000 | 35 |

| 1987-88 | 28 | 2000-01 | 40 |

| 1988-89 | 29 | 2001-02 | 42 |

| 1989-90 | 29 | 2002-03 | 45 |

| 1990-91 | 22 | 2003-04 | 50 |

| 1991-92 | 22 | 2004-05 | 55 |

| 1992-93 | 21 | 2005-06 | 55 |

| 1993-94 | 27 | 2006-07 | 62 |

| 1994-95 | 40 | 2007-08 | 75 |

| 1995-96 | 42 | 2008-09 | 95 |

| 1996-97 | 45 | 2009-10 | 200 |

Portfolio:

During 2009-10, the fund made investments of Tk. 119.06 lac in securities of 24 companies. As on 30 June 2010 the Fund had securities of 120 companies in its portfolio with a total cost of Tk. 612.98 lac, the market value of which was Tk. 1782.44 lac. Details of the portfolio of the Fund as on 30 June 2010 were Tk. 174510768.45

The ex-dividend net asset value per certificate of Tk. 100.00 each of First Mutual Fund stood at Tk. 2788.41 as on 30 June 2010.

The opening and closing market price per certificate of First ICB Mutual Fund of Tk. 100.00 each of the fund was Tk.2244.75 and Tk. 2578.75 as respectively in 2009-10.

The number of certificate holders of the fund was 1093 as on 30 June 2010.

Third ICB Mutual Fund:

The 3rd ICB Mutual Fund was floated at 19 May 1985.

Dividend and Interest income:

The Fund had earned dividend of Tk. 36.41 lac from 53 securities during 2009-2010 of which a sum of Tk. 32.46 lac (89.15 percent) was received in cash within 30June 2010.

Capital Gains on Sale of Investments:

During 2009-10, the Fund earned Tk. 261.02 lac as capital gains by securities of 76 companies and total capital gain is Tk. 26,102,001.85

Here, the maximum capital gain came from the company of Jamuna Oil Co. Ltd. Total no. of securities 15800 and the amount is Tk. 2,544,718.3

Income, Expenses and Distributable Income:

| Particulars | Taka (Lac) | Taka (Lac) |

| Dividend IncomeInterest income on Bank depositsCapital gains Gross Income…….. Total expense…….. (commission and brokera9ge, printing and stationery, postage, Bank charges, provision against investments and others) Net income………

Previous year’s undistributed income Net distributable income Distributable income per certificate | 36.415.38261.02 | 302.81 (118.43) |

| 184.38192.51 | ||

| 376.89376.89 |

Dividend:

The Fund declared dividend at the rate of Tk. 114.00 per certificate of Tk. 100.00 each for the year 2009-10, which was Tk. 85.00 per certificate in the previous year. After making provision of Tk 140.00 lac for payment of dividend the Fund had an undistributed income of Tk. 236.89 .The Year –wise dividend performance of the Fund is shown in the following table

Year –wise dividend Performance

| Financial Year | Dividend Per Certificate | Financial Year | Dividend Per Certificate |

| 1985-86 | 21 | 1997-98 | 35 |

| 1986-87 | 22.50 | 1998-99 | 38 |