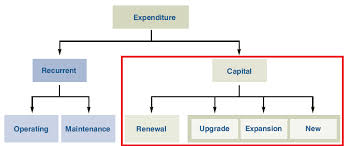

Basic objective of this article is to describe productivity during Capital Expenditure. Capital expenditures are expenditures altering the near future of the business. A capital expenditure is incurred each time a business spends money either to acquire fixed assets or to enhance the value associated with an existing fixed asset that has a useful life increasing beyond the taxable season. Now some capita expenditures cost the boatload of money then one has to understand that although buying such some equipment will save time and energy during operations, sometimes it doesn’t makes sense for the reason that pay off time is to much time and the further labor costs from the task, job or production run are simply slightly increased.

Productivity during Capital Expenditure