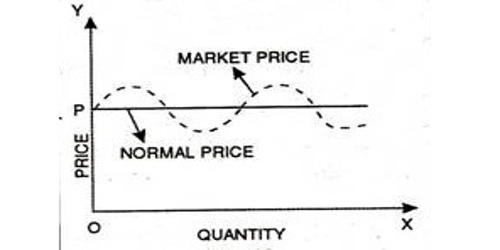

Asset-liability mismatch refers to a situation in which an institution, such as a bank or an investment firm, has assets and liabilities with mismatched maturities or cash flow profiles. For example, if a bank borrows short-term funds to make long-term loans, it has an asset-liability mismatch. This can be risky because if interest rates rise, the cost of borrowing may increase, while the income generated from long-term loans may remain fixed or decline. This can lead to a decrease in the bank’s net interest margin and profitability.

An asset-liability mismatch occurs in finance when the financial terms of an institution’s assets and liabilities do not match. Mismatches of various kinds are possible. A bank that borrows entirely in US dollars and lends in Russian rubles, for example, would have a significant currency mismatch: if the value of the ruble fell dramatically, the bank would lose money. In extreme cases, such changes in the value of assets and liabilities may result in bankruptcy, liquidity issues, and wealth transfer.

A bank may also have significant long-term assets (such as fixed-rate mortgages) that are financed by short-term liabilities such as deposits. When short-term interest rates rise, the maturities of short-term liabilities re-price, while the yield on longer-term, fixed-rate assets remains unchanged. The income from longer-term assets remains constant, while the cost of the newly re-priced liabilities that fund these assets rises. This is known as a maturity mismatch, and it can be measured by the duration gap.

When a bank borrows at one rate but lends at another, this is referred to as an interest rate mismatch. For example, a bank may borrow money by issuing floating-rate bonds while lending money through fixed-rate mortgages. If interest rates rise, the bank must raise the interest it pays to bondholders even if the interest it earns on mortgages does not.

Asset liability management handles mismatches.

Asset-liability mismatches are important for insurance companies and pension plans because they may have long-term liabilities (promises to pay the insured or pension plan participants) that must be backed up by assets. Choosing assets that are appropriately matched to their financial obligations is thus a critical component of their long-term strategy.

Asset-liability mismatch is a common risk in financial institutions and can lead to financial instability if not managed properly. To mitigate this risk, institutions may use various techniques such as asset-liability management (ALM), interest rate risk management, and liquidity risk management. These techniques involve monitoring and adjusting the composition of assets and liabilities to maintain a balance between risk and return.