Cash Flow from Investing Activities is that the section of a company’s income statement that displays how much money has been utilized in (or generated from) making investments during a selected time period. Investing activities include purchases of long-term assets (such as property, plant, and equipment), acquisitions of other businesses, and investments in marketable securities (stocks and bonds).

Negative cash flow is often indicative of a company’s poor performance. However, negative cash flow from investing activities might be due to significant amounts of cash being invested in the long-term health of the company, such as research and development.

Other items to include are a sale of a division, proceeds from the sale of PP&E, and proceeds from the sale of marketable securities and other businesses. Some companies will have items not mentioned above, so it’s important to seem at the balance sheet of a company to determine the line items.

Before analyzing the different types of positive and negative cash flows from investing activities, it’s important to review where a company’s investment activity falls within its financial statements. There are three main financial statements: the balance sheet, income statement, and cash flow statement.

The balance sheet provides a summary of a company’s assets, liabilities, and owner’s equity as of a particular date. The income statement provides a summary of company revenues and expenses during a period. The cash flow statement bridges the gap between the income statement and the balance sheet by showing how much cash is generated or spent on operating, investing, and financing activities for a selected period.

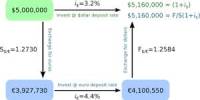

Formula:

Cash Flow from Investing Activities =

(Purchase)/Sale of Long-Term Assets (Capex)

+ (Purchase)/Sale of Other Businesses (M&A)

+ (Purchase)/Sale of Marketable Securities

It is important to know how investing activities are handled in accounting.

Investing Activities Include:

- Purchase of property plant, and equipment (PP&E) – a.k.a. capital expenditures

- Proceeds from the sale of PP&E

- Acquisitions of other businesses or companies

- Proceeds from the sale of other businesses (divestitures)

- Purchases of marketable securities (i.e., stocks, bonds, etc.)

- Proceeds from the sale of marketable securities

The only sure way to know what’s included is to look at the balance sheet and analyze any differences between non-current assets over the two periods. Any changes in the values of these long-term assets (other than the impact of depreciation) mean there will be investing items to display on the cash flow statement.

Investing activity is an important aspect of growth and capital. A change to property, plant, and equipment (PPE), a large line item on the balance sheet, is considered an investing activity. When investors and analysts want to know how much a company spends on PPE, they can look for the sources and uses of funds in the investing section of the cash flow statement.

Capital expenditures (CapEx), also found during this section, may be a popular measure of capital investment used in the valuation of stocks. An increase in capital expenditures means the company is investing in future operations. However, capital expenditures are a reduction in cash flow. Typically, companies with a significant amount of capital expenditures are in an exceedingly state of growth.

Although a company or an organization may report a negative cash flow in investing activities, it doesn’t necessarily mean that it’s going to have a negative impact on the business. The company has faced a negative impact on cash flow due to the purchase of property, plant, and equipment, but in the long-term, the assets could help generate growth in an exceedingly company’s revenue. Investing activities provide an insight into how effectively the company is keeping its asset base up to this point, and investing for future growth.

Information Sources: