Bearer Cheque

A cheque is a very common form of a negotiable instrument. A bearer check is one, which bears the words “Or Bearer” across its face after the name of the payee. ‘Or Bearer’ means the cheque is payable to anyone who bears and presents it to the bank for payment. It is made payable to the bearer i.e. it is payable to the person who presents it to the bank for encashment. It can be negotiated or cashed without the endorsement of the payee. It is a type of cheque in which there are no crossings on it. Any person having a bearer cheque can encash it as there is no order given regarding its acceptance. The cashier hands over the mentioned amount in the cheque to the person who has presented the cheque to him. The bank does not need any identification proof while presenting a bearer cheque for encashment. However, such cheques are risky, this is because if such cheques are lost, the finder of the cheque can collect payment from the bank.

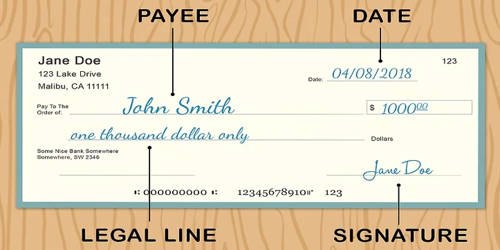

How to write Bearer Cheque –

- First, mention the date on which the cheque is issued.

- As the bearer cheque does not contain the name of the bearer, the issuer must write ‘self’ or ‘pay to the order of cash’

- Mention the amount of money you want to pay in the amount section. Make sure to write ‘Only’ after writing the amount in words.

- Finally, sign on the space provided above the Authorized Signatory text

In simple words, a cheque which is payable to any person who presents it for payment at the bank counter is called ‘Bearer cheque’. It can be collected by the bank for the credit of anyone’s account. It can be paid to any bearer and the bank is in order in making payment of the cheque and there is no necessity for the bank to verify the identity of the person. It does not have any name written on it, but just the amount authorized to withdraw. It can be transferred by mere delivery; they need no endorsement. The transferor of cheque while passing the cheque does not need to endorse the cheque. However, in normal banking practice, where the amount of the cheque is substantial, the identity of the cashier is insisted on. It is necessary for the cashier to sign at the back of the bearer cheque to confirm the receipt of money from the bank.